Pritzker price tag: Candidate’s spending promises require doubling state income tax

By Adam Schuster, Orphe Divounguy, Bryce Hill

Democratic gubernatorial candidate J.B. Pritzker has promised a number of new spending programs as well as closing Illinois’ current structural deficit. To finance these promises, Pritzker has proposed a progressive income tax hike.

But how much would these promises cost? And how high would taxes need to be to finance them?

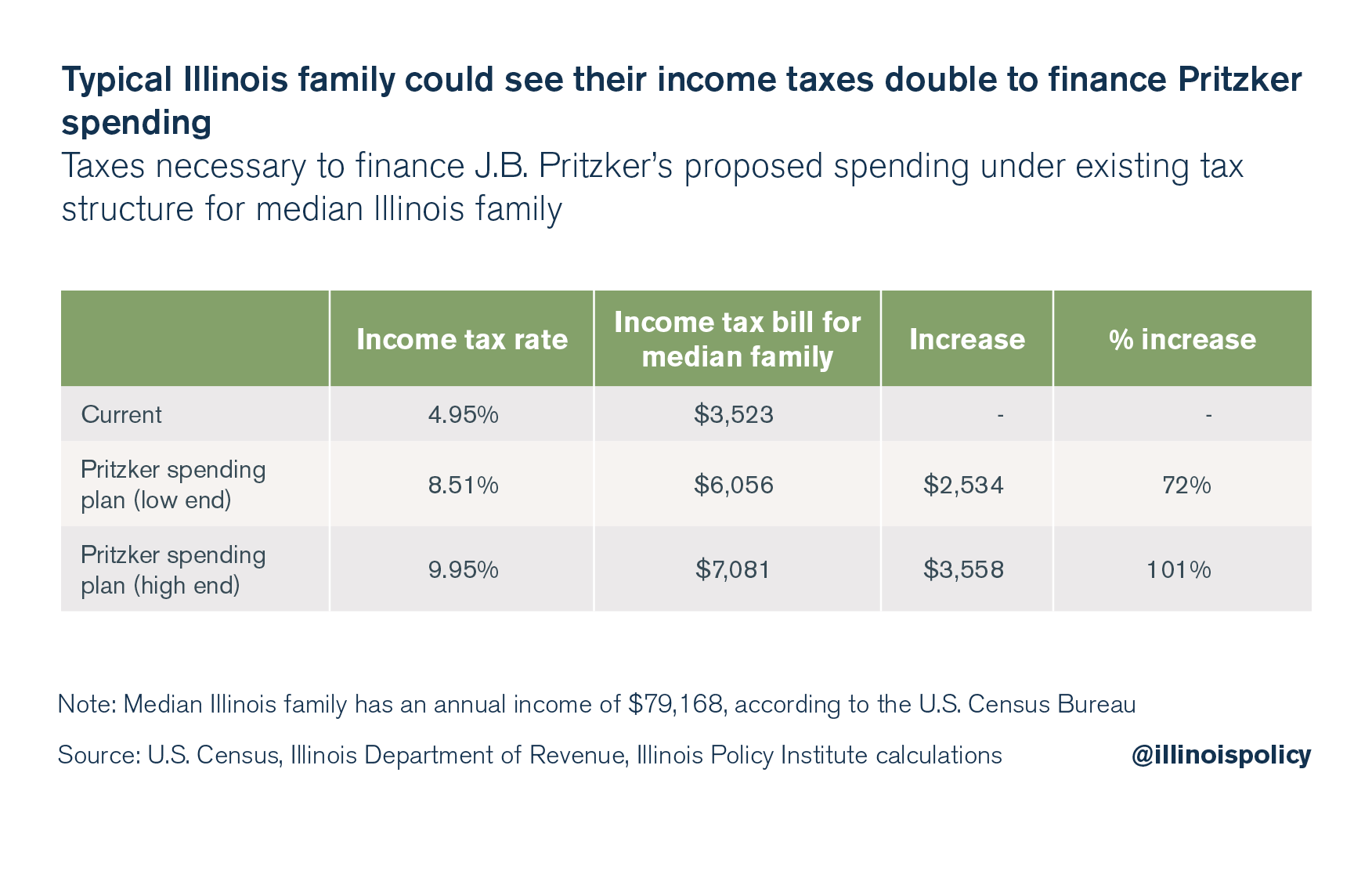

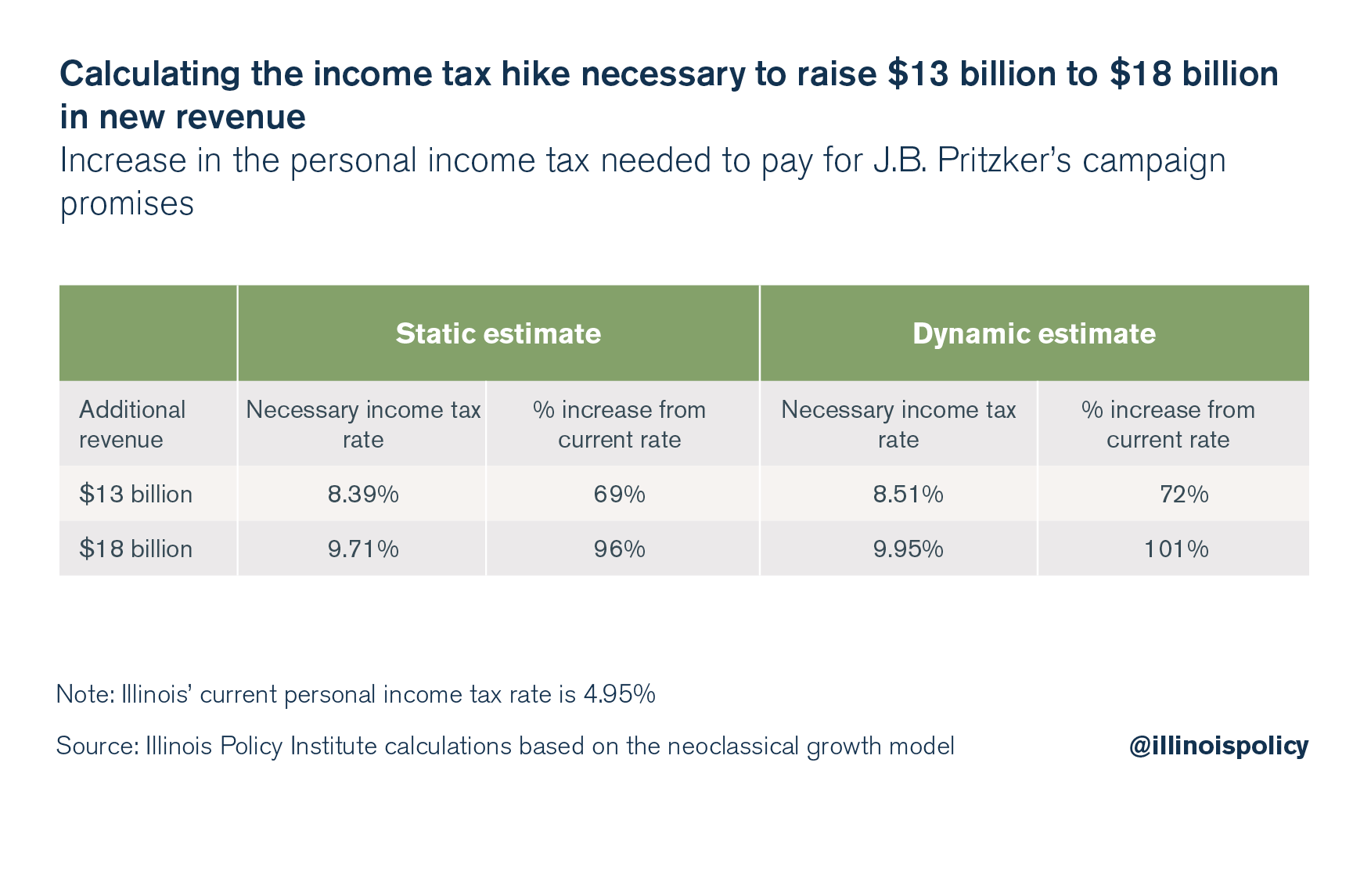

Reasonable estimates show the cost of Pritzker’s spending promises demand an income tax hike of $13 billion to $18 billion. This would require approximately doubling the state’s personal income tax to 9.95 percent on the high end and 8.51 percent on the low end from the current 4.95 percent income tax rate.

That means within the existing flat income tax structure, which would remain in place until at least 2020, the typical family in Illinois making just over $79,000 would pay an additional $2,500 to $3,500 in income taxes in order to finance Pritzker’s spending promises.

Economic modeling shows a tax hike of this magnitude could cost the state between 94,000 and 132,000 jobs and $22.4 billion to $31.3 billion in economic activity.

Illinois taxpayers deserve to know the effects of policy proposals by aspiring elected officials. Unfortunately, Pritzker has yet to release any details about his tax policy proposal, including the amount of revenue he wants to raise or the tax bracket schedule under his progressive income tax hike. As a result, it is necessary to approach his tax plan in reverse by estimating the following:

- The cost of Pritzker’s potential spending based on public statements

- The tax rates necessary to pay for that spending

- The economic impact of the resulting tax increase

Pegging down Pritzker’s proposals

Members of the Illinois media have been trying to get clear answers from Pritzker regarding how much revenue he would like to raise through tax increases and what his tax rates would be for each income level under a progressive income tax.

