Sales tax hikes take effect in 50 Illinois taxing districts

More than 50 Illinois counties, municipalities and business districts started imposing sales tax increases ranging from 0.25-1.5 percent as of July 1.

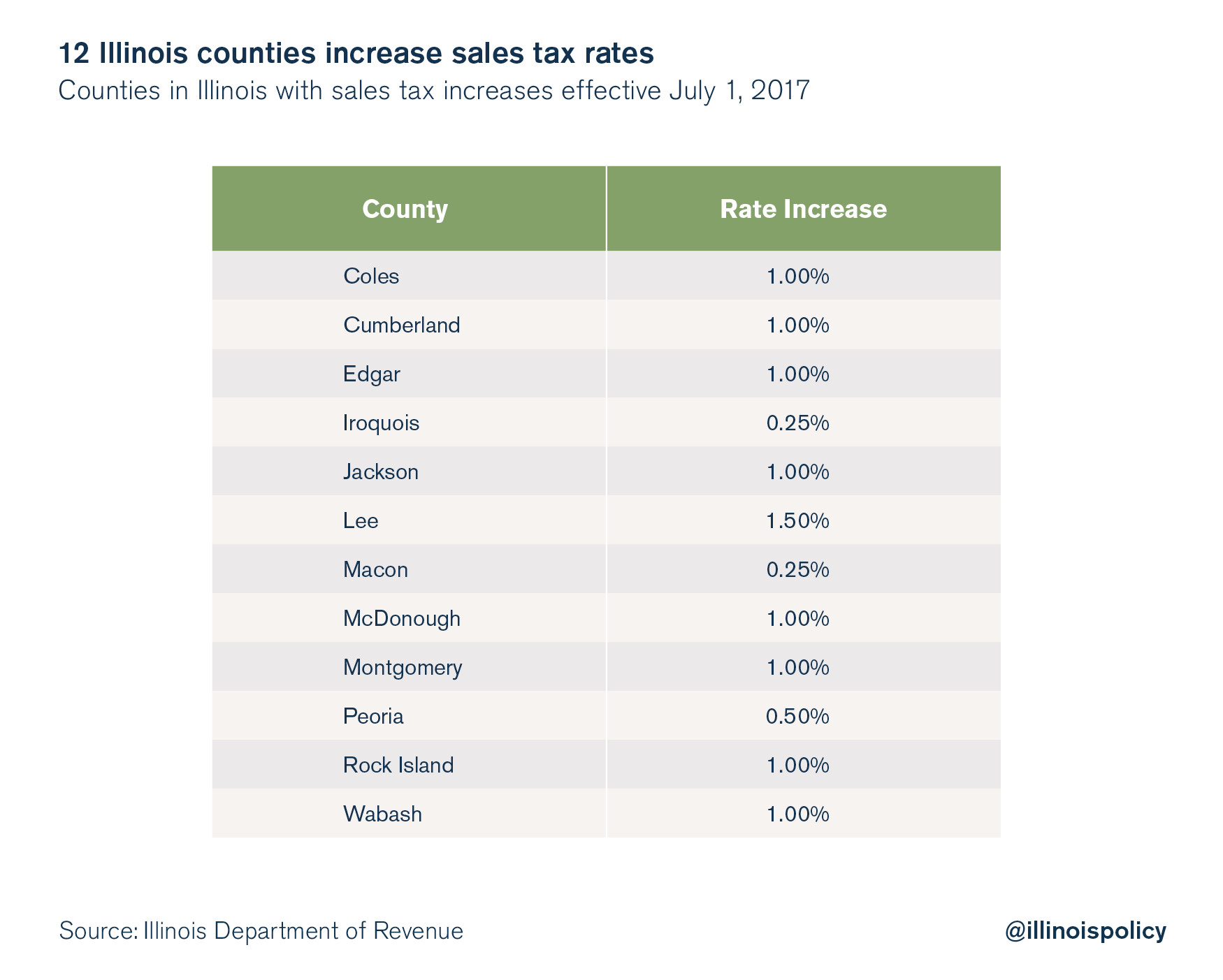

If Illinois shoppers are experiencing sticker shock in store checkout lines, it’s because dozens of Illinois taxing districts across the state passed sales tax increases that took effect July 1. Twelve counties, 20 municipalities and 20 business districts within 15 cities have hiked their rates, according to the Illinois Department of Revenue.

Coles, Cumberland, Edgar, Iroquois, Jackson, Lee, Macon, McDonough, Montgomery, Peoria, Rock Island and Wabash counties have all passed sales tax rate increases effective as of July 1. The county rate increases range from 0.25 percent in Iroquois and Macon counties, to 1.5 percent in Lee County.

Among the municipalities that will see increased sales tax rates, the part of Sandwich that lies within DeKalb County has the relatively greatest increase in its combined sales tax rate, rising to 7.25 percent from 6.25 percent, a 16 percent increase. Olympia Fields and Orland Hills, both in Cook County, will have new combined sales tax rates of 10 percent.

Some of the business districts are strikingly narrow. Fox River Grove in McHenry County will charge an extra 1 percent sales tax to customers of a new banquet hall. The Avante Banquets and Conference Center is the only building within the newly created business district.

Illinoisans already suffer under the highest combined sales tax rate in the Midwest, and residents are also forced to pay sky-high property taxes, both of which contribute to one of the heaviest tax burdens in the nation. And with the 32 percent income tax hike just enacted by the Illinois General Assembly, that burden will only grow heavier.

Through local sales tax hikes, officials are pushing policy in the wrong direction. Polling from the Paul Simon Public Policy Institute lists Illinois’ high taxes as the primary reason people want to leave the state. And people are leaving – at a quickening pace in some areas of Illinois such as Cook County.

Illinois taxpayers need relief, and local governments are missing an opportunity to compete for more residents and businesses if they continue to follow the state’s trend of ever-higher taxes.