Report: Kendall County property tax rates more than double the national average

The average property tax bill for a Kendall County homeowner in 2017 totaled nearly $6,500.

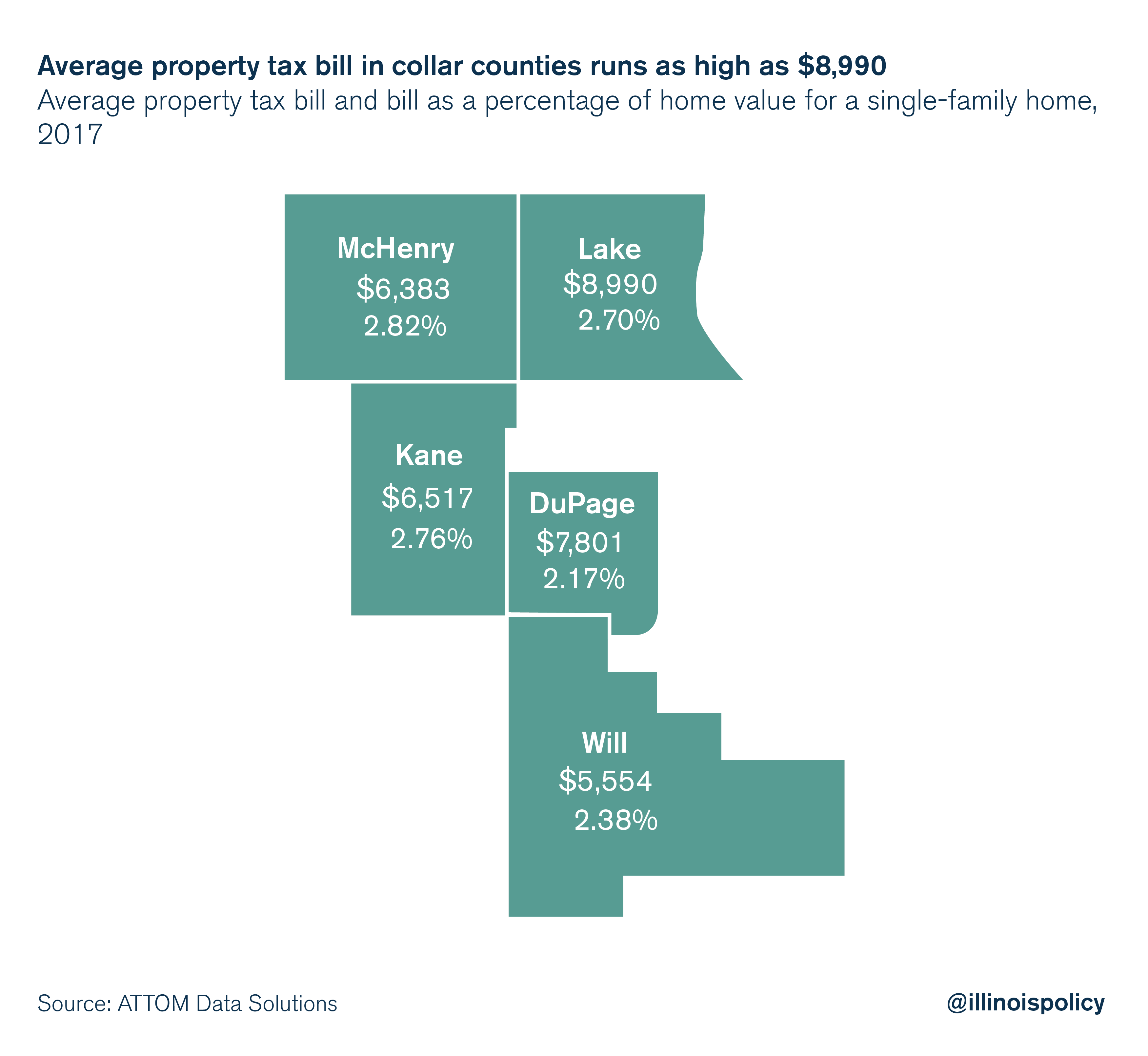

Chicago’s collar counties are infamous for high property tax bills. But measured as a percentage of home value, Kendall County homeowners are lifting an even heavier burden, according to new research.

Kendall County homeowners paid an average property tax bill of nearly $6,500 in 2017 for an effective property tax rate of 2.95 percent, according to ATTOM Data Solutions, a property data company. That’s a higher effective rate than any of the collar counties.

Statewide, the average property tax bill for a single-family home was $4,941, an effective rate of 2.22 percent, according to ATTOM. The national average bill was just under $3,400, or 1.17 percent.

While high property taxes have dovetailed with outmigration and population loss in the collar counties and throughout the state, Kendall County has been something of an outlier.

The county’s population grew by more than 10,800 from 2010 to 2017, a 9.4 percent increase, according to data from the U.S. Census Bureau. Also unlike the rest of the state, Kendall County saw more people arrive from other counties than leave to other counties, gaining 2,300 residents on net from domestic migration over the same time period.

What Kendall County shares with other areas of the state, however, is a frustrating lack of control over the cost-drivers of government. Getting local property tax bills under control will require state lawmakers to address the barriers to government consolidation, inflated costs on public works projects, unfair negotiating powers wielded by government worker unions and more.

Kendall County enjoys the rare advantage in Illinois of a growing tax base, which means local tax revenues should grow naturally. But residents should see the rest of Illinois as a cautionary tale – taxes can only go up so much before they raise red flags for existing and potential residents alike.