AFSCME health benefits, wages out of sync with what Illinois taxpayers can afford

By Ted Dabrowski, John Klingner

Download Report

Introduction

Health insurance premiums for the average Illinoisan have risen dramatically over the past several years. Copays have also spiked, and access to doctors is shrinking. On top of these rising costs, Illinois taxpayers also have to subsidize heavily the more than $2.7 billion spent annually on health care benefits for Illinois state workers.

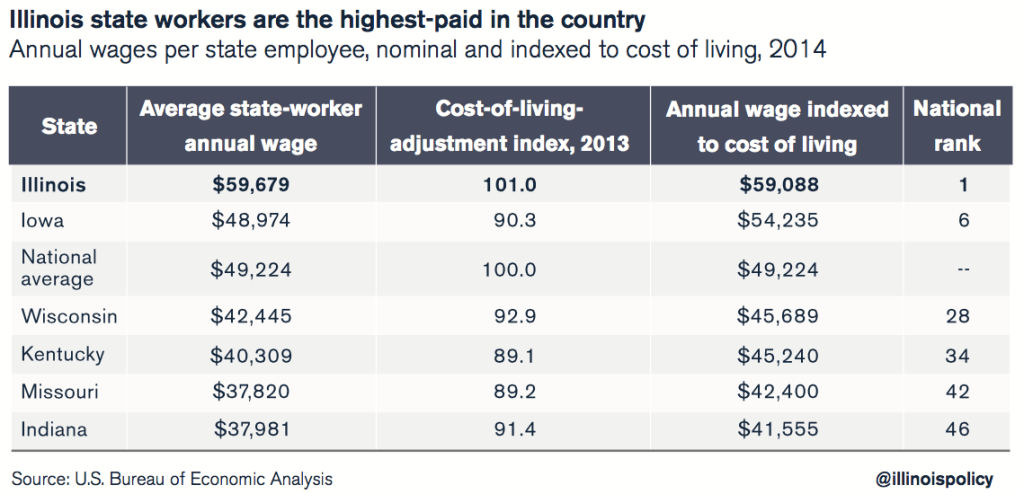

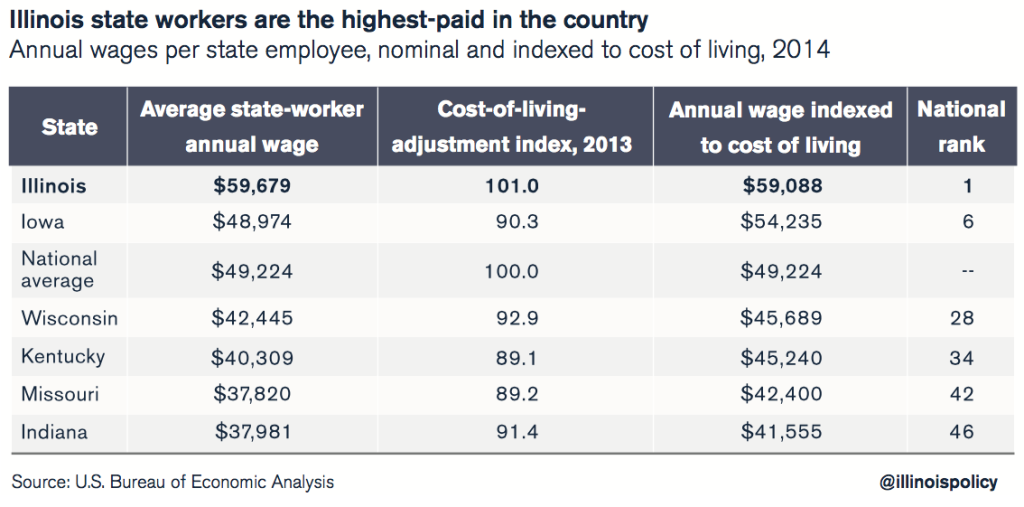

Illinois residents, struggling with stagnant incomes in one of the nation’s weakest economies, can no longer pay so much for state workers’ benefits. Illinois state employees, the highest-paid state government workers in the country, need to pay their fair share to bring the cost of their health insurance benefits in line with what taxpayers can afford.

Nowhere is this more necessary than with the benefits provided to state workers who are members of the American Federation of State, County and Municipal Employees. AFSCME is the state’s largest government-worker union, and the health care coverage these state workers receive dictates the benefits for most other state-worker plans.

