Why your property tax bill is so high, and how to fix it

Less than 50 cents of every additional property tax dollar over the last 20 years went to pay for services that raise home values. Instead, the primary driver of the rise in property taxes was pension costs.

Vicki McCarthy purchased her home in northern Illinois’ Round Lake Beach in 2002, paying $195,000. She now pegs that home’s value at around $180,000 and is staring at a property tax bill of nearly $8,000 a year.

Illinoisans such as McCarthy know all too well the pain of their property tax bill. Researcher after researcher pegs them as some of the highest in the country, if not the highest.

What Illinoisans may not know is that as recently as 1996, property tax bills in the Land of Lincoln were hovering around the national average. But a punishing 80 percent increase in residential property taxes since then, adjusted for inflation, has rocketed Illinois to the top of the table.

What happened in those 20-some intervening years? The truth holds the key to fixing the state. And politicians touting further tax increases and opposing sensible spending changes would prefer voters didn’t know.

The answer, revealed in a new report from the Illinois Policy Institute, is a rapid rise in pension costs.

Take McCarthy’s tax bill. Among other things, it’s paying for the retirements of nearly 100 municipal retirees in Lake County who already have become millionaires via the Illinois Municipal Retirement Fund. Their average retirement age was 57 years old, they contributed an average of $74,500 to the pension system over the course of their careers, and receive an average pension check of more than $95,000 each year.

