A little-known Illinois law imposes rules that have unfair effects on nonunion construction workers. By requiring contractors to pay workers – usually union workers – higher-than-market wages for public sector projects, the prevailing wage law reduces job opportunities in the construction sector. But research suggests repealing the law would bring about greater equality and thousands of additional jobs for Illinois construction workers.

This law is called the Prevailing Wage Act. And it sets the wages employers have to pay workers on public construction jobs at close to union rates. Illinois’ prevailing wage rates are inflated nearly 40 percent higher than average wages for private jobs in the same area. For example, the average carpenter in Cook County makes $31.04 per hour in wages, according to Bureau of Labor Statistics data. But Illinois’ prevailing wage law mandates a wage of $43.35 per hour for carpenters in Cook County on public construction projects.

The prevailing wage mandate effectively removes labor wages and benefits from the competitive bidding process on public works projects. The fact that U.S. prevailing wage laws give an unfair advantage to a majority-white union membership has led some experts to note that the laws’ history has roots in racial discrimination. The Davis-Bacon Act – the federal prevailing wage law implemented during the Great Depression – served to protect unionized, predominantly white workers from losing work to nonunionized, predominantly black workers on federal public works projects. Many states, including Illinois, followed suit by enacting their own prevailing wage laws to further insulate unions from competition.

This report highlights the history of prevailing wage laws as well as previous empirical work on this topic. In addition, the report uses the Current Population Survey to estimate the employment effects of a wave of policy changes – repealing the law – that took place in the 1980s. The goal of this report is to inform the debate on the potential impact of repealing prevailing wage laws that exist in most states.

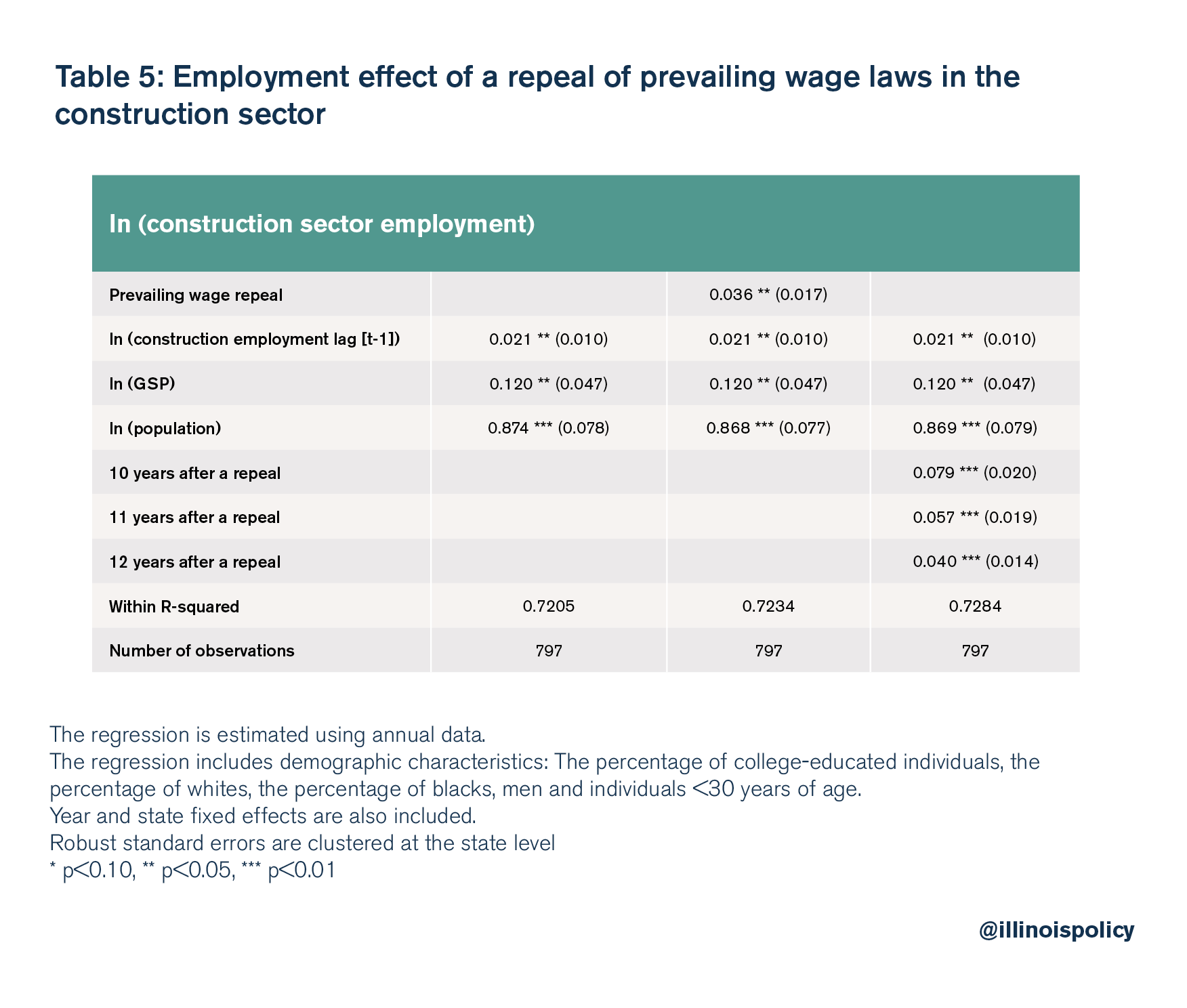

The consensus among economists is that in states that have repealed their prevailing wage laws, the wage gap between black and nonblack construction workers narrowed and average construction sector wages decreased. However, none of the economics literature investigates the effects of prevailing wage laws on employment in the construction sector. This report provides empirical evidence that a repeal was associated with a 7.9 percent increase in construction sector employment in states that repealed their prevailing wage laws. Given employment in the construction sector in 2015, repealing the law would have created more than 14,000 construction jobs in Illinois if the law had been repealed a decade earlier.

Illinois policymakers should repeal the state’s prevailing wage law. In a state with the region’s weakest growth in construction jobs, a repeal would remove barriers to entry into the construction industry and stimulate construction sector employment. Eight states that previously repealed their prevailing wage laws saw a decline in the union construction wage premium, a reduction in the wage gap between black and white workers, and an increase in employment.

If Illinois policymakers choose not to eliminate state-mandated prevailing wages, they should at least adopt the Vermont model, which ties the prevailing wage to local averages reported by the Bureau of Labor Statistics. This would help ensure that prevailing wage rates remain in line with market averages rather than being inflated upward to the advantage of a select group of construction workers.

