S&P downgrades Illinois credit rating closer to junk

The ratings agency also warns that another downgrade could be coming if the state doesn’t enact serious reforms to improve its fiscal condition.

Standard & Poor’s Global Ratings, or S&P, downgraded Illinois’ debt closer to junk-rating territory Sept. 30. The state’s credit rating fell to BBB from BBB+ and was assigned a negative outlook by S&P, meaning the ratings firm could downgrade the state again in the near future.

The reasons for the downgrade serve as yet another indictment of Illinois’ refusal to enact reforms. The ratings agency blamed the state’s history of deficits, failure to curb spending and its growing pension costs as reasons for its downgrade.

S&P’s Illinois downgrade comes on the heels of Moody’s downgrade of Chicago Public Schools. Moody’s similarly blamed the district’s long-term irresponsible deficits, growing pension costs and a lack of reforms for its own ratings action.

- Illinois’ long history of unbalanced budgets

S&P criticized the state’s “long history of structural imbalance” as a primary reason for its downgrade.

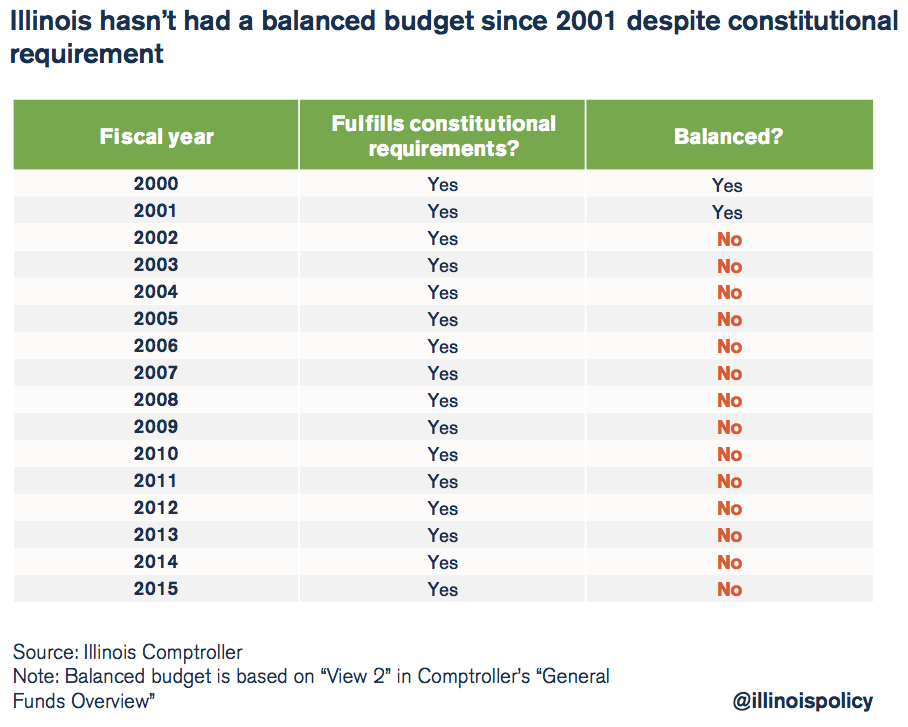

Not only has Illinois run a sizable unpaid bill backlog since 2005, but Illinois hasn’t had a fully balanced budget since 2001.

Politicians have ignored deficits, unpaid bills and credit downgrades for years.

Those problems are why Illinois suffered budget deficits even during the mid-2000’s boom period and during the 2010-2014 income tax hike, which injected an additional $32 billion into Illinois’ coffers.

Despite those revenues, Illinois politicians have always managed to spend beyond the state’s means by engaging in poor financial mismanagement and misplaced priorities.

Over the decades, Illinois has always collected more than enough revenue to pay for its essential expenditures, as shown in the Institute’s recent report on the state’s history of revenues and spending.

- Illinois’ inability to enact spending reforms

S&P also criticized Illinois’ inability to “curb its spending” due to the lack of a full budget for the second consecutive year.