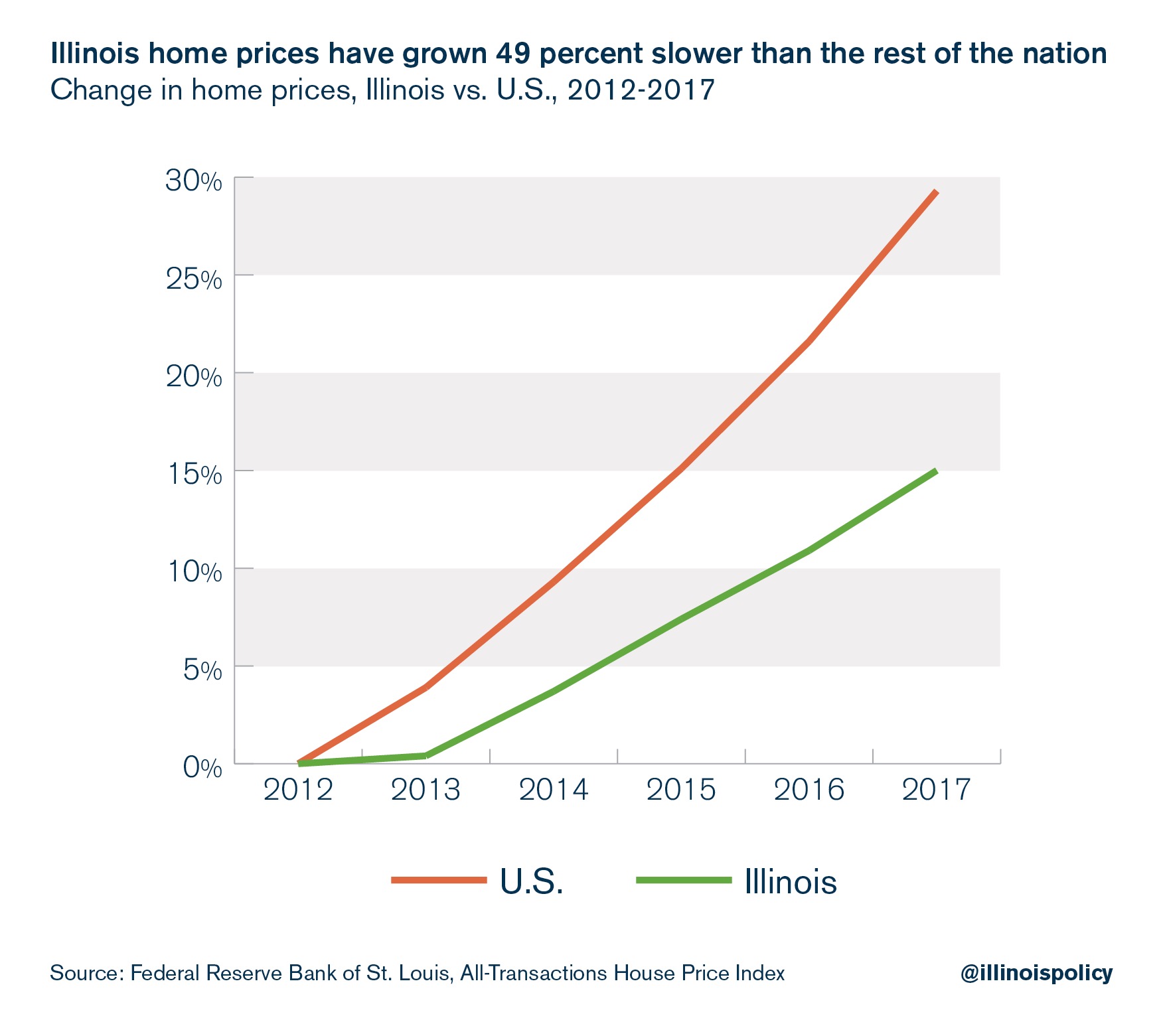

Across the state, home value appreciation is severely lagging the national average despite property taxes increasing at a frenetic pace.

One reason for this is that less than 50 cents of every additional property tax dollar over the last 20 years went to pay for services that raise home values. Instead, the primary driver of the rise in property taxes was pension costs.

State and local governments will continue to hike taxes, hit core services and make themselves ever less attractive to discerning families until the pension problem is fixed.