Illinois’ Prevailing Wage Act has no place in the 21st century. Policymakers should enact fair and competitive construction laws that give all individuals who are willing to work a fighting chance.

Introduction

Illinois’ prevailing wage law sets wages for work on government projects for workers such as carpenters, electricians and operating engineers, based largely on union rates, which are much higher than the wages many nonunion workers charge. The rates vary by county. For example, the prevailing wage rate for a laborer in Cook County is $38, as compared with a prevailing wage rate of $26.03 for a laborer in Jackson County.

Research from states that repealed the prevailing wage in the 1980s suggests that union workers are paid higher wages in states with a prevailing wage, resulting in higher inequality between union and nonunion workers. Prevailing wage repeal is associated with a reduction in the artificially high union wage premium, and a reduction in the wage gap between black and white construction workers. This is because black construction workers are less likely to be union members than white construction workers.

Illinois’ prevailing wage is like a minimum wage for public construction work. However, data from the federal Bureau of Labor Statistics, or BLS, reveal that Illinois’ prevailing wage rates are nearly 40 percent above the average wage rates for the same work in the same area.

Arguments in support of prevailing wage laws often claim that prevailing wage regulations foster higher quality work at the same cost due to higher productivity. In labor economics, this is often referred to as the efficiency wage hypothesis. The efficiency wage hypothesis argues that wages, at least in some markets, form in a way that is not market-clearing. Specifically, it points to the incentive for managers to pay their employees more than the market wage in order to increase their productivity or efficiency, or reduce costs associated with turnover in industries where the costs of replacing labor are high. This increased labor productivity and/or decreased costs compensate for the higher wages.

However, if the higher wage rates resulted in labor efficiency gains, then private industry would abandon the construction market average wage to broadly adopt the government-imposed higher prevailing wage rates. What proponents of these types of government interventions conveniently omit is that efficiency wages also lead to job-rationing. This job-rationing effect is perhaps an explanation for why union representation has decreased in the construction trades.

This report finds empirical evidence of this job-rationing effect. Using the Current Population Survey for 1980-2000, this report provides empirical evidence that a repeal was associated with a 7.9 percent increase in construction sector employment in states that repealed their prevailing wage laws.

The prevailing wage law is an outdated peculiarity whereby Illinois’ government intervenes in the marketplace to give a greater advantage to a subset of highly paid construction workers. However, this additional labor cost has a negative effect on construction sector employment.

Although the eight states that repealed their prevailing wage laws in the 1980s had considerably smaller economies, they showed gains in construction employment relative to large states that never repealed their laws. A prevailing wage repeal creates a fairer, more inclusive and more flexible construction labor market.

How to read this study

This study first lays out the history of prevailing wage laws at the federal level, in the various states and in Illinois.

Next, this study presents data providing evidence that prevailing wage rates are higher than average private sector wages in construction labor markets.

Finally, this study investigates empirically the impact of a prevailing wage repeal on construction sector employment. The results should be used to guide the debate regarding the potential effects of a repeal on employment in Illinois.

Davis-Bacon: The federal prevailing wage law

The federal version of prevailing wage law is known as the Davis-Bacon Act. It was enacted at the beginning of the Great Depression in 1931 and applies to federal construction projects in excess of $2,000.

The law dictates that contractors and subcontractors working on federally funded or assisted contracts in excess of $2,000 must pay their laborers and mechanics employed under the contract no less than the locally prevailing wages and fringe benefits, as determined by the Department of Labor, for corresponding work on similar projects in the area.1

Davis-Bacon wage rates are determined by a Department of Labor survey of unions, other laborers and construction companies in a given geographic area.

A history of racism

David E. Bernstein of the Cato Institute argued that lawmakers passed the Davis-Bacon Act in 1931 to benefit white union workers over black nonunion workers. Bernstein explained that the Davis-Bacon Act was “designed explicitly to keep black construction workers from working on Depression-era public works projects,” and that it continues to favor disproportionately white, skilled and unionized workers.2

Rep. Robert Bacon of Long Island originally drafted the antecedent of the Davis-Bacon Act in 1927 after seeing an Alabama contractor win a bid to build a hospital in Long Island with a crew of black workers. Bacon notably opposed immigration because he believed in maintaining the nation’s “racial status quo.”3

Rep. William Upshaw from Georgia immediately recognized the racial intent of Bacon’s proposal, and commented about Bacon’s “reaction to that real problem you are confronted with in any community with a superabundance or large aggregation of negro [sic] labor.”4 Rep. John Cochran of Missouri, a supporter of Bacon’s proposal, noted that he had “received numerous complaints in recent months about southern contractors employing low-paid colored mechanics … from the South.”5 Rep. Miles Clayton Allgood supported the bill and complained of “cheap colored labor” that was “in competition with white labor throughout the country.”6 Other representatives and senators made similar but less direct statements about the racial purpose of the legislation.

The act institutionalized a number of barriers to nonunionized, black workers on public works projects in the following ways:

- By the 1930s, most major unions that represented skilled construction workers completely excluded blacks from their ranks.

- Blacks faced discrimination in vocational education and occupational licensure, restricting them from joining skilled unions and accessing public construction jobs.

- Despite restrictions, black laborers performed most of the low-skilled construction work in the South and began migrating north, where they gained a foothold in construction work proportionate to their population in urban areas.

- As a reaction to this labor competition, construction unions backed the Davis-Bacon Act, which helped destroy the black foothold in construction work in both the South and the North.

In the 86 years since Davis-Bacon was enacted, skilled trades unions have often barred blacks from entering their unions altogether or otherwise thwarted efforts to allow more opportunities for minority workers. During the Depression era, half of all money spent on construction projects was administered by the federal government and had to comply with the Davis-Bacon Act, meaning that almost all the jobs from Great Depression spending on public works went to whites.

