Workers’ compensation is a significant cost to Illinois taxpayers and drains scarce tax dollars from government coffers. Political and business leaders often view workers’ compensation as a costly regulation that affects private-sector investment and employment in Illinois.[1] This description is accurate yet incomplete. The same heavy costs imposed on private-sector employers[2] are also imposed on taxpayers who cover the workers’ compensation costs for billions of dollars in state and local government payrolls, and billions more for labor on public construction projects.[3] Illinois politicians must reform workers’ compensation to guarantee better stewardship of tax dollars.

This report is part of a series that uses sample data from local governments to estimate the annual cost of workers’ compensation to Illinois taxpayers. According to the findings of this report, the cost of workers’ compensation for municipalities, counties and state government is more than $400 million per year. These units of government represent less than half of all government payroll costs in Illinois.

A future report will look at the cost of workers’ compensation for other units of local government, along with the cost of workers’ compensation with respect to public works construction projects, which is ultimately borne by taxpayers. Those findings combined with this report will provide a more exact estimate of the total cost of workers’ compensation for Illinois taxpayers.

There are a variety of reform proposals that would lead to better stewardship of taxpayer dollars. Reform proposals specifically targeted for local governments include adopting the federal definition of catastrophic injuries for the Public Safety Employee Benefits Act, and eliminating the effective bump in take-home pay given to some injured government workers under the Public Employee Disability Act. In addition, governments should structure light-duty programs to bring injured workers back on the job doing light work.

Furthermore, governments would experience substantial savings through reforms to the Workers’ Compensation Act, including putting Illinois’ wage-replacement rates in line with those in surrounding states, eliminating the increase in take-home pay for some injured workers, tying medical reimbursement rates to Medicare or group health rates, and eliminating the financial incentives for doctors to overprescribe opioids and other dangerous drugs.

Workers’ compensation is a state and local government budget issue

On Feb. 13, 2015, Gov. Bruce Rauner issued Executive Order 15-15[4] to create the bipartisan Local Government Consolidation and Unfunded Mandates Task Force. The purpose of the task force was to study issues of local government consolidation and unfunded mandates. On Dec. 17, 2015, Lt. Gov. Evelyn Sanguinetti released a study on cost drivers for local governments, which was the result of the executive order.[5]

The study included a survey of 500 units of local government to assess how costly and burdensome local governments perceived various state mandates to be. The survey found that workers’ compensation is one of the most significant unfunded mandates that concern local governments. In particular, the survey found that for municipalities, workers’ compensation is the third-most burdensome mandate behind public pensions and collective bargaining/interest arbitration.[6] In the same study, counties put workers’ compensation as the fourth-most costly mandate, behind health insurance, public pensions and prevailing wage.

In addition, workers’ compensation is a significant cost for state government. In 2012, Illinois Attorney General Lisa Madigan wrote[7] a brief to explain the challenges faced by her office in defending the state against workers’ compensation claims made by state employees. In 2015, state Rep. Mark Batinick, R-Plainfield, requested workers’ compensation data from Illinois’ Legislative Research Unit and authored an article in The (Springfield) State Journal-Register[8] about how the workers’ compensation system drives up taxpayer costs at both the state and local levels. Batinick estimated that Illinois taxpayers pay an excess of $190 million beyond what they would pay if the state’s costs were in line with costs in the average American state.

Thus, workers’ compensation for public employees is clearly a significant cost for Illinois taxpayers. Not only do taxpayers bear the burden of paying for government wages, health insurance, pensions, and other benefits, but Illinoisans are also hit with workers’ compensation costs that are higher than costs in any other state in the region. There are two main reasons workers’ compensation costs are so high for Illinois taxpayers:

- Illinois’ workers’ compensation costs are out of line with those of other states because Illinois’ laws and judicial rulings have created a much more expensive system than those in surrounding states. Many of the legal cost drivers are codified in statute in Illinois’ workers’ compensation laws. Additional costs come from statutory requirements that pertain specifically to injuries for government employees. Still more costs are added by expansive judicial rulings that extend workers’ compensation to situations many states don’t find compensable.

