Introduction

For opponents of economic and budgetary reform, the solution to Illinois’ financial woes is always tax hikes. They claim Illinois is a low-spending, undertaxed, small-government state that can’t fix its chronic budget problems without more money from taxpayers.

As a result, many lawmakers have proposed increasing Illinoisans’ tax burden. Higher gas taxes, a millionaire tax, a progressive income tax, a return to the personal and corporate income taxes’ pre-sunset rates – all have been proposed as solutions to the state’s budget crisis and mounting deficit.

But a lack of tax revenues isn’t the problem. Illinoisans are already overtaxed. In fact, they’re already some of the highest-taxed citizens in America. Illinois’ perennial budget crises stem from the state’s persistent overspending and misplaced spending priorities. That’s led to Illinois’ dramatic fiscal decline and the budget crisis that has plagued the state since 2015.

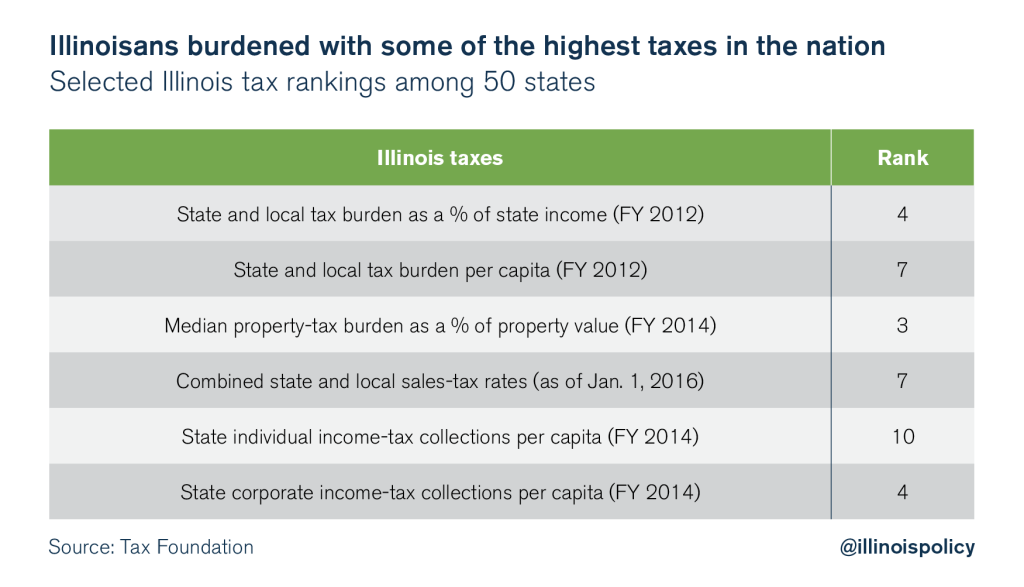

According to the most recent tax data comparable across all states, Illinoisans face the fourth-highest overall tax burden in the nation. Illinois’ property taxes rank third-highest in the nation, and are now likely the highest in the nation due to the $543 million property-tax hike Chicago’s City Council passed in 2015. Illinois’ combined state and local sales-tax rate is the seventh-highest in the U.S. And Illinois’ individual and corporate income taxes are the 10th-highest and fourth-highest in the nation, respectively.

Passing additional tax hikes would only add to Illinoisans’ heavy tax burden.

Residents in Illinois’ largest city, Chicago, face an even higher tax burden compared with other Illinois residents. In all, the city subjects Chicagoans to over 30 individual taxes and a multitude of fees – far more than any other major Illinois municipality.

Chicago’s taxes are also high compared with other cities across the nation. Chicago’s combined sales-tax rate is the highest of any major U.S. city. And Chicago’s residential and commercial property taxes ranked 18th- and fourth-highest, respectively, in 2015 when compared with other large cities across the country.

Chicagoans’ property-tax burden is even higher now with the city’s passage of a record $543 million property-tax hike in 2015. On top of that, Chicagoans face the prospect of an additional $250 million tax hike to be imposed by Chicago Public Schools.

Illinoisans are taxed enough already. The real solution for Illinois’ fiscal crisis requires lawmakers to enact state and local spending reforms to lower the cost of government to a level Illinoisans can afford.

Until then, lawmakers in Springfield and Chicago shouldn’t ask for another penny from taxpayers.

