Pritzker’s proposed tax and fee hikes total $4.5 billion

The new governor has thus far refused to address the root causes of Illinois’ dismal finances.

Illinois Gov. J.B. Pritzker came into office in 2019 preaching bipartisanship and a new day for the state. But thus far, his office has refused reform to Illinois’ most severe cost drivers, instead pushing for billions of dollars in tax hikes on some of the nation’s most heavily taxed residents.

The following is a comprehensive list of Pritzker’s proposed tax and fee hikes, totaling nearly $4.5 billion, which together stand among the highest of any first-year governor in Illinois history.

“Fair tax” hike offers no protection for middle class

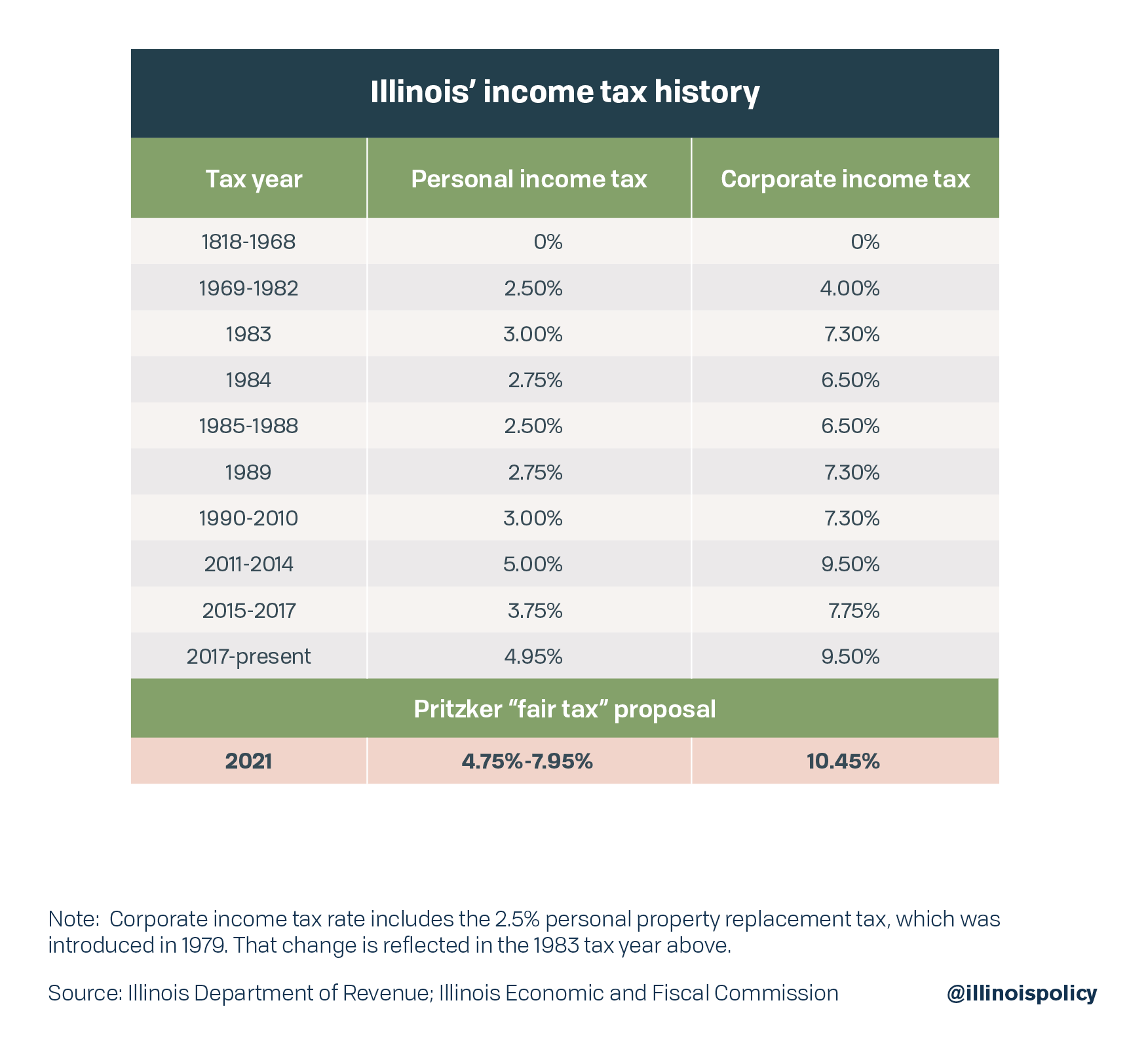

The largest proposed tax hike thus far is Pritzker’s “fair tax,” which his office claims would hit up higher-income earners and small businesses for an additional $3.4 billion once implemented.

In order for the fair tax to take effect, lawmakers would first need to approve an amendment to the Illinois Constitution removing the state’s flat income tax protection, and voters would then need to approve that change at the ballot box –either by a 60 percent majority of those voting on the ballot question or more than 50 percent of those voting in the election.