- Illinois has 7,000 layers of government, by far the most of any state in the nation.[9] Duplicative layers of government increase payroll costs, which drive up workers’ compensation costs. Some areas of the state have more than a dozen layers of government. Each layer of payroll can add to the overall workers’ compensation bill.

Simply put, Illinois’ workers’ compensation system is a taxpayer budget issue for state government, local governments and public construction projects. The extraordinary cost to Illinois taxpayers derives from statutory differences compared with other states, expansive, pro-plaintiff judicial rulings, and excess layers of government that add to total government payrolls.

Adding up the taxpayer cost of workers’ compensation

The cost of workers’ compensation to taxpayers permeates Illinois’ many layers of government and various government payroll cost structures. This report looks at the direct cost to taxpayers for workers’ compensation payments made to state, municipal and county workers. In addition, other layers of government spending with additional workers’ compensation costs include:

Workers’ compensation costs for state, municipal and county governments

State government: $132 million

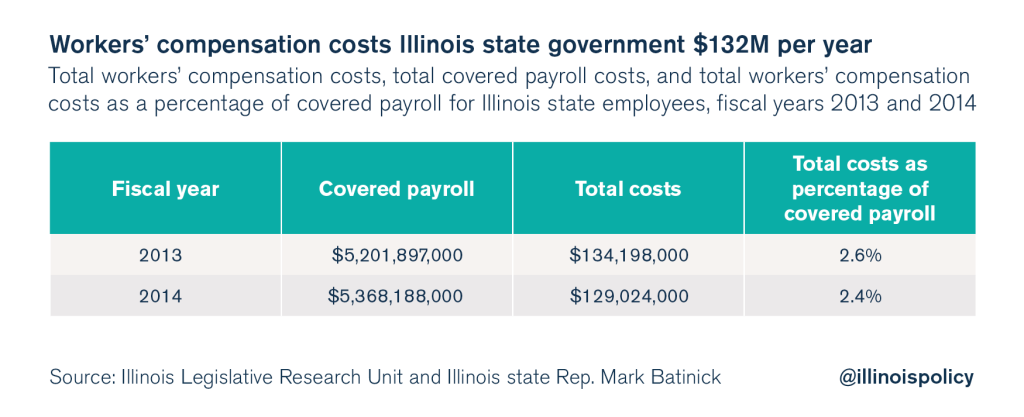

Comprehensive data are available on workers’ compensation as a cost to state government. These data were provided to Batinick by Illinois’ Legislative Research Unit. The state of Illinois has a total covered payroll approaching $5.5 billion per year, according to the data. On that covered payroll, Illinois state government pays approximately $132 million per year for workers’ compensation, judging from data filed for fiscal years 2013 and 2014.[13]

This gives Illinois a cost ratio of workers’ compensation to total payroll of about 2.5 percent. This ratio is not far from the 2.35 percent premium rate assigned to Illinois by the state of Oregon’s 2014 Premium Rate Rankings study.[14] However, it’s worth noting that industries that drive up the cost of workers’ compensation across state averages – jobs such as manufacturing, construction and transportation – are not present in state government.

