Introduction

Illinois has the worst pension crisis in the nation. Sensible changes must be made to keep the promise of a retirement benefit for government workers and to respect the interests of taxpayers and those who rely on core government services.

On May 8, 2015, the Illinois Supreme Court struck down Senate Bill 1, the pension-reform law enacted in 2013 by former Gov. Pat Quinn. In its ruling, the court said that even the modest reforms found in SB 1 are unconstitutional.

Despite this ruling, Illinois’ pension crisis still stands. If the state moves forward with bold reforms, namely transitioning benefits for all future work while protecting already-earned benefits, Illinois could finally put an end to its pension crisis. The actuarial data presented in this report show capping Illinois’ defined-benefit pension system and transitioning to a defined-contribution plan going forward will stabilize the state’s pension systems and result in significant savings. Furthermore, the results here show that there are a number of viable ways in which the state can pay down the remaining unfunded pension liability after the defined-benefit plan is capped. These payment schedules are much more affordable than maintaining the status quo, and will save the state from insolvency and protect workers’ hard-earned retirements.

Opportunities for meaningful pension reform

A plan that ultimately ends the state’s pension crisis is one that moves all new and current employees to a defined-contribution plan. Defined-contribution plans are a stable and predictable way to budget for retirement costs. Instead of the quickly growing costs associated with traditional pension plans, defined-contribution retirement plans are a known cost – a fixed percentage of payrolls each year. Additionally, capping the existing defined-benefit system would help relieve pressure from the state’s budget woes and ensure the state is able to pay for the pension obligations that have already been accrued.

There are a few different ways to achieve the shift to a defined-contribution retirement plan. The Illinois Policy Institute’s comprehensive reform plan – first proposed in 2012 – caps the defined-benefit system, means tests cost-of-living adjustments, aligns retirement ages with Social Security and moves all current and future government workers onto defined-contribution retirement plans going forward.

Alternatively, if the goal is to only impact the accrual of future benefits, a defined-contribution reform plan could simply cap the current defined-benefit pension plans, protect already-earned benefits (including pensions, retirement ages and cost-of-living adjustments) and transition all current and future workers to a defined-contribution type of retirement system going forward.

Specifically, this approach stops all future accruals under the current defined-benefit pension system. That means all already-accrued benefits will be paid to current and future retirees, but no additional benefits will accrue under the existing plans.

These reforms achieve security for workers and significant cost savings. In doing so, taxpayers and those who rely on government services can rest easier knowing their interests will finally be represented in pension policy.