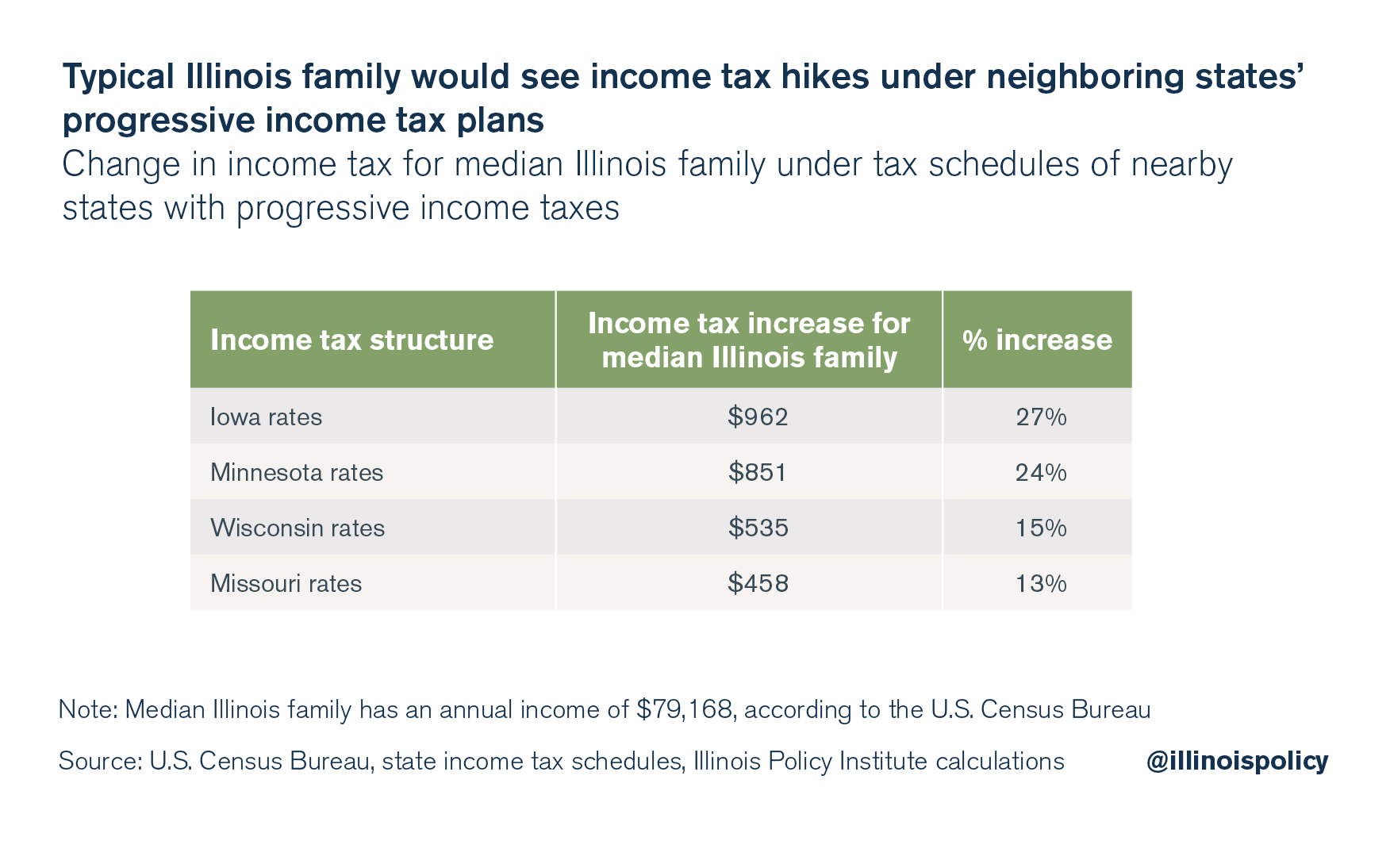

The closest the candidate has come so far to providing those answers was in a radio interview with WJBC-AM 1230 in April.1 In that interview, Pritzker pointed to Minnesota, Wisconsin, Iowa and Missouri as examples of what his tax plan could look like. The median income family in Illinois would pay higher income taxes under every one of those states’ plans.

But because Pritzker will not provide more detail, and because he also has stated he wants to cut taxes for the middle class,2 reporters have been left to speculate as to how much additional revenue he wants to raise. Rich Miller from the Springfield-based political blog Capitol Fax came up with one estimate, which he originally pegged at $5.6 billion.3 After Pritzker’s recent comments on education funding, Miller revised his estimate upward to $10.7 billion.4 These estimates, while useful, are too low.

This report uses public statements from Pritzker and various government data to develop estimates of the fiscal impact of his new spending proposals. A detailed cost estimate regarding each of Pritzker’s public proposals can be found in Appendix A.