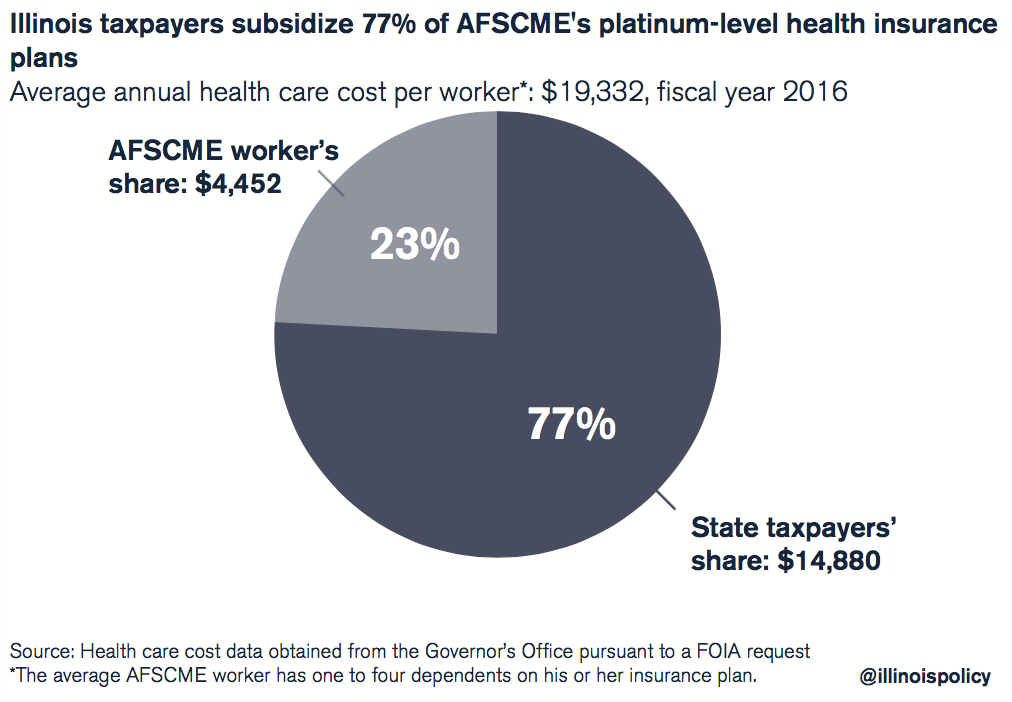

AFSCME workers receive platinum-level health benefits, but on average only pay bronze-level prices, meaning the average worker ends up paying for less than a quarter of his or her health care, which costs $19,332 a year. State taxpayers subsidize the rest.

On average, taxpayers pick up nearly $15,000 annually in health care costs for every AFSCME worker’s platinum-level plan. But that’s not all the health care benefits that AFSCME workers receive.

But that’s not all the health care benefits that AFSCME workers receive.