Transitioning to a 401(k)-style plan lowers retirement costs

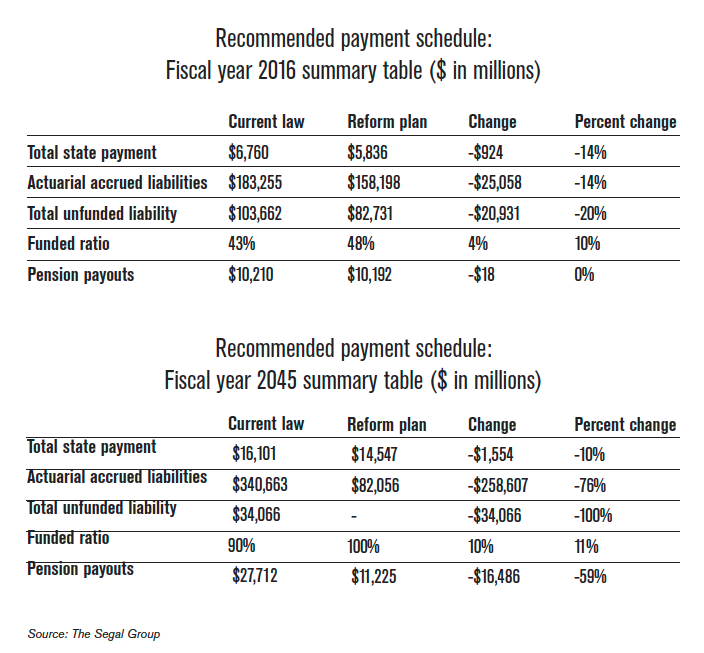

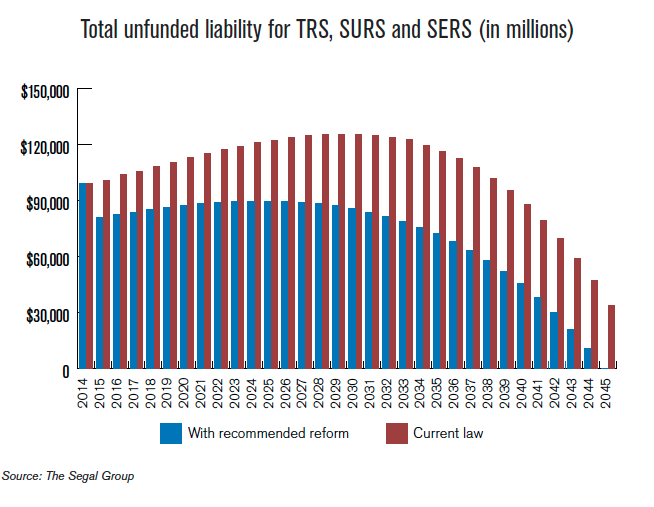

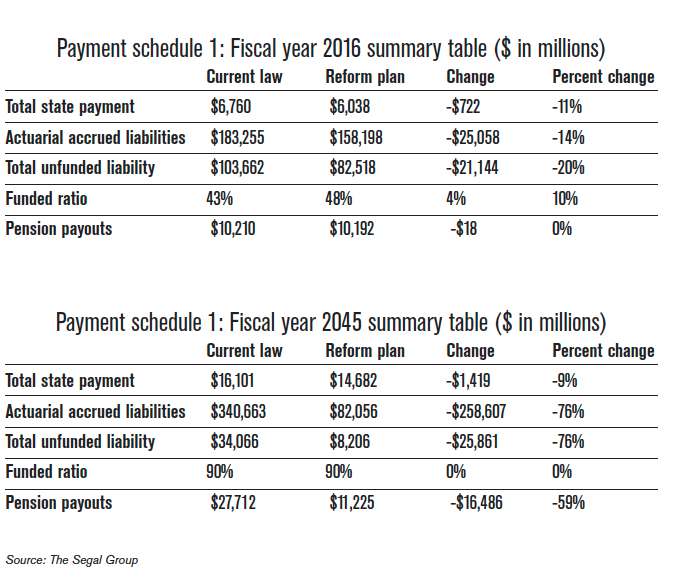

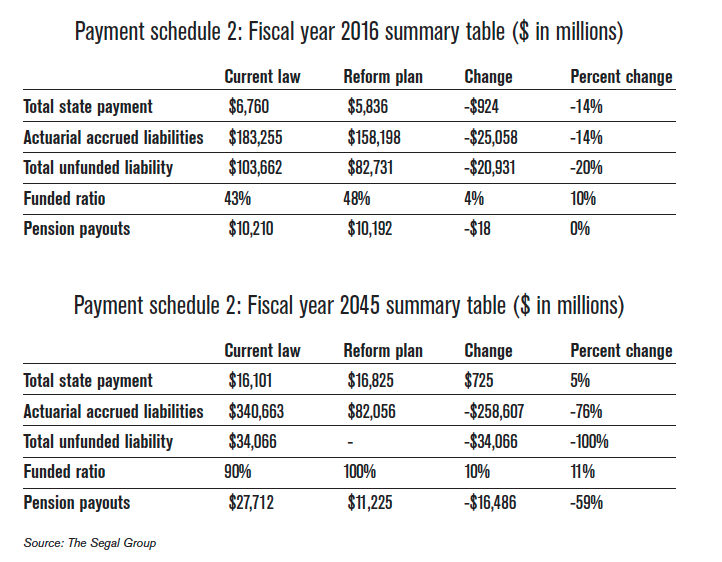

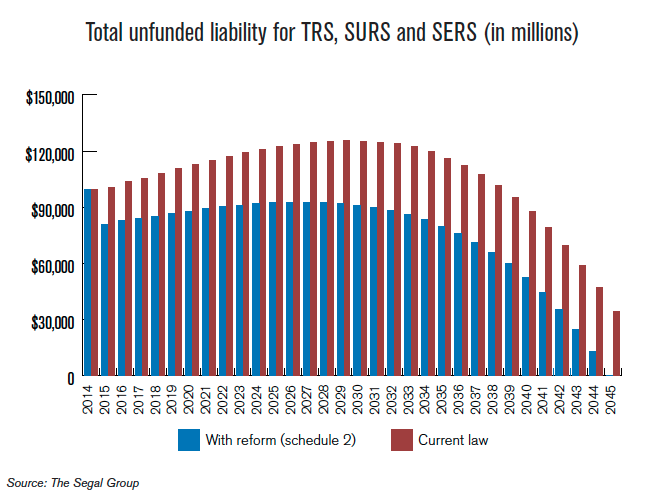

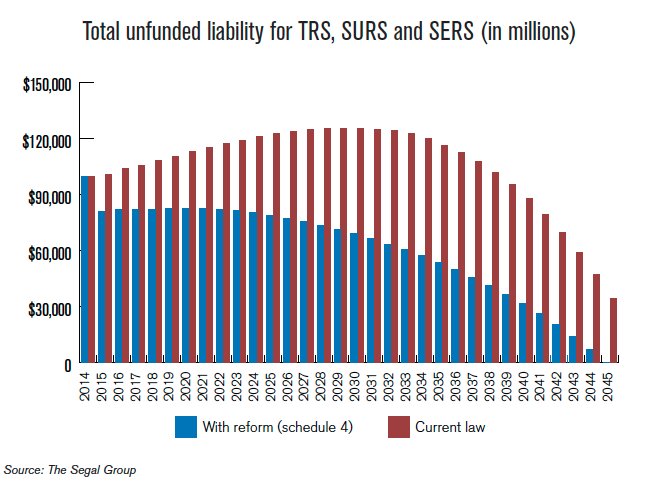

Capping the state’s defined-benefit pension system and moving to a defined-contribution retirement plan will immediately reduce the state’s unfunded liability by 20 percent, or more than $20 billion, to $82 billion in fiscal year 2016, according to The Segal Group, an actuarial consulting firm that works with the state.

Once the defined-benefit pension plan is capped, the remaining unfunded pension liability effectively becomes debt.

To pay this debt, state officials must structure a repayment schedule that achieves the following:

1. Meets the payouts to current and future retirees for already-earned pension benefits.

2. Avoids issues with cash flow, which can occur if the state starts significantly depleting its pension assets for a sustained period of time by not making contributions large enough to keep up with pension payouts while providing funds that can be invested for additional returns.

3. Brings the system to a healthy funding level between 90 and 100 percent.

There are a number of ways in which the state can structure a repayment schedule for the remaining unfunded liability. Segal scored four potential repayment schedules for the state’s retirement systems. Each repayment schedule is unique and each meets the original three criteria outlined above.

