Cullerton backs away from proposal to tax Illinois drivers by the mile

SB 3267 would introduce electronic driver tracking, and create a behemoth bureaucracy to keep tabs on Illinois drivers and figure out how to process tax credits.

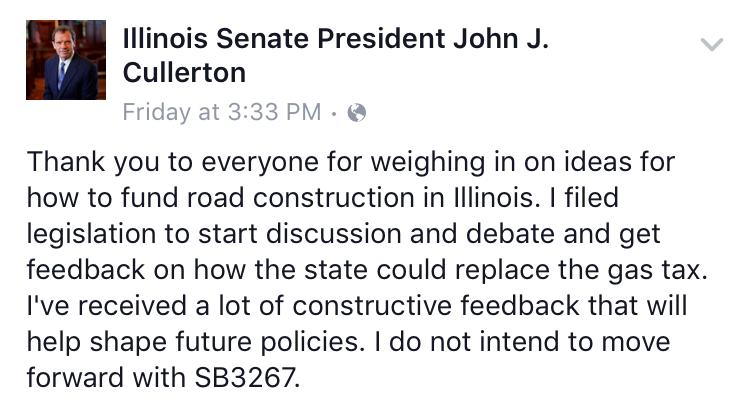

UPDATE: Senate President John Cullerton has decided to pull his proposal to tax Illinois drivers per mile.

Illinois already hoses drivers at the pump – now, one of the state’s most powerful politicians is eyeing a new way to collect road-usage taxes from all drivers – and to make sure electric-car drivers don’t slip through the cracks.

Illinois Senate President John Cullerton’s Senate Bill 3267 would require all drivers – not just those with electric cars – to pay a per-mile road-user fee starting July 2017. Drivers would still be required to pay gas taxes at the pump, but would receive a tax credit from the state to cover the number of miles they drive per month, according to the legislation.

If Cullerton’s plan becomes law, drivers would have to pick one of three tracking options: two plans that utilize tracking devices, or a third option through which drivers pay a flat $450 per year.

Cullerton said the motivation behind this bill is a lack of sufficient funds to maintain the state’s roads, and told the Daily Herald, “The Prius owners are the reason we need the bill.” He explained, “If all the cars were electric, there would be no money for the roads.”

SB 3267 is in the Senate Executive Committee, and Cullerton said it could move as soon as April 13.

But is this a good plan for drivers?

The administration of such a large-scale tracking and monitoring system seems a behemoth task – with every possibility of going awry, considering the layers of bureaucracy that would be needed to administer such a program. Just consider: 10.4 million cars are registered in the state of Illinois, according to the secretary of state.

The bill also would create the Illinois Road Improvement and Driver Enhancement Commission, a new administrative arm complete with an appointed chairman – with an annual salary of $18,000 – and four other members – each receiving $15,000 salaries per year.

Car-monitoring systems also raise privacy issues, as two of the per-mile monitoring plans would allow the government to track drivers’ activity.

State Sen. Matt Murphy, R-Palatine, has called on the state to consider a measured approach to Cullerton’s proposal, arguing it might be best to test as a pilot program, according to the Daily Herald. Carefully testing such a complex program would certainly be preferable to a massive change in the way drivers are taxed, but no new money should flow to Illinois roadwork until state lawmakers reform two major policy points that make road maintenance and construction so expensive: outlandishly high workers’ compensation costs and prevailing-wage requirements.

Illinois should certainly pump the brakes on this proposal, at the very least until taxpayers and politicians alike can see the price tag and magnitude of creating this new system.