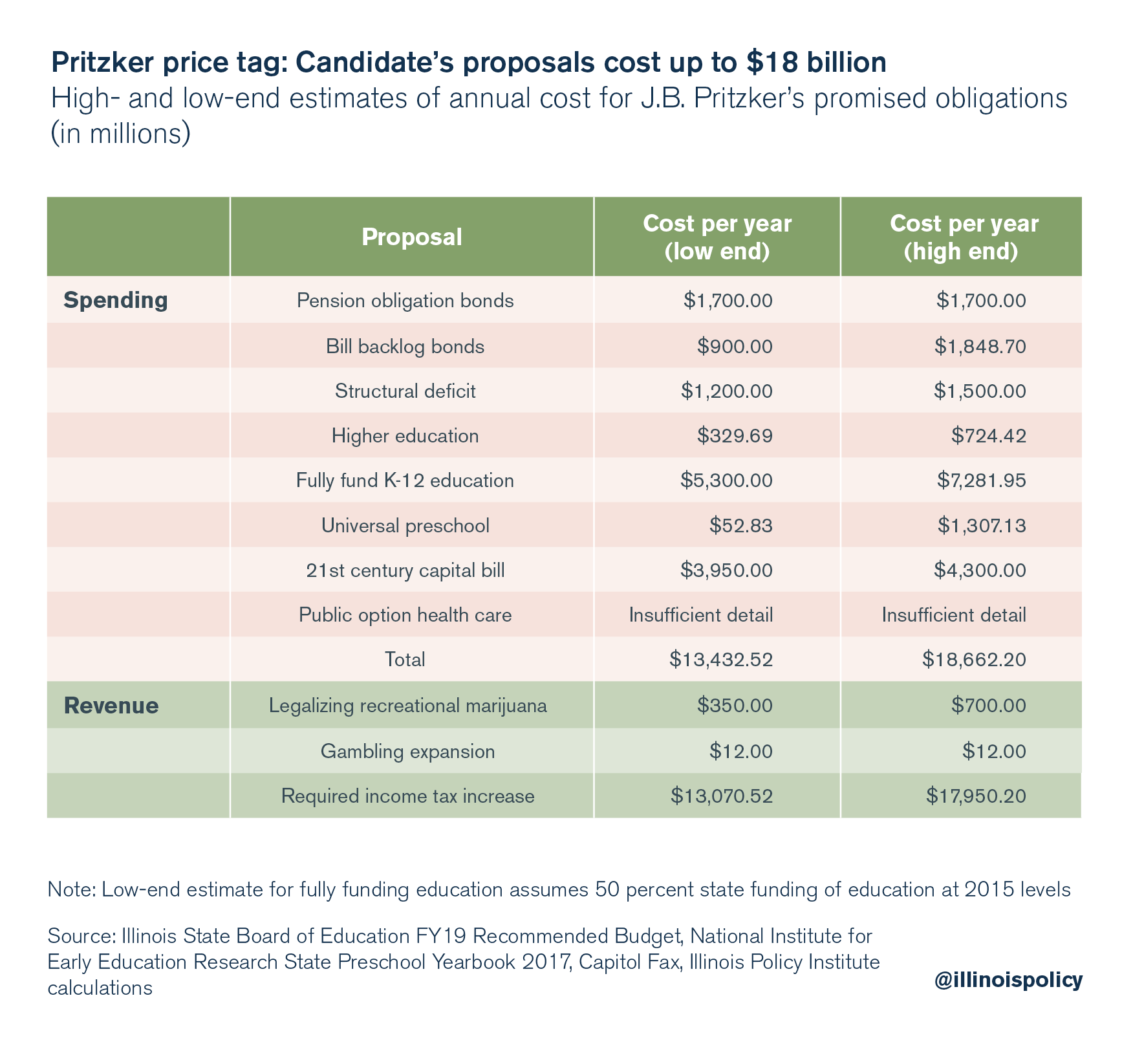

At the high end, the new spending promised by Pritzker could cost taxpayers more than $18 billion per year.

This cost estimate demonstrates that given the amount of revenue needed to fulfill his campaign promises, it would be virtually impossible for Pritzker to cut taxes on the middle class through a progressive tax. The reason is simple: middle-class Illinoisans far outnumber wealthy Illinoisans. According to data from the Internal Revenue Service, just 0.3 percent of Illinois tax returns reported income of over $1 million.5

In looking at examples of detailed progressive tax plans in Illinois, this reality becomes more clear. A progressive tax proposal from the Center for Tax and Budget Accountability, or CTBA, would hike taxes on anyone earning more than $300,000 a year – about 2 percent of Illinois taxpayers according to CTBA’s calculations – but would have only raised $2 billion in a static estimate (assuming no negative economic effects of higher taxes).6

So what would tax rates have to look like in order to raise $13 billion to $18 billion in new revenue?

This analysis estimates the tax rates necessary to cover Pritzker’s promised spending based on the current flat tax structure in Illinois. While Pritzker has proposed instituting a progressive income tax, he has not released his own rate schedule, so there is no concrete plan that can be used for estimates. Additionally, a progressive income tax cannot be implemented in Illinois prior to fiscal year 2021.

