High-earners leaving Illinois in droves

A net of 1.25 million more people left Illinois than entered from 1985-2010, according to data from the Internal Revenue Service on the migration of Illinois taxpayers and their dependents. In every single recorded year, more people left Illinois than entered. Recent U.S. Census Bureau estimates, which go through 2012, show that the exodus has...

A net of 1.25 million more people left Illinois than entered from 1985-2010, according to data from the Internal Revenue Service on the migration of Illinois taxpayers and their dependents.

In every single recorded year, more people left Illinois than entered. Recent U.S. Census Bureau estimates, which go through 2012, show that the exodus has continued.

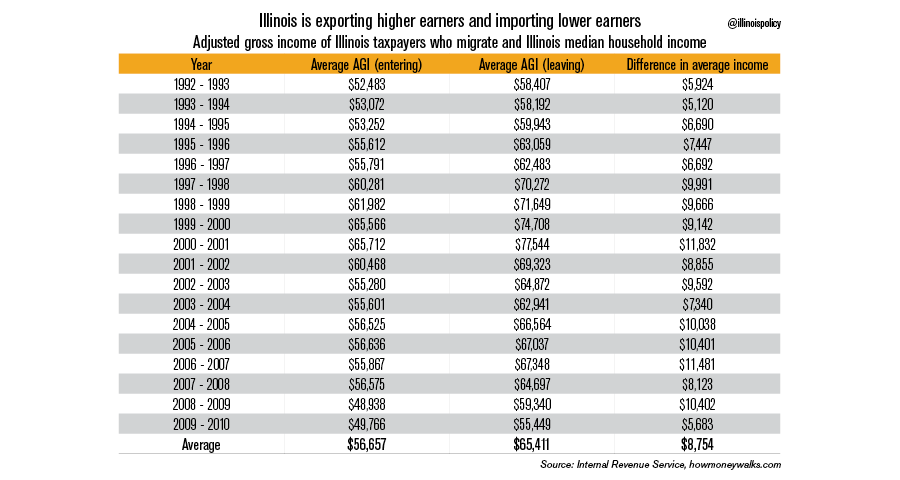

Not only that – the IRS recorded the income of the people who changed states from 1992-2010. Those incomes can easily be adjusted into 2014 dollars to add color to the migration trends. For example, the average income of taxpayers who entered Illinois in in 2006 is $55,866. The average income of taxpayers who left in the same year is $67,348.

Every single year, the average income of people who leave is higher than the average income of people who enter Illinois. The people who leave make $8,700 more per year than the people who enter. The people who leave also make $13,100 more than the Illinois median household income.

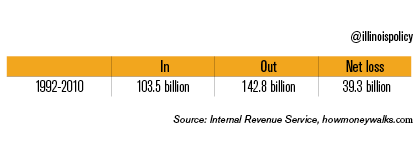

Those losses add up. The 1992-2010 Illinois exodus has cost the state $39.3 billion in annual income.

Even Illinois legislators should be shocked into rethinking their ways. It’s clear what’s happening:

- People with means are leaving.

- They are taking their hard-earned dollars with them.

- They are heading to states with lower taxes and regulations.

If Illinois had simply kept its people, the gusher of additional tax dollars would relieve the state’s budget woes.

The votes of Illinois exiles are final. Millions have chosen to uproot their families and move to another state over Illinois. Every morning, legislators should consider their part in this exodus.