Senators pitch tax on ‘privilege’ of doing business in Illinois, among other tax hike proposals

In addition to raising the state’s personal and corporate income taxes back near their all-time highs, senators are proposing taxing businesses on the “privilege” of doing business in Illinois, as well as taxing several services.

Illinois Senate Republican and Democratic leadership is now proposing to add a payroll tax – described as an “opportunity tax” on businesses “for the privilege of doing business in the State” – and a services tax, on top of a personal income tax hike up to 4.99 percent and a corporate income tax hike up to 9.5 percent.

If passed, the new taxes and tax increases would make Illinois one of the only states in the country to tax payroll, return the personal and corporate income tax rates close to their record-high rates under former Gov. Pat Quinn, and impose new taxes on services such as storage, amusements, repair and maintenance, landscaping, laundry and dry cleaning.

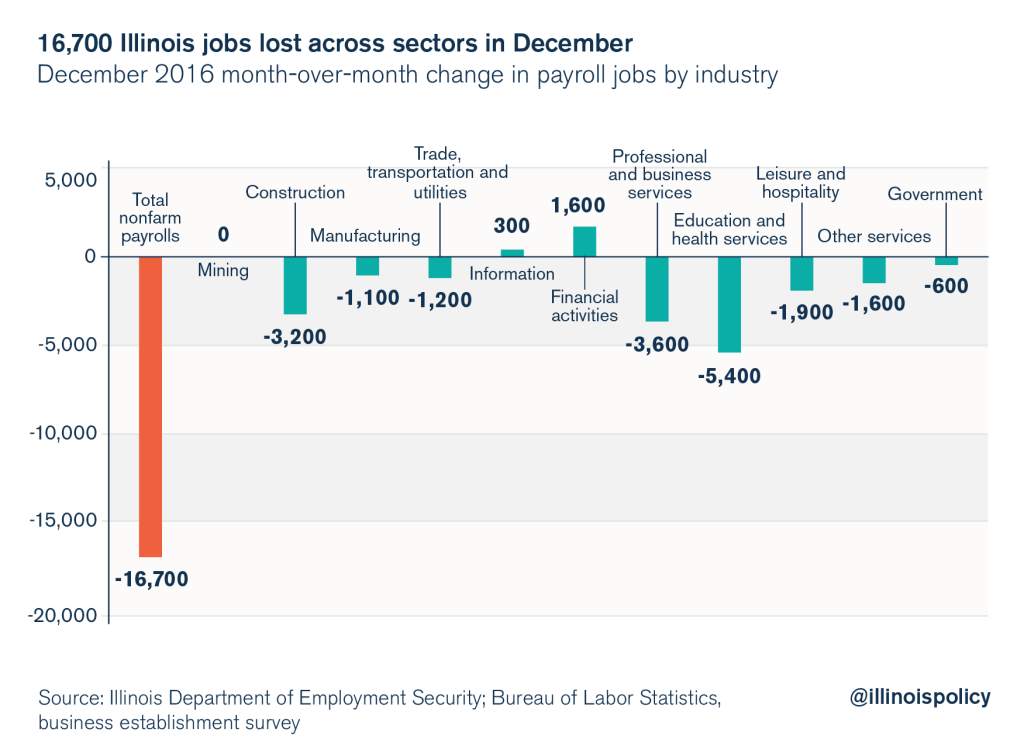

The so-called “opportunity tax” would tax employers based on payroll with five different tax brackets. Employers would pay between $225 and $15,000 in taxes on payroll for a taxable year. The Senate’s proposal for a new tax on payroll would worsen Illinois’ position significantly by increasing the incentive for businesses to move their labor force out of Illinois. The proposal is especially tone deaf given that the Illinois Department of Employment Security just announced Illinois lost 16,700 payroll jobs in December, and that November’s jobs number was revised down by 6,200.

This proposed new payroll tax would be added on top of another Senate proposal: increase to the corporate income tax rate, which would go up to 9.5 percent from 7.75 percent (with the 2.5 percent Personal Property Replacement Tax added on). This would give Illinois the fourth-highest corporate rate in the nation, a significant deterioration in the state’s current ranking.

The Senate’s newest proposals coincide with the withdrawal of the statewide sugary drink tax proposal; lawmakers’ revised pitch also would eliminate the state’s harmful franchise tax, which discourages entrepreneurship and investment in the state. But overall, the tax hike proposals taken together are not a welcome sight for Illinoisans already facing one of the highest combined tax burdens in the country. And, beyond the economically damaging tax hikes, the budget proposal lacks any serious, structural reforms to reverse the state’s downward trajectory.

The Senate’s “compromise” plan includes a watered-down, two-year property tax freeze, does little to change the state’s expensive, uncompetitive workers’ compensation system and doesn’t end Illinois’ broken defined-benefit pension system. The proposed deal also features $7 billion in borrowing, including a bailout of Chicago Public Schools with no reforms required from the district.

If Springfield politicians were serious about getting the state back on track, they would propose structural spending reforms, such as 401(k)-style retirement plans, amending the constitution to allow changes to Illinois’ incredible pension debt, comprehensive property tax reform, and an overhauled workers’ compensation system. Current proposals do nothing more than force taxpayers to compensate for decades of politicians’ mistakes and recklessness. With people and income fleeing the state in droves, lawmakers should put forward a budget that gives taxpayers relief, and optimism about staying in Illinois.