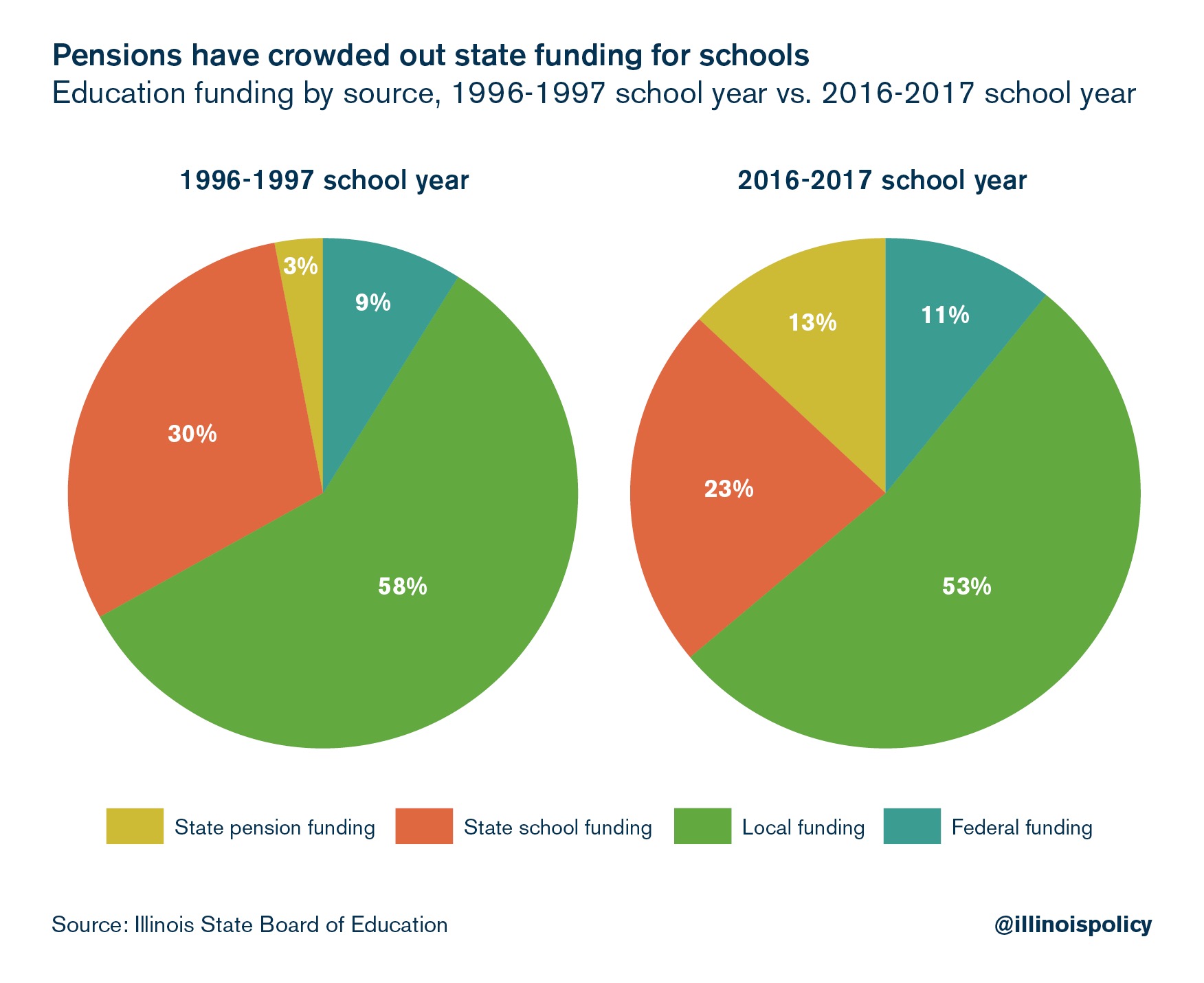

These data have powerful implications for J.B. Pritzker’s campaign platform. Pritzker and many others, including some Republicans, have argued that families’ absurdly high property tax burden is the result of the state’s underfunding of schools – local governments need to fill in the gap with property taxes, they say. So his solution is to hike the state’s income tax.

But today, state sources actually make up a larger share of education funding in Illinois than they did in 1996, back when property taxes were a nuisance, not a crisis. The state spent an additional $5.4 billion on education between 1996 and 2016, a whopping 87 percent hike.

So if the problem wasn’t state money, how come property taxes exploded? The answer is found by following where that money went.

Of that $5.4 billion increase, $3.6 billion went to the teacher pension system, not classrooms. In order to make up for that diversion of resources, local school districts continuously hiked property taxes. And here we are.

