Progressive tax could cost nearly $1,800 a year in home equity

By Orphe Divounguy, Bryce Hill, Jon Josko

Gov. J.B. Pritzker promises his $3.7 billion “fair tax” would only hit those making over $250,000, but it also threatens to cost more than 3.2 million Illinois homeowners an average of $1,800 a year in home equity.

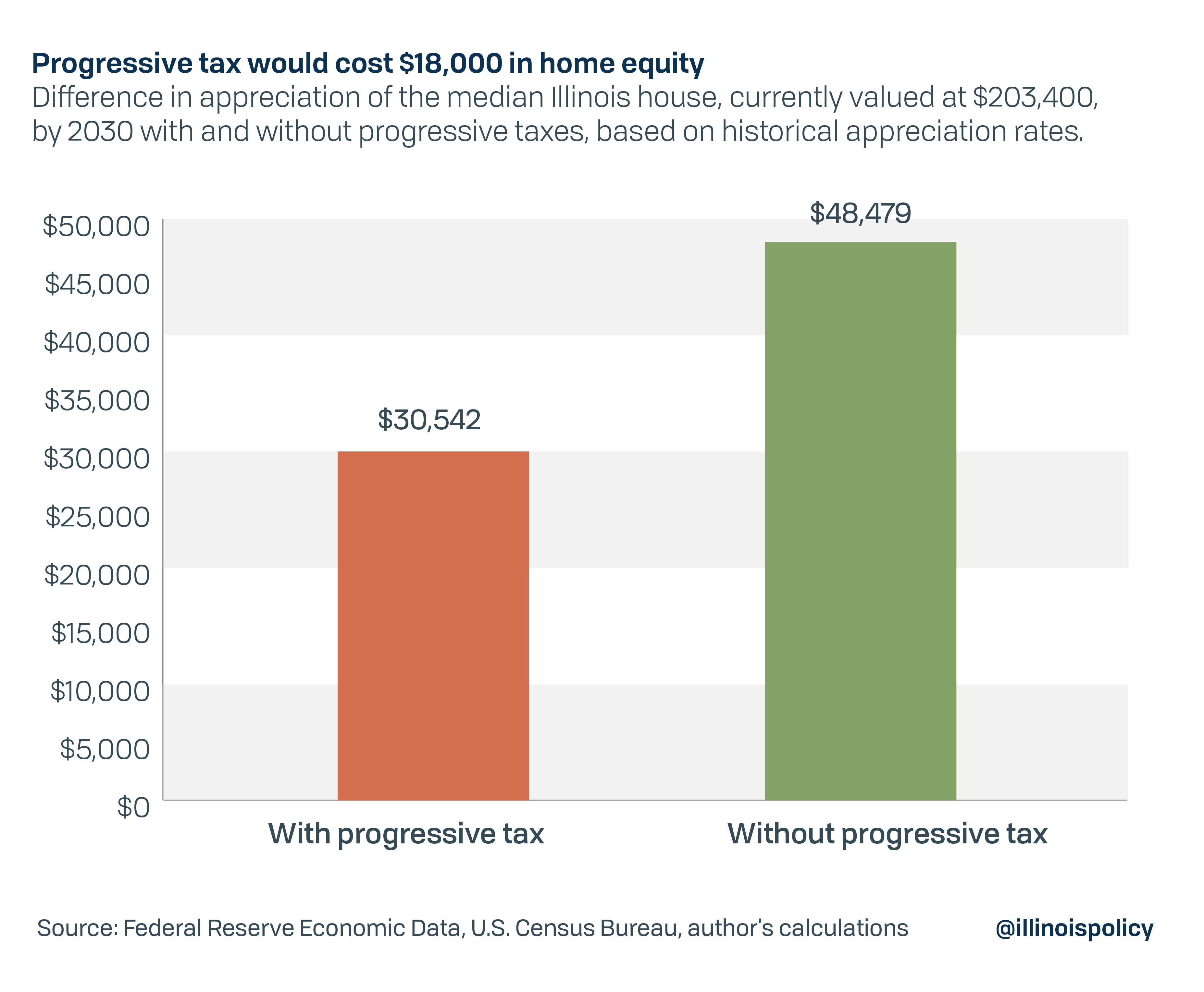

If voters approve the state income tax increase, it could eventually cause Illinois’ home price appreciation rate to fall by 34.8% (see Appendix), if the state has the same experience as the last state to enact a progressive income tax: Connecticut in 1996. If the median homeowner, with a home value of $203,400, were planning on selling their house in 10 years, a progressive income tax would cost them $17,937 in foregone equity. The average annual cost of the progressive tax for these homeowners would be nearly $1,800 in home equity.

Because lower home prices are a hidden cost that will impact homeowners at all income levels, it is disingenuous for proponents of the progressive tax to claim it will only affect the rich. Less housing wealth will be a concern even if state lawmakers could be trusted not to abuse their new taxing powers to spread tax hikes to the middle class or retirees, as Connecticut also did.