Illinoisans’ overall tax burden

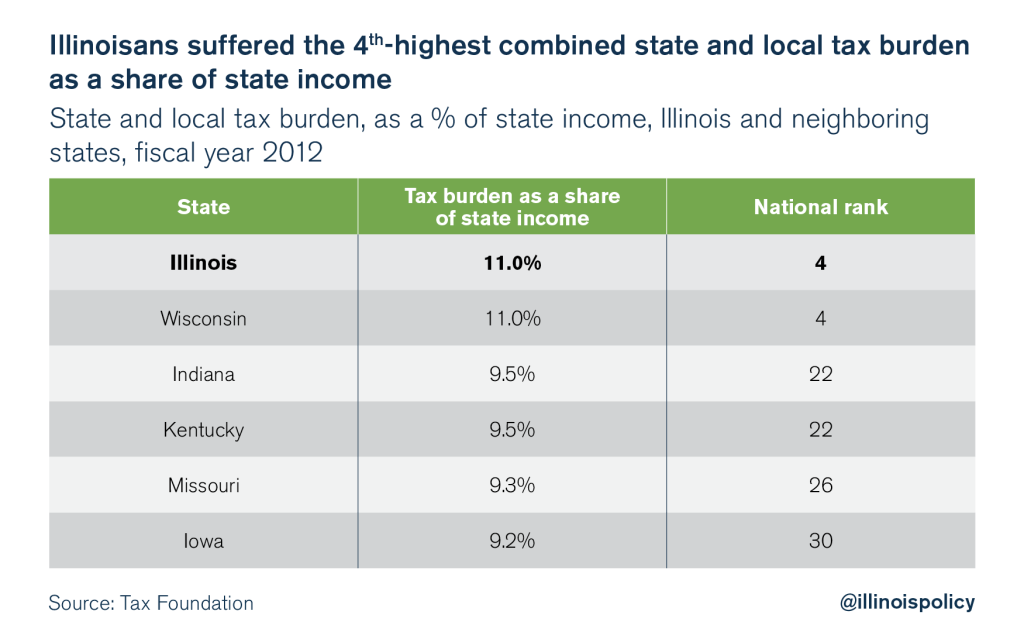

According to data from the nonpartisan Tax Foundation, Illinois had the fourth-highest combined state and local tax burden as a share of state income in the country in fiscal year 2012, the most recent year with tax data comparable across all states.

And Illinois had the seventh-highest per capita state and local tax burden in the country. At $5,235 per capita, Illinoisans’ tax burdens were higher than those of residents of any other bordering state.

The Tax Foundation’s 2012 data, while the most recent available, are not a precise representation of Illinoisans’ state and local tax burden today.

The fiscal year 2012 state and local tax burden data published by the Tax Foundation include the temporary 67 percent individual and 30 percent corporate income-tax increases enacted by the Illinois General Assembly in 2011.

The hikes increased the individual income-tax rate to 5 percent from 3 percent, and the corporate tax rate to 9.5 percent from 7.3 percent (including Illinois’ 2.5 percent personal property replacement tax).

The tax hikes partially sunset in January 2015, with the individual income tax falling to 3.75 percent and the corporate tax falling to 7.75 percent.

With the sunset having taken place, the 2012 data is no longer perfectly accurate.

However, Illinois’ rank in 2010 prior to the tax hikes can serve as a proxy for Illinoisans’ current tax burden.

In 2010, before the income-tax hike, Illinois’ combined state and local per capita tax burden equaled $4,512, the ninth-highest in the country and higher than that of any neighboring state. That ranking is not far from Illinois’ rank of seventh-highest total burden in 2012.

