Millions that migrate

House Speaker Mike Madigan has proposed an extra tax on million-dollar incomes. His proposed legislation, HJRCA51, would amend the Illinois Constitution to impose an additional tax of 3 percent on income over $1 million. This tax won’t touch any millionaires who don’t want to pay it. They’ll simply leave, and they are well-equipped to do so. The middle...

House Speaker Mike Madigan has proposed an extra tax on million-dollar incomes. His proposed legislation, HJRCA51, would amend the Illinois Constitution to impose an additional tax of 3 percent on income over $1 million.

This tax won’t touch any millionaires who don’t want to pay it. They’ll simply leave, and they are well-equipped to do so. The middle class and poor will be left behind to carry the extra weight of funding the state’s growing debt, pension liabilities and core government services.

And the middle class and poor will have to do it with fewer job opportunities.

According to 2011 Internal Revenue Service data, a quarter of Illinois income beyond $1 million comes from small businesses that create jobs, and another quarter comes from investment gains. The middle class needs those jobs to make ends meet, and those investment dollars to grow their businesses.

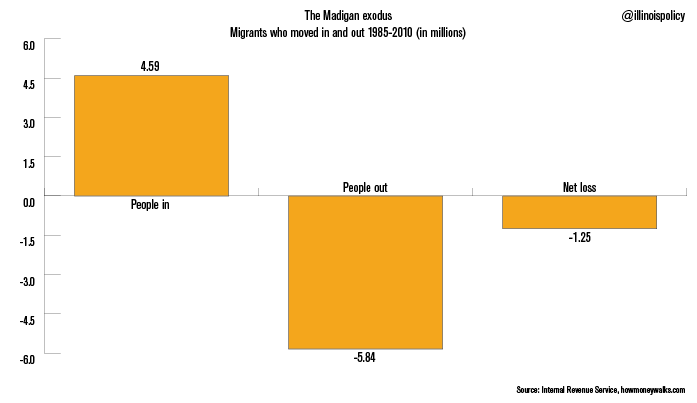

Illinois has already lost 1.25 million people to net out-migration under Madigan’s leadership.

Migration data from the Internal Revenue Service cover the years from 1985-2010. Illinois has lost more than 5.8 million people to other states. Only 4.6 million people came in. Illinois has been a loser of people in every year of recorded data since 1985. Madigan has been Speaker since 1983.

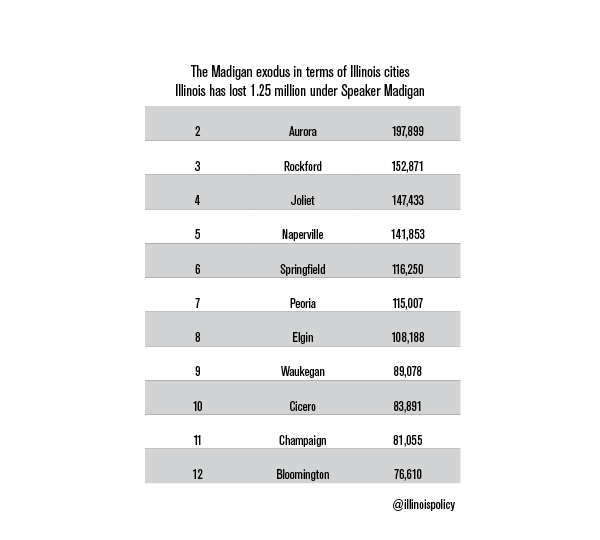

This loss is equal to nearly half of Chicago’s population. It’s also equal to the next 10-largest cities in Illinois, combined.

Madigan estimates that his surcharge will raise $1.05 billion in annual tax dollars. This fantasy assumes nobody will leave.

According to the IRS and U.S. Census Bureau, the average income of a taxpayer who leaves Illinois is $13,100 above Illinois’ median household income. Higher-income earners are already leaving.

Maryland offers proof that hiking taxes on millionaires causes them to relocate. With the highest number of millionaires per capita, Maryland decided to levy a millionaire tax in 2008. The results are shocking.

Maryland went from having 3,000 people report income over a million in 2008, to only 2000 people in 2009. The Great Recession alone could not account for Maryland’s loss of millionaires – they had fled the state.

In the face of overwhelming evidence to the contrary, Madigan states that millionaires in Illinois are “probably so much in love with Illinois that they’re not going to leave.” This is a dream, and Madigan knows better.

Before voting, legislators should ask themselves:

- Will this legislation cause more people to leave?

- Will the middle class and poor be left behind to pick up the tab?

It’s not about the millionaires. It’s about the millions in the middle and lower classes.

Millionaires can and will pick up and leave. Plenty of attractive states, such as Florida, Washington and Texas, don’t tax income at all. The middle class will be forced to stay in Illinois with fewer opportunities. Or they will pick up and leave, too.

The state’s most vulnerable residents are the ones being left behind. They are the ones who can’t move. They are the ones who must bear the cost of the General Assembly’s mistakes.