Tax freedom: Illinoisans worked 114 days into 2019 to pay all their taxes

Illinoisans needed extra time to pay all their federal, state and local taxes. As long as that took, a progressive state income tax would delay your freedom even more.

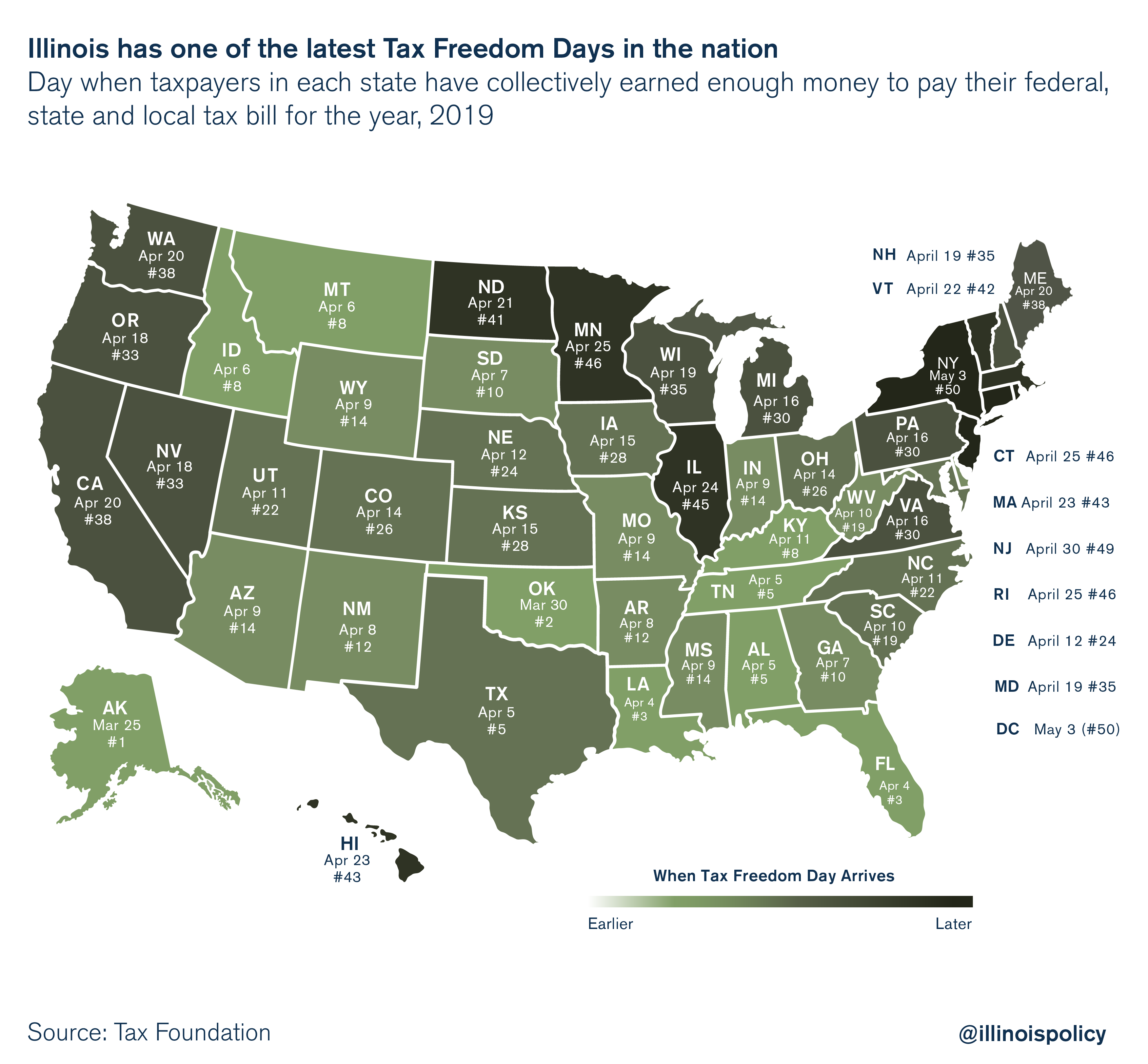

Tax Day was April 15. Tax Freedom Day was April 16. Illinois’ Tax Freedom Day is April 24.

It may feel more like a hangover than a celebration in Illinois, though, because few other states’ resident must work as long to pay off federal, state and local taxes. Tax Freedom Day is when Americans on average have earned enough to pay all their taxes.

Nationwide, Americans worked 105 days into the year before reaching Tax Freedom Day on April 16, according to the nonpartisan Tax Foundation. Illinoisans had to work another eight days to pay off their tax burden.

Illinois’ Tax Freedom Day arrived second-last in the Midwest behind Minnesota, and sixth-last in the nation. The last Tax Freedom Days this year are for Minnesota, New York, New Jersey, Connecticut, Rhode Island and Washington, D.C.

National Tax Freedom Day came three days earlier this year, and seven days earlier than in 2017. The Tax Foundation primarily attributes the earlier freedom dates to the federal Tax Cuts and Jobs Act, which took effect in 2018. Illinois likely also benefited, reaching its statewide Tax Freedom Day five days earlier than last year.

But Illinoisans still had to forfeit 114 days’ worth of pay to finance their tax bills – nearly a third of the year.

Achieving true ‘tax freedom’

Unfortunately, this hasn’t stopped Gov. J.B. Pritzker from championing a graduated, or “progressive,” income tax system, a proposal that would all but guarantee tax hikes on Illinois’ struggling middle class.

Illinoisans are justified in their skepticism of Pritzker’s tax plan. The state has already hiked income taxes twice in the past seven years, squeezing household budgets and costing the economy thousands of jobs and billions of dollars.

Despite beginning 2019 in line with the nation’s positive employment trends, Illinois ended its first quarter in the bottom half of U.S. states in jobs growth.

Illinois’ heavy tax burden repels job creators – diminishing employment opportunities for Illinois’ most vulnerable. In turn, working-age Illinoisans are moving elsewhere: For the first time in state history, every metropolitan area in Illinois shed population last year, according to U.S. Census data.

Under Pritzker’s desired tax rates, the Illinois Senate’s proposed progressive tax amendment would allow for the highest effective corporate tax rate in the nation, at 15.22%. That would mean fewer businesses taking a risk on Illinois, an even tougher job environment and more workers heading for the state line.

Only by reducing the state’s key cost drivers – such as its $134 billion unfunded pension liability – can state leaders restore a basic level of certainty about the long-term growth of state government, avoid future tax hikes and once again become an attractive destination for families and businesses.

But give state lawmakers a blank check to hike taxes through a progressive tax, and you might see Illinois’ Tax Freedom Day pushed so far back that you could consider celebrating with fireworks.