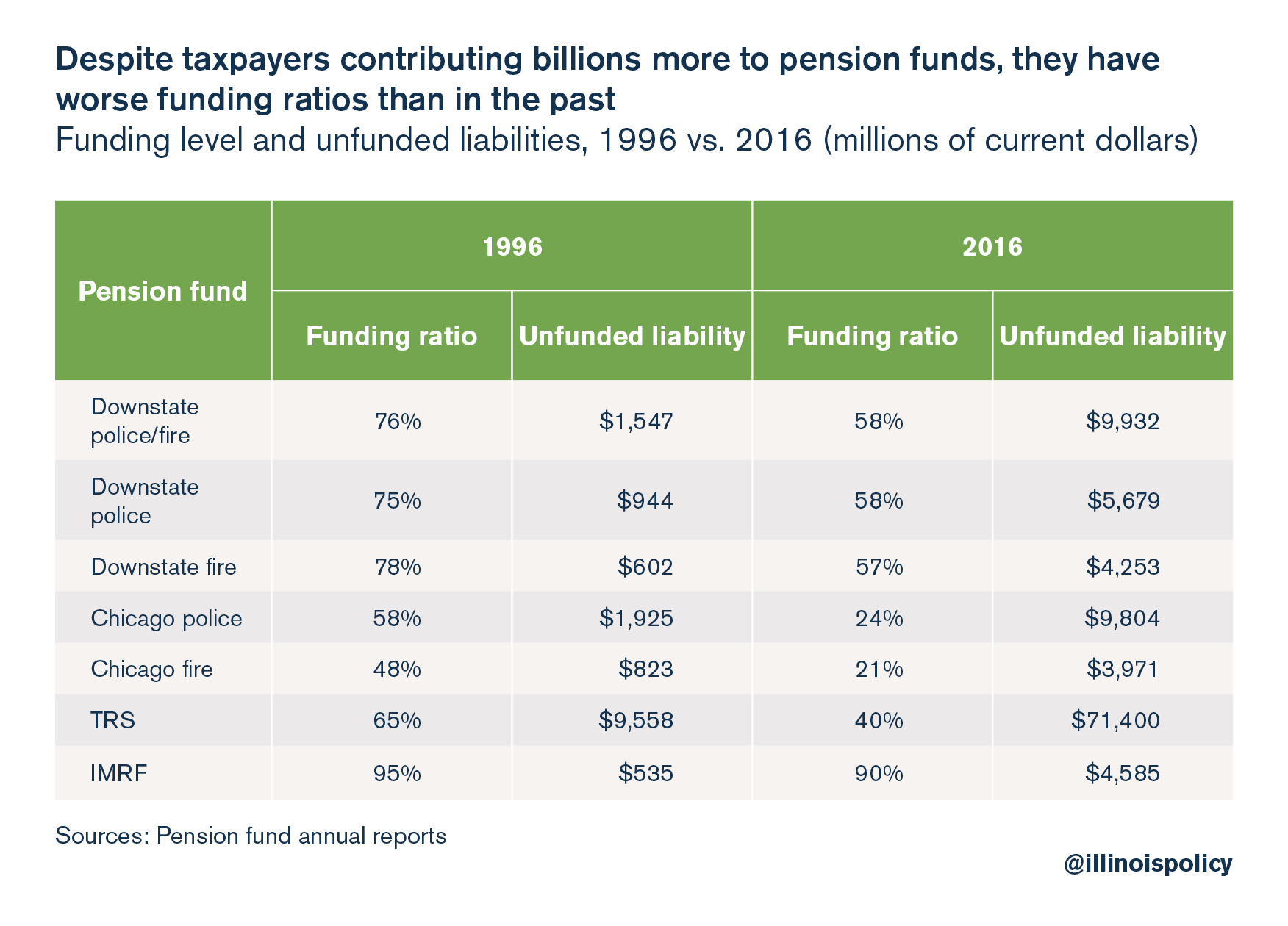

Adding insult to injury, despite boosting property taxes to the nation’s highest levels to chase after pension promises, the health of most pension funds is worse. There is no greater indictment of the argument that pensions are in such bad shape because of underfunding.

Yes, pensions were underfunded. But that’s because state lawmakers overpromised. Imagine if you took out a mortgage for a million-dollar home on a $40,000 income. You would underfund your mortgage payment. But you clearly bought too much house.

Yes, pensions were underfunded. But that’s because state lawmakers overpromised. Imagine if you took out a mortgage for a million-dollar home on a $40,000 income. You would underfund your mortgage payment. But you clearly bought too much house.

This is why teachers, public safety personnel and other public sector workers are not to blame for this problem. Their retirement security is now in jeopardy because politicians wrote checks they knew the government could never cash. Meanwhile, taxpayers continue to pay more and get less.