Defense construction projects during World War II were subject to “stabilization agreements” that preserved the status quo of white unions dominating public construction work. By the late 1950s, the percentage of skilled black workers declined significantly due to exclusion from public construction work. Well into the 1960s, unions for electrical workers, operating engineers, plumbers, plasterers and sheet metal workers still excluded black workers. And unions held work stoppages to prevent blacks from working on public projects such as the Cleveland Municipal Mall (1966), the U.S. Mint in Philadelphia (1968) and the New York City Terminal Market (1964). A study from the 1968 Equal Employment Opportunity Commission showed that minority employment was much better among contractors who did not work for the government.7

Unskilled workers were only allowed on public projects if they participated in bona fide apprenticeship programs, which hurt black workers because unions continued to discriminate in their apprenticeship programs.8

By 1979, the comptroller general of the United States wrote “Davis-Bacon wage requirements discourage nonunion contractors from bidding on Federal construction work, thus harming minority and young workers who are more likely to work in the nonunionized sector of the construction industry.”9

Few minorities made it through to become union journeymen, and union apprenticeship programs imposed arbitrary education requirements, which kept out disadvantaged workers. The comptroller’s report concluded that Davis-Bacon diminished minority employment opportunities, and the report found no evidence that repeal would have any discriminatory effect on women or minorities.10

Herbert Hill, the former labor director for the NAACP, noted that racial exclusion in the building trades remained largely intact through the 1980s, the last time any reforms were attempted regarding the Davis-Bacon Act.11

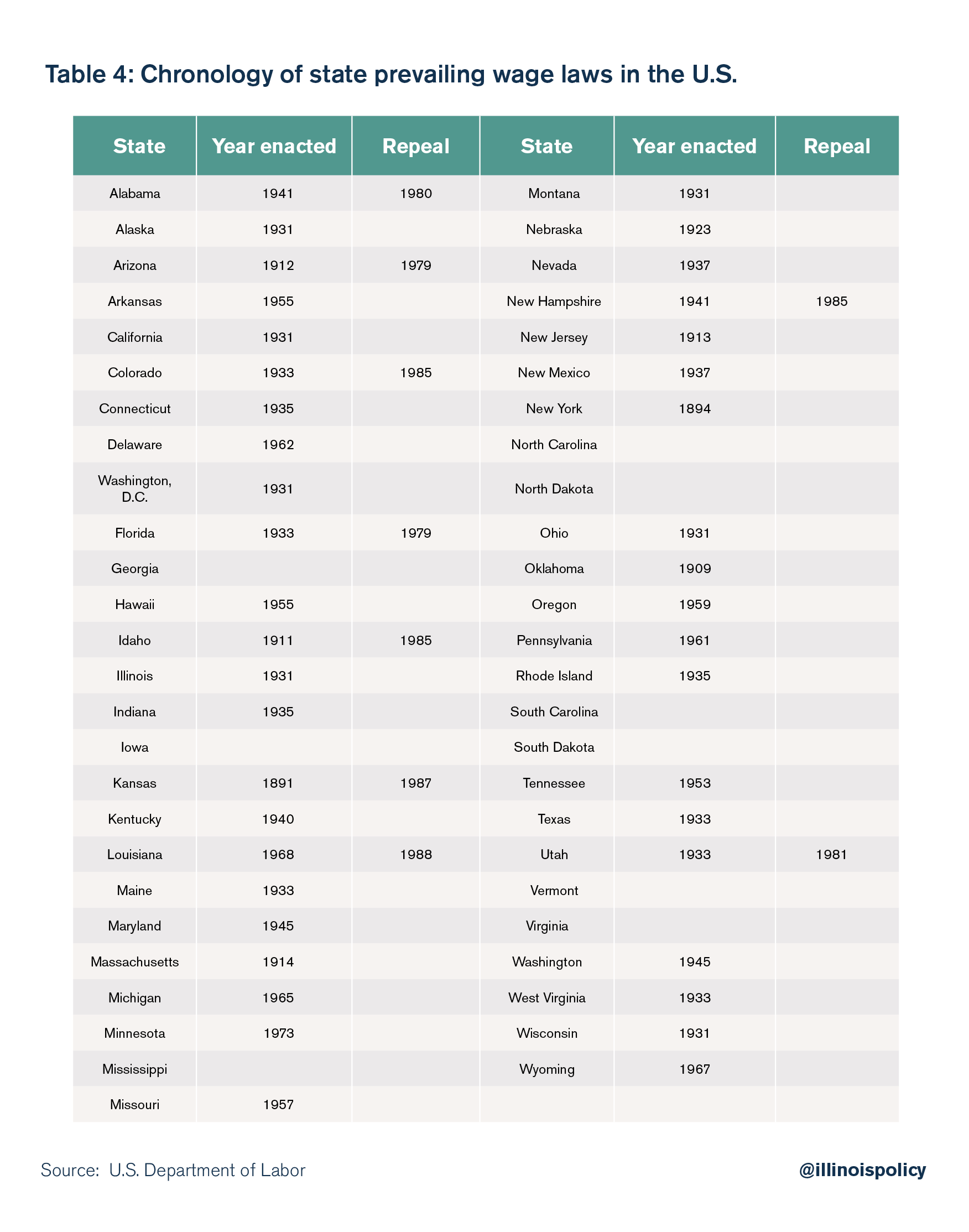

The “Little Davis-Bacon Acts”: Prevailing wage laws in the states

The federal Davis-Bacon Act governs construction projects that receive funding from the federal government. The majority of states, including Illinois, enacted their own versions of prevailing wage laws to govern state and locally funded public works. These state prevailing wage laws were based on the same principles as the Davis-Bacon Act and are sometimes referred to as “Little Davis-Bacon Acts.”

State prevailing wage laws broadly follow the pattern of the federal Davis-Bacon Act, which became law in 1931 as a Depression-era measure under President Herbert Hoover. The purpose of the Davis-Bacon Act was to protect labor from cost-saving measures that are a part of competitive bidding, and state prevailing wage laws have the same outcome.

Twenty-one states do not have prevailing wage laws. A number of states repealed their prevailing wage laws in the 1980s. Illinois’ neighbor Indiana repealed its prevailing wage law in 2015, Kentucky followed suit in January 2017, and Wisconsin repealed its prevailing wage law for local projects effective in 2017.

Illinois’ Prevailing Wage Act

Illinois’ Prevailing Wage Act became law in 194112 and governs the wages that a contractor or subcontractor is required to pay to workers on public works projects.13 There is no threshold for contract size, meaning the prevailing wage requirements apply regardless of the size of the contract.14

Illinois’ Prevailing Wage Act governs the wage requirements and record-keeping requirements for contractors and subcontractors. It also sets forth the obligations of municipalities and other public bodies. It’s worth noting that the law raises taxpayer costs in all of these ways – with wage mandates, compliance and reporting mandates, and government administration.

