Typical Illinois family will likely see $244 increase in state, local tax burden with ‘fair tax’

Increased property and sales taxes will likely offset all savings from progressive income tax scheme.

Gov. J.B. Pritzker and other proponents of his proposed $3 billion “fair tax” claim increasing Springfield’s power to set multiple tax rates will bring much-needed tax relief to low- and middle-income families.

That isn’t the case. The median family in Illinois is likely to pay $244 more in state and local taxes next year regardless of any “relief” from a progressive income tax.

That’s because the costs that are driving up state and local budgets are not being reformed. They have led to constant tax increases during the past decade, and more are projected that a “fair tax” will not fix.

Illinois property taxes are already second-highest in the nation. Those, plus expected increases in consumption, based on 20-year historical averages, will likely mean the typical family will pay an extra $244 in state and local taxes if the “fair tax” passes.

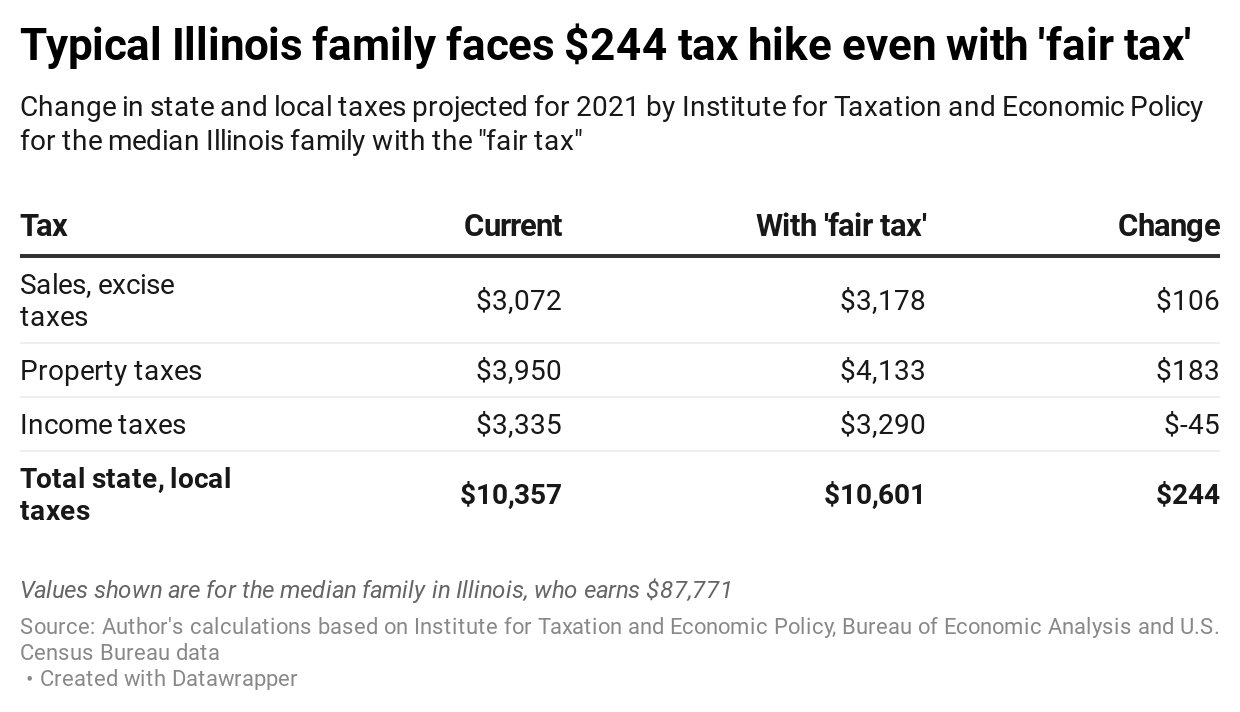

Breaking that down, the median family earns $87,771 per year, according to the U.S. Census Bureau. They can expect to pay an extra $106 to state and local governments for sales and excise taxes in 2021. They will also pay $183 more in property taxes. The “fair tax” relief promised by Pritzker would only reduce their state income taxes by $45.