Municipal government: $225 million

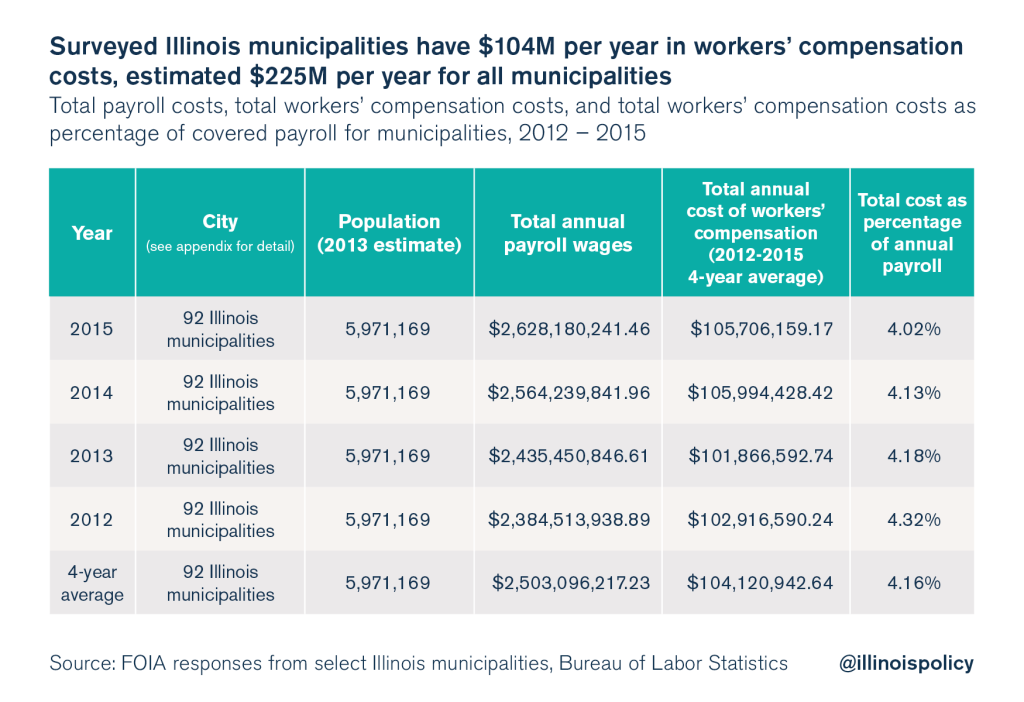

The municipalities covered in this study represent nearly 6 million Illinoisans. They range in size from Carterville (5,700) to Chicago (2.7 million). Sixty-one of the 92 municipalities were covered under a policy from the Intergovernmental Risk Management Agency. Their data are presented as a summary of all 61 covered.

The total annual wages covered by these municipalities averaged $2.5 billion per year over the four years from 2012 to 2015. The total annual workers’ compensation costs for these municipalities averaged $104 million per year over the four years from 2012 to 2015. Workers’ compensation costs thus averaged 4.2 percent of total payroll costs each year for these municipalities.

These municipalities, which represent 46 percent of Illinois’ population, have an average annual cost of $104 million per year. Assuming the same cost rate pertains to the municipalities covering the other 54 percent of Illinois’ population, the total municipal cost for workers’ compensation is an estimated $225 million per year.

However, there is not perfect consistency across the data received in response to Illinois Policy Institute FOIA requests. That is because different municipalities house different departments with very different employment risk profiles. The most obvious example of this is Chicago, where costs are already significantly above average even though the city’s data do not include its police and fire departments, which are covered separately. Including the Chicago police and fire departments’ workers’ compensation costs would add significantly to the city’s payroll and workers’ compensation costs.