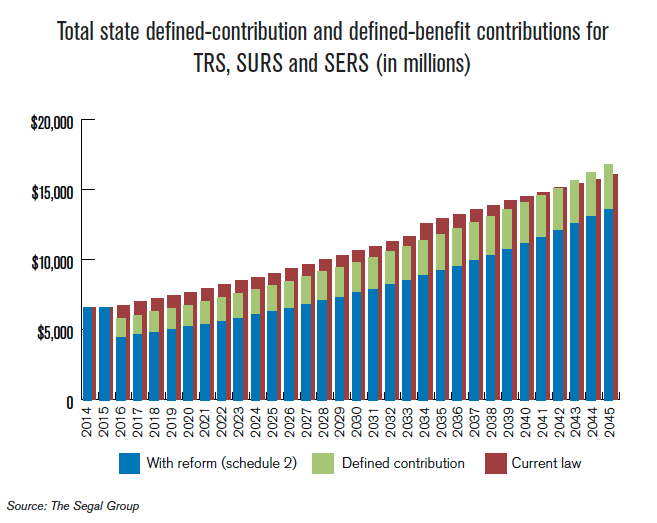

The defined-contribution plan used in each of the four repayment schedules Segal scored is modeled after the plan that currently exists in the Illinois State Universities Retirement System, or SURS, in which employees contribute 8 percent of their salary into their defined-contribution retirement plan and the state contributes a matching 7 percent. The only structural difference between each of the repayment structures is how the state pays down the remaining unfunded liability.

The four payment schedules include:

Payment schedule 1: A repayment schedule based on a level percentage of total payroll. The state’s fiscal year 2016 defined-benefit contribution would be reduced to $4.7 billion. The fiscal year 2016 retirement contribution would total $6 billion when the defined-contribution payment is factored in. After fiscal year 2016, total defined-benefit pension contributions are based on a level percentage of payroll.

Payment schedule 2: A repayment schedule that reduces the state’s defined-benefit pension contribution to $4.5 billion in fiscal year 2016. The fiscal year 2016 retirement contribution would total $5.8 billion when the defined-contribution payment is factored in. After fiscal year 2016, the total defined-benefit pension contribution increases by a level 3.88 percent each year in order to fully fund the system by 2045.

Payment schedule 3: A repayment schedule that reduces the state’s defined-benefit pension contribution to $4.5 billion in fiscal year 2016. The fiscal year 2016 retirement contribution would total $5.8 billion when the defined-contribution payment is factored in. After fiscal year 2016, the total defined-benefit pension contribution increases by a level $235 million each year in order to fully fund the system by 2045.

Payment schedule 4: A repayment schedule where total state contributions – including the defined-contribution plan – equal the state’s total defined-benefit contributions under current law through 2025. After 2025, the defined-benefit payments are held at a constant $7.46 billion in order to fully fund the system by 2045.

There are many concerns that the state will deplete its pension assets (i.e. run out of money to pay for pensions) or that costs will increase after capping a defined-benefit plan. But the actuarial analyses included in each of the four payment schedules show the state can save money by capping the defined-benefit system and moving to a defined-contribution plan.

It is important to note that these are just four of many potential repayment schedules. The state could choose to make higher contributions in the short term, for example, which would increase the contributions in the initial years but result in more significant long-term savings. Similarly, the state could choose to pay down the remaining unfunded liability during a shorter period of time, which would also result in higher short-term contributions but more significant long-term savings – similar to an individual choosing a 15-year mortgage over a 30-year mortgage. However, these payment schedules may have unintended consequences, resulting in some combination of tax increases and increased pressure on the state’s economy that could otherwise be avoided.

Alternatively, the state could choose to make even smaller contributions in the near term to achieve greater initial budgetary savings, but this approach would create the need for higher contributions in future years and may also run into cash-flow issues depending on how low the payments are.

The key is to develop a viable repayment structure that avoids straining the state’s budget, ensures the pension funds are on a stable path forward and pays for the pension benefits that have already been earned. There are a number of ways the state can achieve those goals. And regardless of which structure it chooses, it will be important to frequently revisit and examine the financial health of the systems to ensure that the repayment structure is meeting its objectives.

This policy brief focuses on repayment schedule 3. The results from the remaining scenarios are included in the appendix and the raw data for each schedule are available at illin.is/1GH1T9o.

A way forward for pension reform

The actuarial data presented in this policy brief and in the appendix show there are a number of ways Illinois can cap the current defined-benefit system and transition to a defined-contribution retirement system.

If the state moves forward with this approach, a simple way to transition to a defined-contribution plan is to implement a reform plan that only impacts the accrual of future benefits. Specifically, a defined-contribution reform plan could cap the current defined-benefit pension plans, protect already-earned benefits (including pensions, retirement ages and cost-of-living adjustments) and transition all current and future workers to a defined-contribution style retirement system going forward. The defined-contribution plan could be modeled after the plan that currently exists in the Illinois State Universities Retirement System, or SURS, where employees contribute 8 percent of their salary into their defined-contribution retirement plan and the state contributes a matching 7 percent.

This approach stops all future accruals under the current defined-benefit pension system. That means all already-accrued benefits will be paid to current and future retirees but no additional benefits will accrue under the existing plans.

Once the defined-benefit pension plan is capped, the remaining unfunded pension liability effectively becomes debt. There are a number of ways in which the state can structure a repayment schedule for the remaining unfunded liability. Segal scored four potential repayment schedules for the state’s retirement systems. Each repayment schedule is unique and each meets the original three criteria outlined above.

