Southern Illinois municipal pensioners have collected more than $500M in benefits over last 20 years

Despite regional struggles and a shrinking population, taxpayers in southern Illinois have been saddled with rapidly growing pension costs.

Illinois’ broken pension system is a major pain point for taxpayers, including residents in the state’s shrinking southern region.

Local government retirees in Illinois’ 17 southernmost counties collected over $500 million in pension benefits over the last 20 years alone. That’s according to records from the Illinois Municipal Retirement Fund, or IMRF, which only include retirees still currently drawing benefits from the system – meaning the overall cost over the last 20 years is much higher.

These growing costs undoubtedly play a role in explaining many residents’ high property taxes. And barring reform, they aren’t likely to slow down anytime soon.

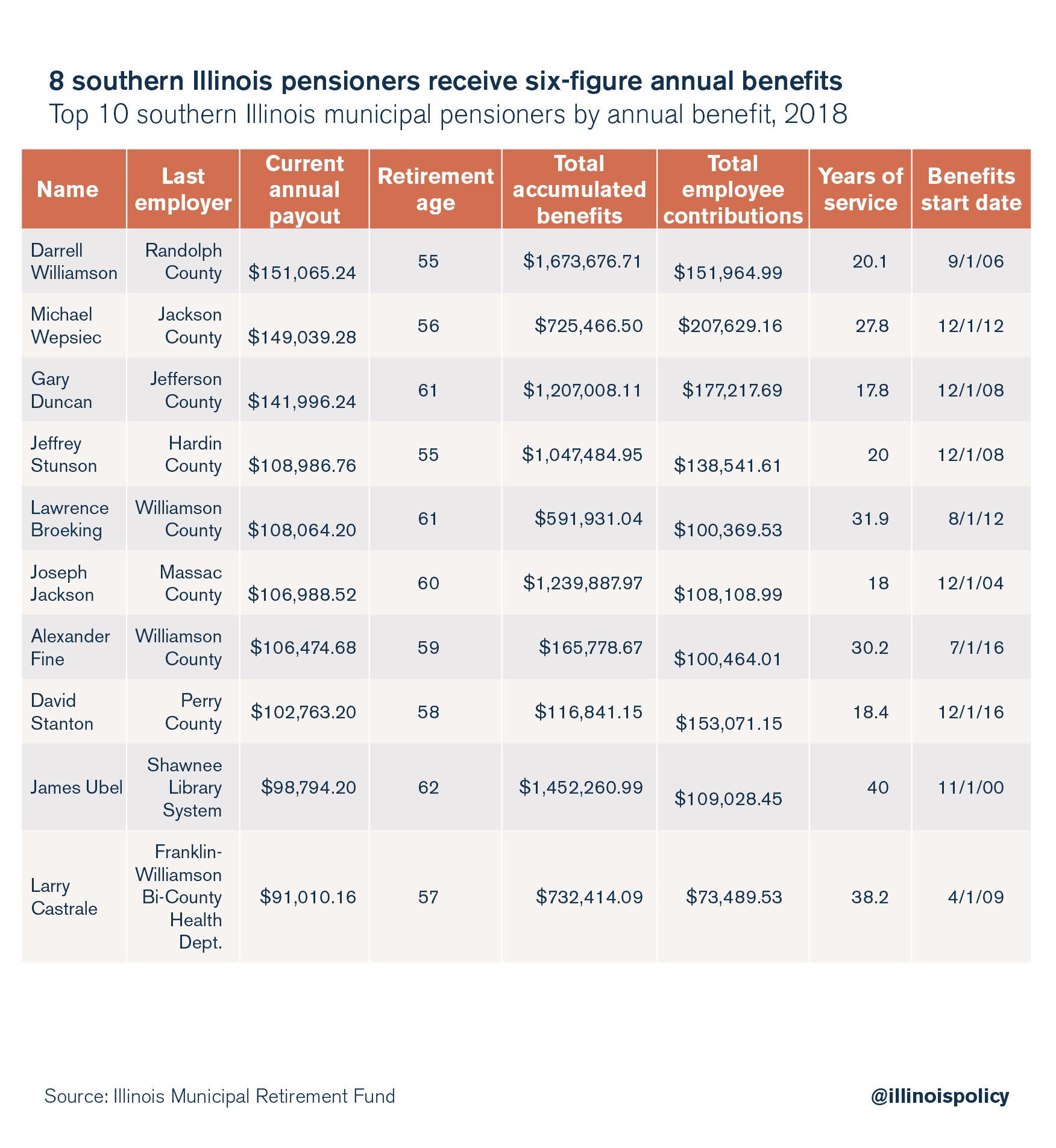

Among Illinois’ southernmost counties, the highest median household income is in Randolph County at $48,343. But more than 130 IMRF retirees’ annual pension benefits in the region exceed that amount, with eight of those pensioners receiving six-figure annual payouts.

The cost burden weighing on southern Illinois taxpayers is unmanageable, and many have let the state know with their feet. Sixteen of the 17 southernmost counties dropped in population in 2017, in line with the ongoing trend of statewide population loss driven by more residents leaving Illinois than arriving.

Competitive pressure from a more welcoming neighbor doesn’t help matters. While southern Illinois shrank between 2015 and 2016, neighboring Kentucky gained 1,100 Illinoisans over that time. Outgoing Illinoisans have found themselves among new crops of Kentuckians for more than a decade: Over 13,000 Illinoisans migrated from Illinois to Kentucky on net from 2006 to 2015 – amounting to more than five Illinoisans lost to the Bluegrass State per day. With growing pension costs causing Illinoisans’ tax burdens to skyrocket, these trends should come as no surprise.

If lawmakers would like to see southern Illinois grow and thrive, they must pursue meaningful policy changes that reduce pension costs and provide relief to overtaxed residents, while protecting the retirement security of government workers. In the short term, lawmakers should enroll all new government workers into 401(k)-style plans, alleviating the growth of future government retirement costs. In the long term, however, state lawmakers must amend the state constitution to allow for changes to future, unearned benefits.

State action is required for Illinois’ southern residents to flourish. Otherwise, Illinois will continue to shrink, while its remaining taxpayers continue to feel the pain of an unaffordable, unmanageable pension system.