Short-term state funding won’t fix Illinois’ systemic higher-education crisis

Illinois’ public colleges and universities used to be affordable, but schools have increased tuition from 74-112 percent over the last decade to help pay for administrative hiring sprees and skyrocketing pensions.

Gov. Bruce Rauner has signed a law authorizing $600 million in state funding for Illinois’ universities and community colleges, including $170 million for tuition grants to low-income students. The appropriation is enough to keep higher education running through the fall. But it won’t do anything to stem Illinois’ long-term higher-education crisis.

In fact, while these funds will relieve budgetary pressure on students and universities temporarily, the money distracts from the real problems with higher education: skyrocketing tuition, executive-level administrative compensation, and out-of-control pensions. More money from the state will not solve these problems. Instead, the state and universities must engage in comprehensive reforms by fixing the pension crisis, realigning salaries and eliminating administrative bloat.

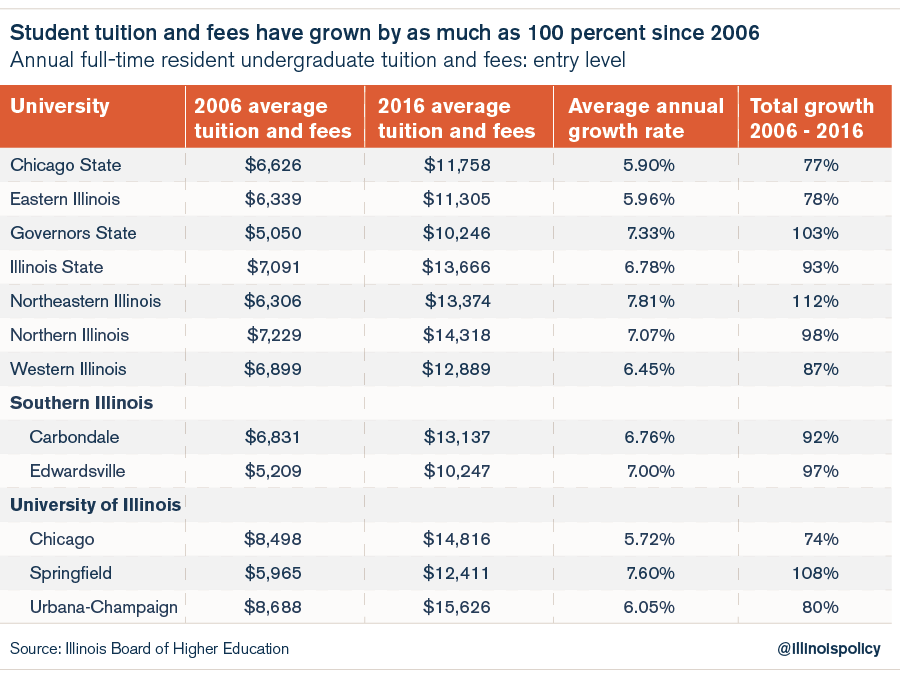

College used to be affordable for students – but no longer. Illinois’ public colleges and universities have increased tuition from 74 to 112 percent over the last decade to help pay for administrative bloat. At Northeastern Illinois University for example, average annual tuition and fees have more than doubled, to $13,374 in 2016. Students used to able to work in order to pay for school. Now, tuition is out of reach without taking on massive debt, receiving subsidies from the state, or both.

Universities have used tuition money to fund an ever-expanding administrative bureaucracy. Between 2004 and 2010, the number of university administrators in Illinois skyrocketed by more than 30 percent, while the student and faculty populations grew less than 3 percent. The state’s worst offender, Chicago State University, now has nearly one administrator for every faculty member. With so many administrators to pay for, it’s no wonder Chicago State University has nearly collapsed during the state’s budget crisis.

Executive compensation has also jumped to exorbitant levels. Over half of Illinois’ 2,465 university administrators received a base salary of $100,000 or more in 2015. The state’s top-paid administrator, Paula Allen-Meares of the University of Illinois – Chicago, received over $887,000 in compensation through her salary and one-time bonuses in 2014.

And the state’s community colleges are not immune to the practice of providing high executive compensation either. Lewis and Clark Community College paid its president over $540,000 in total compensation in 2014.

Those big salaries lead to big pensions. Over 25 percent of university pensioners will receive $1 to $2 million in total retirement benefits, while the universities’ top pensioners can expect to receive $6 to $17 million.

Those large pension payouts have in turn put tremendous strain on the university pension system and the state.

While underfunding by politicians has played a role, growing benefits have been the main driver of the pension crisis.

The total annual pension benefits for members of the State Universities Retirement System (the benefits accrued by all pensioners) have grown at the incredible pace of 8.4 percent annually since 1987, to $37 billion in 2014 from just $4.2 billion in 1987. That benefit growth rate is so rapid that state appropriations cannot possibly keep up with it in the absence of pension reform.

As a result, more than 50 percent of Illinois’ $4.1 billion budget appropriation for universities is spent on retirement costs instead of university classrooms.

Ending the current budget gridlock is only a short-term solution for Illinois’ students. Unless universities and the state enact comprehensive reforms, the pension crisis and administrative bloat will continue to drive up the cost of higher education.

To begin making college affordable again, Illinois’ colleges and universities must reduce salaries and eliminate their administrative bloat – then pass the savings onto students.

The state must also do its part to fix the problems with higher education by addressing the pension crisis.

Illinois needs to move away from its broken pension systems – starting by moving new university workers onto 401(k)-style plans. That will be relatively easy for university employees, as such a program already exists for them today. Almost 20,000 active and inactive members of the State Universities Retirement System already participate in a 401(k)-style plan. These state-university workers control their own retirement accounts, which aren’t part of the increasingly insolvent pension system.

The combination of university administrative reforms and a move to 401(k)-style plans will go a long way toward fixing the crisis in higher education and making college affordable for Illinois students once again.