The repayment schedule this report recommends from the Segal scoring is schedule 3, which reduces the state’s fiscal year 2016 defined-benefit pension contribution to $4.5 billion. Going forward, the defined-benefit pension contributions increase by a level $235 million annually in order to fully fund the system by 2045.

The defined-contribution reform plan in schedule 3 achieves the following:

• Immediately reduces the state’s unfunded pension liability by 20 percent. The reduction in the unfunded liability is the direct result of capping benefit accruals in the existing defined-benefit system. That cap means future pensions for current workers will be based on their salaries at the time of the cap and their future retirement benefits will accrue under the defined-contribution retirement plan going forward.

• Reduces the state’s fiscal year 2016 retirement payment by nearly $1 billion (this accounts for the new cost of making the contribution to the defined-contribution plan). The state’s fiscal year 2016 retirement payment would total $5.8 billion – of which the defined-benefit contribution would total $4.5 billion and the defined-contribution payment would total $1.3 billion.

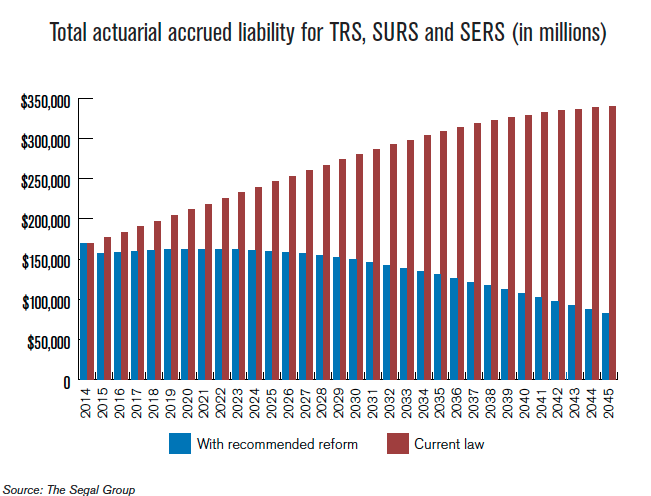

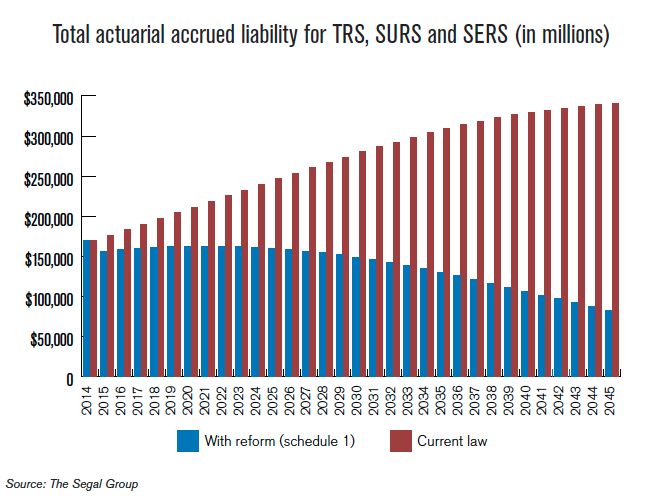

• Reduces the state’s total actuarial accrued liability by 76 percent, or $258 billion by fiscal year 2045, compared with current law.

• Increases the funded ratio to 100 percent by 2045.