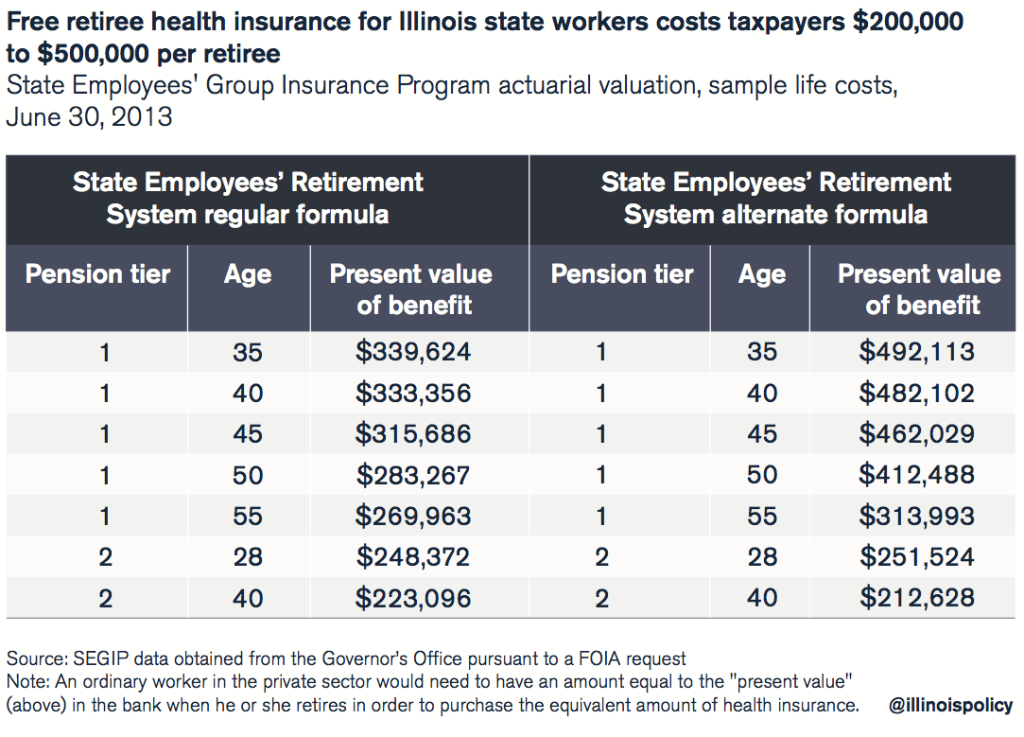

State employees who work 20 years or more for the state also receive free health insurance during their retirement. This additional benefit has a cash value of anywhere from $200,000 to $500,000 for individual retirees, all paid for by taxpayers. In contrast, such a benefit is nearly unheard of in the private sector.

According to the U.S. Bureau of Economic Analysis, Illinois’ state workers are also the highest-paid state government workers in the nation when adjusted for the cost of living. Illinois pays its state workers over $59,000 a year, far more than its neighbors.

Illinois state-worker compensation is out of sync with almost every other state, as well as with the private sector. Gov. Bruce Rauner has proposed a reform plan to bring state-worker health insurance benefits more in line with what state taxpayers can afford. Under the governor’s plan, Illinois taxpayers would still subsidize 60 percent of AFSCME workers’ annual health care costs. State workers would be asked to pay 40 percent of their costs, up from 23 percent.

The state and AFSCME have been locked in negotiations since their last contract expired in June 2015, with the union demanding an increase in workers’ benefits. AFSCME wants a new labor contract under which taxpayers would pay for more than $3 billion in new state-worker salary, health insurance and pension benefits. Specifically, AFSCME leaders are seeking four-year raises ranging from 11.5 to 29 percent, a 37.5-hour workweek, five weeks’ vacation and enhanced health care coverage.

It’s in the best interest of all Illinoisans to provide health care benefits that are affordable for both state workers and taxpayers. Instead of increasing benefits as AFSCME has demanded, the state should work to bring its employees’ health care benefits more in line with those in the private sector while maintaining effective coverage for state workers.

State employee health care in Illinois

Illinois provides state workers with health insurance coverage through its State Employees Group Insurance Program, or SEGIP, rather than through a private company such as Blue Cross Blue Shield. Because Illinois is self-insured, taxpayers cover a significant portion of any costs that SEGIP incurs.

In fiscal year 2016, SEGIP spent more than $2.7 billion to provide medical, dental, vision and life insurance, along with other coverage, to state workers, retirees and their dependents.

SEGIP and its related insurance programs had 356,609 estimated participants in fiscal year 2016, composed of 100,213 active state workers, 166,501 dependents and 89,895 retirees.

About 35,000 of those active state workers are subject to the state’s collective bargaining agreement with AFSCME. The remaining active workers include other state employees, state- university employees, college insurance program enrollees, teachers and other local employees.

This study focuses primarily on the health care costs of AFSCME’s 35,000 state workers because their health care benefits are currently being renegotiated. Any health care reforms the governor accomplishes with AFSCME will have far-reaching effects because AFSCME’s contract dictates the benefits for other government-worker agreements across the state.

