State lawmaker falsely claims progressive tax ‘not mine to vote for’

At least one lawmaker is attempting to avoid responsibility for one of the most important policy issues in the state.

The progressive income tax is arguably the most pressing policy question facing Illinois today. Scrapping Illinois’ constitutionally protected flat income tax, as gubernatorial candidate J.B. Pritzker and others have proposed, would expose the state’s middle class to brutal tax hikes.

But one lawmaker is attempting to avoid responsibility for the issue altogether.

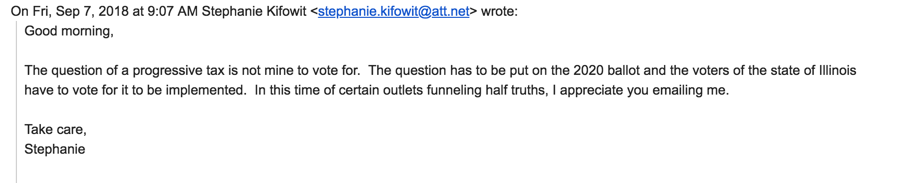

In an email response to a constituent, state Rep. Stephanie Kifowit, D-Aurora, attempted to wash her hands of the tax. “The question of a progressive tax is not mine to vote for,” she wrote. “The question has to be put on the 2020 ballot and the voters of the state of Illinois have to vote for it to be implemented.”

In order to amend the Illinois Constitution to allow for a progressive income tax, it’s true that voters would need to approve of the change on the 2020 ballot.

But what Kifowit fails to mention is that lawmakers like her have to pass legislation to get that question on the ballot in the first place. She is wrong to claim she doesn’t have a vote on the issue. In fact, her vote is critical.

Article XIV of the Illinois Constitution discusses the process by which the Illinois Constitution can be changed. One option would be for the General Assembly to call a constitutional convention. This would mirror the process in 1970 that gave Illinois the current iteration of the state constitution. Since this would likely take power away from lawmakers, the most likely path appears in Section 2(a), which outlines the following process:

- Amendments to the constitution can be initiated in the Illinois House of Representatives or the Senate.

- Amendments must be read in full on three different days in the House and the Senate and reproduced before the vote is taken on final passage.

- Amendments approved by three-fifths of the House and the Senate will be submitted to voters at the next general election, occurring at least six months after legislative approval.

In short, state representatives such as Kifowit are the driving force behind constitutional amendments outside of citizen initiatives.

Destroying Illinois’ constitutionally protected flat income tax would remove one of the only pro-taxpayer policies in the state. While sold as a tax on the rich, the reality is that higher tax rates under a progressive tax system creep down into lower income levels, harming the very people politicians claim they are helping.

Here are the facts:

First, a progressive tax hike could hit single taxpayers earning as little as $17,300 a year. This would mean that the average family with two kids and a $73,000 annual income would see their tax bill go up an additional $665.

Second, tax hikes kill economic growth, period. If Illinois enacted the progressive tax proposal put forth by state Rep. Robert Martwick, D-Chicago, it’s estimated that the state would lose $5.5 billion and 34,500 jobs in the first year alone. In the last 10 years, states without a progressive tax experienced 36 percent more GDP growth, employment grew 37 percent faster and wages increased 21 percent more than in states with a progressive tax, according to the Bureau of Economic Analysis.

And finally, the truth is Illinois doesn’t have a revenue problem, it has a spending problem. State government spending grew 25 percent faster than personal incomes from 2005 to 2015, which is faster than taxpayers can afford.

Despite pressure from their local officials, many members of the Illinois House of Representatives have refused to publicly oppose the progressive tax. Illinoisans can contact their state representative and tell him or her to sign the pledge to oppose a progressive income tax and protect taxpayers by clicking here.