Introduction

The Illinois General Assembly failed to pass a full budget for fiscal year 2016 and only passed a stopgap budget for fiscal year 2017. State politicians have done nothing to stop Illinois’ unpaid bills from growing or its credit rating from falling. They’ve failed to pass comprehensive spending, pension and economic reforms to prevent Illinois’ fiscal collapse.

Yet despite these politicians’ inaction on critical problems plaguing the state, Illinois taxpayers are still forced to pay for the cost of their legislature.

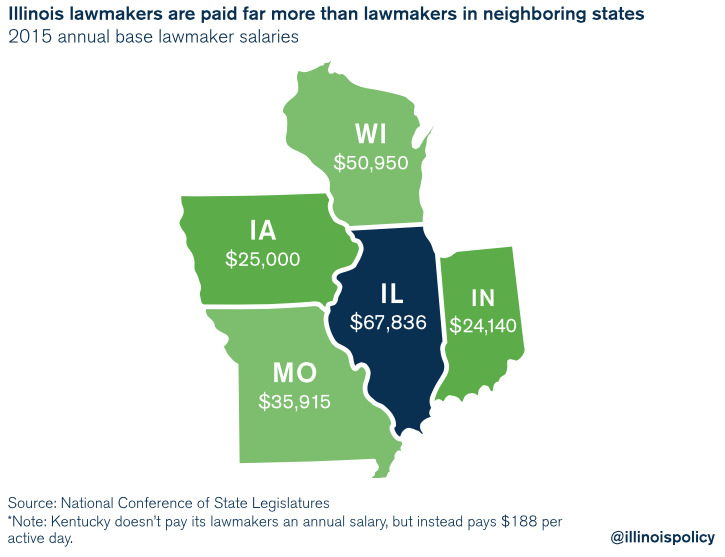

In 2015, each Illinois lawmaker cost taxpayers nearly $68,000 in base pay alone, far more than lawmakers in neighboring states and more than twice what lawmakers in Iowa and Indiana earn.

In fact, Illinois lawmakers pay themselves the fifth-highest annual lawmaker base salary in the country.

On top of those salaries, the total cost of Illinois lawmakers also includes generous state-provided health care, dental and earned pension benefits. Taxpayers also pay for per diem costs and mileage reimbursements when politicians are in session.

The average total operating cost to taxpayers per active Illinois lawmaker equaled more than $100,000 in 2015 – all for what is essentially part-time work. The regular legislative session only runs from January through May, and most lawmakers maintain careers outside their work in the General Assembly.

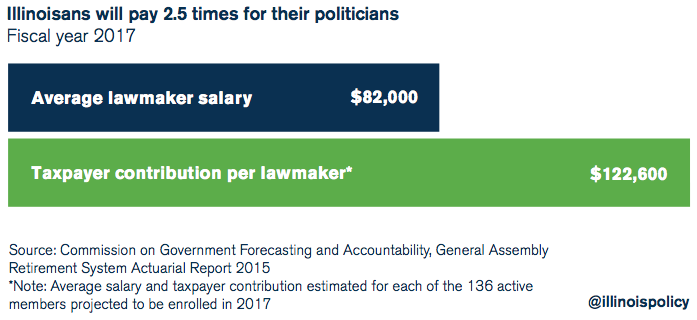

In addition, Illinois taxpayers are forced to pay millions every year to bail out lawmakers’ basically insolvent pension fund. When that cost is added to taxpayers’ annual burden, it turns out they are paying lawmakers 2.5 times – once for lawmakers’ salaries and then the equivalent of 1.5 times salary for lawmakers’ pensions. In total, lawmaker compensation costs Illinois taxpayers more than $32 million a year.

Politicians’ unwillingness to rein in their own costs reveals an astonishing tone deafness and disregard for the struggles of Illinois taxpayers.