Pritzker has previously floated the idea of an “artificial progressive income tax,” wherein lawmakers increase the flat tax rate but also increase deductions and exemptions for lower income earners to reduce their effective rate.7 However, the candidate has not released any details about the value of the increased deductions, so those cannot be credited in any estimate.

Under the existing tax structure, which a potential Gov. J.B. Pritzker would almost certainly have to work with for fiscal year 2020, the cost of the candidate’s spending promises could mean doubling the income taxes paid by a median income Illinois family making $79,168, according to the U.S. Census Bureau.8

Raising $18 billion to finance Pritzker’s spending promises would require nearly doubling Illinois’ personal income tax rate to 9.95 percent from 4.95 percent. At the low end, Pritzker’s new spending would cost $13 billion. Raising $13 billion in additional revenue would mean increasing the personal income tax rate to 8.51 percent from 4.95 percent, a 72 percent hike.

After applying Illinois’ standard personal exemption of $2,000,9 the median income family would pay an additional $2,534 to $3,558 in taxes in order to finance Pritzker’s spending promises with the existing tax structure.

If Pritzker truly wants to fix Illinois finances and provide tax relief to hard-working residents, he should abandon his progressive tax plan and expensive new spending promises, focusing instead on meaningful spending reforms such as an amendment to the state constitution’s pension clause and a spending cap.10,11

The impact of Pritzker’s spending promises

When taking into account the predictable responses of individuals, businesses and investors to changes in tax policy, lawmakers would have to increase taxes by 72 percent to pay for an additional $13 billion in state spending and would have to more than double the income tax burden in order to raise $18 billion in additional income tax revenue.12

The corporate income tax rate is assumed to be held constant, as no public statements have been found linking Pritzker to a desire to increase the corporate rate. Illinois already has one of the top five highest corporate income tax rates in the nation.13

While traditional revenue estimation (often called static scoring) assumes no incentive effects of tax hikes on economic activity, the economic model used in this report assumes that individuals and businesses adjust their economic decisions in response to changes in the economic environment, such as higher taxes. Most economists agree that taxes influence aggregate income.

So how will these tax hikes affect the Illinois economy?

In the best-case scenario, a $13 billion income tax hike could depress growth in employment by the equivalent of 94,000 full-time jobs. Meanwhile, an $18 billion income tax hike could mean 132,000 fewer new full-time jobs only one year after the tax hike, the equivalent of the past three years of jobs growth.14

There are also implications for the overall size of the state’s already fragile economy.

The impact of a potential income tax hike of $13 billion to $18 billion on economic activity would be devastating. A $13 billion income tax hike would cost Illinois an estimated $22.4 billion in economic activity the first year after the tax is introduced. For an $18 billion income tax hike, the model predicts a cost of $31.3 billion in economic activity just one year after the tax increase.

Pritzker has insisted that he will be able to deliver on his spending promises and provide middle-class tax relief with a progressive income tax. However, it is unlikely that low- and middle-income Illinoisans will get any long-term relief due to the enormous price tag of Pritzker’s promises.

Even if Pritzker funded his promises with a progressive income tax, the effects of this massive tax hike on the economy would be even more severe, as progressive income taxes are more detrimental to capital accumulation and economic growth than flat income taxes.15

Thus, if Pritzker follows through on his promises and lawmakers approve his plan, all Illinoisans would suffer.

Conclusion

Pritzker’s current suggested spending and taxation policies will fail to achieve his stated goals of improving Illinois’ economy, fixing state finances and delivering tax relief to the middle class. Financing the new spending programs in accordance with Pritzker’s stated policy preferences would likely require an income tax increase of between $13 billion and $18 billion, harming taxpayer wallets as well as Illinois’ economy and job creation.

To achieve his stated goals, Pritzker should abandon his current policy proposals and instead support pro-taxpayer solutions that will lead to long-run fiscal balance and tax relief.

First, Pritzker should support meaningful pension reform that starts with a constitutional amendment to allow changes in future, not-yet-earned benefit accruals for current workers and ends with moving all new hires into 401(k)-style personal retirement accounts. Pension-related financial pressure is currently crowding out core government services, harming the state’s credit rating and encouraging calls for tax hikes. Real, lasting pension reform is the only way to protect taxpayers from further tax hikes, protect government worker retirement security from fund insolvency, and ensure state and local governments can continue to provide core services such as education and public safety.16

Second, Pritzker should support a constitutional spending cap amendment. From 2005 to 2015, state spending per capita grew 25 percent faster than residents’ per capita personal income.17 This spending growth is unsustainable and unaffordable to taxpayers. A spending cap would tie growth in state spending to a 10-year average of growth in the economy, effectively tying lawmakers’ ability to spend to taxpayers’ ability to pay.

Adopting these commonsense policies will improve state and local finances while leading to tax relief for Illinois residents.

This report was written and published by Illinois Policy, a 501(c)(4) taxpayer advocacy organization.