Illinoisans pay some of the highest property taxes in the nation

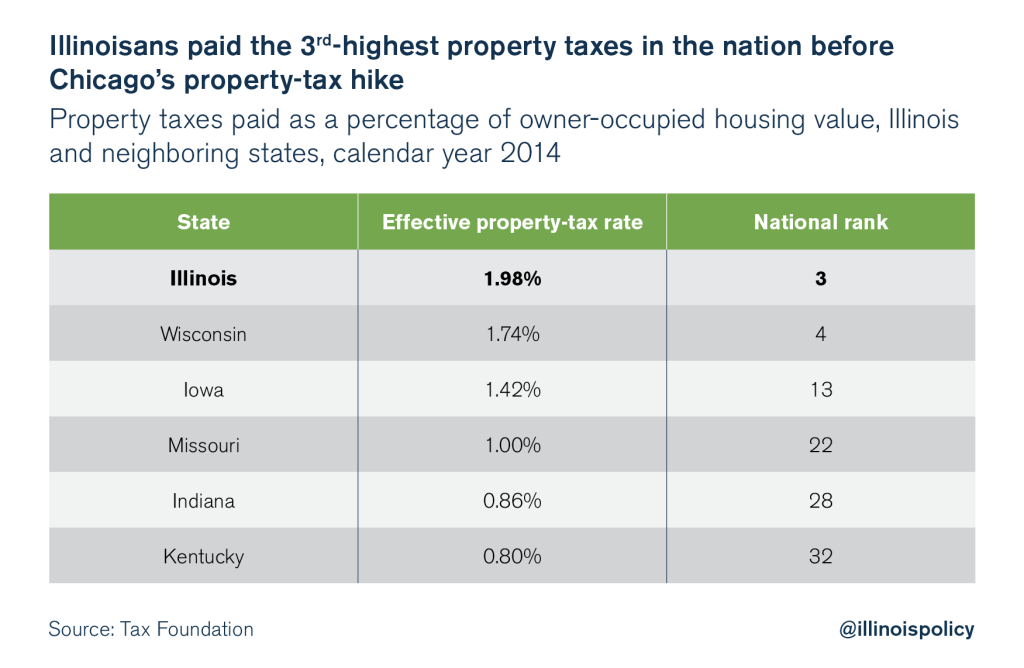

The Tax Foundation’s most recent data, from 2014, found that Illinoisans pay the third-highest property taxes in the nation. Illinoisans bear a lighter property-tax burden than residents of New Jersey and New Hampshire, but they carry a heavier property-tax burden than residents in any of Illinois’ neighboring states.

However, the Tax Foundation has noted that Illinoisans now likely pay the highest property taxes in the nation due to the $543 million property-tax hike Chicago enacted in 2015. On top of that, Chicagoans face the prospect of an additional $250 million tax hike to be imposed by Chicago Public Schools.

A different study released in 2016 by the analytics firm CoreLogic reported that Illinois had the highest median property taxes in the nation in 2015.

Illinoisans pay the 7th-highest combined sales taxes

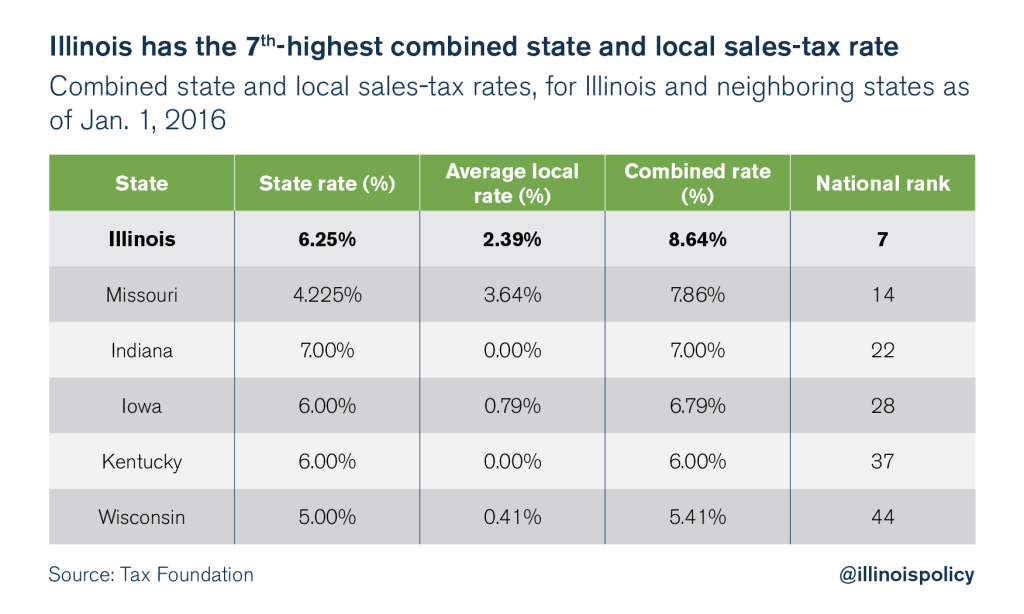

Illinoisans are also subject to the seventh-highest combined state and local sales-tax rates in the nation, far outpacing the rates of neighboring states.