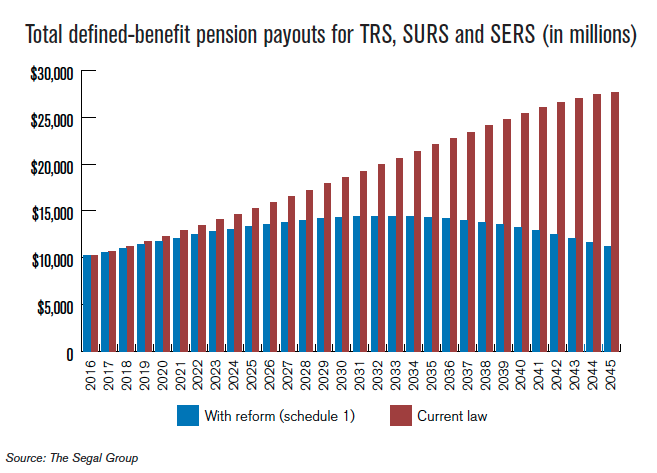

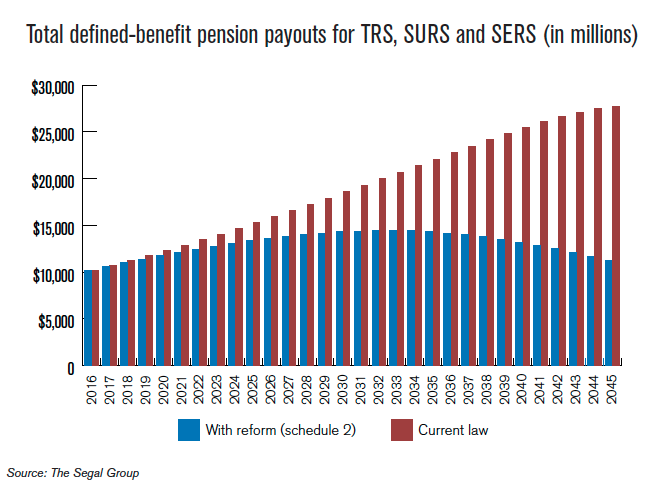

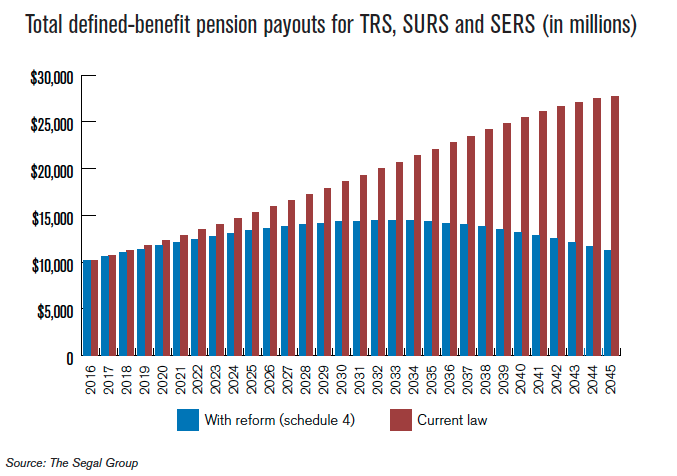

• Reduces the state’s total defined-benefit pension payouts by $182 billion, or 32 percent, over the next 30 years compared with current law.

Simply put, the defined-contribution plan outlined here protects already-earned benefits, saves the state billions, fully funds the remaining defined-benefit liability and puts retirement costs on a stable path with a defined-contribution style retirement system going forward.

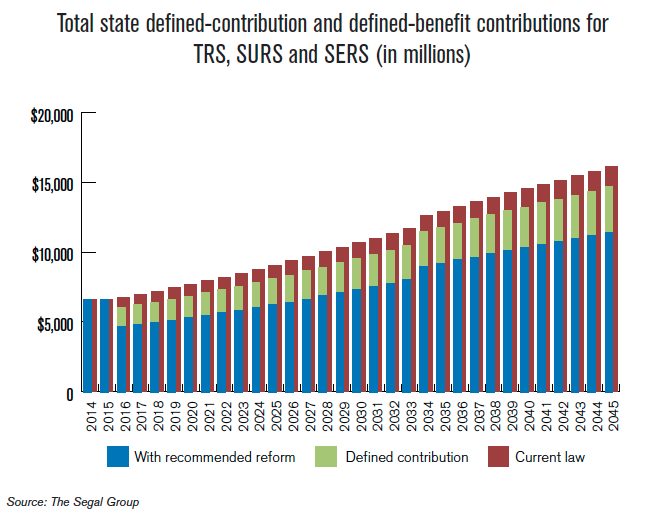

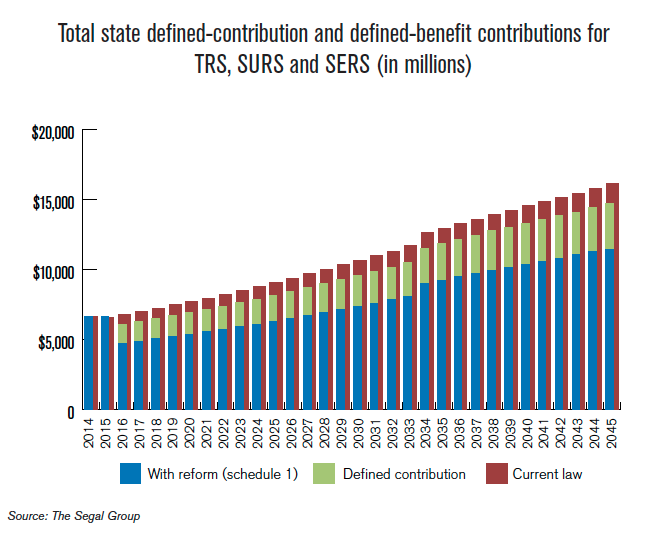

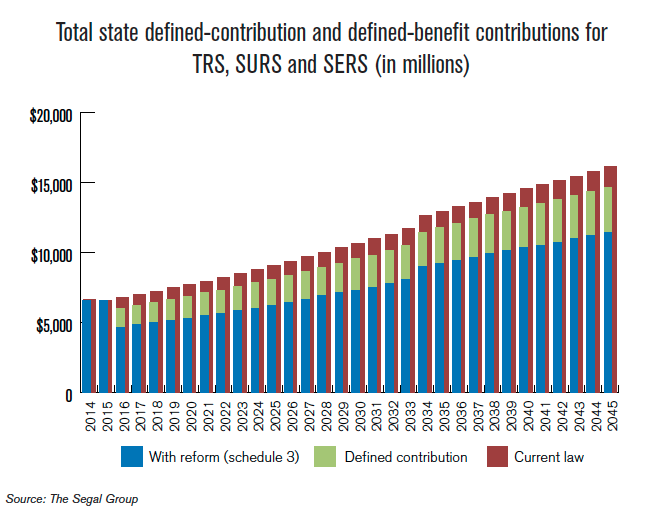

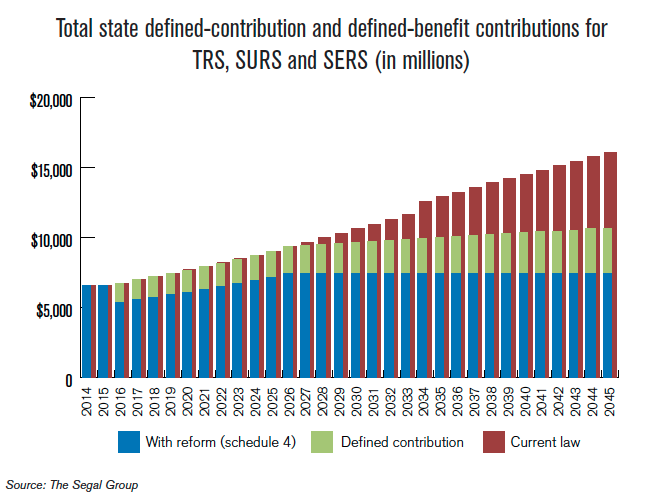

Recommended payment schedule: State contributions

This payment schedule reduces Illinois’ fiscal year 2016 contribution by nearly $1 billion, and it reduces total contributions by $30 billion over the next 30 years.

