St. Clair County approves 5 percent property tax levy hike

The county board approved a $3.5 million property tax levy increase for 2019.

The St. Clair County board voted to approve a 5 percent increase to the county’s property tax levy for 2019. The increase will raise the county’s property tax levy to $71.5 million from $68 million, according to the Belleville News-Democrat. Only five of the board’s 29 members voted against the levy hike.

Taxpayers in St. Clair County won’t find out what the levy hike means for their own property tax bills until property values are assessed in spring. That’s when the county will decide to what extent it will abate the property tax levy.

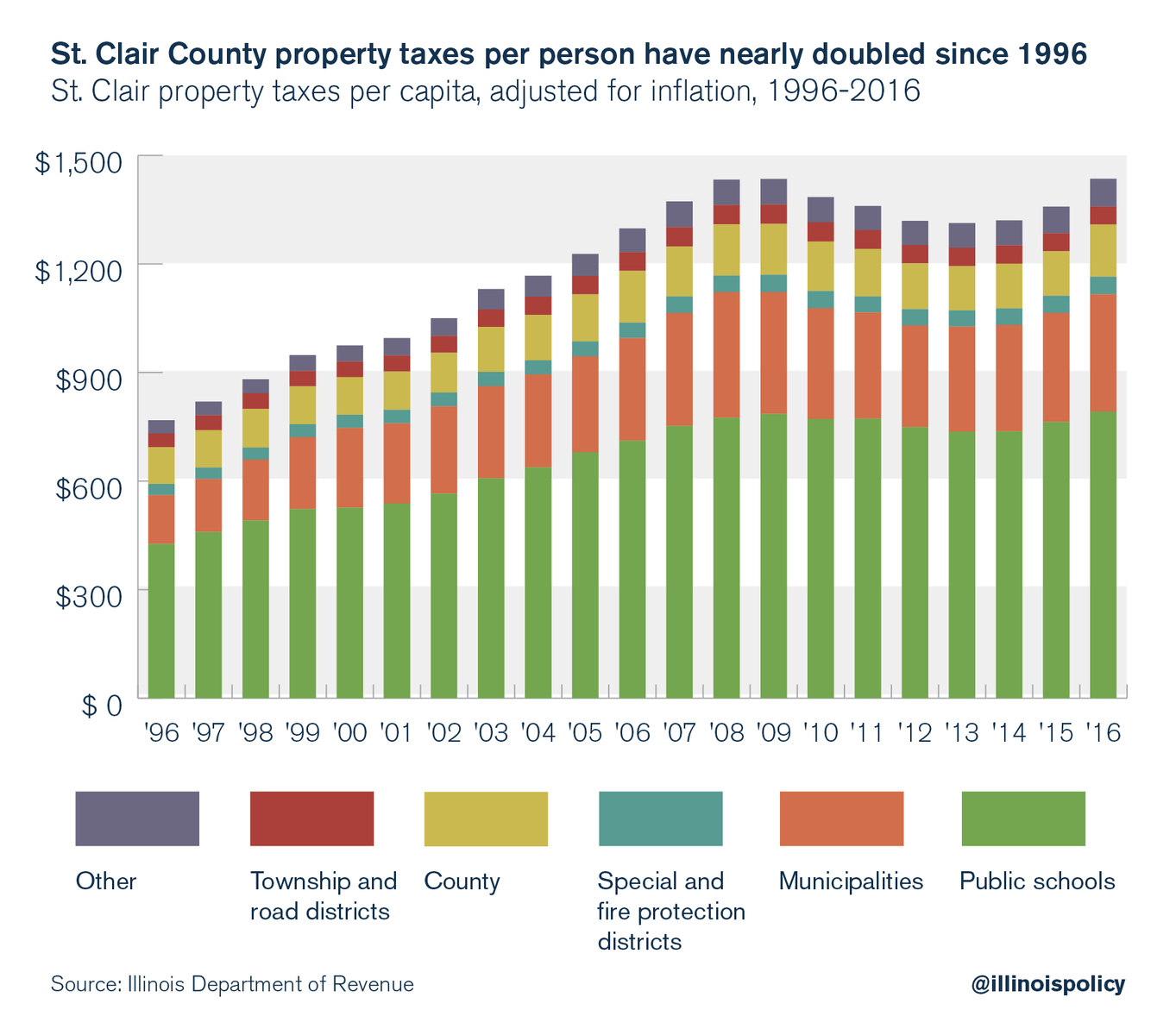

Taxpayers in the region need real property tax relief. St. Clair County property taxes have nearly doubled over the past 20 years after adjusting for inflation – an increase that amounts to around $665 per person.