Below is a summary of the key parts of Illinois’ law.15 The parts of the law that drive up taxpayer costs have been emphasized:

- The law defines “general prevailing rate of hourly wages,” “general prevailing rate of wages” or “prevailing rate of wages” to mean the hourly cash wages plus annualized fringe benefits for training and apprenticeship programs approved by the U.S. Department of Labor, Bureau of Apprenticeship and Training, health and welfare, insurance, vacations and pensions paid generally, in the locality in which the work is being performed, to employees engaged in work of a similar character on public works.

- Illinois’ prevailing wage rates are completely divorced from actual marketplace rates because they apply only to rates paid on public projects. This creates a circular logic in which the prevailing wage rates are determined only by the existing prevailing wage rates, and not by competitive market rates.

- The rate depends on the county in which the work is being performed as well as the occupation classification. The rate of pay for laborers, workers and mechanics employed on public works projects is determined by the prevailing wage as ascertained under the act and is not determined based on the rates paid on nonpublic works. It is not an average or median of rates paid.

- “Locality” means the county where the physical work upon public works is performed, except (1) that if there is not available in the county a sufficient number of competent skilled laborers, workers and mechanics to construct the public works efficiently and properly, “locality” includes any other county nearest the one in which the work or construction is to be performed and from which such persons may be obtained in sufficient numbers to perform the work and (2) that, with respect to contracts for highway work with the Department of Transportation of this state, “locality” may at the discretion of the secretary of the Department of Transportation be construed to include two or more adjacent counties from which workers may be accessible for work on such construction.

- When there is a change in the prevailing wage, the revised rate applies to all projects currently underway as well as future projects. The public body is also responsible for notifying the contractor of the revised rates.

- The failure of a public body to notify a contractor does not relieve a contractor from the responsibility to pay the prevailing wage. If a contractor fails to do so, the contractor is liable for the difference in the amount paid and the prevailing wage rate. However, because a public body has an obligation of notification, the public body and not the contractor will be liable for any interest, penalties and fines the Department of Labor might assess.

- Contractors and subcontractors are required to make and keep for at least three years records pertaining to all workers employed by them on the project, including names, addresses, phone numbers, Social Security numbers, worker classifications, gross and net wages, daily hours worked, workers’ hourly wage rates, workers’ hourly overtime rates, workers’ hourly fringe benefit rates, name and address of each fringe benefit fund, plan sponsor of each fringe benefit, and plan administrator for each fringe benefit. A contractor or subcontractor who remits contributions to fringe benefit funds jointly maintained or governed by multiple employers or multiple labor organizations does not need to keep certified payroll records that include records on fringe benefits.

- Contractors are required to submit certified payroll records to the public body in charge of the project on a monthly basis, by the 15th of the following month in which the work was performed.

- Records are subject to inspection and copying at a location within the state by the director of labor and his or her deputies and agents, as well as other government officials, upon seven business days’ notice.

- Failure to keep records or submit certified payrolls can result in the contractor’s immediate four-year debarment from working on public works projects. Knowingly filing a false certified payroll is a Class A misdemeanor.

- Contractors found to have violated other provisions of the act twice in a five-year period can face debarment from working on public works projects for four years.

- Where a worker transports materials or equipment to or from a public works job site, the time involved is covered by the Prevailing Wage Act. The transportation of such materials or equipment by the sellers or suppliers would not be covered.

- If the Department of Labor finds that a contractor or subcontractor has violated the act, the contractor or subcontractor is liable for the difference between what was paid to the employees and the prevailing wage for all hours worked and owes the Department of Labor a penalty worth 20 percent of the underpayment. In addition the worker is owed 2 percent of the amount of any such penalty for each month during which underpayments remain unpaid. For a second or subsequent violation, the 20 percent penalty increases to 50 percent, and the 2 percent penalty rises to 5 percent.

Calculating prevailing wages

- The public body shall ascertain the general prevailing wage rate in the locality in which the work is to be performed for each craft or type of worker or mechanic needed to execute the contract. The Department of Labor may ascertain the rate if the public body prefers, in which case the public body notifies the Department of Labor to do so.

- Each public body shall, during the month of June of each calendar year, investigate and ascertain the prevailing rate of wages and publicly post or keep available for inspection

by any interested party in the main office of such public body its determination of such prevailing rate of wage and shall promptly file, no later than July 15 of each year, a certified copy thereof in the office of the Illinois Department of Labor. - The Department of Labor shall during the month of June of each calendar year, investigate and ascertain the prevailing rate of wages for each county in the state. If a public body does not do so as required, then the prevailing rate of wages for that public body shall be the rate as determined by the Department of Labor for the county in which such public body is located.

- The public body, except for the Department of Transportation with respect to highway contracts, shall

within 30 days after filing with the Department of Labor, or the Department of Labor shall within 30 days after filing with such public body, publish in a newspaper of general circulation within the area that the determination is effective, a notice of its determination and shall promptly mail a copy of its determination to any employer, and to any association of employers and to any person or association of employees who have fled their names and addresses, requesting copies of any determination stating the particular rates and the particular class of workers whose wages will be affected by such rates. - At any time within 30 days after the Department of Labor has published on its official website a prevailing wage schedule, any person affected thereby may object in writing to the determination or such part thereof as they may deem objectionable by filing a written notice with the public body or Department of Labor, whichever has made such determination, stating the specified grounds of the objection.

A review of the economics literature: Theory and evidence

In order for a prevailing wage law to have an impact on economic outcomes, there must exist a wage differential between the prevailing wage and the competitive market wage. When the prevailing wage regulation imposes a wage that is equal to the competitive wage, then the prevailing wage law has no impact on economic outcomes. As a result, the first step in determining whether the prevailing wage law has an impact on economic outcomes is to establish the presence of a wage premium for prevailing wage construction projects. This procedure consists in establishing whether wages are higher on prevailing wage contracts for workers with identical observable characteristics.

Arguments in support of prevailing wage laws often claim that prevailing wage regulations foster higher-quality work at the same cost due to higher productivity. In labor economics, this is often referred to as the efficiency wage hypothesis. The efficiency wage hypothesis argues that wages, at least in some markets, form in a way that is not market-clearing. Specifically, it points to the incentive for managers to pay their employees more than the market wage in order to increase their productivity or efficiency, or reduce costs associated with turnover in industries where the costs of replacing labor are high. This increased labor productivity and/or decreased costs compensate for the higher wages.

There is evidence to suggest that higher wages can boost productivity for workers who are employed, but many advocates conveniently omit that there is also substantial evidence that “efficiency wages” lead to increases in unemployment.