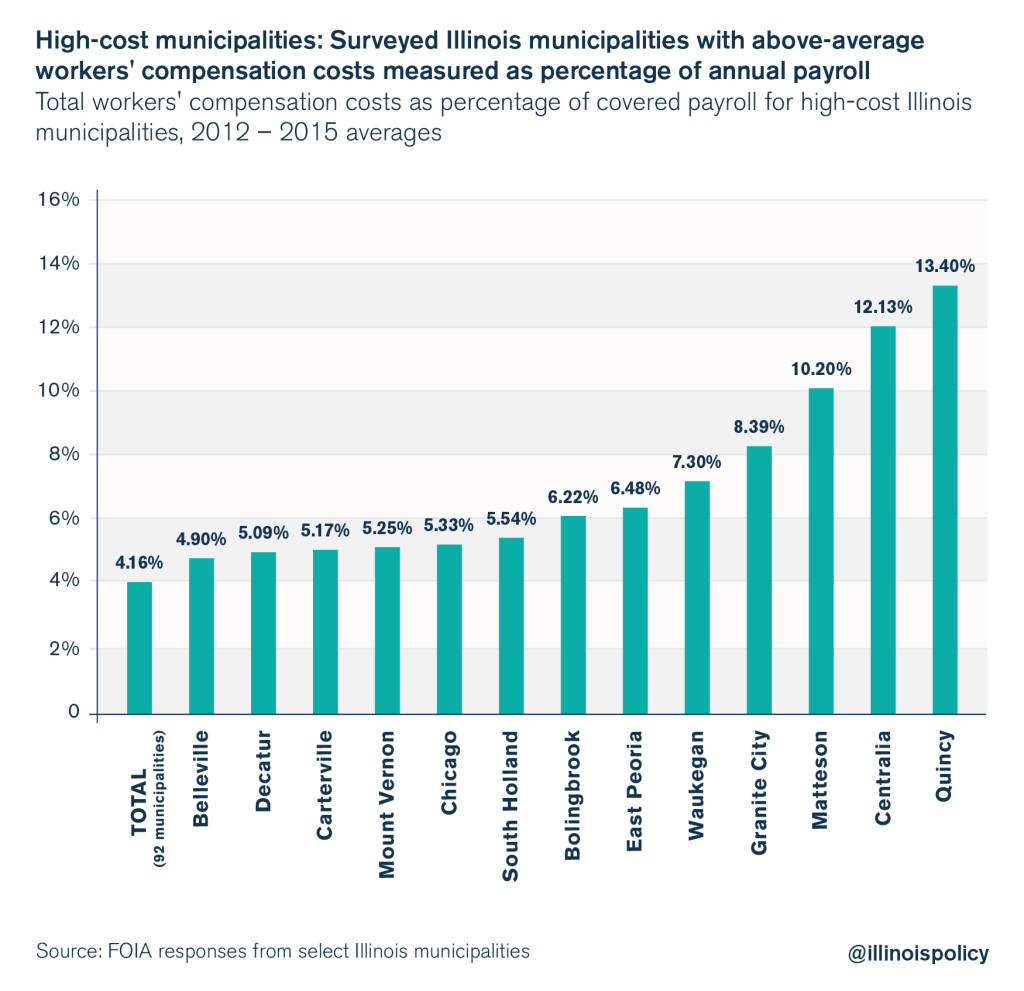

Nonetheless, Chicago still ranks as one of the highest-cost municipalities among those surveyed. The average annual cost for workers’ compensation across the four years of complete data (2012-2015) is 4.16 percent of total payroll. The municipalities shown below all registered above average costs.

