Total student-loan debt in Illinois is approaching $50 billion

More than 1.7 million Illinoisans hold student-loan debt.

Every young adult in Illinois deserves a chance at college. For many, a college degree is the path to breaking out of a cycle of poverty. For others, it’s a badge of honor to build upon the hard work of their parents. And it used to be that if someone couldn’t afford the cost of college, he could work his way through.

But years of massive growth in higher-education bureaucracies, and outrageous increases in administrative pay and employee pension benefits have had an incredibly harmful effect.

Lower-income students are now priced out of a college degree. Tuitions have skyrocketed to pay for the administrative bloat and exorbitant salaries, and the costs are falling on taxpayers – and on families and students who are trying to get ahead through higher education.

Now, if low-income students want a college degree, they are forced into crippling debt. More than 1.7 million Illinoisans hold student-loan debt. Total student-loan debt in Illinois is approaching $50 billion.

In addition to debt, many students are now forced to depend on grants. But for too many would-be students, college is no longer an option.

It’s not surprising to see university and college administrators across Illinois searching desperately for a scapegoat as the state’s budget crisis exposes the mess they’ve created. Instead of admitting their problems are self-inflicted, university officials have settled on blaming the state instead.

Due to the budget gridlock, the state has not appropriated nearly $2 billion in funding for higher education. That’s obviously had an impact on university and college budgets. But higher-education institutions don’t steward this money responsibly to help keep college affordable. Instead, those funds are funneled into skyrocketing administrative costs.

Listening to university officials, however, doesn’t provide the real story. So here it is:

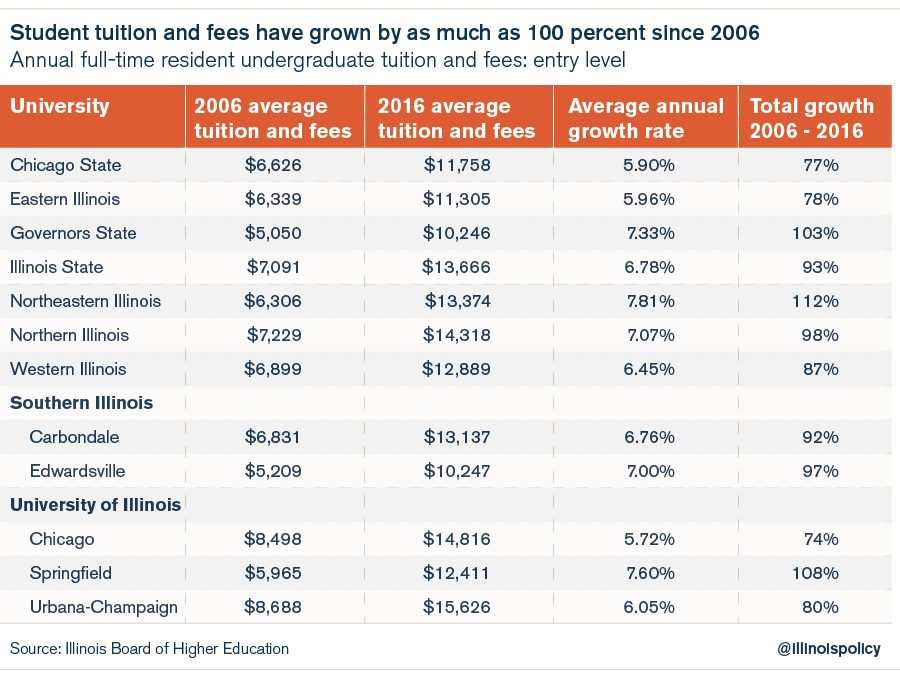

Students are losing access to college because colleges and universities have massively increased tuitions. Combined tuition and fees have grown by over 100 percent at many universities. Even at institutions such as Chicago State University, which serves low-income students, annual tuition and fee costs now equal $11,758, up 77 percent since 2006.

Illinois’ public universities and colleges have forced students and families to pay more and more each year in tuition, whether in the form of cash, federal student loans or state money, then used those funds to hire more and more administrators. Administrative staff increased by 31 percent between 2004 and 2010, while the student and faculty populations each increased by less than 3 percent. Chicago State University has the most administrators per student, by far, of any Illinois university.