The classic example of efficiency wages is the policy enacted by Henry Ford at the Ford Motor Company in 1914, known as the “five dollar day.” As Raff and Summers (1987) allude, after this policy was enacted, productivity and profitability at Ford increased. However, as the study also admits, after the enactment of this policy, the company slowed hiring despite long queues of applicants for Ford jobs, and the number of persons receiving unemployment relief in the county where the Ford factory was located increased by two-thirds due to increased levels of unemployment.16 The authors also admit that there is debate about how much of this increase in productivity was due to technological and production process advancement and not to higher wages.

Furthermore, when examining more recent Current Population Survey, or CPS, data, Krueger and Summers (1988) highlight that efficiency wages can result in reduced turnover and better performance, but that these wages will also create higher levels of involuntary unemployment due to the pricing out of less-skilled workers.17 Lastly, Stiglitz (1984) finds that the presence of efficiency wages can help explain why women and minorities are more likely to be unemployed.18 These findings suggest that prevailing wage laws contribute to higher unemployment and more inequality.

Other advocates of prevailing wage laws also argue that firms will invest in labor-saving technologies to offset higher labor costs (Philips, 1996).19 Evidence that prevailing wage contracts tend to employ union workers raises doubt about the hypothesis that these contracts result in higher investments in technologies that make workers on construction sites more productive. Hirsch (2008) finds that higher union wages discourage firm-level investments.20 In addition, the high cost of negotiating changes in working conditions leads to lower worker efficiency since union contracts are slower to adjust to economic conditions.

Some proponents of the policy claim that in most cases, the wage set by the regulation is either below or at market wage. If this were the case, the regulation would be unnecessary to begin with. While it is true that in a handful of states, the prevailing wage laws are nonbinding – because the wage is set at the market wage – no state has a prevailing wage set below the local market wage.

Using data from all 50 states, Kessler and Katz (2001) find that a repeal of prevailing wage regulation caused wages of construction workers to decrease in states that repealed their laws.21 For example, the long-run union wage premium fell by approximately 10 percentage points, which equated to nearly half of the union wage premium over the market wage premium. This finding is consistent with Gujarati (1967), which used data on prevailing wages across 300 metropolitan and nonmetropolitan counties from 1960 and 1961 to find that prevailing wages are often set as the union wage for occupations in the construction industry.22 The negative effect of a repeal on construction sector average wages provides strong support for the existence of inflated wages imposed on construction contracts by prevailing wage laws. In addition, the law repeal has differential effects across groups of construction workers: union versus nonunion, and black versus nonblack workers.

Another study by Jeffrey Petersen, formerly of the United States Government Accountability Office, found that prevailing wage law repeals result in 15 percent reduction in wages and 53 percent reduction in fringe benefits in states that repealed compared with ones that did not.23

Petersen found that prevailing wage laws inflated fringe benefits more than wages, and upon repeal, the union premium for fringe benefits fell most dramatically while overall compensation shifted from benefits to wages. The largest component of benefits that is inflated by prevailing wage laws is the pension benefit. Petersen reached his conclusions through a regression analysis comparing the states that repealed their prevailing wage laws in the 1980s with those that kept their prevailing wage laws and those that never had prevailing wage laws.

As for the safety concerns that motivate imposing heavy regulations for government construction contracts, A.J. Thieblot examined the repeal of state prevailing wage laws and used data from the Occupational Safety and Health Administration to show that repeal did not result in an increased accident rate.24

Although it seems logical that a decline in wages would lower construction costs, studies that attempt to estimate the effect of prevailing wage laws on construction costs have come under heavy criticism. This is because in some cases the savings are passed on to taxpayers, while in other cases the savings may just result in higher profits for contractors.

Many prevailing wage advocates have argued that labor costs are not the dominant costs in government construction contracts. Even including benefits and payroll tax es, labor costs are roughly 20 to 30 percent of construction contracts (Phillips 1998).25 Thus, for example, if labor costs are 25 percent of total costs and prevailing wage rules raise wages by 10 percent, the impact on contract costs would be no more than 2.5 percent. Thus, they argue that even if there is an increase in contract costs, it is likely to be small. However, prevailing wage rules raise wages by 37 percent in Illinois, suggesting higher costs for public sector construction projects, which, at least in theory, have an impact on economic outcomes.

The empirical literature is still divided on the impact of prevailing wage rates on construction costs (see, Fraundorf et al., 1984; Prus, 1996; Phillips, 1998; Prus, 1999; Dunn et al. 2005).26,27,28,29,30 For that reason, this analysis does not highlight the potential taxpayer savings implied by a reduction in construction costs. Instead, this report focuses on the impact of prevailing wage laws on employment outcomes in the construction industry.

Illinois construction workers earn high pay, but only if they can find a job

Government is by far the largest marginal buyer of construction services in the marketplace. Government spending accounts for more than 23 percent of total construction spending, according to May 2017 U.S. Census Bureau data. Combined state and local governments spend about 10 times more on construction than the federal government spends as of May 2017.31