County government: $45 million

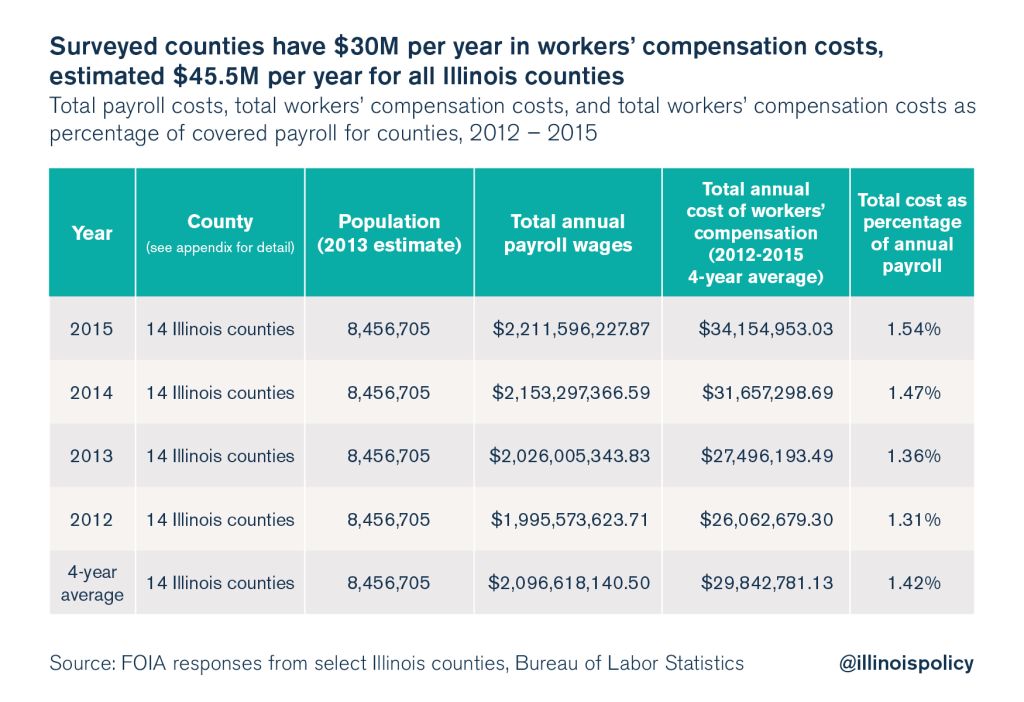

Fourteen sample counties covering 8.5 million Illinois residents returned data responsive to the FOIA request. These counties paid an average of $30 million per year for workers’ compensation on an average combined annual payroll of $2.1 billion. Workers’ compensation costs were 1.4 percent of average annual payroll at the county level.

These counties, which represent 66 percent of the population of Illinois, have an average annual cost of $30 million per year. If the same cost rate is projected on the remaining counties covering the other 34 percent of the Illinois population, the total county cost for workers’ compensation is an estimated $45.5 million per year.

$402 million: Total estimated cost of workers’ compensation for state, municipal and county governments

Based on these estimates, the total annual cost of workers’ compensation for state government ($132 million), municipal government ($225 million) and county government ($45 million) across Illinois is $402 million per year. These are three of the most significant layers of government in Illinois, but they represent less than half of total government payroll costs.

The total payroll cost for state government is covered by these data. However, these data cover only a part of local government payroll costs, which also include school districts, independent police and fire districts, townships, park districts, special districts, and various other units of local government.

All told, the data contained in this study cover an estimated $5.4 billion of annual municipal payroll and $3.2 billion of county payroll, which amount to $8.6 billion of local government payroll across Illinois. Bureau of Labor Statistics payroll wage data for 2015 show that local governments in Illinois had total payrolls of $28.7 billion for the year.[15]

If the average cost rate for county and municipal government (3.1 percent of payroll) were applied across Illinois’ total local government payroll, the annual cost of workers’ compensation would be $900 million just for local governments. However, it is unlikely that school districts and townships, which combined contain a substantial portion of overall local payroll costs, would have workers’ compensation costs nearly as high as those of municipalities and counties. Furthermore, it’s unlikely that all $28.7 billion of Illinois local government payroll would be considered “covered payroll” for workers’ compensation purposes.

One final area where taxpayers pay significant workers’ compensation costs is for public works projects. According to 2013 data from the U.S. Census Bureau, Illinois state government spent $3.6 billion on construction while local governments spent $7.1 billion, for a total of $10.7 billion in annual construction costs. Construction labor costs come with especially high workers’ compensation costs, and the cost of workers’ compensation is included in the bids contractors submit on public works projects.[16] Thus, public works projects that fall under Illinois’ prevailing wage law likely add hundreds of millions of dollars annually in taxpayer-funded workers’ compensation costs.