Such high rates can hurt Illinois’ revenue collections, particularly in areas near the state’s borders. Every sales transaction an Illinois resident makes in Wisconsin, Missouri or Indiana is one less revenue opportunity for the state of Illinois.

Illinois’ individual and corporate state income-tax collections are among the highest in the country

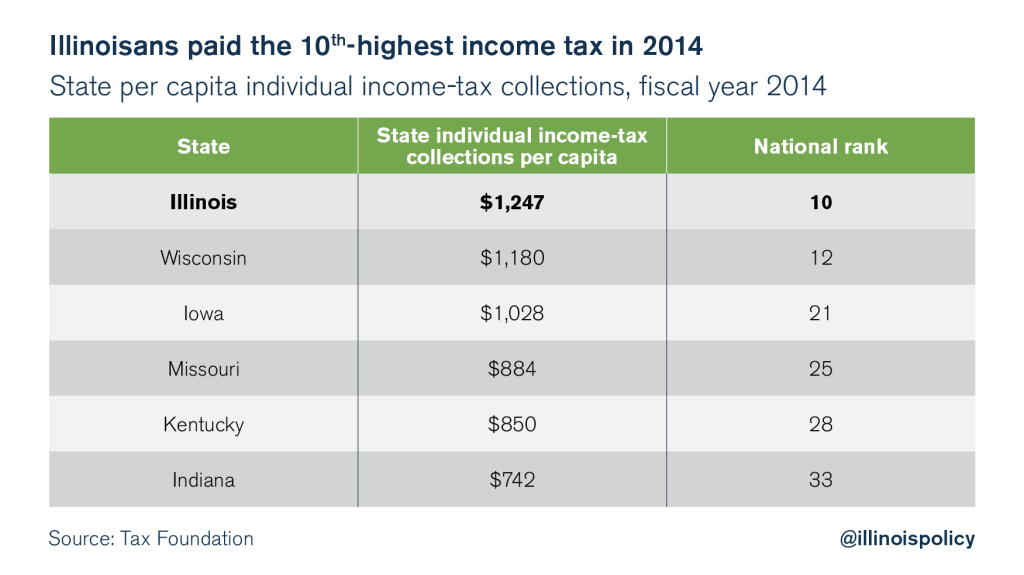

According to the most recent data from the Tax Foundation, Illinois had the 10th-highest individual income taxes in the nation in 2014. The state collected over $1,200 in income taxes per Illinoisan, far more than neighboring states collected. The average Illinoisan paid over $1,200 in income taxes, far more than residents in any neighboring states.

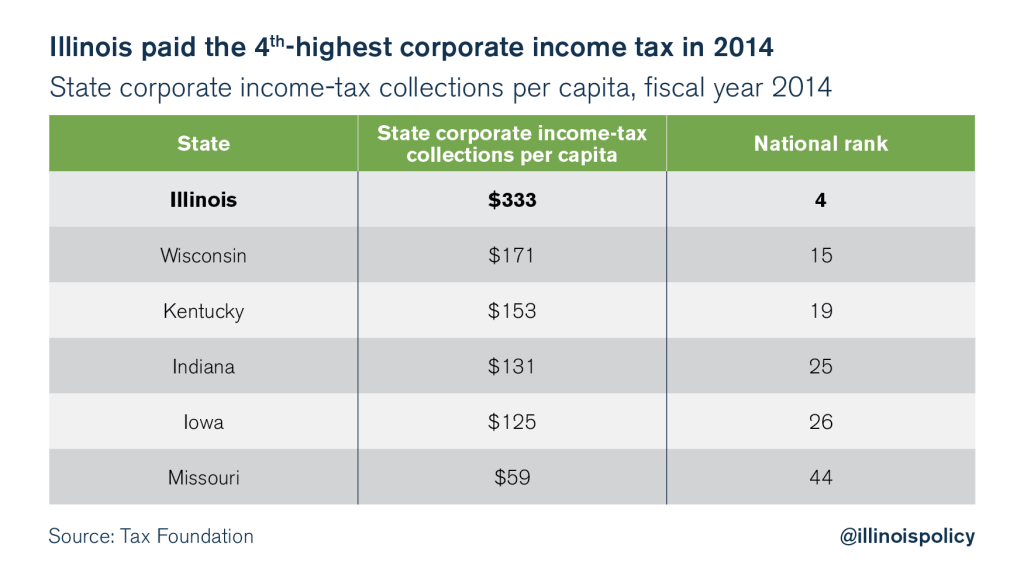

The state’s corporate income tax was even higher, ranking fourth in the nation behind only Alaska, New Hampshire and North Dakota. No neighboring states’ corporate income-tax collections came close to matching Illinois’. Wisconsin’s per capita corporate income-tax collections came in at a little more than half Illinois’ collections.