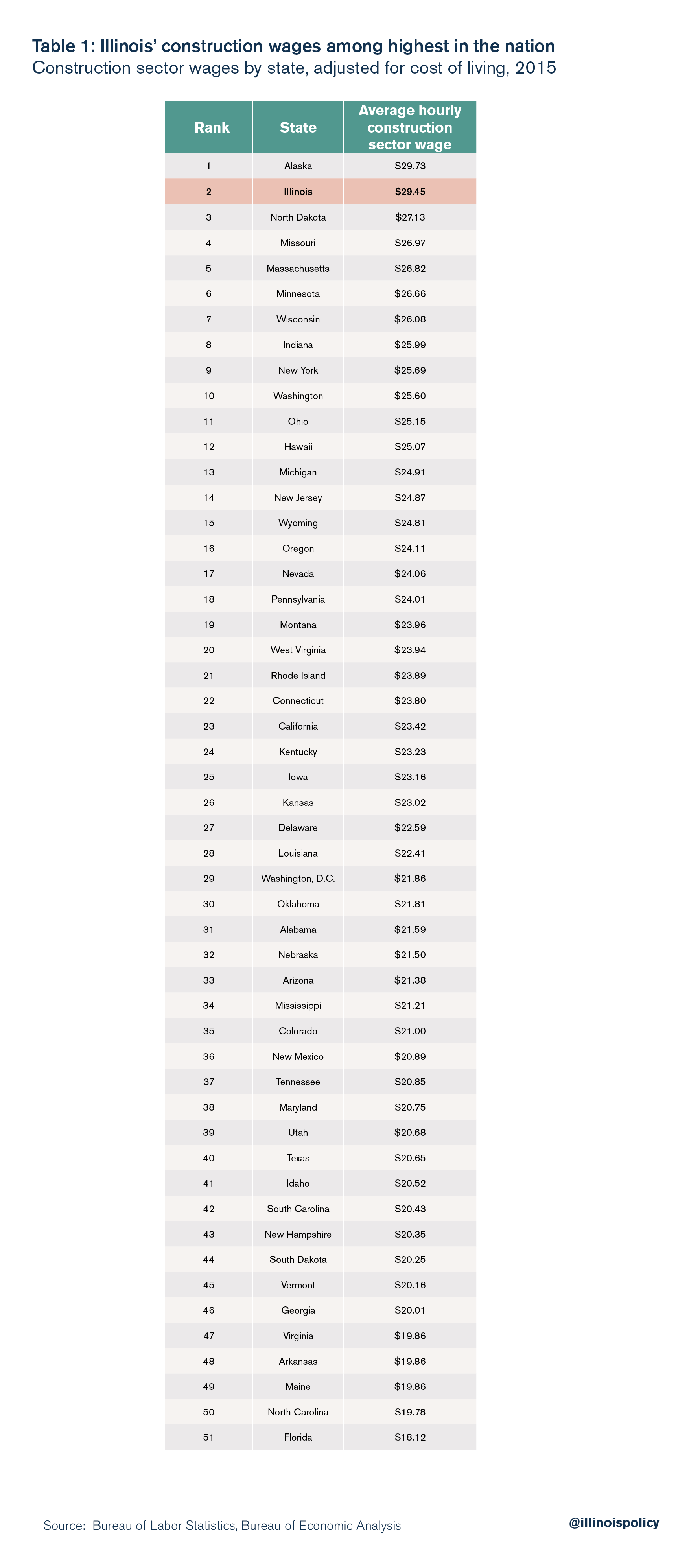

Illinois’ high construction spending and prevailing wage law drive up the market for construction wages and benefits to the point where Illinois has the second-highest average construction work wage in the country, behind only Alaska, after adjusting for the cost of living in each state.32 This is initially peculiar for Illinois given its weak overall economy, shrinking population33 and large construction job losses over the last decade.34

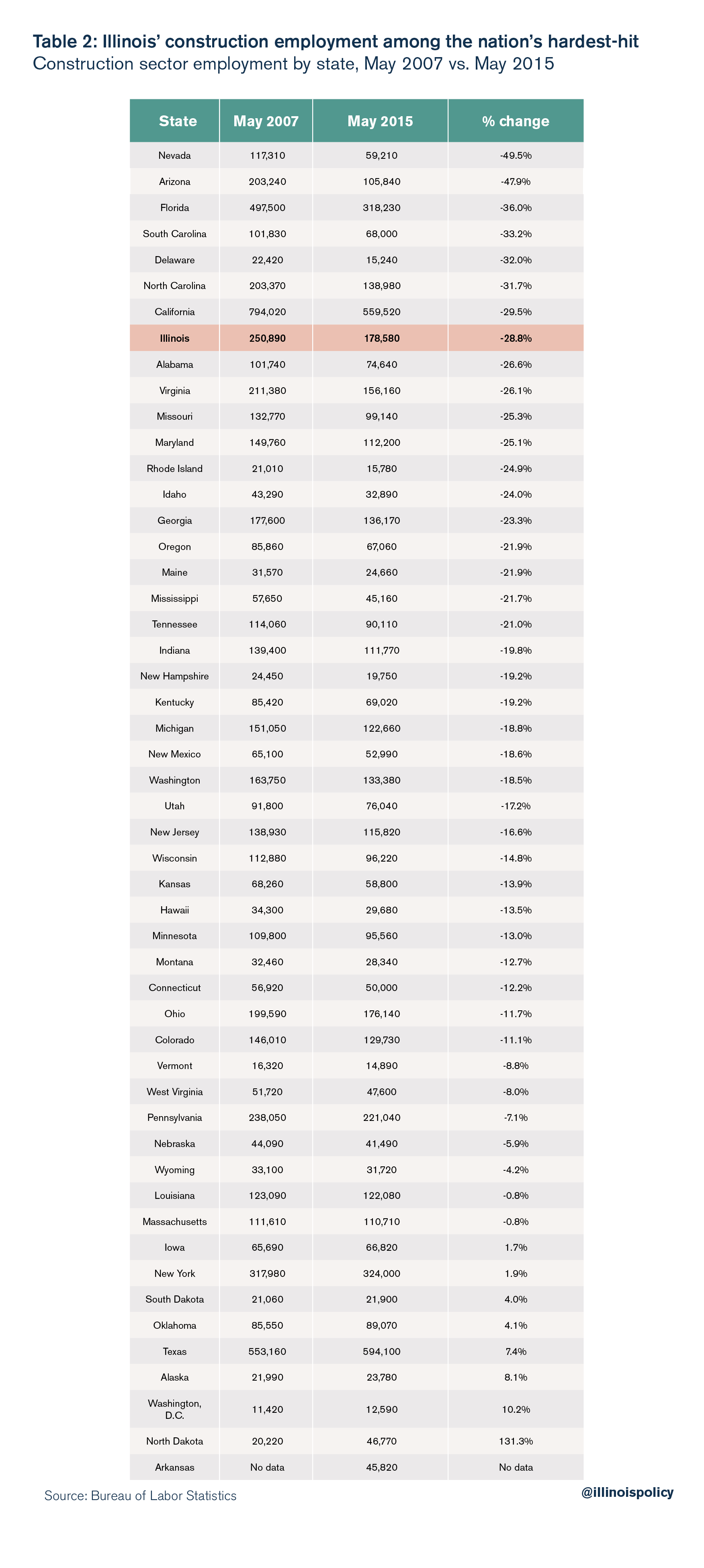

Illinois’ housing sector has been incredibly weak over the last decade, and demand for construction labor has not recovered from the Great Recession. Illinois’ total construction jobs were still down by 28.8 percent in the post-recession era – the eighth-worst in the country – as of May 2015.35 It is counterintuitive for wages to be so high given weakness in Illinois’ construction sector relative to other states.