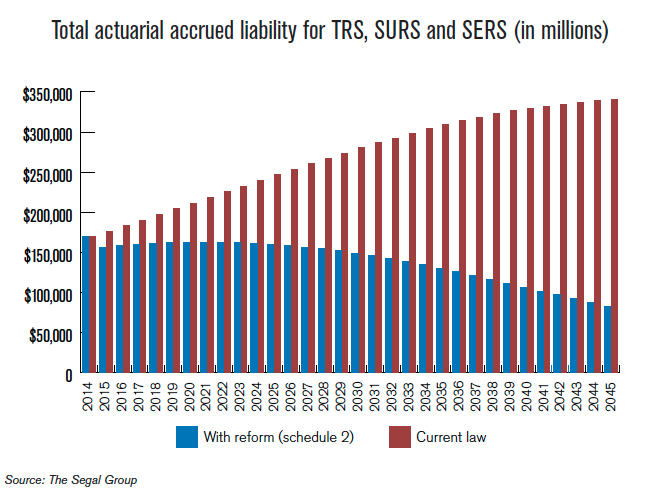

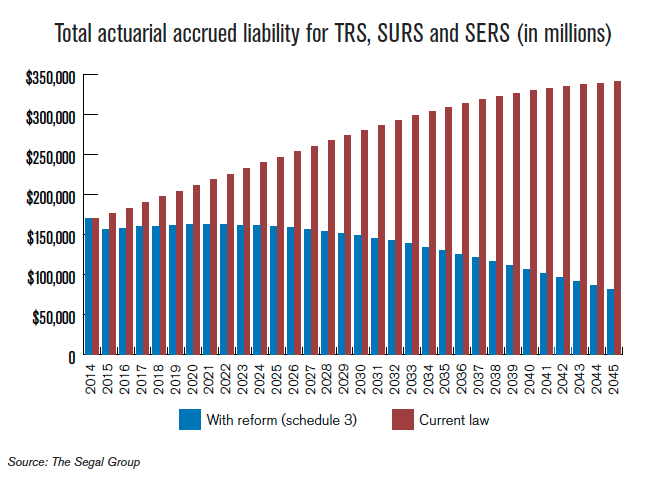

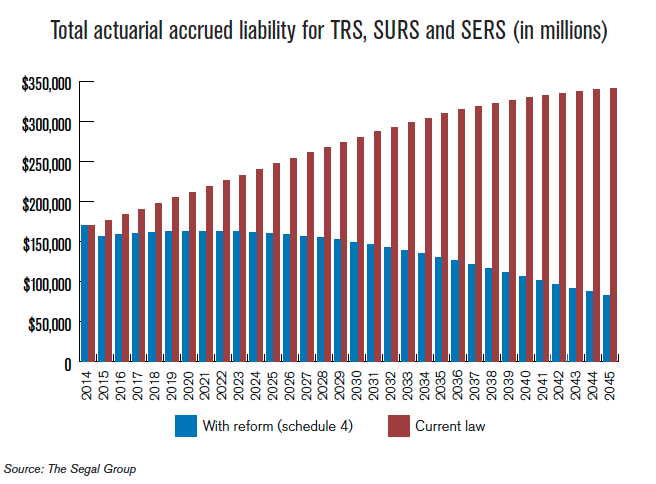

Recommended payment schedule: Actuarial accrued liability

This payment schedule reduces Illinois’ fiscal year 2045 actuarial accrued liability by 76 percent, or more than $258 billion, compared with current law.

