What if Illinois grew like Indiana?

Despite Illinois’ built-in economic advantages, personal income in Indiana is growing much faster than personal income in Illinois.

Personal income is growing much faster in Indiana than Illinois. But it doesn’t have to be that way. Illinois has several advantages over Indiana, including a global city – an important asset at a time when large cities are increasingly important as economic engines.

Illinois should at least be on par with Indiana’s growth rate. And one of the biggest differences between the two states is that Indiana’s government has spent the past decade focused on economic growth and job creation, while Illinois’ has not.

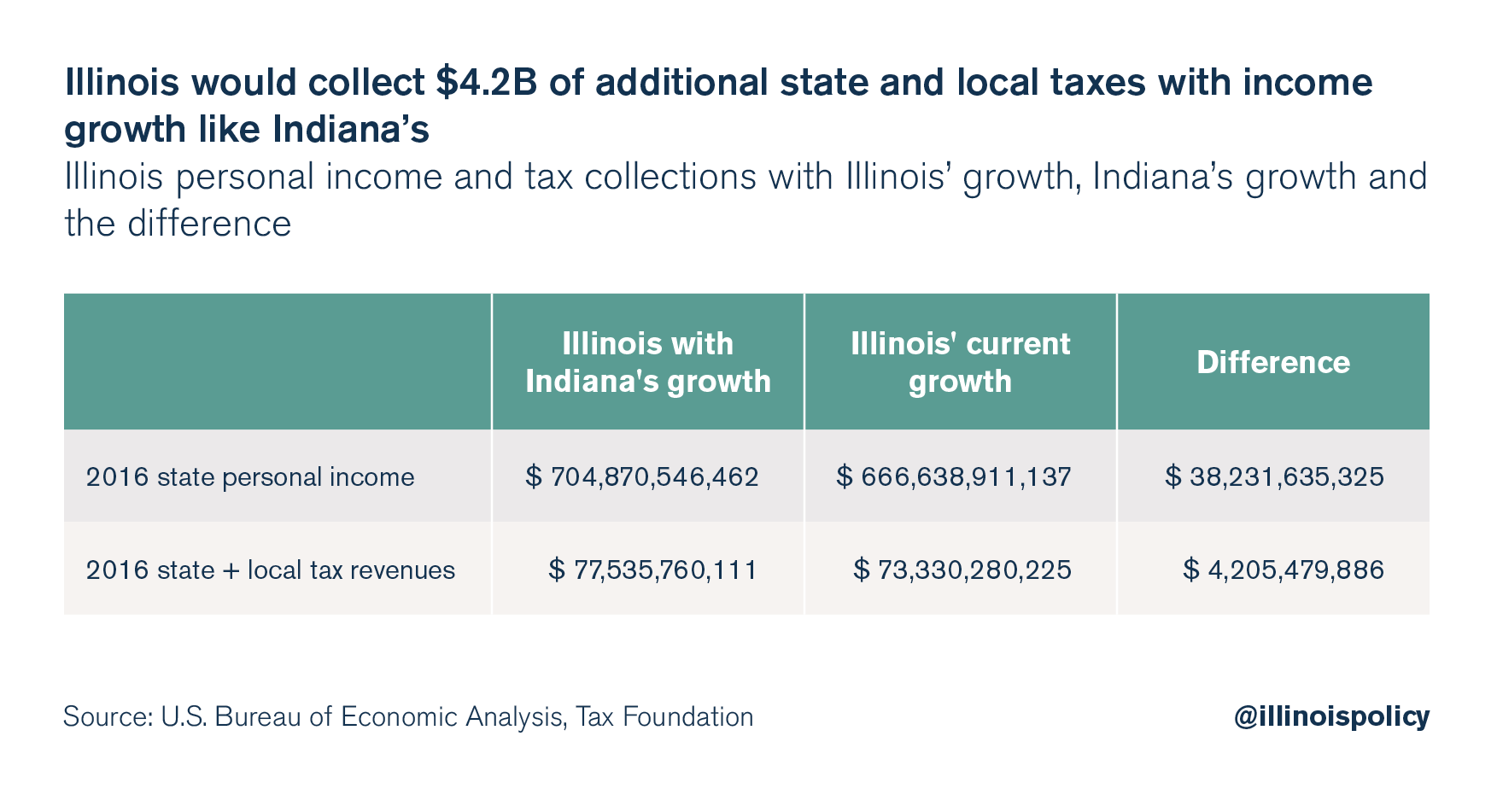

Illinoisans would have an additional $38 billion of personal income each year if the Land of Lincoln had simply matched Indiana’s income growth over the past decade. That additional income would translate into more than $4.2 billion of annual state and local tax revenue.