AFSCME worker health care costs

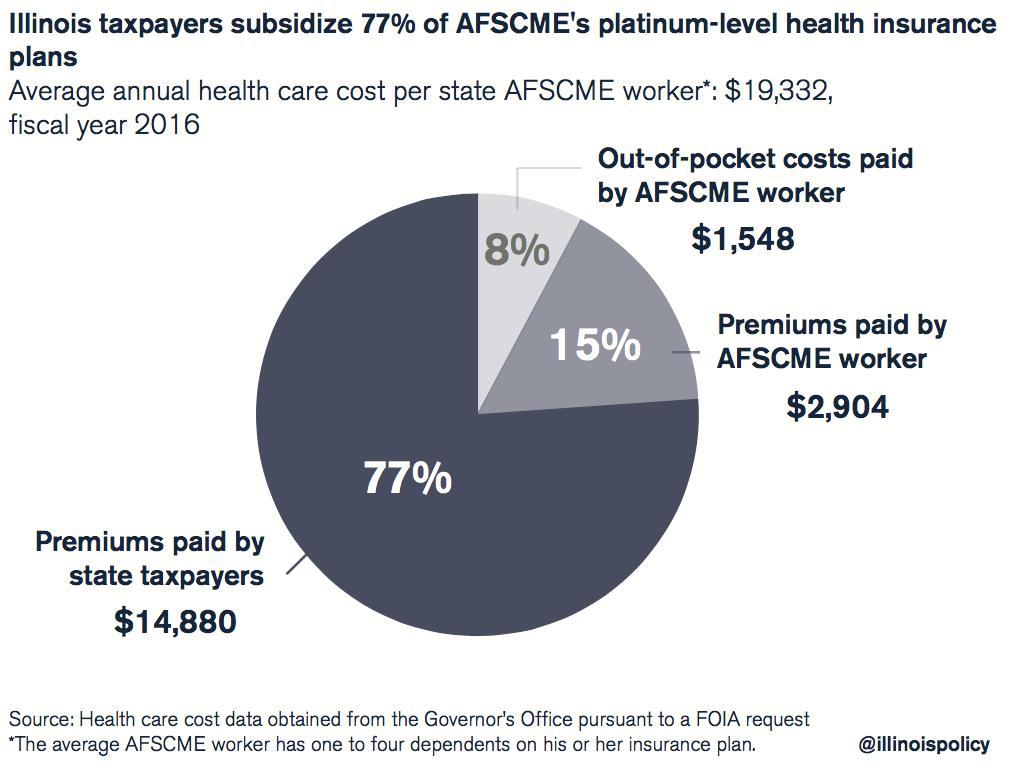

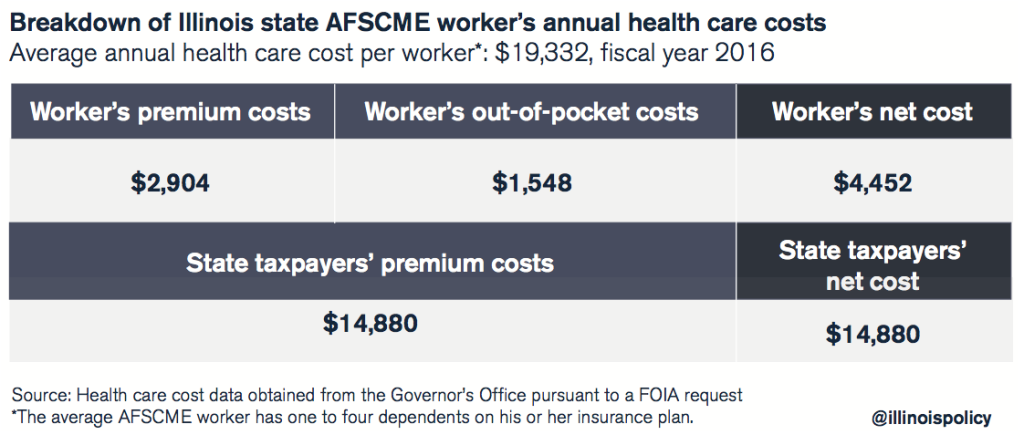

The average health care cost for an AFSCME worker totals $19,332 a year ($1,611 a month).

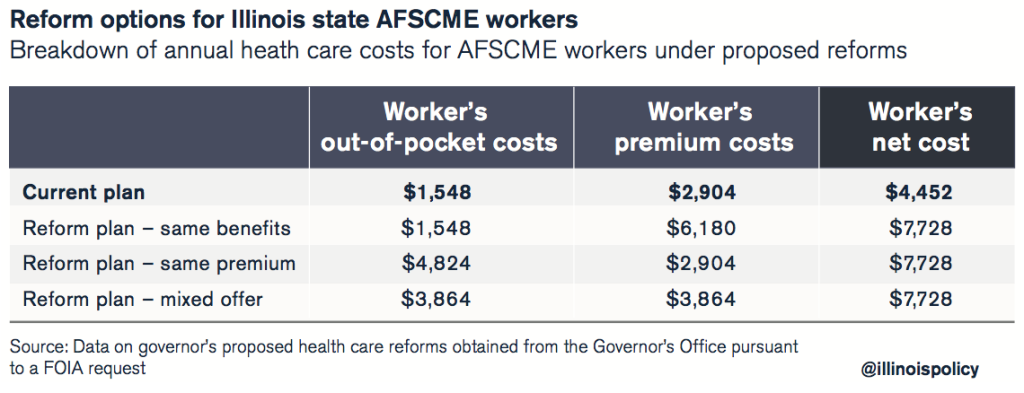

AFSCME workers pay for just 23 percent of that cost, or $4,452 a year ($371 a month). That includes $2,904 in premium payments and $1,548 in out-of-pocket expenses such as deductibles and copays.