Cost drivers and proposals for change

Several factors contribute to the high costs of workers’ compensation in Illinois. First, high medical reimbursement levels, indemnity payments, and wage-replacement rates increase costs. The statutory requirements that drive these costs have been described in a previous report[17] and are briefly summarized below.

Simply put, Illinois’ laws, including the Illinois Workers’ Compensation Act, the Public Employee Disability Act and the Public Safety Employee Benefits Act, are out of line with the laws in surrounding states.

Illinois Workers’ Compensation Act

The Illinois Workers’ Compensation Act covers all public employees in Illinois with the exception of police and firefighters in Chicago. Despite marginal cost-saving changes made to the Illinois Workers’ Compensation Act in 2011, Illinois still has the highest costs in the region. The 2016 Oregon Workers’ Compensation Premium Rate Ranking Summary ranks Illinois as the most expensive system in the Midwest and seventh-most expensive in the country, measuring workers’ compensation costs as a percentage of payroll.[18] A broad approach to reforming Illinois’ law is necessary to bring taxpayer costs in line with those in surrounding states.

Among the reforms Illinois needs are further changes to its workers’ compensation statutes. The following proposed revisions to the Illinois Workers’ Compensation Act were addressed in a previous report:[19]

- Repeal the majority of former Gov. Rod Blagojevich’s 2005 workers’ compensation law.

- Tie the medical fee schedule to Medicare reimbursement rates or private insurance reimbursement rates.

- Prohibit physician dispensing beyond the first few days of an injury, which would eliminate the financial incentive for doctors to overprescribe opioids.

- Put Illinois’ maximum wage-replacement rate in line with other states’ by capping it at 100 percent of the state’s average weekly wage.

- Put Illinois’ minimum wage-replacement rates in line with other states’ for temporary total disability, permanent partial disability and permanent total disability so workers do not receive effective pay hikes for being injured.

- Give more weight to American Medical Association guidelines in determining the amount of injury awards.

- Clarify the definitions and application of “traveling employee” and injury causation to limit judicial activism in interpreting the law.[20]

Light duty

State and local governments can achieve cost savings by implementing light-duty work programs to bring injured workers back to work in a job that would not interfere with their recovery from injury. Often an employee collecting workers’ compensation would be able to perform light office work, which would not pose a threat to the employee’s health. For example, the city of Chicago has implemented some improvements in bringing injured police officers back to work, though more remains to be done.[21]

When a worker returns for light-duty work, workers’ compensation payments are adjusted so that taxpayers cover only the difference between the worker’s previous wages and his or her new wages, assuming the new wages are lower. The state of Illinois should ascertain and implement best practices for light-duty work for workers’ compensation recipients, and local governments should follow suit.

Public Employee Disability Act

The Public Employee Disability Act, or PEDA,[22] provides extra benefits for police officers and firefighters who make a workers’ compensation claim. PEDA gives police officers and firefighters their full salary tax-free for up to one year when they are injured. This is a unique benefit because a tax-free full salary is not offered to other public employees, and it gives injured police officers and firefighters an effective pay hike. When nonsafety public employees are injured on the job they receive 66 2/3 percent of their lost wages, untaxed, subject to certain minimums and maximums.

One way to bring meaningful reform to PEDA would be to align the lost wage benefits for all government employees and remove the take-home pay increase that police and firefighters receive. The PEDA law creates not only higher costs for taxpayers but also an incentive for workers to extend their time receiving benefits. As noted above, other government employees receive 66 2/3 of their pay, untaxed, if they file a workers’ compensation claim. This is a standard rate in other states as well, and for the rest of the Illinois workforce. The 66 2/3 rate should apply to all government workers, including public safety workers.