Persistent income tax hikes for decades have not been able to fix the state’s finances, which have been ravaged by the nation’ most severe pension problem. Primarily due to runaway pension debt, Illinois’ credit rating has been downgraded 21 times since 2009.

Given the state’s income tax history, it is especially concerning that Pritzker’s proposed “fair tax” does not include any protection against future tax hikes for middle-class Illinoisans – nor any promise of pension reform.

Pritzker price tag

Beyond the “fair tax,” Pritzker has proposed a litany of other new tax and fee hikes. The full list of new revenue, totaling nearly $4.5. billion, is as follows:

“Fair tax” ($3.4 billion)

Pritzker’s progressive income tax plan would slightly lower the marginal income tax rate on earnings under $250,000 and hike them significantly after that, topping out with a 7.95 percent tax on income over $1 million. But rather than a marginal rate on that income, Pritzker’s plan uses a rare tax tool known as “recapture,” where those who earn over $1 million would instead see a much higher flat tax on all of their income – effectively adding a $8,565 tax bill to the first dollar earned over $1 million, according to the Tax Foundation.

Pritzker’s proposed rates would almost certainly be short-lived, as estimates using the most recently available IRS data reveal his proposal would actually raise just $1.4 billion to $2.4 billion, and his spending promises total $14 billion to $19 billion. Nevertheless, Pritzker is claiming his tax change would raise $3.4 billion.

The last state to implement a plan similar to Pritzker’s was Connecticut in 1996. State lawmakers made the same promises of middle-class tax cuts, property tax relief and increased spending on social services. But those promises were broken. The typical Connecticut family saw a 13 percent hike in their income tax rates, property tax burdens increased 35 percent, and the poverty rate increased 47 percent.

Tax on Medicaid providers ($390 million)

Pritzker’s proposed budget calls for a new tax levied on managed care organizations generating an estimated $390 million. While budget documents from the administration focus on Medicaid providers, federal law requires the tax to apply uniformly to private sector managed care organizations. Taxing medical providers could increase premium costs for consumers.

Tax sports gambling ($200 million)

Pritzker proposes legalizing and taxing sports betting online and at select locations across the state. Between license fees and new taxes the governor estimates this would raise $200 million in revenue for fiscal year 2020.

Recreational cannabis tax and licensing regime ($170 million)

The governor’s budget proposal calls for selling marijuana licenses at $100,000 a piece for an estimated $170 million in new revenue. In comparison, a liquor license costs just $750.

Retailer tax hike ($133 million)

Pritzker’s proposed budget reduces a tax credit available to retailers for collecting sales tax on behalf of the state, generating an estimated $75 million for the state and $58 million for local governments.

Video gambling tax hike ($89 million)

Companies with video gaming terminals in Illinois would see marginal net income from those terminals above $2.5 million a year taxed at 50 percent rather than the current 30 percent under Pritzker’s proposed budget, bringing in an estimated $89 million.

Increased cigarette tax ($55 million)

Illinois’ cigarette tax is already among the highest in the region, driving sales across state lines. Pritzker’s budget proposes hiking the cigarette tax rate by 32 cents per pack, generating an estimated $55 million.

Plastic bag tax ($19 million to $23 million)

A new 5-cent statewide tax on plastic bags would hit up Illinois shoppers for as much as $23 million in state revenue under Pritzker’s budget proposal. Two bills currently in the General Assembly would impose a per-bag tax of 7 cents or 10 cents, respectively. No U.S. state currently collects a statewide plastic bag tax.

New e-cigarette tax ($10 million)

Pritzker’s budget proposal calls for taxing e-cigarettes statewide at 36 percent of the wholesale price.

Total tax and fee bill: $4.47 billion

Pritzker should abandon his plans for a progressive tax hike to finance billions of dollars in new spending. Instead, the governor should look to structurally reform the cost drivers of Illinois’ budget and debt problems: the rising costs of pensions and government worker health insurance. The Illinois Policy Institute recently released Budget Solutions 2020, a plan to balance Illinois’ budget immediately, pay off its debt and cut taxes in less than five years.

The most critical single aspect of any good budget plan in Illinois is meaningful pension reform to put the state on a trajectory where pension contributions are significantly lower in the short term but also sufficient to eliminate the state’s unfunded liability more quickly than planned under current law. Standard & Poor’s Global Ratings recently confirmed that Illinois cannot avoid a junk credit rating without a “practical reduction in liabilities,” which can only be achieved through pension reform.

Pritzker should push for an amendment to the state constitution that allows for slower growth in future benefits, while protecting all benefits earned to date. HJRCA 21 would do just that.

By adopting structural spending reforms, Pritzker can achieve his goals of investing in core government services such as education, social services and public safety without more economically harmful tax hikes.

Sign the petition

Stop the progressive income tax

Sign the petition today to tell your lawmaker to oppose the progressive income tax.

Learn More >