Introduction

Lawmakers are asking voters to approve a $3.7 billion income tax increase on Nov. 3, promising the tax increase will only harm those making more than $250,000. However, the financial damage would also spread to Illinois’ 3.2 million homeowners. The 2011 state income tax hike previously reduced housing prices in Illinois, according to the Harvard Joint Center for Housing Studies, which added a caveat because housing prices were already declining prior to the tax hike. The same study found the 2007 Washington, D.C., income tax cuts led to a significant increase in housing prices.

Even if the tax rates as currently proposed were to remain in place – which is increasingly unlikely amid declining state revenue from the COVID-19 related downturn and the state’s growing fiscal imbalance – house prices would appreciate by 1.5% to 4.9% less (see Appendix).

It is much more likely the progressive income tax hikes would be extended to middle- and low-income earners, taking even more income tax dollars from them. Without real reforms, Illinoisans could face far slower housing appreciation as income taxes and the nation’s second-highest property taxes continue to increase – as happened in Connecticut after it switched from a flat tax in 1996 and phased in a progressive income tax over three years.

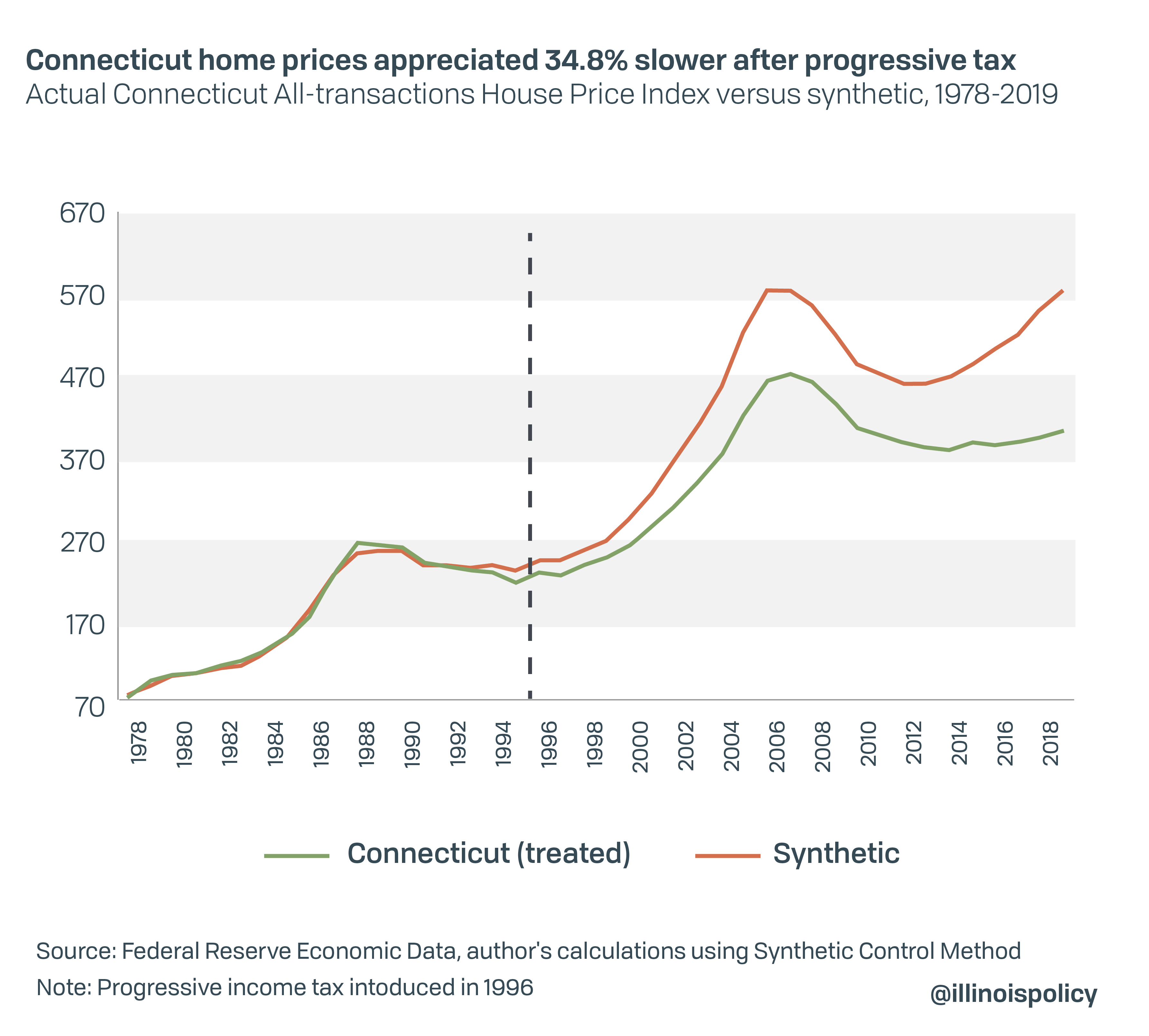

Connecticut’s results were disastrous. A decade after the tax hikes, housing prices had appreciated 46% less when compared to similar nearby states such as Massachusetts, Rhode Island and New Jersey. By 2019, the gap was even larger: average housing prices in Connecticut had appreciated by 70% relative to 144% housing appreciation – less than half – the growth in housing values in similar nearby states.