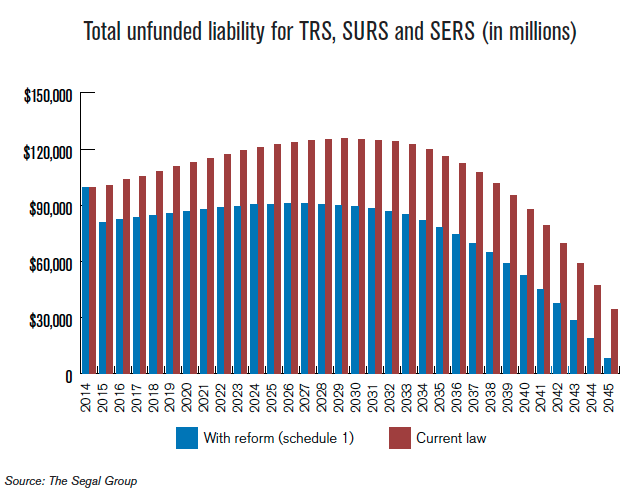

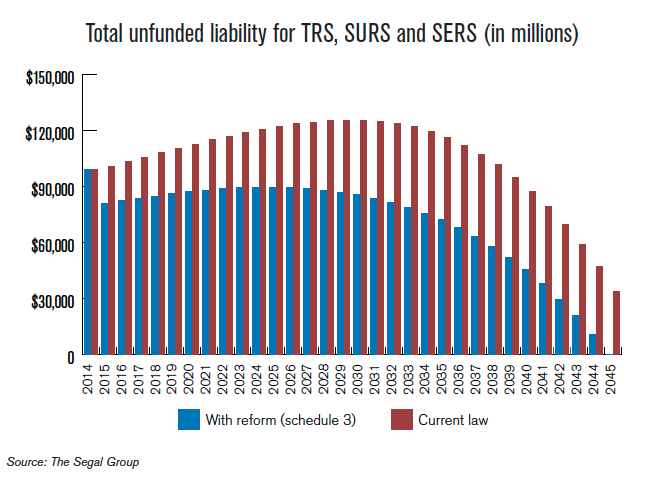

Recommended payment schedule: Unfunded liability

This payment schedule immediately reduces Illinois’ fiscal year 2016 unfunded liability by 20 percent, or $21 billion, compared with current law.

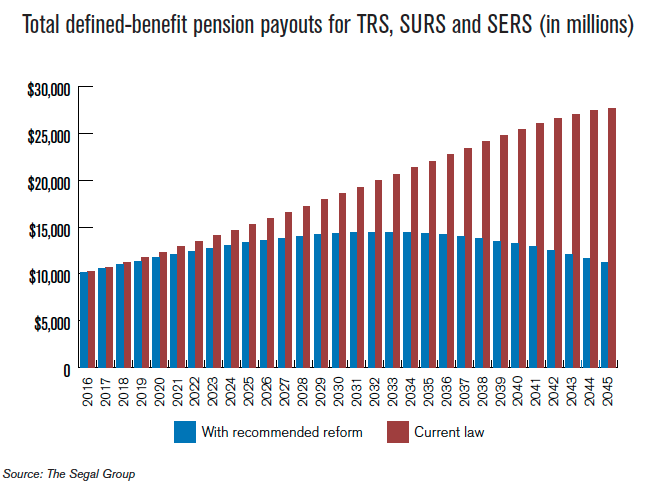

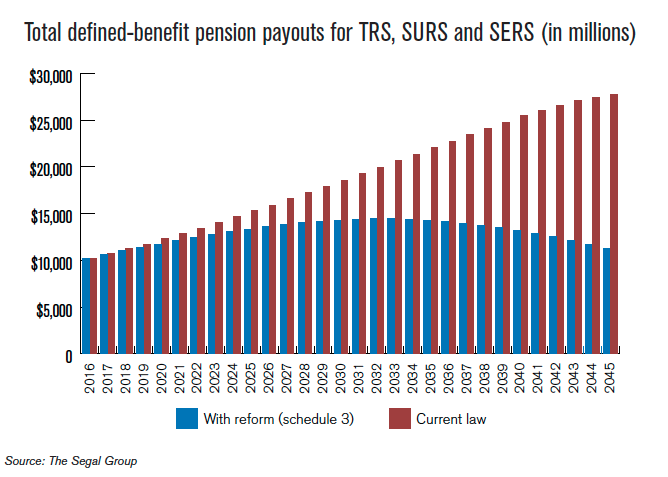

Recommended payment schedule: Pension payouts

This payment schedule reduces total pension payouts by $182 billion, or 32 percent, over the next 30 years compared with current law.

Illinois should learn from other states’ reforms

There’s a reason states across the nation are moving to defined-contribution retirement plans. Compared with traditional defined-benefit plans, defined-contribution plans are much more stable and predictable ways to budget for retirement costs. Instead of the quickly growing costs associated with traditional pension plans, defined-contribution retirement plans are a known cost – a fixed percentage of payrolls each year.

The shift to defined-contribution plans has been taking place for nearly two decades. Michigan moved all new public employees onto 401(k)-style plans in 1997. Alaska followed suit in 2006 and Oklahoma made the switch in 2014.

It is imperative that Illinois – a state home to the nation’s worst pension crisis – follow the lead of other states by adopting a defined-contribution retirement plan.

Conclusion

The actuarial data presented in this policy brief and in the appendix show that there are a number of ways Illinois can freeze the defined-benefit plan and make the move to a defined-contribution retirement system.

Illinois should move forward with a defined-contribution reform plan to the fullest extent possible, and should determine which repayment structure for the defined-benefit liability makes the most sense for the state, its taxpayers and its government workers.

Appendix

Payment schedule 1: Level percentage of payroll

Payment schedule 1 is a repayment schedule based on a level percentage of total payroll. The state’s fiscal year 2016 defined-benefit contribution would be reduced to $4.7 billion. The fiscal year 2016 retirement contribution would total $6 billion when the defined-contribution payment is factored in. After fiscal year 2016, total defined-benefit pension contributions are based on a level percentage of payroll.

Payment schedule 1: State contributions

Schedule 1 reduces Illinois’ fiscal year 2016 contribution by $700 million and it reduces total contributions by $32 billion over the next 30 years.

Payment schedule 1: Actuarial accrued liability

Schedule 1 reduces Illinois’ fiscal year 2045 actuarial accrued liability by 76 percent, or more than $258 billion, compared with current law.

Payment schedule 1: Unfunded liability

Schedule 1 reduces Illinois’ fiscal year 2016 unfunded liability by 20 percent, or more than $20 billion, compared with current law.

Payment schedule 1: Pension payouts

Schedule 1 reduces total pension payouts by $182 billion, or 32 percent, over the next 30 years compared with current law.

