Think tax hikes will fix Illinois’ pension crisis? Think again

More revenue can’t fix a fundamentally flawed system. Illinois lawmakers should know this; they tried that approach and failed.

In the wake of the Illinois Supreme Court’s decision on Senate Bill 1, the state is back to square one in dealing with its pension crisis. Without the ability to change retirement ages and benefits of current workers, the prevailing narrative in the media and among many politicians has been that tax hikes are the only sensible solution.

But a look at the last four years shows that higher taxes aren’t the solution. In fact, higher taxes have made Illinois’ economy worse.

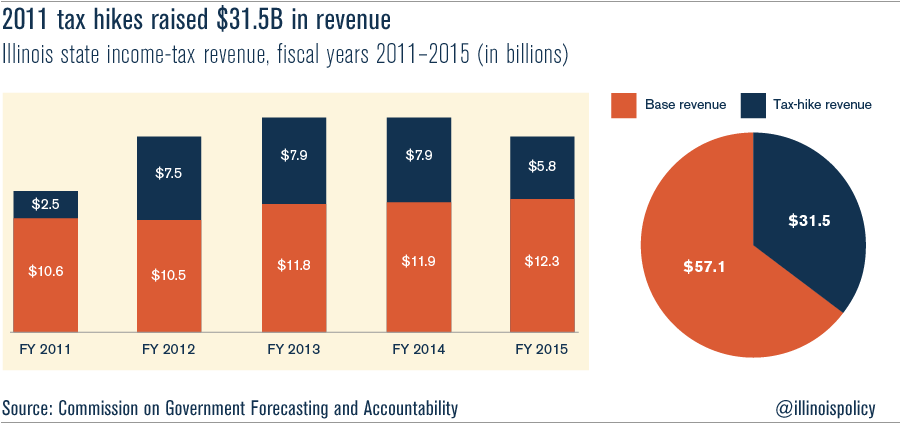

In 2011, Illinois raised its personal-income tax by 67 percent and its corporate-income tax by 46 percent – all in the name of fixing pensions. The tax hikes raised $31.5 billion in additional tax revenue from 2011 to 2015, 90 percent of which went to fund pensions.

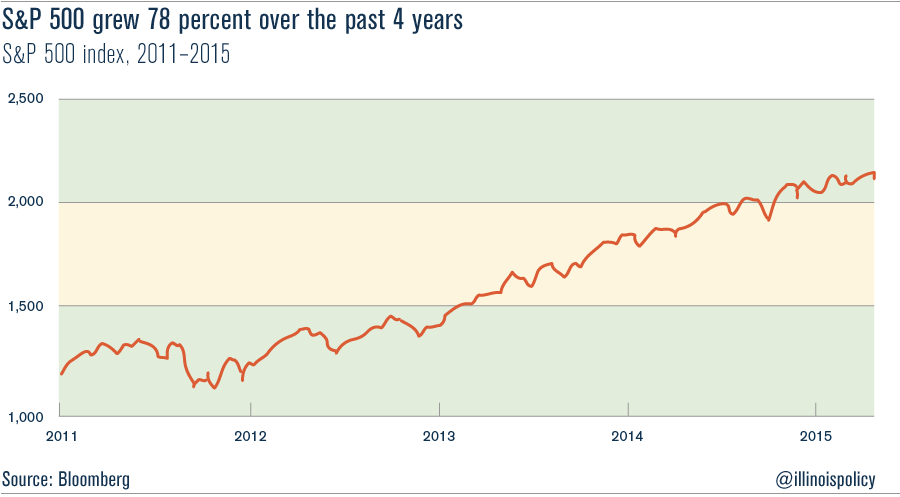

During the same time frame, the Standard & Poor’s 500 index rose by 78 percent, providing big gains for pension funds across the country.

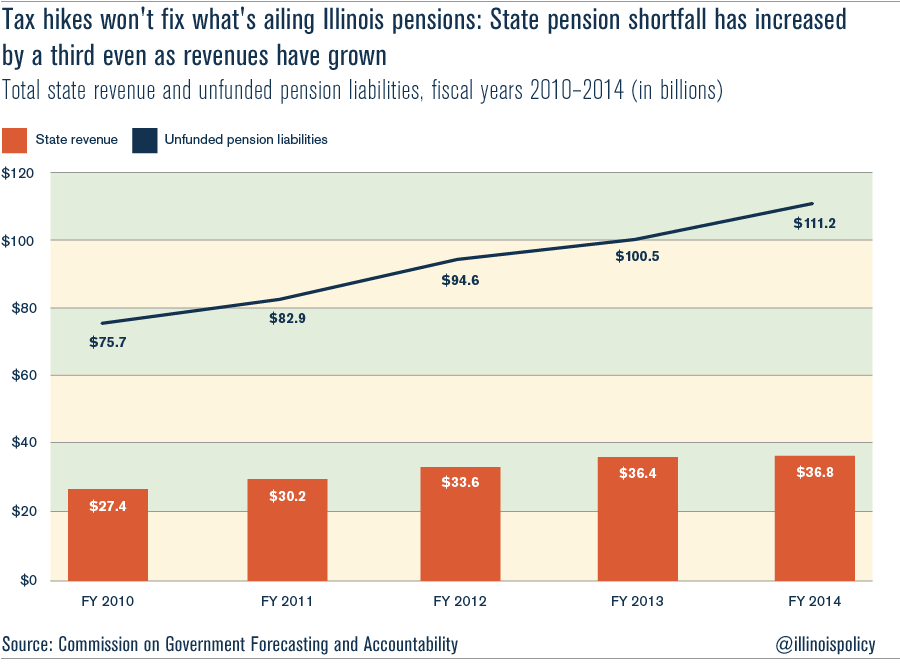

Despite these two massive inflows of cash, Illinois’ pension crisis only deepened.

As the above graph shows, extra revenue came nearly in lockstep with growth in the state’s pension liabilities. More money didn’t fix the problem; it fed the problem.

Despite the $31 billion tax hike, the state’s pension shortfall has grown by $28 billion, or one-third, since 2011. The total shortfall now stands at over $111 billion.

The last four years prove that neither tax hikes nor a booming market can solve Illinois’ pension crisis. Instead, workers need to take back control over their retirements from the politicians who have run them into the ground. Transitioning to 401(k)s is one way to accomplish that.