Appendix A: Detailed cost estimate of Pritzker proposals

Cost of current government obligations annually: $3.8 billion to $5 billion

It is important to look at the cost of financing Illinois’ current obligations through tax hikes, without structural reform. Illinois’ structural deficit – or the gap between revenue and current baseline spending – is between $1.2 billion18 and $1.5 billion.19

With respect to restructuring pension debt, Pritzker told the Crain’s Chicago Business editorial board that we should “determine a level dollar annual payment beginning now and into future years and re-amortize the pension payment schedule.”20 Pritzker has also stated that he wants to “step up principal payments earlier” to “flatten out” the repayment schedule.21

Taken together, these statements sound very similar to a plan proposed by the Center for Tax and Budget Accountability.22 That plan requires $11.2 billion in new pension obligation bonds to make front-loaded payments, extends the repayment schedule, and changes the schedule to level dollar payments. The cost of financing the bonds would be $1.7 billion per year for eight years, given Illinois’ average 4.54 percent bond yield on long-term bonds.23

And still more bonds may be used to pay back the current bill backlog, which stands at $8.105 billion as of Sept. 18.24 Capitol Fax estimated the cost of paying back half the backlog at about $900 million annually, which serves as a low-end estimate. Paying back the full backlog over five years would cost $1.849 billion per year.

Infrastructure spending: An additional $4 billion

Pritzker’s website calls for a “comprehensive 21st Century Capital Bill.”25 Providing further detail, the candidate has called for “broadband internet for all” in response to questionnaires from the Chicago Sun-Times26 and State Journal-Register.27 Pritzker also told the Decatur-based Herald & Review he would look at a number of revenue streams for infrastructure improvements, “likely to cost billions of dollars.”28 In the first televised candidate forum for the Illinois gubernatorial election, Pritzker said he was open to building an additional major airport in the south Chicago suburbs.29

These statements suggest a desire for a capital bill that covers not only Illinois’ deferred maintenance costs – the cost of repairing existing roads, bridges and other transportation infrastructure – but also additions and improvements to existing infrastructure.

As explained in reporting by the Chicago Tribune, the federal government is unlikely to cover a significant portion of capital investment costs in Illinois.30

To estimate how much Pritzker would likely spend on a capital bill, one can look at likely policy influencers that have produced reasonable estimates.

According to a communication between the Illinois Department of Transportation and the Civic Federation, a nonpartisan think tank, Illinois must spend $1.7 billion annually to keep up with existing highway and transit infrastructure needs, along with $2.25 billion annually for needed improvements, for a total price tag of $3.95 billion per year.31 The Metropolitan Planning Council, a nonpartisan nonprofit research organization, estimates the state needs to spend an average of $4.3 billion every year over the next 10 years – $43 billion in total – to rebuild and improve the state’s infrastructure network.32

“Full funding” for K-12 education: $5 billion to $7.281 billion on top of current spending

Pritzker told the Chicago Sun-Times that he is “committed to moving the state toward fully funding our education system.”33 While the phrase “fully funding” can be interpreted in multiple ways, there is an objective measure available that can reasonably be linked to Pritzker’s statement.

The Illinois State Board of Education’s fiscal year 2019 budget recommendation called $15.7 billion “the estimated cost of fully funding education in Illinois” according to the new K-12 school “evidence based” funding formula.34 Pritzker supports the new funding formula, according to his candidate questionnaire with the Daily Herald,35 so full funding under that formula is a fair standard to hold him to.

That total price tag puts the cost of “full funding” of education by state government at $7.281 billion more than the enacted fiscal year 2019 budget, despite an extra $381 million included for the Evidence Based Funding Formula this year.36

Rich Miller at Capitol Fax pegged this cost at $5.3 billion by estimating what it would take the state to fund half of 2015 education spending,37 so that number can serve as a low-end estimate.

There are better ways to fund education than pouring billions more into the new funding formula, including ensuring dollars are not diverted from the classroom by administrative and benefit spending. The Illinois Policy Institute will address this question more fully in a forthcoming report, but for now it is fair to take Pritzker’s comments in their current context for estimate purposes.

Government-provided preschool: $52.8 million to $1 billion

Pritzker’s website touts the goal of universal taxpayer-funded preschool.38

According to the National Institute for Early Education Research, Illinois currently has a program called “Preschool for All,” but due to funding constraints it is only available to students who have two or more risk factors, including poverty, and enrollment acceptance is prioritized based on need.39 The state of Illinois spent $4,226 per student enrolled in pre-K education for the 2016-2017 school year. Total state spending was $304 million to cover 71,759 students, or 23.2 percent of the pre-K population.40

Assuming the same level of per student spending for an additional 237,547 students would mean total pre-K spending of $1.307 billion, or an increase of more than $1 billion on the high end.41 However, Pritzker’s website calls for an incremental ramp-up of the program serving an additional 12,500 children each year,42 for an annual increase of $52.8 million.