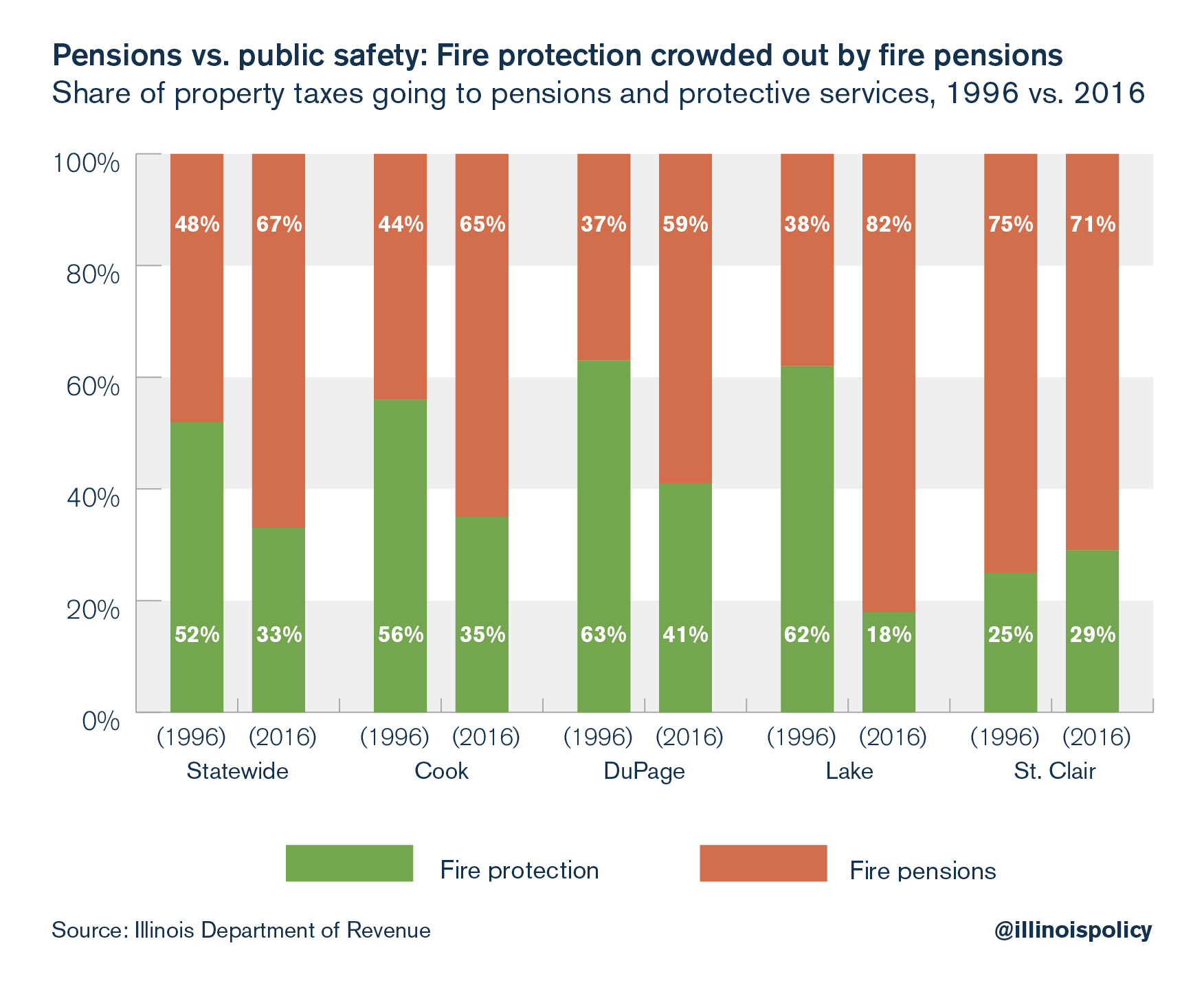

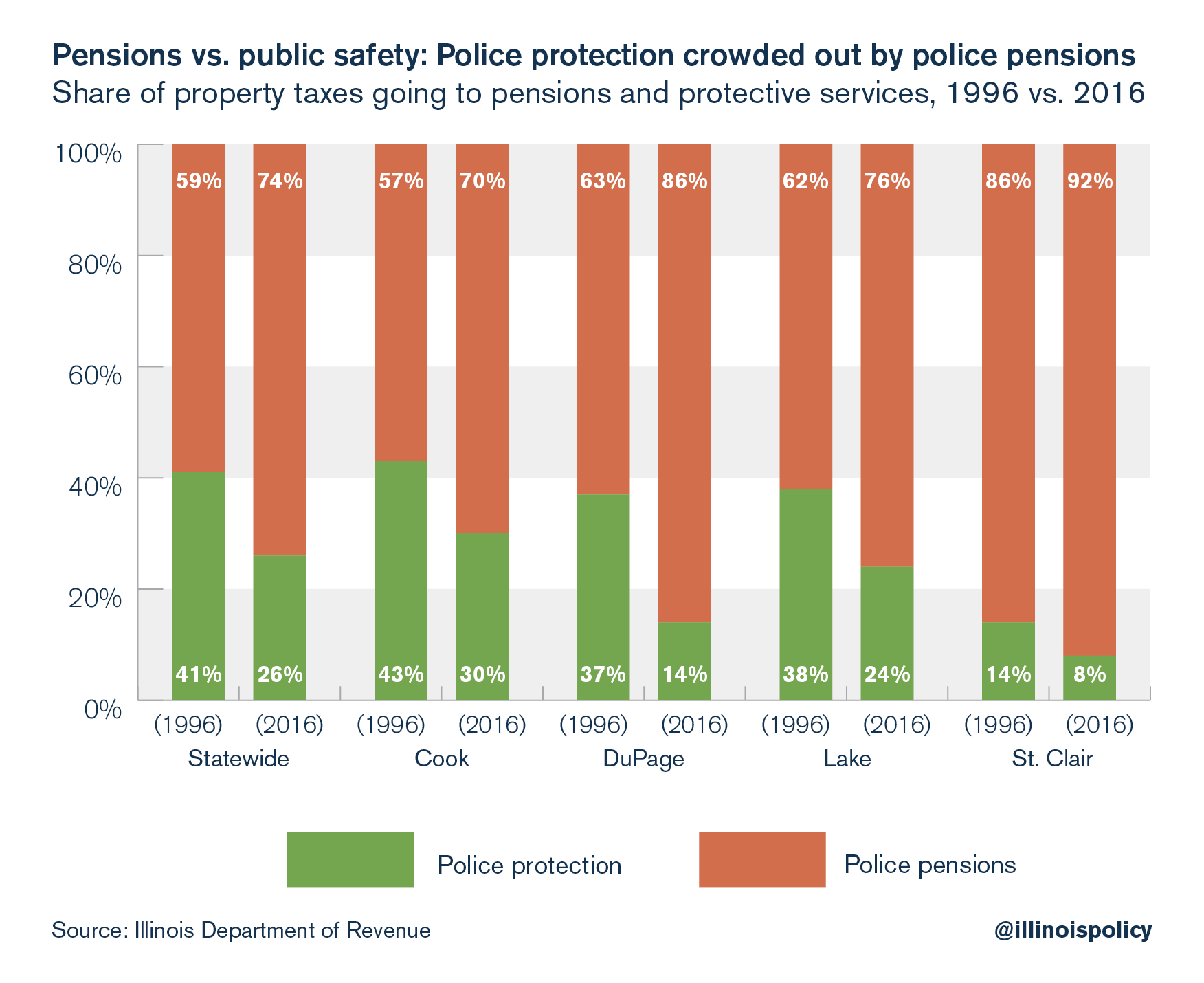

Of every additional property tax dollar that went to municipal fire departments in Illinois from 1996 to 2016, 78 cents went to pensions, not protection.

Of every additional property tax dollar that went to municipal police departments, 81 cents went to pensions, not protection.

The path forward is not as complex and unfathomable as political actors make it seem. It’s limited only by political will, which should change as more and more Illinoisans realize they’re not getting the services they think they’re paying for.

In order to protect pensioners and taxpayers, state lawmakers must amend the Illinois Constitution to allow for reductions in unearned, future benefits. Among other things, this means ending automatic 3 percent compounding benefit increases and bringing retirement ages in line with the private sector.

Many Illinoisans, such as Vicki, are deeply frustrated with their property taxes. But more than frustration, thousands are trapped. The depreciation of their property outweighs what they’ve paid toward principal, meaning they would need to fork over extra cash just to sell their home.

Those who are trapped are looking to Springfield, where one of two paths will shape their future: either their property taxes (and probably income taxes) will continue to rise, or lawmakers will get serious and amend the state constitution.