Warning signal: High-end home sales slow to a crawl in Chicago suburbs

“Not totally dead” yet In the Chicago suburbs of Burr Ridge, Naperville and Hinsdale this summer, sales of high-end real estate hit a huge slump, which continues. For example, Crain’s Chicago Business reports the city of Burr Ridge has 100 homes on the market priced at $1 million or higher, but only 14 have sold...

“Not totally dead” yet

In the Chicago suburbs of Burr Ridge, Naperville and Hinsdale this summer, sales of high-end real estate hit a huge slump, which continues.

For example, Crain’s Chicago Business reports the city of Burr Ridge has 100 homes on the market priced at $1 million or higher, but only 14 have sold at that price in the past six months.

Crain’s Chicago Business has the details in “This suburb has too many $1 million-plus homes for sale”:

“‘It’s been disquietingly slow, brutally slow getting these sold,’ said Linda Feinstein, the broker owner of ReMax Signature Homes in neighboring Hinsdale. ‘It feels like the brakes have been on for months.’

“[S]ales slowed down all over the Chicago area this summer, and sometimes potential sellers don’t get the message soon enough, which creates an over-stock of inventory.

“‘It’s not as busy as we’d all like it to be, but it’s not totally dead,’ said Dave Ricordati, a Coldwell Banker agent with three $1 million-plus listings, the newest of which has been on the market since July. ‘I mean, it’s not 2009 or 2010,’ when the real estate market was at a virtual standstill.

“Another factor in the backlog, said Linda Saracco, a ReMax Signature agent who’s been working Burr Ridge for over 30 years, is that ‘a lot of our sellers are baby boomers who bought in the ’80s or ’90s, built up a lot of equity in their homes and are ready to cash it in.’

“When the market doesn’t deliver a buyer who’s willing to pay the price they want, ‘they’re not taking it. They’ll wait and see if they can get their number.’

“Her prediction: They won’t.”

Ready to cash in, but no buyers

ReMax agent Linda Saracco should be commended for her accurate, honest assessment: “They won’t [get their price].”

This is precisely what happens when everyone heads for the exit door at the same time.

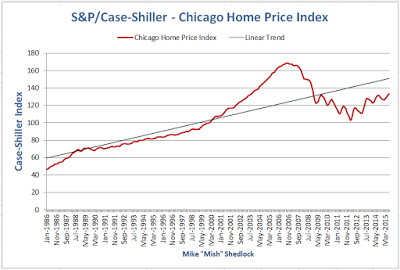

Case-Shiller Chicago update

The suburbs aren’t the only place where home prices are concerning, according to the Case-Shiller Home Price Update.

The city of Chicago had a huge boom in home prices, followed by a huge bust from which the city’s real-estate market never quite recovered.

Chicago Home Price Index

Economic rot vs. home-price rot

Unlike overall economic weakness that starts at the periphery and spreads to the core, real-estate rot frequently starts at the high end when buyers begin to balk at prices.

Each drop in high-end prices hits the next lower home-price level.

Illinois rush

Why shouldn’t home buyers run for the exits? Who can really afford such prices anyway?

Certainly not millennials with mountains of student debt or those stuck in low-wage jobs.

But why a rush to the exit in Illinois and not everywhere?

Illinois has a second problem: misguided state policies.

Emanuel’s folly

Mayor Rahm Emanuel is wrong to think tax hikes are the way out of Chicago’s fiscal mess.

Yet, as noted in “Chicago tax collector hath arrived with massive tax hike” on Oct. 1, Emanuel says, “[No] stone unturned.”

Worse yet, Emanuel says he’s “not done yet [hiking taxes]” and he won’t leave “any stone unturned” in the search for revenues.

Bet your bottom dollar

You can bet your last dollar on this: When politicians promise to raise taxes, they will, and by more than they say.

Emanuel will raise property taxes by the greatest amount in Chicago history. How could that not affect property values and homeowners’ desires to cash out?

It’s not just Chicago. Illinois has a litany of problems that make people want to leave. And they will.

But they won’t sell their homes at the prices they expect.

A proposal

To spare the residents of Illinois massive tax hikes, the only reasonable course of action is as follows:

- Halt defined-benefit pension plans for new employees

- Reform collective bargaining by government-worker unions

- Scrap Illinois’ prevailing-wage laws so that cities do not have to overpay for services

- Enact Right-to-Work legislation

- Pass legislation allowing cities, municipalities and other taxing bodies the right to file for bankruptcy protection

Had the first four items been embraced a decade ago, Illinois would not be as bad off as it is today. Now, even those measures might be inadequate to fix the state’s problems.

Policies in Illinois are to blame for this “rush to the exit” by businesses and individual taxpayers alike.

The net business flight and high-end wealth flight from Illinois to other states will now accelerate thanks to policies in the city of Chicago and the state of Illinois.