Higher education spending: An additional $330 million to $724 million

The cornerstones of Pritzker’s recently released plan to increase spending on higher education are increasing funding for means-tested tuition assistance, the Monetary Award Program, or MAP, by 50 percent and restoring state funding for public community colleges and universities to “pre-Rauner” levels.43

The fiscal year 2019 MAP appropriation is $401.34 million.44 An increase of 50 percent would mean another $200.67 million in fiscal year 2020.

What it means to restore funding for public universities to levels found before Gov. Bruce Rauner took office is open to interpretation. The Illinois Board of Higher Education, or IBHE, budget requested $129.02 million more than it received in this year’s budget,45 which can serve as a low-end estimate of the increase Pritzker would seek because this includes the amount needed to keep buying power the same while accounting for inflation.

However, Pritzker has also stated he wants to “fully fund higher education,”46 which could be a different standard from returning to “pre-Rauner” levels. On the high end, data from IBHE show returning to the state’s peak year of higher education funding in fiscal year 2002 would require $523.75 million more than the amount appropriated in the fiscal year 2019 state budget.47

The combined cost of increasing support for public universities and MAP grants is between $330 million and $724 million.

Other fiscal considerations

Pritzker has proposed a number of other new programs. Of these proposals, the greatest potential fiscal impact would be from his public option health insurance plan dubbed “Illinois Cares,” which would be government-provided health insurance that competes with the private market by allowing residents to buy into Medicaid.48

Pritzker claims this program would come at no additional cost to taxpayers because premiums would cover the cost.49 This claim is dubious because some economists argue public option health insurance cannot be both self-funding and remain optional. For example, health economist Robert Book has argued that in order for a public option to be available to everyone it would require heavy taxpayer subsidization and that a public option operated at a loss would likely put private health insurance out of business, making it a step toward a fully socialized single-payer system.50 But without more detail on Pritzker’s specific plan, it is impossible to estimate the potential cost of his proposed program.

Other unspecified costs identified from the candidate’s website and candidate questionnaires include more funding for social service agencies,51 additional state funding for child care for low-income families,52 and more spending on home care for senior citizens.53

Pritzker has also advocated for new sources of additional revenue besides the income tax, which should be credited toward his total balance of new spending and new revenue.

Pritzker’s advocacy of legalizing and taxing marijuana is likely to raise between $350 million and $700 million, according to the Marijuana Policy Project, a group that testified before the Illinois General Assembly on the issue.54 Pritzker has also pointed to expanded gambling as a source of revenue,55 which the Commission on Government Forecasting and Accountability, a legislative advisory agency, says would raise about $12 million annually.56

Endnotes

- Bryce Hill and Joe Tabor, “Typical Illinois Family Would See a Tax Hike Under Nearby States’ Progressive Tax Rates,” Illinois Policy Institute, April 10, 2018.

- Derrick Blakley, “J.B. Pritzker Proposes Tax Hikes, Refuses to Reveal Entire Tax Proposal,” CBS Chicago, August 27, 2018.

- Rich Miller, “Pritzker Refuses to Say How Much New Revenue He’ll Need From Tax Hike, So Here’s My Initial Guesstimate,” Capitol Fax, August 23, 2018.

- Rich Miller, “Pritzker Revenue Need ‘Guesstimate’ Revised to $10.7 Billion”, Capitol Fax, September 11, 2018.

- Internal Revenue Service, “Historic Table 2 State Data Tax Year 2016,” accessed October 3, 2018.

- Ralph Martire and Daniel Hertz, “Cutting Taxes for the Middle Class and Shrinking the Deficit: Moving to a Graduated State Income Tax in Illinois,” Center for Budget and Tax Accountability, April 30, 2018.

- Rick Pearson, “Pritzker: Raise State Tax Rate, Boost Exemptions While Working on A Graduated Income Tax“, Chicago Tribune, April 3, 2018.

- US Census Bureau, “American Fact Finder: Median Household Income in the Past 12 Months (in 2017 inflation-adjusted dollars).”

- Illinois Department of Revenue, “What’s New for Illinois Income Tax”, January 2018.

- Adam Schuster, “Tax Hikes vs. Reform: Why Illinois Must Amend Its Constitution to Fix the Pension Crisis,” Illinois Policy Institute, Summer 2018.

- Adam Schuster, “Cap Spending Now: Illinois Taxpayers Need a Responsible Budget This Year”, Illinois Policy Institute, May 4, 2018.

- See Appendix B

- Morgan Scarboro, “State Corporate Income Tax Rates and Brackets for 2018,” Tax Foundation, February 7, 2018.

- Illinois Department of Employment Security, “Monthly Statewide data (2000-Present)”, Accessed October 3, 2018.

- Orphe Divounguy, Bryce Hill, and Joe Tabor, “False Promises, Real Harm: Why Illinoisans Should Reject a Progressive Income Tax,” Illinois Policy Institute, Spring 2018.

- Adam Schuster, “Tax Hikes vs. Reform: Why Illinois Must Amend Its Constitution to Fix the Pension Crisis”.