While there are some lawmakers who have opted out of the heavily taxpayer-subsidized state pension and health care plans, the Illinois General Assembly as a body should set an example for the rest of the state and implement long-overdue salary and pension reforms.

Base pay

According to data from the National Conference of State Legislatures, Illinois lawmakers receive the fifth-highest annual base salary in the country, at $67,836.

Only lawmakers in New York, Michigan, Pennsylvania and California receive a higher annual salary.

Illinois General Assembly members’ salaries are especially high when compared with those of lawmakers in neighboring states such as Iowa and Indiana, whose base annual salaries for lawmakers were $25,000 and $24,140, respectively.

Additional pay for committee and leadership roles

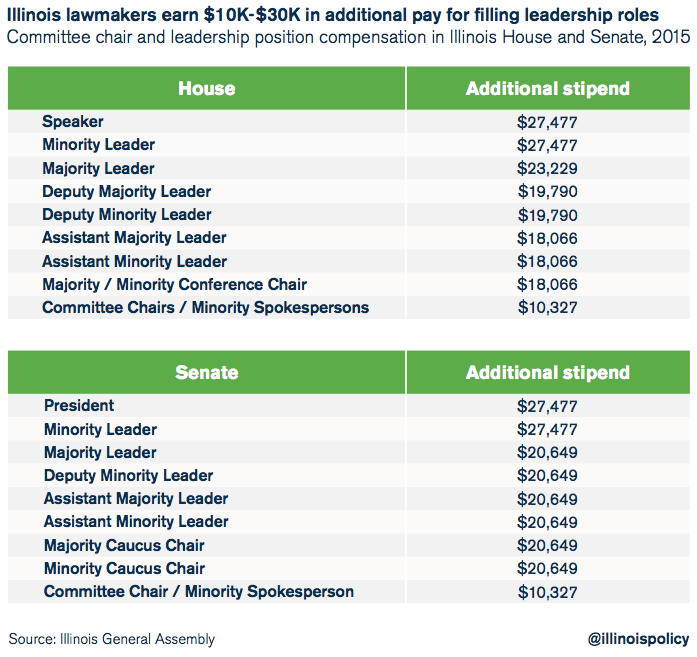

Illinois lawmakers also receive an additional stipend for filling leadership roles. For example, state Reps. Mike Madigan, D-Chicago, and Jim Durkin, R-Western Springs, each received more than $27,000 for acting as House of Representatives speaker and minority leader, respectively. State Sens. John Cullerton, D-Chicago, and Christine Radogno, R-Lemont, received the same for serving as their parties’ leaders in the Senate.

In Illinois, caucus leaders also appoint committee chairs to the state’s more than 80 legislative committees. The committee chairs, who oversee committees ranging from Agriculture to Veterans’ Affairs, earn stipends of more than $10,000 for their roles.

One hundred and twenty-one senators and representatives, or 67 percent of Illinois lawmakers, receive a stipend, pushing up the overall average cost of salaries for each Illinois lawmaker to $76,000 (including the cost of lawmakers who only served partial terms). Those stipends also boost the pensionable salaries of lawmakers who participate in the state pension plan.

Benefits

Health care and dental insurance

Members of the Illinois General Assembly also are eligible for taxpayer-paid benefits under the State Employees Group Insurance Program.

For lawmakers receiving health care benefits, the average taxpayer cost per lawmaker was $8,800 in 2016. The average lawmaker’s annual contribution to his or her own care was less than $1,800, or 17 percent of the health care cost.

The bulk of the cost of the lawmakers’ dental plan is also borne by taxpayers. Participating lawmakers only contributed an average of $132 annually to their dental plan, or a third of the total $394 annual cost of their dental insurance. Taxpayers paid for the remaining two-thirds of the cost of the dental plans.

In total, taxpayer contributions toward lawmakers’ health and dental insurance in 2016 came to $1.29 million, or nearly $7,300 per each active lawmaker in 2016.

