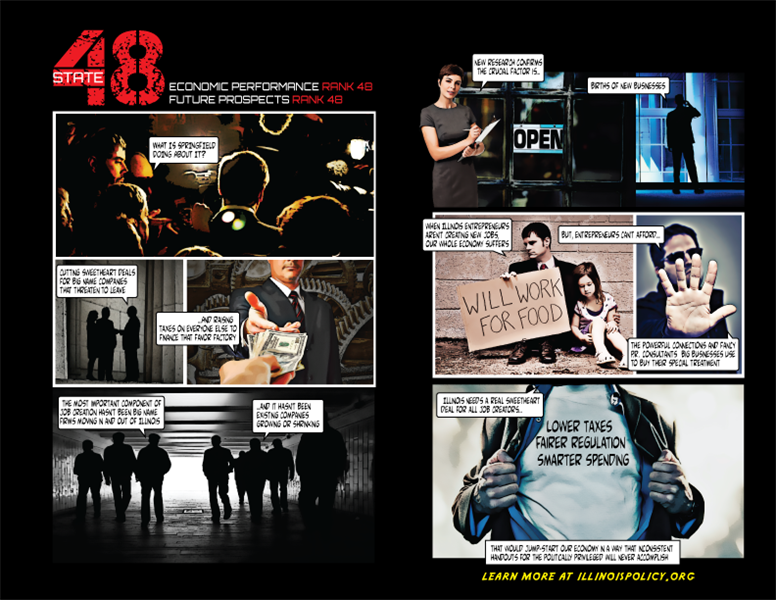

State 48

Illinois’ state debt: Illinois’ total state debt is $271 billion Illinois’ state debt has ballooned to $51,000 per household Illinois has roughly $9 billion in unpaid bills Illinois will spend more on pensions than on education by 2016 Illinois’ economic performance: Illinois is 47th in job growth Illinois is 48th in economic outlook Illinois is 48th in...

Illinois’ state debt:

- Illinois’ total state debt is $271 billion

- Illinois’ state debt has ballooned to $51,000 per household

- Illinois has roughly $9 billion in unpaid bills

- Illinois will spend more on pensions than on education by 2016

Illinois’ economic performance:

- Illinois is 47th in job growth

- Illinois is 48th in economic outlook

- Illinois is 48th in economic performance

- Illinois is 48th in net domestic migration

- Illinois is 48th in average workers’ compensation costs

- The rate of entrepreneurship in Illinois has been below the national average every year since 1996, with the exception of 2001

- Chicago is tied with Detroit for the worst entrepreneurship rate among the 15 largest metropolitan areas in the country

- Illinois has had 12 credit downgrades since 2008

- Illinois has more units of local government than any other state in the nation

- Illinois hiked state income taxes by 67%

- Rate of entrepreneurship below national average last 15 of 16 years

- Worst credit rating in the nation

- Illinois has had 12 credit downgrades since 2008

- It will take 43 months for Illinois’ unemployment rate to recover to its pre-recession low, given the current pace of job creation and assuming no growth in the labor force

Illinois’ pensions:

- Illinois has the worst funded pension in the nation

- Illinois’ pension inaction costs the state $18 million per day

- Illinois pension funds need 19 percent annual investment returns in order to pay for the promised benefits

Illinois’ health care:

- Medicaid reimbursement rates are among the worst in the nation

It’s no surprise Illinois loses 1 resident every 10 minutes.