Payment schedule 2: Annual level percentage increases

Payment schedule 2 is a repayment schedule that reduces the state’s defined-benefit pension contribution to $4.5 billion in fiscal year 2016. After fiscal year 2016, the total defined-benefit pension contribution increases by a level 3.88 percent each year in order to fully fund the system by 2045.

Payment schedule 2: State contributions

Schedule 2 reduces Illinois’ fiscal year 2016 contribution by nearly $1 billion and it reduces total contributions by $21 billion over the next 30 years.

Payment schedule 2: Actuarial accrued liability

Schedule 2 reduces Illinois’ fiscal year 2045 actuarial accrued liability by 76 percent, or more than $258 billion, compared with current law.

Payment schedule 2: Unfunded liability

Schedule 2 immediately reduces Illinois’ fiscal year 2016 unfunded liability by 20 percent, or $21 billion, compared with current law.

Payment schedule 2: Pension payouts

Schedule 2 reduces total pension payouts by $182 billion, or 32 percent, over the next 30 years compared with current law

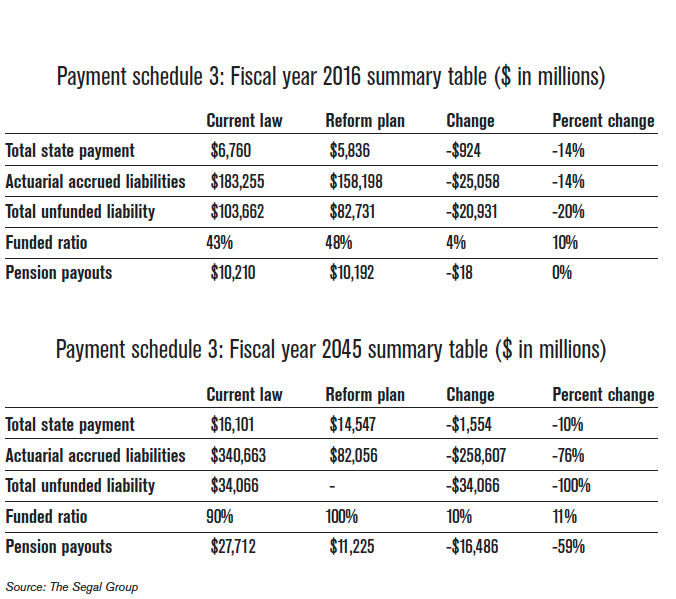

Payment schedule 3: Annual level dollar increases

Payment schedule 3 is a repayment schedule that reduces the state’s defined-benefit pension contribution to $4.5 billion in fiscal year 2016. After fiscal year 2016, the total defined-benefit pension contribution increases by a level $235 million each year in order to fully fund the system by 2045.

Payment schedule 3: State contributions

Schedule 3 reduces Illinois’ fiscal year 2016 contribution by nearly $1 billion, and it reduces total contributions by $30 billion over the next 30 years.

Payment schedule 3: Actuarial accrued liability

Schedule 3 reduces Illinois’ fiscal year 2045 actuarial accrued liability by 76 percent, or more than $258 billion, compared with current law.

Payment schedule 3: Unfunded liability

Schedule 3 immediately reduces Illinois’ fiscal year 2016 unfunded liability by 20 percent, or $21 billion, compared with current law.

Payment schedule 3: Pension payouts

Schedule 3 reduces total pension payouts by $182 billion, or 32 percent, over the next 30 years compared with current law.

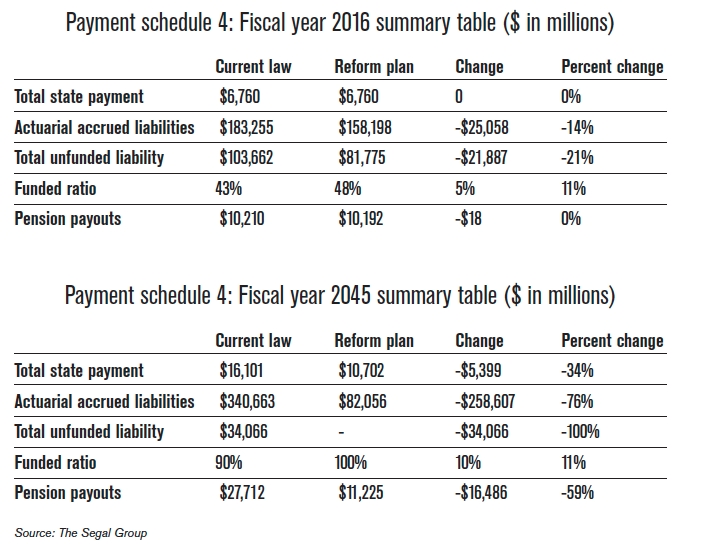

Payment schedule 4: Match current-law contributions through 2025

Payment schedule 4 is a repayment schedule where total state contributions – including the defined- contribution plan – equal the state’s total defined-benefit contributions under current law through 2025. After 2025, the defined-benefit payments are held at a constant $7.46 billion in order to fully fund the system by 2045.

Payment schedule 4: State contributions

Schedule 4 reduces total contributions by $55 billion over the next 30 years.

Payment schedule 4: Actuarial accrued liability

Schedule 4 reduces Illinois’ fiscal year 2045 actuarial accrued liability by 76 percent, or more than $258 billion, compared with current law.

Payment schedule 4: Unfunded liability

Schedule 4 reduces Illinois’ fiscal year 2016 unfunded liability by 21 percent, or more than $21 billion, compared with current law.

Payment schedule 4: Pension payouts

Schedule 4 reduces total pension payouts by $182 billion, or 32 percent, over the next 30 years compared with current law.