Illinois’ prevailing wage rates are 37% above market rates

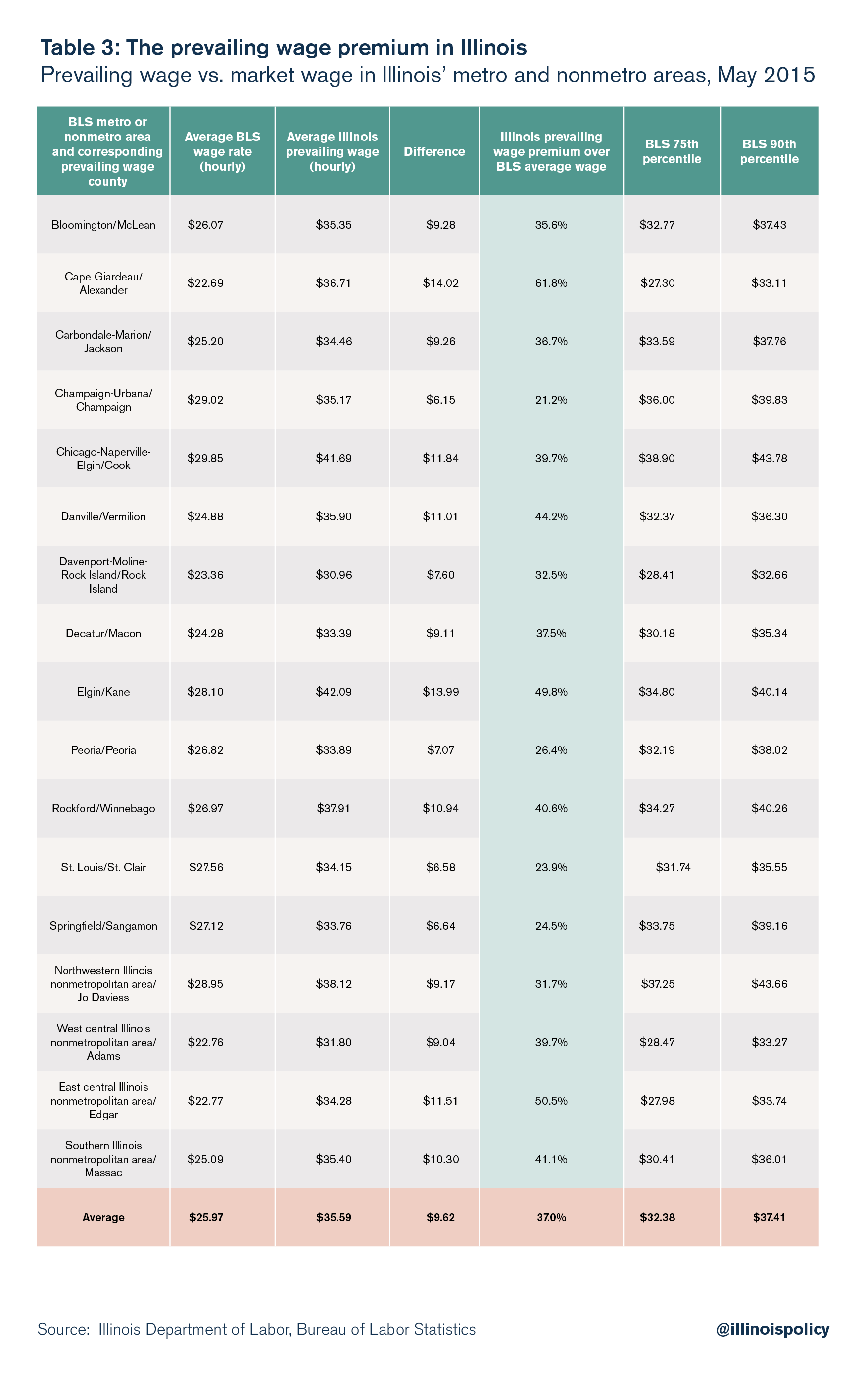

Illinois’ prevailing wage rates are approximately 37 percent higher than average market wage rates, based on a comparison between prevailing wage rates36 and average wage rates compiled by the Bureau of Labor Statistics’ Occupational Employment Statistics, or OES.

The OES data are collected from more than 1.2 million business establishments covering over 800 occupations, which are classified by job classification and industry. The data are gathered on a semiannual basis, and provide estimates of the average (mean) wage, 10th percentile wage, 25th percentile wage, 50th percentile (median) wage, 75th percentile wage and 90th percentile wage for various occupations in different geographical areas. The OES wage data do not include fringe benefits.37

The OES data include wage information for construction occupations in 13 Illinois metro areas and four Illinois nonmetro areas. This allows for a comparison between the OES wage rates and the county-level prevailing wage rates imposed by Illinois’ prevailing wage law. Illinois’ prevailing wage rates commonly hover above the BLS’ 75th percentile wage rate, and are sometimes above the 90th percentile wage rate.

Empirical analysis: Estimating the employment impact of the prevailing wage

The analysis consists of using state-level regressions to estimate the impact of repealing the prevailing wage on construction sector employment. The analysis employs data from 1980-2000 on the number of working-age (25 to 59 years old) individuals employed during each year for all states that had a prevailing wage law before 1980. The state-level construction employment data were constructed using the full yearly samples on employment status and industry variables from the Current Population Survey, or CPS, as compiled in the Integrated Public Use Microdata Series, or IPUMS, database. State demographic data, which were used to control for age, race, gender and schooling attainment, were also taken from the CPS. The microdata can be aggregated to allow for the control of changes in workforce composition in a state-level regression. The analysis also employs gross state product and population data from the Bureau of Economic Analysis. IPUMS

CPS harmonizes microdata from the monthly U.S. labor force survey and the CPS, covering the period 1962 to 2016.

The empirical analysis includes lagged employment to control for cyclical factors. The analysis also takes into account fixed differences across states, as well as time, varying factors that affect construction employment. For example, if states that repeal their prevailing wage laws also have unobserved fixed differences in policies that lead to higher construction employment, then the estimated effect of the laws might represent in part unobserved fixed differences across states, leading to the overstatement of the impact of prevailing wage law repeal. Along these lines, if a state repeals its prevailing wage laws in response to weak economic performance, then the estimated absolute effect of the repeal might represent in part the effect of unmeasured weak economic output in a given year.

The regression specification tests the relationship between prevailing wage laws and construction employment. Let Yi,t denote the dependent variable in state i and in year t.

Yi,t=β0+β1Ri,t+β2Yi,t-1+β3Xi,t+β4GSPi,t+β5Ni,t+statei+yrt+ϵi,t

In Illinois, a 7.9 percent increase in construction sector employment would translate to more than 14,000 construction-sector jobs created in 2015 if the prevailing wage laws had been repealed a decade earlier.