- Orphe Divounguy, Bryce Hill, and Joe Tabor, “Special Report: Why Illinois Needs a Spending Cap,” Spring 2018, Illinois Policy Institute.

- Adam Schuster, “State of Illinois Confirms New Budget is Out of Balance by $1.2B,” Illinois Policy Institute, August 21, 2018.

- Adam Schuster, “Illinois General Assembly Passes State Budget Out of Balance by as much as $1.5B”, Illinois Policy Institute, May 31, 2018.

- Sun-Times Editorial Board, “Illinois Democratic Candidate for Governor: J.B. Pritzker,” Chicago Sun-Times, February 1, 2018.

- Mark Maxwell, “How Rauner, Pritzker Pension Plans Compare,” WCIA, July 19, 2018.

- Center for Tax and Budget Accountability, “Addressing Illinois’ Pension Debt Crisis With Reamortization,” May 21, 2018.

- Cooper J. Howard, “When to Choose Munis From Outside Your Home State,” Charles Schwab, May 3, 2018.

- Illinois Comptroller, “Backlog Voucher Report,” Accessed September 18, 2018.

- JBPritzker.com, “Think Big: A Plan for Illinois Jobs,” Infrastructure for our Future.

- Sun-Times Editorial Board, “Illinois Democratic Candidate for Governor: J.B. Pritzker”.

- State Journal Register Editorial Board, “Candidate Questionnaire: J.B. Pritzker”, State Journal Register, February 25, 2018.

- Ryan Voyles, “Pritzker: Decatur Showcases Importance of Unions, Vocational Training,” Herald & Review, April 27, 2018.

- C-SPAN, “Illinois Gubernatorial Forum,” September 20, 2018. (Relevant video clip starts at 00:18:00)

- Robert Reed, “Illinois Needs $40 Billion in Infrastructure Improvements. Can Trump Help?” Chicago Tribune, February 12, 2018.

- The Civic Federation, “State of Illinois FY2019 Budget Roadmap,” February 9, 2018.

- Metropolitan Planning Council, “Illinois Has a $43 Billion Transportation Deficit.”

- Sun-Times Editorial Board, “Illinois Democratic Candidate for Governor: J.B. Pritzker”.

- Illinois State Board of Education, “Investment to Support Educational Excellence: Fiscal Year 2019 Recommended Budget,” February 2018.

- Daily Herald, “JB Pritzker: Candidate Profile,” February 13, 2018.

- Illinois State Board of Education, “Fiscal Year 2019 Investment to Support Educational Excellence”, June 4, 2018.

- Rich Miller, “Pritzker Revenue Need ‘Guesstimate’ Revised to $10.7 Billion”.

- JBPritzker.com, “Early Childhood Education.”

- National Institute for Early Education Research, “Illinois Year Book,” 2017.

- National Institute for Early Education Research, “The State of Preschool 2017.”

- Illinois Policy Institute calculations: Calculated by finding total pre-K population (71,759/0.232=309,306) and multiplying by per student spending (309,306 * $4,226).

- JBPritzker.com, “Early Childhood Education”.

- JBPritzker.com, “JB’s Plan for Higher Education: Growing a Globally Competitive Workforce.”

- Illinois Student Assistance Commission, “Monetary Award Program”, last updated September 17, 2018.

- Illinois Board of Higher Education, “Excel Download of FY 2019 Budget Tables.” Link found under the heading “Appropriations”.

- Eric Bradach, “Governor Candidates Divulge Plans for Reducing Student Debt”, The Chronicle, March 4, 2018.

- Illinois Board of Higher Education, “Fiscal Year 2019 Higher Education Budget Recommendations: Operations, Grants, and Capital Improvements”, February 2018.

- JBPritzker.com, “Illinois Cares: JB’s Healthcare Plan.”

- Ibid.

- Robert Book, “The Public Option Isn’t Really an ‘Option’,” Forbes Magazine, September 30, 2016.

- See for Example, JBPritzker.com: “JB’s Plan for Economic Inclusion;” “JB’s Principles for Disability Inclusion;” “JB’s Plan for the Opiod Epidemic;” “JB’s Plan to Support Illinois Veterans;” “JB’s Criminal Justice Reform Plan;” “JB’s Domestic Violence Prevention Plan.”

- JBPritzker.com, “Early Childhood Education: Increase Access to the Childcare Assistance Program.”

- JBPritzker.com, “JB’s Plan to Protect Illinois Seniors.”

- Editorial Board, “Should Illinois Legalize Recreational Marijuana?” Chicago Tribune, February 9, 2018.

- Marni Pyke, “Pritzker: Expanding Gambling for Road Funds Worth a Look, but Mileage Tax Too Experimental,” Daily Herald, September 26, 2018.

- Ted Slowik, “Lawmakers Weigh Concerns About Potential Gaming Expansion that Could Land Casino in South Suburbs,” Daily Southtown, August 22, 2018.