Per diems and mileage reimbursement

In addition to large salaries and generous benefits, lawmakers also cost taxpayers in mileage reimbursements and per diem payments to cover daily expenses during session days.

The average annual per diem payout per active lawmaker was more than $5,500 in 2015. The average annual mileage reimbursement per active lawmaker equaled more than $2,200.

According to numbers provided by the Illinois comptroller’s office, the total combined cost to taxpayers of both mileage reimbursements and per diem payments for the Illinois General Assembly was $1.37 million, or more than $7,700 per active lawmaker in 2015.

Pensions

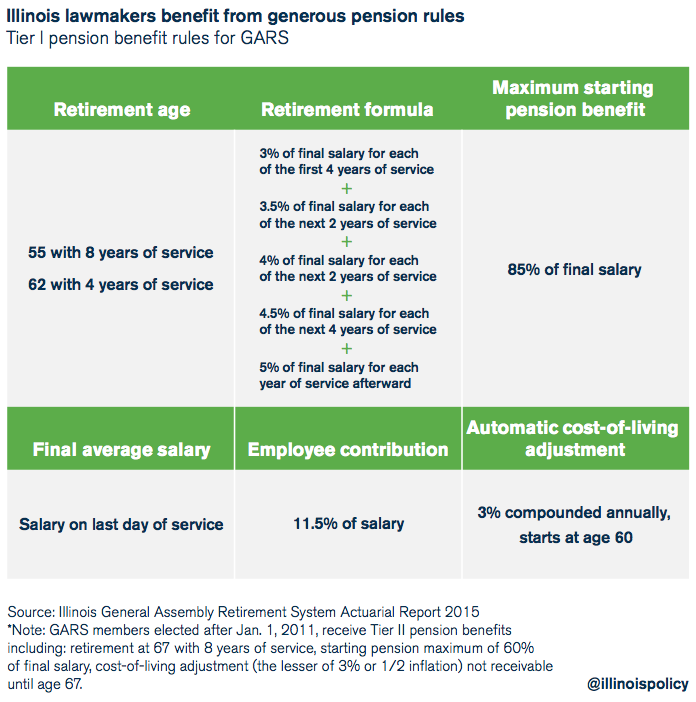

The annual cost of lawmakers also includes the amount of pension benefits each lawmaker earns annually, known as the “normal cost.” The average taxpayer-paid normal cost for each lawmaker enrolled in the General Assembly Retirement System, or GARS, in 2015 was nearly $14,600. The total annual normal cost paid by taxpayers in 2015 equaled nearly $2 million.

Lawmakers receive $14,600 in annual accrued pension benefits because they benefit from generous pension rules. Lawmakers can retire in their 50s, receive 3 percent annual cost-of-living adjustments, and earn 85 percent of their final salary after just 20 years of service.

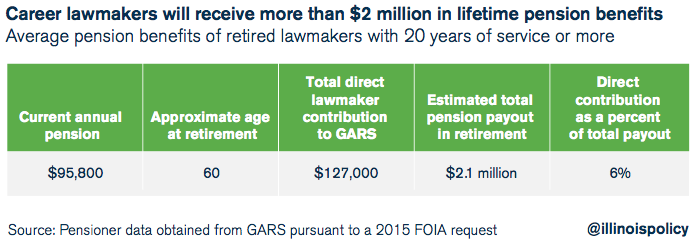

The average retired lawmaker who had 20 years or more of service receives an annual pension payout of nearly $96,000, and that lawmaker’s estimated total payout over the course of retirement will total more than $2.1 million.

However, those retirees on average each contributed just $127,000 toward their pensions, meaning they will earn back what they directly contributed after less than two years in retirement.

The retiree collecting the most lucrative pension is former state Sen. Arthur Berman, who left office in 2001. Berman receives an annual pension of $230,000 and can expect to collect over $3.3 million over the course of his retirement.

Because he contributed less than $110,000 to his pension over the course of his 22-year career, Berman will have only directly contributed 3 percent of what he is expected to receive in total pension payouts (6 percent if investment returns on his contributions are included).

