Supermarkets, gas stations forced to advertise Pritzker tax ‘relief’ July 1

July 1 marks the start of the suspended state grocery tax and delay in the automatic gas tax hike. Both industries are required by law to display signs reminding customers of the suspensions, but only gas stations face $500-a-day fines if they fail to comply.

July 1 is the start of a one-year suspension in the state’s 1% grocery tax. It is also the start of a six-month delay in the next automatic inflation adjustment to the state gas tax.

Gov. J.B. Pritzker has mandated grocers and gas station owners both advertise his election-year “relief.” But only the station owners face criminal penalties – $500-a-day fines that would tally $65,000 if a retailer refused to comply between July 1 and Election Day.

“I know Pritzker is trying to ‘freeze’ taxes as though he’s doing us a favor, but any citizen who has been paying attention the past two years should be able to recall what he has done. He will resume the tax increases the moment he is re-elected,” said Gina Williams, a working mom of three from Barrington, Illinois. “I feel angry and manipulated by his latest moves to ‘help.’ He thinks we’re stupid and that the average Illinoisan isn’t capable of remembering his history of tax hikes!”

Pritzker’s latest unbalanced budget year begins July 1, with a series of tax changes his campaign ads claim provide economic relief from high inflation and gas prices. He mandated posting signs at grocery check-out lanes and on gas pumps proclaiming the tax changes.

But the signs are thinly veiled political ads, said Josh Sharp, CEO of the Illinois Fuel and Retail Association.

“This type of speech should be relegated to campaign commercials and direct mail,” Sharp said.

His group fought back by suing, but lost and is considering an appeal. They pointed out in the lawsuit that they face fines but grocers do not.

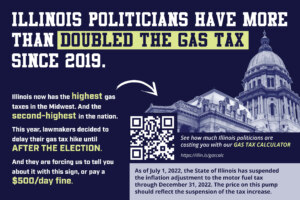

Gas station owners will comply with Pritzker’s mandate but also are adding information to their pump signs to let drivers know who doubled the state gas tax to 38 from 19 cents per gallon.

The July 1 suspension means drivers can expect two gas tax hikes in 2023, one on Jan. 1 and the next automatic hike on July 1, 2023. The two hikes are expected to drive the state’s gas tax to 45.2 cents per gallon.

Illinoisans pay the second-highest gas taxes in the nation. Before Pritzker doubled the gas tax, Illinois ranked No. 10.

Grocery taxes are not universal. Illinois is one of only 13 states to tax groceries, and the only big state to do so.

Inflation doesn’t stop in 2023, and neither should tax relief. Tax repeals, not suspensions, would bring permanent relief at the pump and the grocery store.

Instead, Pritzker wants the taxes back in time for his next budget.