The damage to the housing market should caution Illinois homeowners voting on the progressive tax issue in November.

If Pritzker’s tax hike is enacted, land values and home equity growth are likely to suffer, stripping wealth from Illinois homeowners and causing property tax burdens to increase. Again, those were the impacts seen in Connecticut when it implemented a progressive tax.

Pritzker’s argument for the progressive tax relies on the same myths used to persuade Connecticut voters: that a progressive income tax will allow for middle-class tax relief, that it will lower property taxes and that it will shore up the state’s finances. On the contrary, if Illinois ditches its constitutionally protected flat income tax, history shows Illinoisans will likely face the same fate as Connecticut – higher taxes for everyone, fewer jobs and an even more sluggish economy – all at a time when Illinois’ economy is trying to recover from COVID-19 shocks.

The impact of the progressive income tax hike on housing prices

Using the “synthetic control method” as in Abadie and Gardeazabal (2003), we investigated the impact of Connecticut’s tax hikes on house prices. We learned that the switch to a progressive income tax in Connecticut permanently lowered housing prices. By 2019, average house price appreciation rates in Connecticut were lower by 34.8% relative to housing values in similar nearby states such as Massachusetts, Rhode Island and New Jersey because of the state’s income tax hikes (see Appendix).

The evidence also suggests those nearby states likely benefitted from Connecticut’s policy misstep. This was to be expected. The increase in the cost of housing in Connecticut, relative to other states, likely led to a decrease in demand for housing services in Connecticut, dragging down housing prices.

Similarly, a progressive income tax increase in Illinois is likely to harm homeowners and renters in Illinois when compared to neighboring states that offer similar amenities. Income tax hikes cause demand for housing services to decrease. The result is vacant units take longer to sell (time on market increases), housing prices fall and the number of vacancies increases relative to the number of potential buyers.

Higher income taxes also have a negative impact on the labor market prospects and incomes of homeowners and renters in Illinois relative to other states. This is especially true now that a federal cap on state and local tax deductions increases tax burdens on those who live in high-tax states. As a result, land values decrease and so do housing prices.

Owning a home in Illinois becomes less rewarding than in states where homeowners face much lower costs. On the supply side, constrained homeowners with little or no equity could walk away from rising costs by opting to sell. On the demand side, a declining working-age population with stagnant income growth means fewer, already risk-adverse buyers dragging down housing prices.

The negative effect on housing prices is exacerbated by the fact houses are illiquid assets – meaning they cannot be sold quickly for what is considered the market price. A decrease in demand could mean time on the market for vacant units increases, prices fall and housing sales decline.

For those reasons, even small negative shocks can have lasting negative effects on the housing market.

Lower growth in housing values will impair the recovery

If a progressive tax were adopted in Illinois, the resulting decrease in housing appreciation would have negative implication for mortgage delinquency as well as the economic recovery. This is because growth in home equity is negatively associated with mortgage delinquency.

As of February, Illinois had the second-highest foreclosure rate in the country.

COVID-19 worsened the situation. First, rental income dried up and now data released by the Mortgage Bankers Association shows Illinois delinquent mortgages increased by 79% in the second quarter of 2020 versus a year earlier.

Unfortunately, that makes sense: substantial home equity fends off delinquency, and housing wealth increases the likelihood that you spend more freely and support the economy. A decline in housing wealth is associated with lower consumer spending, thus harming Illinois’ economic recovery.

A better path forward

Rejecting a progressive income tax would spare Illinoisans from Connecticut’s sorry fate. Changes to the state tax code will not fix the structural flaws with the state’s finances or reform the main cost-drivers, pensions and government employee health care costs. By eating nearly one-third of the dollars taxpayers will send to Springfield this year, state spending on pensions has crowded out the delivery of core services, including social spending on the disadvantaged as well as important public investments that would raise the incomes and home values of Illinois taxpayers.

So long as the state continues to prioritize government workers over everyone else, Illinoisans will be forced to endure tax hikes regardless of the structure of the state income tax. A progressive income tax will only make it easier for politicians to gradually raise middle-class taxes and to levy a tax on retirement income, just like Connecticut did.

How will the progressive tax affect your home value?

lower than under Illinois’ current income tax.

home details above

This tool compares the expected sale price based on the most recent 10-year average house price appreciation with the expected change in housing prices under the proposed tax increase that would go into effect Jan. 1, 2021, should voters approve a progressive tax constitutional amendment Nov. 3. This calculation assumes no change in other owner's costs such as mortgage rates, maintenance costs, property taxes and the federal income tax liability.