Paying twice: Once for salaries, a second time to keep lawmaker pensions afloat

On top of paying for state politicians’ salaries and benefits, Illinois taxpayers also pay for an annual bailout of GARS. In 2017, taxpayers will contribute the equivalent of nearly $123,000 (including normal cost) for each participating Illinois politician just to keep GARS from going bankrupt. The GARS is the worst-funded of Illinois’ state-run pension plans, with just 16 percent of the funding it needs today to meet its future obligations.

When that $123,000 cost is added to taxpayers’ annual burden, it turns out they are paying lawmakers 2.5 times – once for lawmakers’ salaries and then the equivalent of 1.5 times salary for lawmakers’ pensions.

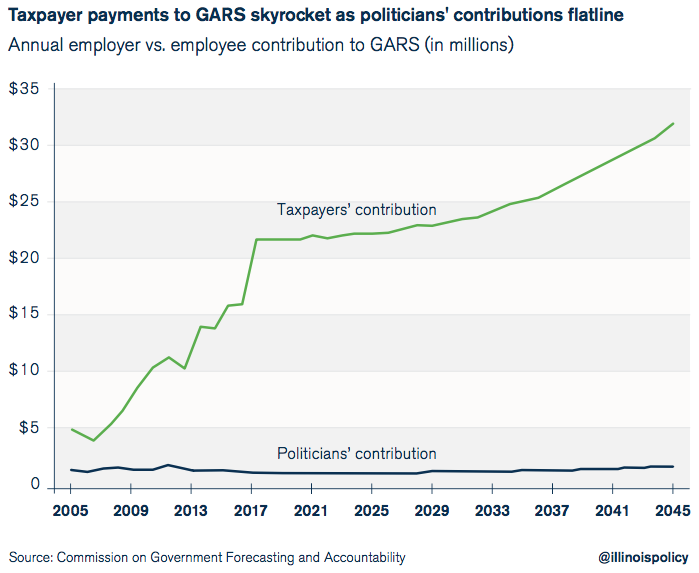

In fiscal year 2017, taxpayers will contribute 17 times more than lawmakers will toward politicians’ pensions. The state will contribute nearly $21.7 million, while lawmakers, on the other hand, will put in just $1.28 million toward their own pensions.

By 2045, taxpayers will pay more than $31.8 million a year into GARS while lawmakers will contribute just $1.9 million.

Illinois’ legislature costs too much

According to numbers provided by the Illinois comptroller’s office, the total cost of lawmakers’ 2015 salaries was over $13.5 million. When combined with the cost of health insurance, dental insurance, mileage reimbursements, per diem payments and normal pension costs, the total annual operating cost of Illinois lawmakers in 2015 was over $18 million, or more than $100,000 per lawmaker.

When the cost of bailing out the lawmakers’ pension fund is added in, taxpayers spent over $32 million on lawmaker salaries and benefits in 2015.

Illinois lawmakers receive some of the most lucrative legislative compensation packages in the nation. In Illinois, politics remains one of the only lines of work where employees receive a full-time salary for what is essentially part-time work.

Illinois’ legislature simply costs Illinois taxpayers too much. And this is especially galling in light of state politicians’ lack of action regarding the most urgent problems facing Illinois.

The General Assembly should set an example for the rest of the state and implement long-overdue salary and pension reforms.

Illinois lawmakers should repeal a law they passed in 2014 that guarantees payment of their salaries. Politicians should not have their salaries protected while state workers, vendors and providers of vital core services enjoy no such guarantees.

Lawmakers should also create a new defined-contribution plan for themselves – based on the already existing self-managed plan for state-university workers – that’s fair and ends their insolvent pension fund.

Such reforms would set the tone for other state agencies and unions and mark a change in how the state spends money. It would be a good first step toward lowering the cost of government to a level taxpayers can afford.