State taxpayers pay the remaining 77 percent, or an average of $14,880 per worker ($1,240 a month).

Breaking down the costs

State AFSCME workers receive insurance benefits equivalent to a platinum-level plan offered through the Affordable Care Act, or ACA, insurance marketplace. Platinum-level insurance is defined as any plan that pays for 90 percent or more of an individual’s incurred health care expenses (i.e., broken arms, doctors office visits, etc.). Individuals pay the remainder out of pocket through copays, coinsurance and deductibles.

On average, AFSCME workers pay 8 percent of their health care expenses out of pocket. This costs each worker an average of $1,548 a year in copays, coinsurance and deductibles.

The remaining $17,784, or 92 percent, of the health care expenses are funded by premiums paid to SEGIP, the cost of which is split between AFSCME workers and the state.

AFSCME workers pay 16 percent of the premiums, or $2,904 annually. That cost is equivalent to the average premium paid for a bronze-level plan under the terms of the ACA.

The state pays for the remaining 84 percent of workers’ premiums owed to SEGIP, at a cost of $14,880 annually per worker.

In sum, the average AFSCME worker pays a total of $4,452 a year in health care costs. Illinois taxpayers pay the remainder, or $14,880 per worker. Illinois taxpayers cannot afford this deal. AFSCME workers receive platinum-level benefits but only pay the equivalent of bronze-level insurance premiums. This forces a vast share of workers’ health care costs onto state taxpayers.

Illinois taxpayers cannot afford this deal. AFSCME workers receive platinum-level benefits but only pay the equivalent of bronze-level insurance premiums. This forces a vast share of workers’ health care costs onto state taxpayers.

Illinoisans, struggling with their own health care costs, stagnating wages and one of the nation’s weakest economies, can no longer afford to subsidize workers’ health care benefits to such a degree.

Health insurance benefits for state retirees

In addition to providing health care benefits to its active AFSCME workers, the state also subsidizes 100 percent of the health insurance costs for most state retirees.

Currently, state workers receive a 5 percent reduction in the cost of their annual insurance premiums in retirement for each year they work for the state. Under this deal, an employee who works 20 years for the state has 100 percent of his or her retiree health insurance premiums paid for.

As a vast majority of Illinois state workers retire with 20 or more years of service, Illinois taxpayers pay for the entirety of those workers’ health insurance costs.

The taxpayer cost of this benefit is $200,000 to $500,000 per employee, depending on when the worker was hired, how long he or she worked, and when he or she retired.

Put another way, an ordinary worker in the private sector would need to have $200,000 to $500,000 in the bank by retirement in order to purchase the same retiree health insurance that most state workers get for free. Illinois is one of only a few states in the country to offer such a deal. Taxpayers in other states, on average, pay for less than half of their state retirees’ health insurance costs.

Illinois is one of only a few states in the country to offer such a deal. Taxpayers in other states, on average, pay for less than half of their state retirees’ health insurance costs.

Such a benefit is nearly unheard of in the private sector. Only 25 percent of large firms across the country offer health insurance to both their active workers and retirees. And in cases where private-sector workers do receive retiree health insurance from their place of work, those workers typically pay all or most of their insurance premiums themselves.

The governor’s proposed reforms

Gov. Bruce Rauner’s proposed health care reforms for AFSCME workers would bring their costs more in line with those in the private sector, while still maintaining effective, affordable coverage for state employees.

Instead of continuing to pay bronze-level prices for platinum benefits, the governor is seeking to realign AFSCME workers’ health care costs so they more closely match their corresponding benefits.

Under the governor’s plan, Illinois taxpayers would still subsidize 60 percent of AFSCME workers’ annual healthcare costs or over $11,600 per worker annually. Workers would be asked to pay 40 percent of their costs, or $7,728 a year, up from 23 percent.