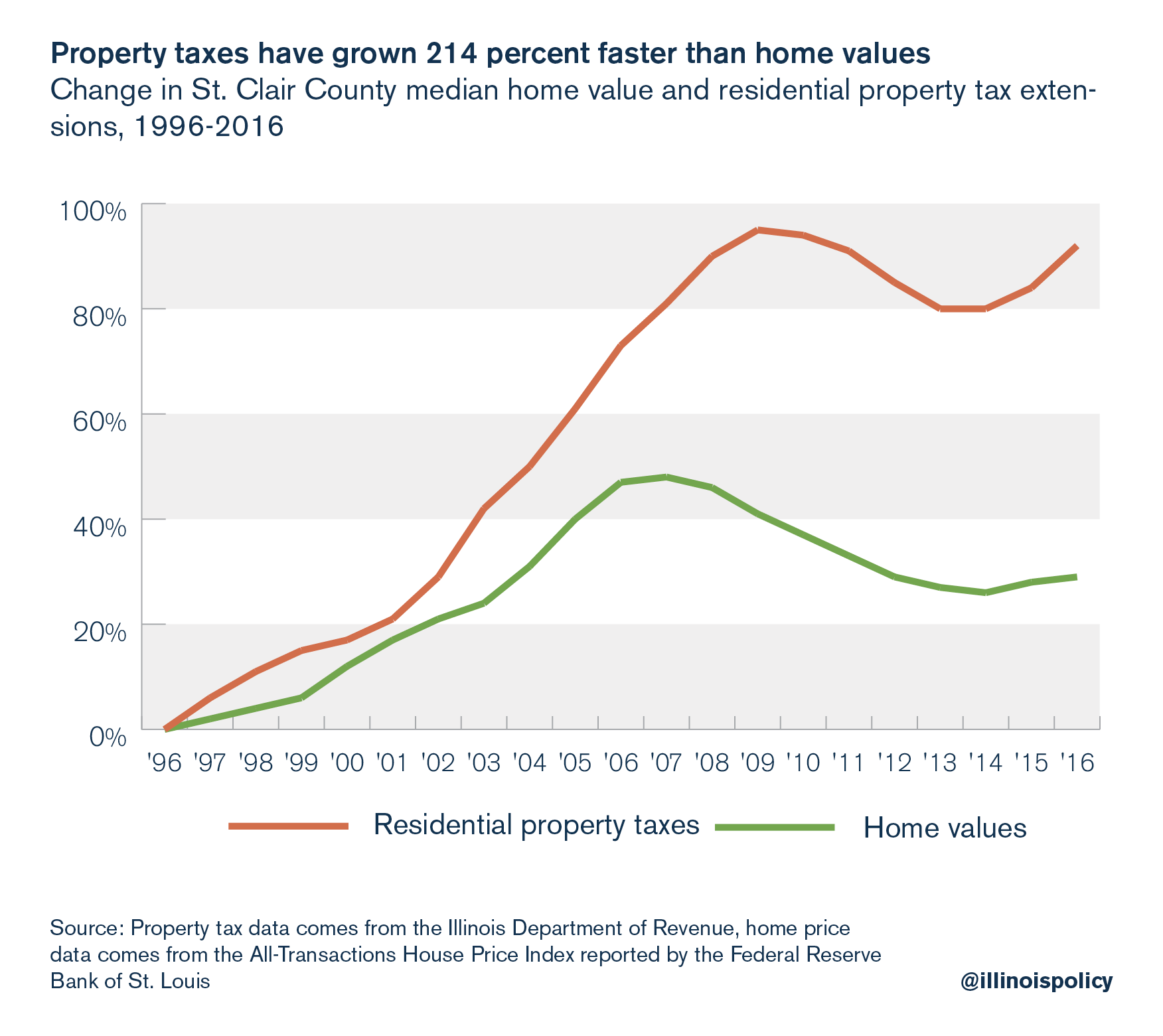

It’s not uncommon for home values to increase in tandem with local property taxes, provided that taxing bodies invest revenues in essential government services. This, however, is not the case in St. Clair County, where property taxes have grown more than 200 percent faster than median home values – a rise driven primarily by growing pension costs.

Migration patterns indicate taxpayers in the area are tapped out. Between 2016 and 2017, more than 1,300 people moved out of St. Clair County to other counties in the U.S. on net, resulting in a population loss of nearly 650 people. Statewide, the Land of Lincoln has suffered population loss for four consecutive years. When polled, Illinoisans looking to plant roots elsewhere cite taxes as the primary motivating factor.

It is a moral imperative that Springfield muster the political will to amend the Illinois Constitution’s pension clause. Without the ability to make sensible changes to future, not-yet-earned pension benefits, taxpayers’ cost of living will continue to spike and government workers’ retirement security will continue to erode. In the short term, however, lawmakers should enable local governments to enroll all new government workers into affordable 401(k)-style defined-contribution plans.

Absent serious reform, rising tax bills will continue to find their way to St. Clair County home addresses – or residents will continue finding their way to home addresses outside St. Clair County.