These rankings do not take into account the partial sunset of Illinois’ individual and corporate income-tax hike in 2015.

However, Illinois’ rank prior to the full implementation of the tax hikes can serve as a proxy for Illinoisans’ current income-tax burden.

In fiscal year 2011, Illinois’ individual income-tax collections equaled $873, the 22nd-highest in the country. So even before the tax hike, Illinoisans’ individual income-tax burden ranked in the top half of all states.

Illinois’ corporate income-tax collections per capita were also relatively high before the tax hike, ranking 17th-highest in the nation in fiscal year 2011.

Having only partially sunset, Illinois individual and corporate income-tax rankings now lie somewhere in between their 2011 and 2014 levels.

Chicagoans pay some of the highest taxes of any city in the nation

Residents of the city of Chicago – who make up a fifth of Illinois’ total population – are stuck with a particularly massive tax burden. They pay state taxes, which are some of the highest in the nation. On top of that, they also pay local city taxes, which are higher than the taxes residents pay in most other major Illinois cities.

In all, the city of Chicago subjects Chicagoans to over 30 individual taxes and a multitude of fees – far more than any other major Illinois municipality.

Several of Chicago’s biggest taxes also rank quite high in comparison with other cities across the country.

Chicagoans pay the highest combined sales taxes of any major U.S. city

According to the Tax Foundation, Chicago has the highest combined state and local sales-tax rate of any major city in the nation. That’s due to a 1 percent sales-tax increase Cook County enacted in 2015.

Chicagoans pay some of the highest property taxes of any major U.S. city

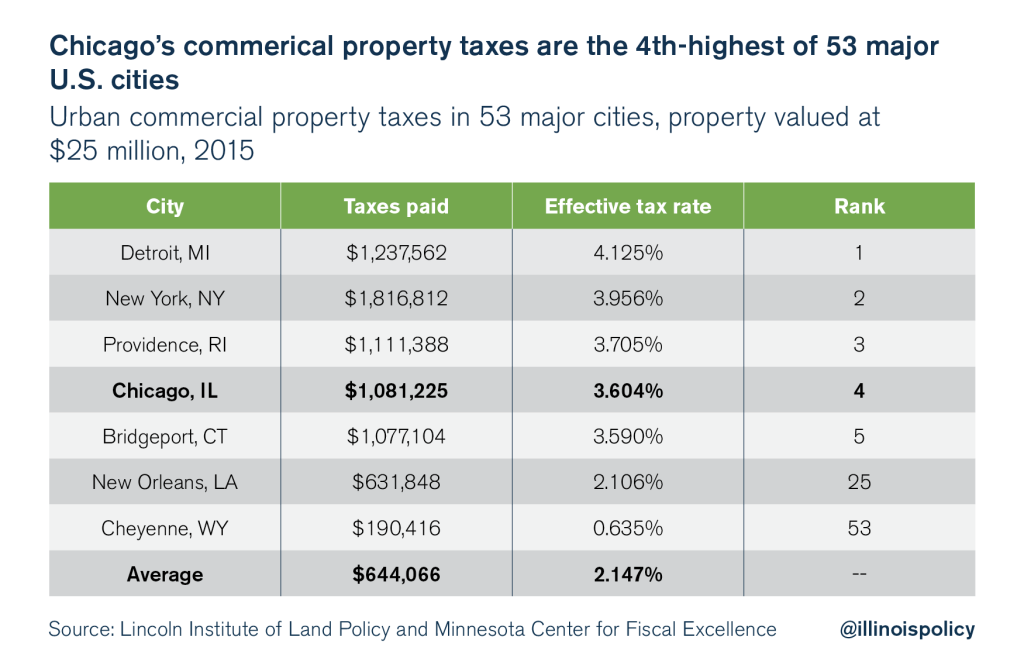

According to a 2016 report by the Lincoln Institute of Land Policy and the Minnesota Center for Fiscal Excellence, the city of Chicago has the fourth-highest effective property-tax rate on commercial properties when compared with the largest U.S. cities.

