Rest of the nation sees 31 percent faster jobs growth vs. Illinois in 2018

Illinois experienced its sixth consecutive month of jobs growth in July, yet continues to trail the pace of growth in the rest of the nation for 2018.

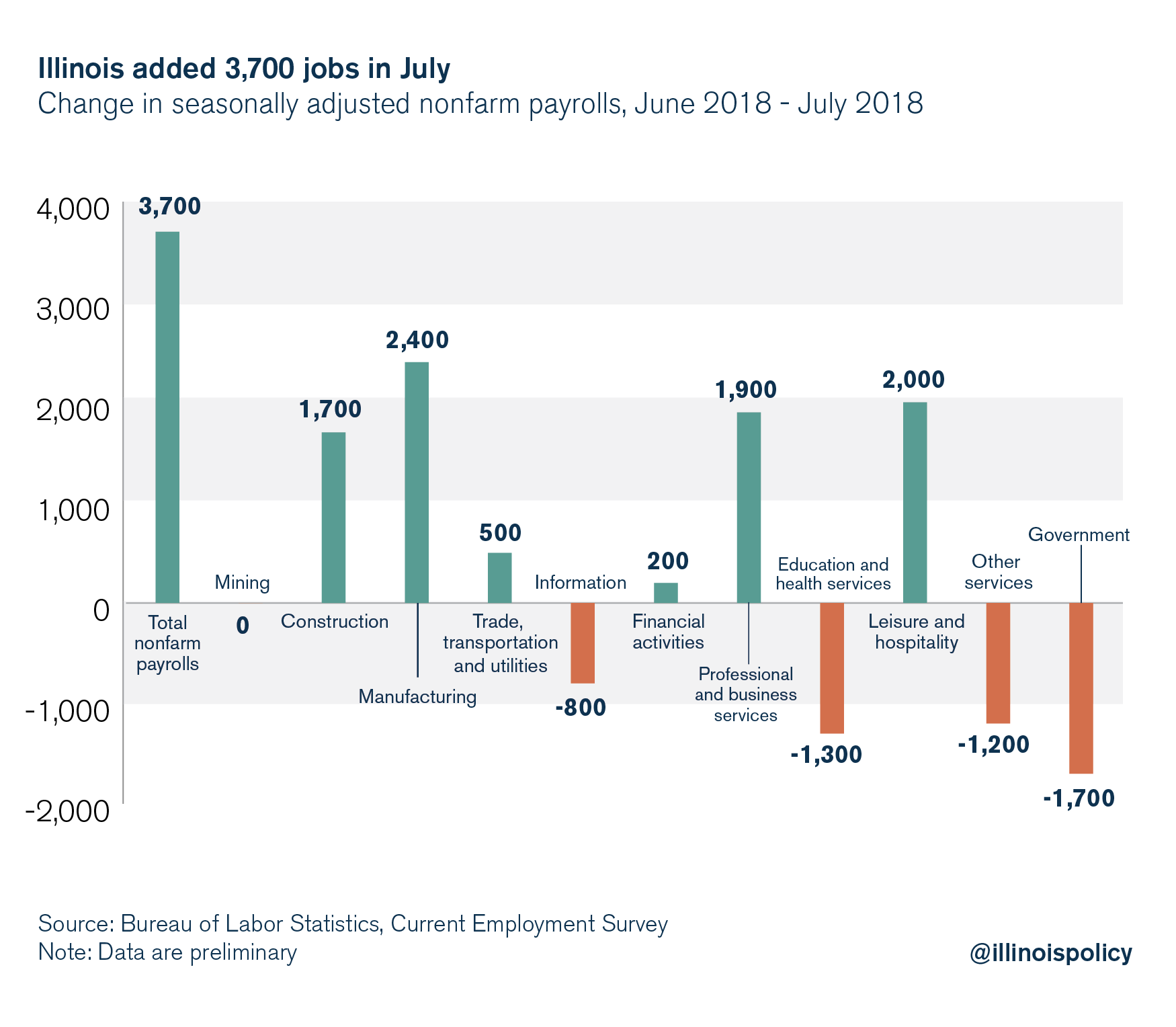

The Illinois economy added 3,700 jobs during July, according to data released on Aug. 16 by the Illinois Department of Employment Security in conjunction with the U.S. Bureau of Labor Statistics.

The preliminary data show Illinois payrolls grew less than 0.1 percent over the month, a drastic cool-down compared with June’s jobs growth. June numbers were revised down to show 17,200 additional jobs – growth of 0.3 percent – instead of the 18,100 originally reported.

While July’s jobs report is welcome news, Illinois still lags the rest of the nation in jobs growth for the year, a gap not likely to close absent pro-growth reforms.

The largest portion of July’s gains were driven by an expansion in the manufacturing sector, a refreshing change from June when the government sector was the primary driver of employment gains.

After manufacturing, the next largest gains came from the leisure and hospitality sector, which added 2,000 jobs, and the professional and business services sector, which added 1,900 jobs. The construction sector also expanded payrolls by 1,700, while trade, transportation and utilities created an additional 500 positions, and financial activities added 200 jobs. Mining employment saw no change during the month of July.

A handful of industries experienced losses in July. Government payrolls shed 1,700 jobs, education and health lost 1,300 positions, other services were down 1,200 jobs, and the information sector lost 800 jobs.

Illinois’ unemployment rate fell to 4.2 percent from 4.3 percent in July, 0.3 percentage points higher than the national rate of 3.9 percent.

Good start to the year

July marks the sixth straight month of payroll expansion for the state, which hasn’t lost jobs on net in any month since January. This is undoubtedly good news. Nevertheless, Illinois has failed to keep up with the rest of the nation in jobs growth thus far in 2018.

Since December 2017, the rest of the nation has expanded payrolls 31 percent faster than Illinois.

Closing the gap

Persistent underperformance relative to the rest of the nation has meant the gap between Illinois’ employment situation and worker opportunities available elsewhere is widening.

When businesses perceive more volatility in the economy (whatever the source), they will want to err on the side of higher prices, which results in more inflation, higher markups, and less economic activity. While passing a state budget this year without any tax hikes reduced uncertainty to some extent in Illinois, the Land of Lincoln must enact lasting and meaningful reforms to close the gap with its peers.

One such reform would be enacting a spending cap that averts the need for future tax hikes. In spring 2018, state lawmakers lent bipartisan support to a constitutional amendment to impose a spending cap on the state budget. Although the spending cap amendment never made it to a vote, members of the Illinois House of Representatives and Senate have pledged to reintroduce the legislation next year. The spending cap would have tied the growth in state spending to the long-run average growth in the economy, avoiding the need for economically damaging future tax hikes.

Just as a spending cap would avert the need for economically harmful tax hikes by reining in government spending, resisting a progressive income tax is also necessary if Illinois is to prioritize its economic growth.

State lawmakers and democratic gubernatorial candidate J.B. Pritzker have called for an end to Illinois’ constitutionally protected flat income tax in favor of a progressive income tax with differing rates set according to income levels. Although often sold as a tax on the rich, a recent progressive tax proposal by Democratic state Rep. Robert Martwick from Chicago would hike taxes on those making more than $17,300 per year.

The state’s economy cannot afford a progressive income tax hike – or any tax hike – if it is to ever close the economic growth gap with the rest of the nation. Illinoisans should demand their lawmakers enact the pro-growth reforms that could close this gap.