Conclusion: Options for reform

The most obvious reform option is to repeal the prevailing wage law completely to remove unfair barriers to entry and to stimulate a weak construction sector.

The harm the prevailing wage law inflicts on Illinois’ construction labor market would likely take some time to repair. Full repeal is advisable as soon as possible so that flexible competitive markets, relaxed labor restrictions and competitive bidding can stimulate growth in Illinois’ construction sector.

If prevailing wage rates must persist, Illinois should adopt the Vermont model,38 which simply captures the wage averages reported by the BLS’ OES, and uses those as the prevailing wage rates with 42.5 percent added for fringe benefits. BLS data provide market average wage rates, although they are likely biased upward due to influence from the current prevailing wage law.

The best option for Illinois lawmakers to pursue is full repeal to allow for a fairer and more competitive labor market for construction. A repeal will reduce the wage disparities between union and nonunion workers and will reduce racial wage disparities. Lastly, a repeal will stimulate the construction sector, providing new employment opportunities.

Lawmakers should stand on the side of fairness by enacting policies that lead to equality of opportunity for all workers. That means repealing the prevailing wage law. Public policy should never choose winners and losers in the marketplace. Illinois should update its laws for the 21st century and scrap its outdated prevailing wage law.

Endnotes

- United States Department of Labor, Wage and Hour Division, “Davis-Bacon and Related Acts.”

- Bernstein, David E., Cato Institute Briefing Paper No. 17: The Davis-Bacon Act: Let’s Bring Jim Crow to an End, (Cato Institute, January 18, 1993).

- Frantz, John, Davis-Bacon: Jim Crow’s Last Stand, (Foundation for Economic Education, February 1, 1994).

- Hearings on H.R. 7995, H.R. 9232, Before the House Committee on Labor, 71st Cong., 2d Sess., (March 6, 1930), 17.

- Hearings on H.R. 7995, H.R. 9232, Before the House Committee on Labor, 71st Cong., 2d Sess., (March 6, 1930), 26-27.

- Congressional Record, February 28, 1931, p. 6,513 (remarks of Allgood).

- Bernstein, Cato Institute Briefing Paper No. 17.

- Ibid.

- Staats, Elmer B., Comptroller General of the United States, “The Davis-Bacon Act Should Be Repealed,” United States General Accounting Office, June 14, 1979, p. 19.

- Ibid.

- Bernstein, Cato Institute Briefing Paper No. 17.

- 820 Ill. Comp. Stat. §130.

- “Prevailing Wage Act FAQ,” Illinois Department of Labor.

- “Dollar Threshold Amount for Contract Coverage under State Prevailing Wage Laws,” U.S. Department of Labor, Wage and Hour Division, January 1, 2017.

- See 820 Ill. Comp. Stat. §130.

- Raff, D. M. & Summers, L. H. (1987). “Did Henry Ford Pay Efficienct Wages?”

Journal of Labor Economics, 5 (4, Part 2), S57-S86. - Krueger, A. B., & Summers, L. H. (1988). “Efficiency Wages and the Inter-Industry Wage Structure.” Econometrica: Journal of the Econometric Society, 259-293.

- Stiglitz, Joseph E., “Theories of Wage Rigidity.” (September 1984). NBER Working Paper No. 1442.

- Philips, Peter. 1996. “Square Foot Construction for Newly Constructed State and Local Schools, Offices, and Warehouses in Nine Southwestern and Intermountain States: 1992-1994.” Prepared for the Legislative Education Study Committee of the New Mexico State Legislature.

- Hirsch, Barry T., “Sluggish Institutions in a Dynamic World: Can Unions and Industrial Competition Coexist?” Journal of Economic Perspectives, Vol. 22, No. 1 (Winter 2008), pp. 153-176.

- Kessler, Daniel, and Lawrence Katz. 2001. “Prevailing Wage Laws and Construction Markets.” Industrial and Labor Relations Review. Vol. 54, No. 2, pp. 259-74.

- Gujarati, D.N. 1967. “The Economics of the Davis-Bacon Act.” Journal of Business. Vol. 40, No. 3, pp. 303-16.

- Petersen, Jeffrey S., “Health Care and Pension Benefits for Construction Workers: The Role of Prevailing Wage Laws,” Industrial Relations, 39, No. 2 (April 2000).

- Thieblot, A. J., “A New Evaluation of Impacts of Prevailing Wage Law Repeal,” Journal of Labor Research 17, no. 2 (June 1996): 297–322.

- Philips, Peter. 1998. “Kansas and Prevailing Wage Legislation.” Report prepared for the Kansas Senate Labor Relations Committee.

- Fraundorf, Martha, Farrell, John P., and Mason, Robert. 1984. “The Effect of the Davis-Bacon Act on Construction in Rural Areas.” Review of Economics and Statistics. Vol. 66, No. 1.

- Prus, Mark. 1996. “The Effect of State Prevailing Wage Laws on Total Construction Costs.” Working Paper, State University of New York, Cortland.

- Philips. 1998. “Kansas and Prevailing Wage Legislation.”

- Prus, Mark. 1999. “Prevailing Wage Laws and School Construction Costs: An Analysis of Public School Construction in Maryland and the Mid-Atlantic States.” Prepared for the Prince George’s County Council, Maryland.

- Dunn, Sarah, Quigley, John, and Rosenthal, Larry. 2005. “The Effects of Prevailing Wage Requirements on the Cost of Low-Income Housing.” Industrial and Labor Relations Review. Vol. 59, No. 1, pp. 141-57.

- “Value of Construction Put in Place at a Glance,” United States Census Bureau, accessed July 3, 2017.

- “RPP1 Regional Price Parities by State,” Bureau of Economic Analysis, accessed October 13, 2017.

- Lucci, Michael, “Illinois Losing 1 Resident Every 4.6 Minutes, Could Fall Behind Pennsylvania in Population,” Illinois Policy Institute, December 20, 2016.

- Construction job losses are based on author’s calculations of BLS data. “Create Customized Tables,” Bureau of Labor Statistics, n.d.

- “Databases, Tables & Calculators by Subject,” Bureau of Labor Statistics, accessed October 13, 2017.

- “Current Prevailing Wage Rates by County,” Illinois Department of Labor.

- Ibid.

- “2016 Vermont State Construction Prevailing Wage,” Vermont Department of Labor, Economic & Labor Market Information.