The governor’s reform proposal offers state employees a choice regarding how they want to pay for their increased share of their health insurance costs.

State employees could choose to keep their current monthly premiums and pay additional out-of-pocket expenses, pay the same out-of-pocket expenses but have their monthly premiums grow, or a combination of the two.

While the governor’s reform plan would change how much AFSCME workers would pay for their health care costs, it’s important to note what wouldn’t change under the plan:

The health care options SEGIP provides would not change. The insurance program would still offer the same medical, dental, life and other insurance coverage as before.

The amount of catastrophic protection provided to workers would not change. No matter what health care expenses a worker accumulates, his or her maximum out-of-pocket costs would still equal $6,850 a year.

Retiree health insurance benefits would remain untouched, so state workers would still receive a benefit with a cash value of up to $500,000.

The governor’s attempt to more closely align state-worker health insurance costs with those in the private sector should also be understood in the context of the wages AFSCME members and other state workers currently receive.

In addition to top-tier health care and pension benefits, Illinois state workers receive the highest wages of any set of state workers in the country, when adjusted for cost of living. Illinois pays its state workers more than $59,000 a year when adjusted for cost of living, far more than its neighbors and nearly $10,000 more than the national average.

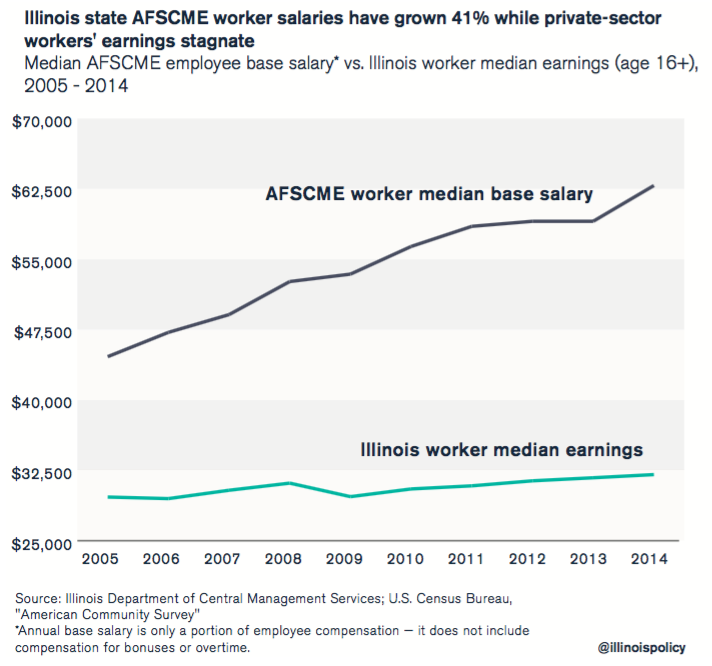

Moreover, state AFSCME workers have seen salary increases not matched by Illinois’ private sector.

Median AFSCME worker salaries increased more than 40 percent from 2005 to 2014, to more than $62,800 in 2014. During that same period, median private-sector earnings in Illinois remained virtually flat.

Asking AFSCME workers to contribute their fair share for their own health care benefits is not out of line considering that most state workers receive free retiree health insurance, that Illinois state workers in general receive the nation’s highest state-worker wages, and that AFSCME workers in particular have seen their salaries grow significantly over the past decade.

It would also help relieve some of the financial burden on Illinois’ private-sector workers, who are suffering from stagnating wages and massive health care cost increases due to the impact of the ACA. Younger Illinoisans on the ACA health insurance exchanges have been hit particularly hard. Between 2013 and 2015, premiums jumped 132 percent, or by over $1,800, for younger individuals. And in 2016 alone, the average premium for all individuals in Illinois will grow by another 22 percent.

Conclusion

Illinoisans struggling to pay ever-increasing health insurance costs are also forced to cover health care costs for state workers represented by AFSCME, to the tune of nearly $15,000 in tax dollars per worker.

AFSCME workers receive platinum-level health benefits but pay much lower bronze-level costs for those benefits. Illinoisans can no longer afford to subsidize that deal. State workers need to pay their fair share to bring the cost of their benefits in line with what taxpayers can afford.

It’s in the best interests of all Illinoisans to provide health care benefits that are affordable for both state workers and taxpayers. Instead of increasing benefits as AFSCME has demanded, the state should work to bring health insurance benefits more in line with those in the private sector while still maintaining effective coverage for state workers.