That results in $244 more taken from that median family, which pushes their combined state and local tax burden above $10,600.

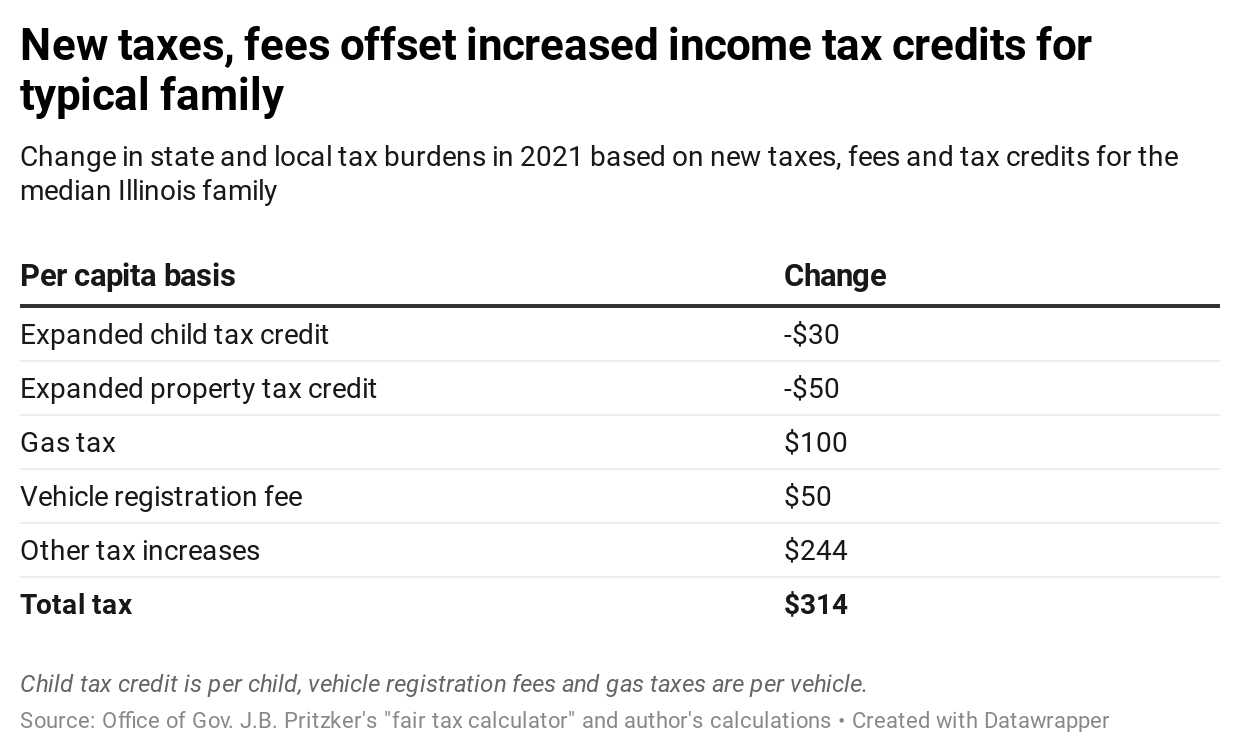

But that estimate doesn’t account for the $150 increase in gas taxes and vehicle registration fees imposed by the state in 2019. Even if Illinois families are able to take advantage of expanded child and property tax credits, the increased cost of owning a vehicle in Illinois will raise their taxes even more.

The grand total: $314 (or more, if the family cannot claim the credits).

Proponents of the “fair tax” tout it as a way to offer tax relief to struggling families, but the reality is average Illinoisans can expect to pay more in state and local taxes despite the small break offered by the initial rates. After voters give state lawmakers the power to change those rates, a simple majority vote could raise taxes by any amount on any group whenever state leaders want more money.

So long as state lawmakers refuse to consider constitutional pension and other spending reforms, Illinoisans will continuously be asked to pay more. And the longer reforms are delayed, the more likely middle-class taxpayers will be hit with an income tax hike.