Such high rates are extremely unattractive for new and pre-existing businesses looking to expand their facilities in the Midwest. Chicago is at a severe disadvantage compared with other cities when large firms and startups are considering property purchases.

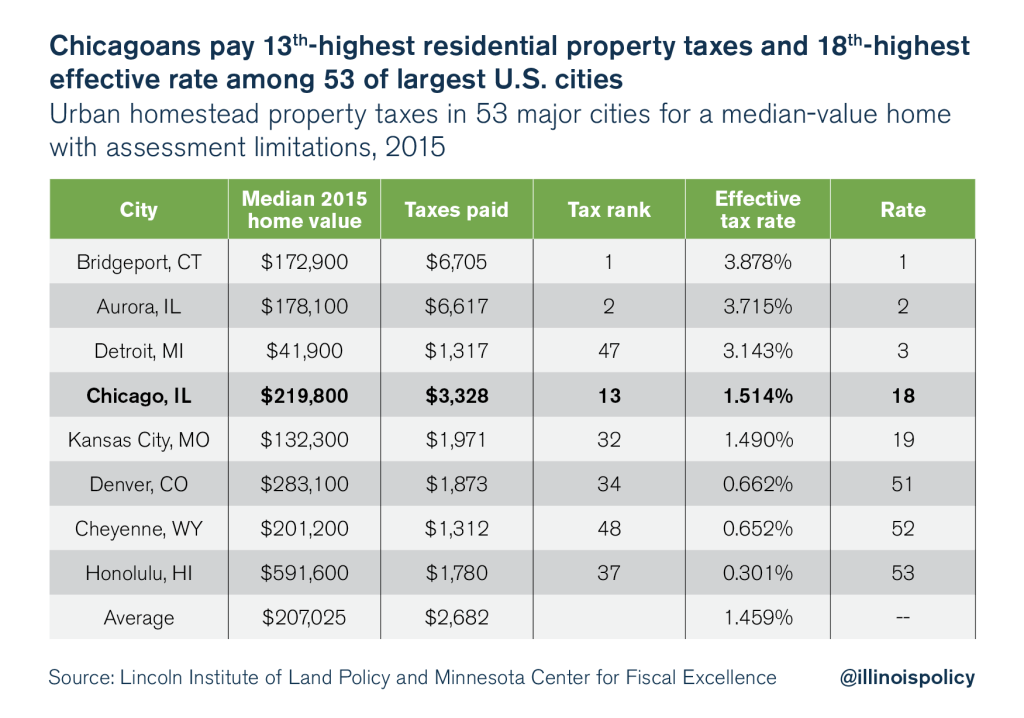

In addition to high property taxes for commercial buildings, Chicagoans also pay high residential property taxes. Chicago ranks 13th in taxes paid based on median property value and 18th in effective tax rates when compared with 53 of the largest U.S. cities.

Conclusion

Illinois is a high-tax state, and Illinoisans already pay more in taxes than residents of most other states. But that hasn’t stopped tax-hike proponents from pushing additional tax hikes. Higher gas taxes, a millionaire tax, a progressive income tax, a return to the personal and corporate income taxes’ pre-sunset rates – all have been proposed by lawmakers in 2015 and 2016 as a solution to the state’s budget crisis and mounting deficit.

Fortunately, none of those recent tax-hike proposals have come to pass. Illinoisans cannot afford the hits to their personal finances and the drag on the state’s economy those taxes would cause.

Illinois doesn’t need more taxes. It needs comprehensive spending and pension reforms at the state and local levels.

Illinois lawmakers must bring down the cost of government to a level Illinoisans can afford, not increase an already unaffordable burden.

Necessary reforms at both the state and local levels include:

- Freezing local property taxes while granting local governments more control over their own collective bargaining agreements

- Moving new state workers to 401(k)-style retirement plans and other commonsense pension reforms, as well as passing a constitutional amendment allowing Illinois to change unearned pension benefits going forward

- Making local school districts and public universities bear the pension costs of their own employees going forward

- Requiring all local school district employees to make contributions toward their own pensions by ending teacher pension “pickups” as an employee benefit

- Eliminating the state’s broken education funding formula and creating a money-follows-the- student model in its place

- Requiring state universities and community colleges to enact spending reforms to eliminate bloated administrative staff and lower the cost of tuition

Until these and other major reforms are signed into law, Illinois lawmakers shouldn’t ask taxpayers for another penny.