The state is on track to spend $39.6 billion in 2017 due to the stopgap budget. That spending is $4 billion, or 11 percent, more compared to 2015, the last year Illinois had a full budget.

More importantly, the state’s increased spending – due to consent decrees, court orders and continuing appropriations – has resulted in a $5.4 billion deficit for 2017.

S&P warned that unless Illinois responsibly addresses its ongoing fiscal imbalance, more downgrades, higher borrowing costs and even bigger burdens on Illinois’ taxpayers are on their way.

- Illinois’ growing pension crisis

S&P also cited, as a reason for the downgrade, Illinois’ “large net pension liability” that threatens to grow even larger.

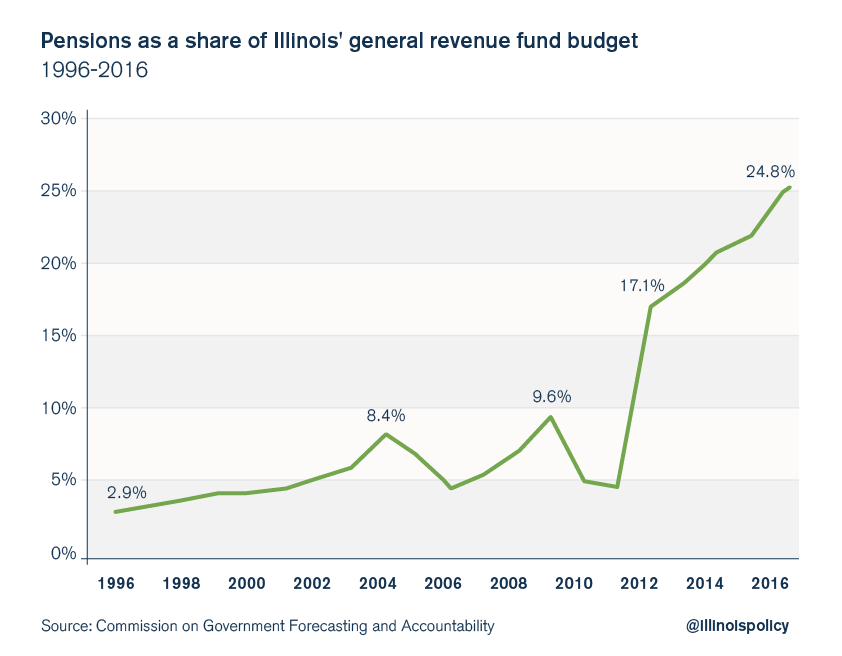

In all, the state’s $111 billion pension crisis already consumes 25 percent of Illinois’ general fund budget. That’s crowded out state spending on social programs, higher education and nearly every other core government service.

And the pension burden on Illinois’ budget is likely to only grow bigger.

S&P notes that the pension funds’ recent lowering of how much they assume their investments will earn in the market, along with poor investment returns, will likely drive up Illinois’ required annual pension contributions by hundreds of millions of dollars.

In fact, without reforms, it’s guaranteed pensions’ burden on taxpayers will grow larger. Taxpayers will have to pay more to pensions as long as Illinois’ promised pension benefits to state workers keep growing.

Promised pension benefits have increased at a nearly 9 percent pace annually for the past three decades, growing to $191 billion in 2015 from just $18 billion in 1987.

That growth rate far surpasses the growth rates of state revenues, inflation, household incomes and taxpayers’ ability to pay for those benefits during that same period.

S&P’s suggestion: real reforms

According to S&P, Illinois will only fix its budget crisis when it passes “significant measures to achieve structural balance and contain fixed cost growth.” That means the state has to reform how it operates and find ways to reduce the costs driving Illinois’ record spending.

Lawmakers can start by moving new state workers to 401(k)-style plans and giving existing workers an optional 401(k)-style plan. That will start to eliminate the costs of the state’s broken pension systems

Illinois can also fix its broken workers’ compensation system and freeze local property taxes, all while giving local governments more control over their collective bargaining agreements.

These kinds of reforms will set Illinois on a fiscally sustainable path and help make government work for taxpayers.