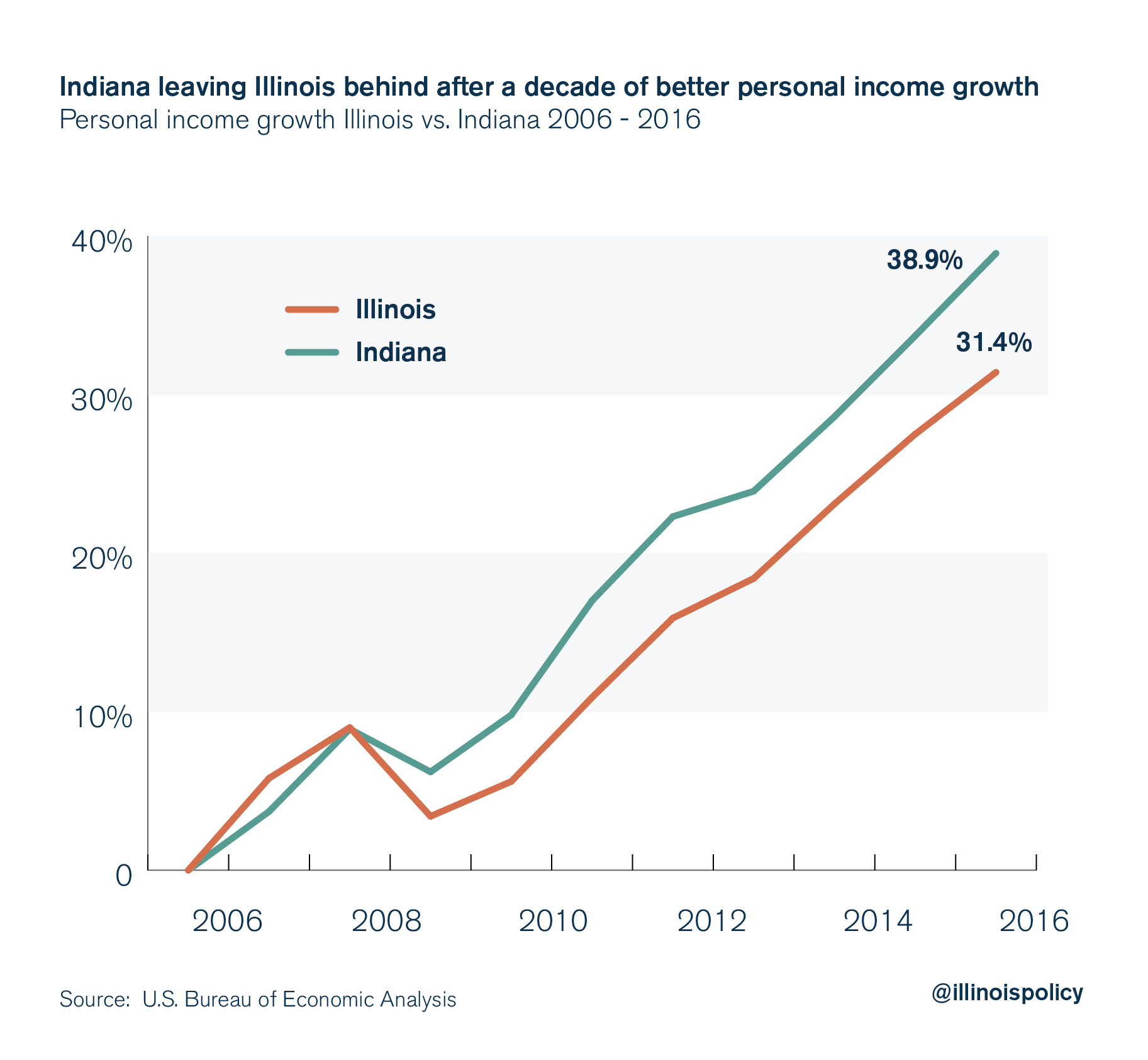

Personal income has grown by only 2.8 percent per year in Illinois, compared to 3.4 percent per year in Indiana. That might not seem like a big difference for one year, but that difference adds up over time.

From 2006 – 2016, personal income grew by nearly 39 percent in Indiana compared to just over 31 percent in Illinois, according to the Bureau of Economic Analysis.