Tuition increases have also been used to push executive compensation to exorbitant levels. Over half of Illinois’ 2,465 university administrators received a base salary of $100,000 or more in 2015.

And Illinois’ top higher-education administrators receive additional compensation – housing allowances, cars, club memberships and generous bonuses – that cost colleges and universities millions of dollars each year.

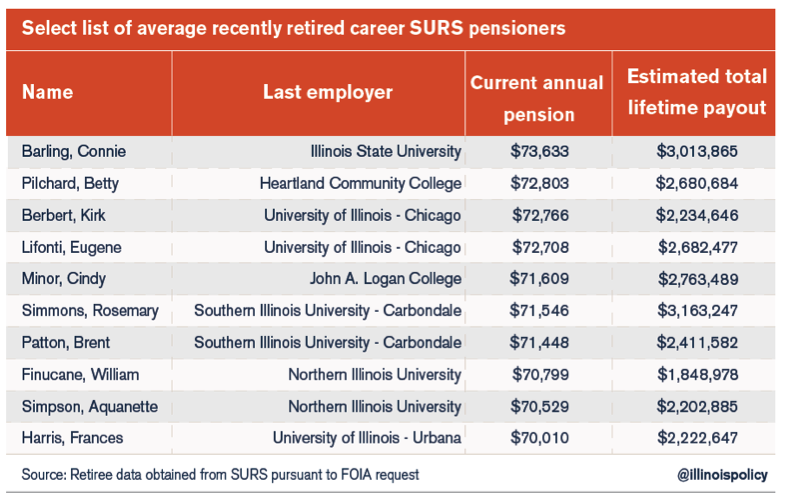

Those big salaries have led to pension benefits that neither Illinois taxpayers – nor students – can afford.

Over 25 percent of university pensioners will receive between $1 million and $2 million in total retirement benefits, while 15 percent will receive more than $2 million in benefits. Early retirement ages – 50 percent of university workers retire in their 50s – and high salaries, coupled with a 3 percent automatic annual benefit boost, allow many university workers to become millionaire pensioners.

That combination of higher salaries and generous pension benefits has put a tremendous strain on the universities’ pension system. The retirement benefits accrued by university workers have grown by 780 percent since 1987, or 8.4 percent yearly.

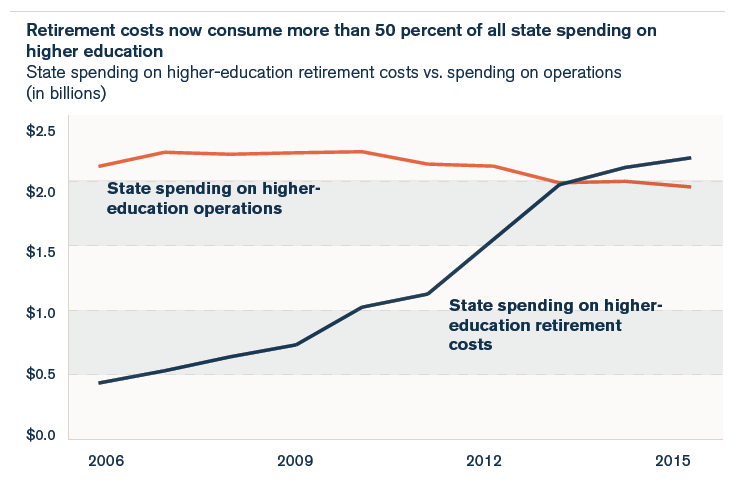

As a result, the state now appropriates more than 50 percent of its $4.1 billion higher-education budget toward retirement costs. A decade ago, retirement costs made up only 20 percent of the state’s total higher-education spending.

College and university officials and politicians are taking advantage of the budget gridlock to blame the state for their current woes – but all the evidence shows the crisis in higher education is self-inflicted.

Rather than blame the state for their own mistakes, universities and colleges need to reform their spending, with the primary goal of increasing the accessibility of college for all students.

To that end, they must reduce salaries and eliminate administrative bloat – then pass the resulting savings on to students so that all Illinoisans can afford a quality higher education.

The state can also help by fixing the broken university pension system – starting by moving new university workers onto 401(k)-style plans based on the current SURS Self-Managed Plan program.

In addition, enacting a constitutional amendment allowing Illinois to reform pension benefits for existing workers going forward will go a long way toward fixing the problems with higher education in Illinois.