Public Safety Employee Benefits Act

The Public Safety Employee Benefits Act, or PSEBA,[23] provides lifetime employer-funded health insurance for police officers, firefighters, correctional and correctional probation officers who are catastrophically injured in the line of duty while responding to an emergency. (In the case of public safety officers who are killed under these circumstances, the PSEBA provides for the payment of benefits to survivors.) However, the definition of catastrophic injury is unclear. Once awarded, the recipient, his or her spouse, and any dependent children are eligible to receive government-funded health insurance along with some educational benefits. This benefit is available if the employee is not able to return to his or her normal job, even if the recipient is able to work elsewhere.

The Commission on Government Forecasting and Accountability conducted a survey on the costs of PSEBA. The report shows that 124 municipalities paid $5.82 million in 2013 for the insurance premiums of 419 PSEBA recipients. Of the PSEBA recipients who responded to the survey, 37 percent said they were employed in some way.[24]

PSEBA, as it exists in Illinois law, leaves unclear what constitutes a catastrophic injury, especially in comparison with federal law. This has resulted in individuals making catastrophic claims for less than catastrophic injuries. In these cases, taxpayers are required to foot the bill for the full cost of health insurance for people who might be fully healthy or otherwise employable outside of the public safety sector.

Illinois should reform PSEBA by adopting the federal definition of catastrophic injury. It is defined in the U.S. Code as “an injury, the direct and proximate consequences of which permanently prevent an individual from performing any gainful work.”[25]

By defining catastrophic injury in accordance with the definition under federal law, the cost of providing, as well as the opportunity for abuse of, this benefit could be reduced. This would permit the state to steer scarce resources toward those who have suffered truly catastrophic injuries.

Conclusion

Workers’ compensation is a salient issue for private-sector employers, especially those who have the option to avoid Illinois’ regulatory costs by setting up shop in other states. However, there are two parts of the economy where Illinois’ workers’ compensation costs cannot be avoided, and both involve costs that are covered by taxpayers. Taxpayers cover the cost of workers’ compensation for government employees, and also cover the cost of workers’ compensation for public works construction projects.

The reasons to reform workers’ compensation are numerous. Changes to the system could result in workers receiving better medical care by ensuring that medical providers, employees and employers all have the incentive to pursue best practices. Reforms could also reduce costly burdens on employers. And the data in this report point to one more reason for reform: Illinois should revise workers’ compensation laws to make government a better steward of scarce tax dollars.

Methodology

This report focuses specifically on the cost to taxpayers of workers’ compensation for state, municipal and county employees. The data on workers’ compensation as a cost to state government come from a request to the Legislative Research Unit originally submitted by state. Rep. Mark Batinick.

Illinois municipalities and counties were asked for data related to their workers’ compensation costs through Freedom of Information Act, or FOIA, requests. These requests were sent to all 102 counties, along with all municipalities with a population higher than 15,000 people. Estimates in this report are based on the responses to FOIA requests from county and municipal governments that represent a significant portion of Illinois’ population. Some units of government did not reply or did not reply with full information. Local governments were asked for the following information from the years 2010-2015:

- The total annual payroll (full- and part-time)

- The total number of employees (full- and part-time)

- The total cost of workers’ compensation each year (claim payouts and premiums paid)

This analysis is based on the data received from these FOIA requests, with one exception: wage information for Chicago and Cook County were found through an online database.

In total, the FOIA requests resulted in complete information for wages and workers’ compensation payouts for 92 municipalities and 14 counties of various sizes for the years 2012-2015. The combined municipalities covered nearly 6 million residents, and the combined counties covered approximately 8.5 million residents. These sample costs can be used to project the total cost onto county and municipal governments across the state. However, these results cover only the cost to counties and municipalities, not the thousands of additional units of government across Illinois.

It is important to note that while municipalities and counties might represent some of the most significant units of local government in Illinois, they do not cover a majority of local government payroll. Furthermore, public works construction projects also involve workers’ compensation costs that are ultimately borne by taxpayers because they are priced into bids for public construction work.