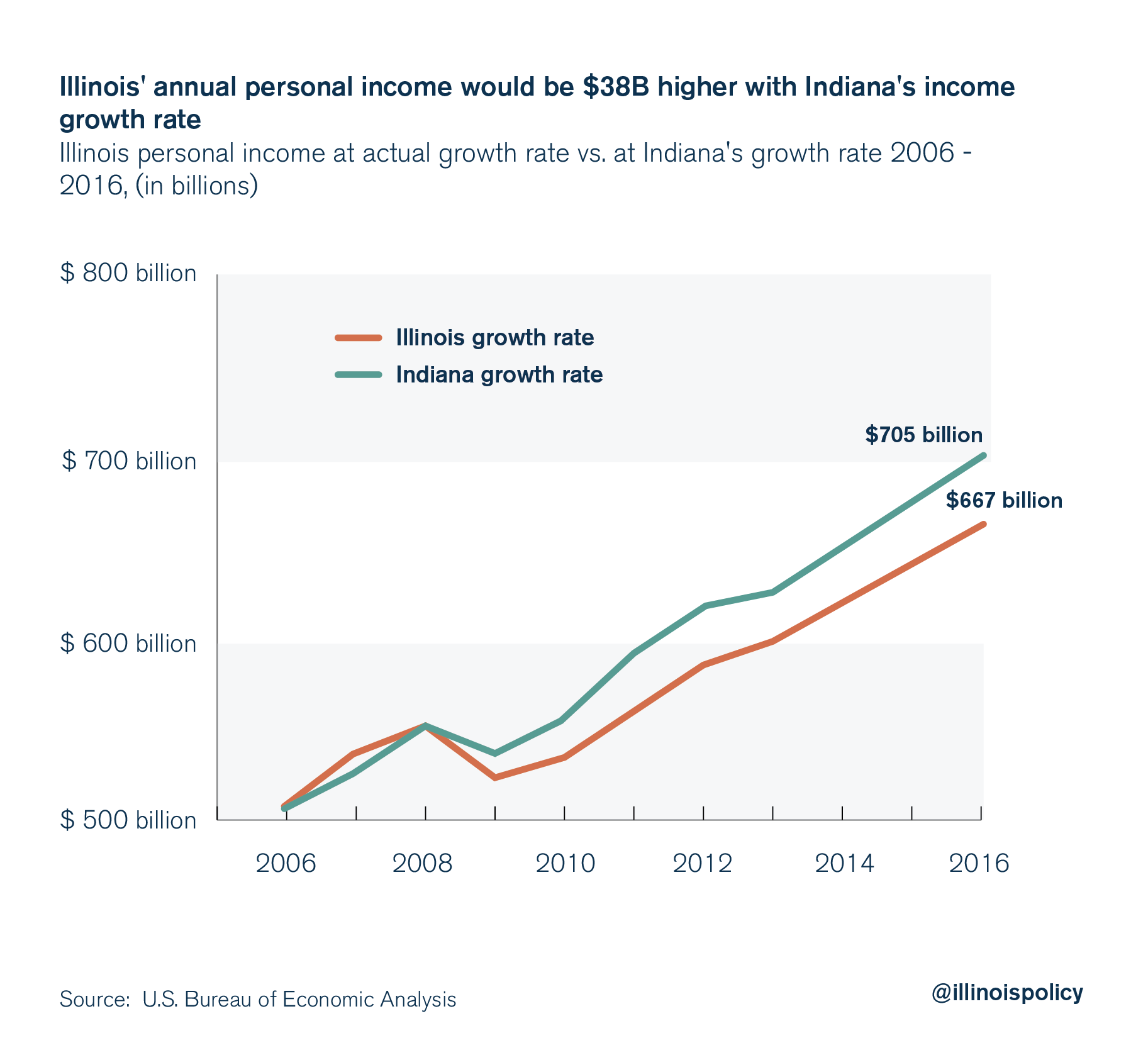

Illinois’ total personal income was $667 billion in 2016. However, if Illinois had grown like Indiana from 2006 – 2016, Illinois’ personal income would have grown to $705 billion in 2016.

The difference is $38 billion of annual personal income that Illinoisans would earn if Illinois had kept pace with Indiana.

More personal income means more jobs, higher wages and more tax revenue. The Tax Foundation calculates that Illinoisans pay 11 percent of their personal income in state and local taxes. That means that state and local governments would have an additional $4.2 billion in annual tax revenue if Illinois’ growth had been in line with Indiana’s over the last decade.

Springfield politicians should take a page out of former Indiana Gov. Mitch Daniels’ book if they want to allow for the type of job creation and income growth that Indiana is achieving. Daniels changed Indiana’s policies to prioritize taxpayers, job creation and income growth over government bureaucracy and excessive regulation.

If Illinois does similar reforms, then the Land of Lincoln will experience similar results. Illinoisans will achieve additional billions in annual income growth that the state is currently frittering away by driving out businesses, maintaining an expensive government bureaucracy, and suffocating growth with red tape.

A brighter future for Illinois begins with an honest assessment of what’s gone wrong in the Land of Lincoln, and what’s working in nearby states. If Illinois’ can achieve Indiana’s income growth levels, then additional billions of dollars in tax revenue will flow in and Illinois’ problems will become much easier to solve.