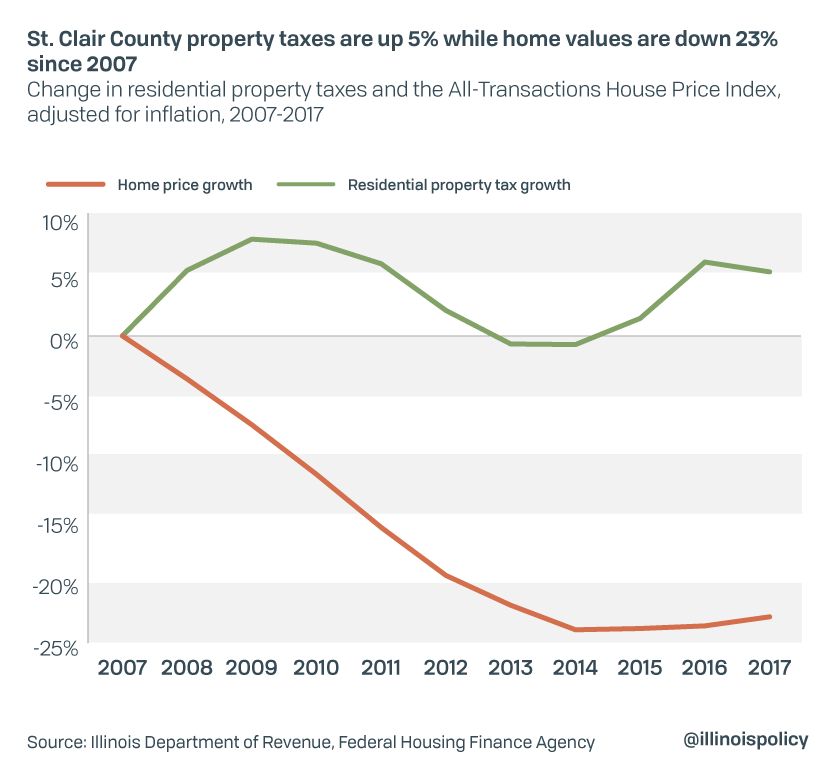

St. Clair County home values down 23%, property taxes up 5% since recession

Without true pension reform, St. Clair County homeowners will only continue to see the gap between their property taxes and home values grow.

Many southwestern Illinois homeowners have yet to recover much of the home value they lost after the 2007 housing market crash. But that hasn’t stopped area homeowners’ property tax bills from climbing.

Average home prices in St. Clair County are 23% lower today than in 2007, adjusted for inflation, according to data from the Federal Housing Finance Agency.

Even though homes are worth less than they were prior to the Great Recession, inflation-adjusted St. Clair County property tax bills have increased by 5.2% on average. Local homeowners paid the first installment of their property taxes June 21, and the second installment Aug. 21.

St. Clair County’s poor housing recovery – like that of other southwestern Illinois counties – is a national outlier: While home prices nationwide have yet to return to their pre-recession peak, they were down just 9% between 2007 and 2017. To put St. Clair County’s housing plight in perspective, its decline in average home values during that time period is an alarming 150% worse than the nation as a whole.

The biggest factor driving rising property taxes? Unsustainable growth in pension costs for government workers. Pension liabilities have risen faster than taxpayers’ ability to pay, forcing state and local governments to constantly scramble for new sources of revenue – often in the form of property tax hikes.

This diminishes homeowners’ standard of living, and potentially their home equity, while jeopardizing government workers’ retirement security.

With constitutional pension reform, Illinois can protect workers’ already-earned benefits while slowing the accrual of future benefits not yet earned – and eliminate the need for endless property tax hikes.