In addition, there are several municipalities from which data were received that did not include police or firefighter workers’ compensation costs because those departments handle their financial reports separately from the municipality reports. In Chicago, for example, police and firefighters are not covered under the city’s normal workers’ compensation fund. Police and fire departments can represent a significant portion of the workers’ compensation claims by nature of their more physical, risk-intense workplaces. Thus, the true costs of workers’ compensation to taxpayers are likely higher than the estimates reported here for municipalities due to the exclusion of some police and fire department data. Such costs are the subject of a future report.

Areas for further study

Further study is needed to arrive at a more exact estimate of the total cost of workers’ compensation for Illinois taxpayers, and thus better gauge how many hundreds of millions of taxpayer dollars could be saved each year through various reforms.

Additional areas to study include:

- Workers’ compensation costs for units of local government other than municipalities and counties

- Workers’ compensation costs for public works projects

These areas will be the subject of future research that will complete the estimate of workers’ compensation as a taxpayer issue.

Endnotes

[1] Doug Finke, “IMA Says Workers’ Comp Reform, Broader Sales Tax Base Will Help Manufacturing Jobs,” (Springfield) State Journal-Register, September 27, 2016.

[2] Michael Lucci, “Illinois’ Broken Workers’ Compensation System,” Illinois Policy Institute, June 4, 2015.

[3] Michael Lucci, “Madigan Wrong Again: Workers’ Compensation Is a Direct Budget Issue,” Illinois Policy Institute, August 30, 2015.

[4] Executive Order 15-15, Executive Order Initiating Consolidation of Local Governments and School Districts, and Eliminating Unfunded Mandates, February 13, 2015.

[5] Office of the Lieutenant Governor, Task Force on Local Government Consolidation and Unfunded Mandates, Delivering Efficient, Effective, and Streamlined Government to Illinois Taxpayers, (December 2015).

[6] Ibid.

[7] Illinois Chamber of Commerce, Background on Workers’ Compensation Claims Filed by State Employees and Reforms Proposed by the Office of the Attorney General (March 2012).

[8] Mark Batinick, “Rep. Mark Batinick: Illinois Can Find Savings in Workers’ Comp Reforms,” (Springfield) State Journal-Register, March 4, 2015.

[9] U.S. Census Bureau, 2012 Census of Governments, Individual State Descriptions: 2012, September 2013, 80, accessed August 30, 2016.

[10] Ted Dabrowski, John Klingner, “Too Many Districts: Illinois School District Consolidation Provides Path to Efficiency, Lower Tax Burdens,” Illinois Policy Institute, Spring 2016.

[11]. U.S. Census Bureau, 2012 Census of Governments, 80.

[12]. U.S. Census Bureau, 2012 Census of Governments, 81.

[13] Ibid.

[14] Oregon Department of Consumer and Business Services, Central Services Division, Oregon Workers’ Compensation Premium Rate Ranking, Calendar Year 2014 (February 2015).

[15] Bureau of Labor Statistics, “Quarterly Census of Employment and Wages 2015, County Employment and Wages,” accessed November 1, 2016.

[16] U.S. Census Bureau, “State and Local Government Finances by Level of Government and by State: 2013 Survey of State and Local Government Finance,” 72-74, accessed November 1, 2016.

[17] Michael Lucci, Mark Adams, “Workers’ Compensation Reform Means Jobs, Tax Savings,” Illinois Policy Institute, Spring 2016.

[18] Oregon Department of Consumer and Business Services, Central Services Division, Oregon Workers’ Compensation Premium Rate Ranking Summary (October 2016).

[19] Ibid.

[20] Illinois Chamber of Commerce, “The Impact of Judicial Activism in Illinois,”6.

[21] Tim Novak, “Watchdogs: After Decades on Disability, Cops Are Put Back to Work,” Chicago Sun-Times, November 4, 2016.

[24] Commission on Government Forecasting and Accountability, “A Study of the Public Safety Employee Benefits Act Pursuant to P.A. 98-0561,” June 2014, accessed August 30, 2016.