Report: Illinois families average $331 in cellphone taxes, highest rate in nation

Cellphone taxes increased nationwide – and Illinois moved up to be the top taxer. Add another $157 in tax on Chicagoans’ wireless bills.

Cellphone taxes will take $331 from the average Illinois household by the end of the year, thanks to the highest average wireless tax rate in the nation.

Across the U.S., taxes and governmental fees on wireless service hit a record high in 2018, according to a new report by the nonpartisan Tax Foundation. That $331 a year in taxes is on a cellphone bill for the typical Illinois household paying $100 a month for four wireless lines.

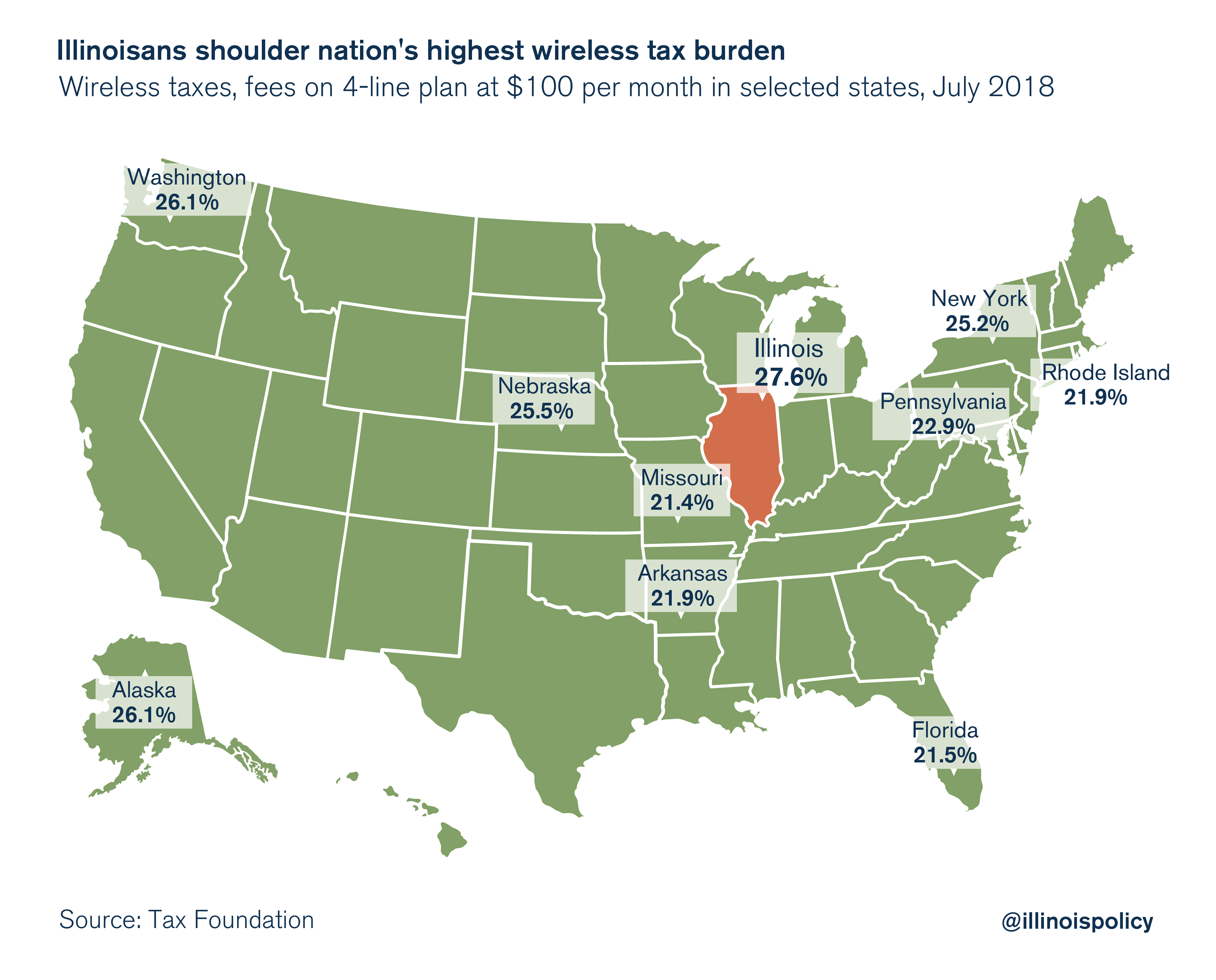

New tax increases in Chicago and statewide drove up Illinois’ average to make the state the nation’s top wireless taxer at a rate of 27.6 percent. Illinois ranked No. 4 last year.

A Chicago household is taxed nearly one-third higher than the statewide average. The average cellphone tax bill is $488 in Chicago for a four-line, $100-a-month plan.

State and local excise taxes and fees make up nearly 21 percent of the Illinois rate, layered on top of the federal government’s 6.6 percent telecommunications tax. Sales and excise taxes in Chicago stand among the nation’s highest, but the study found the city’s combined telecommunication tax rates were the highest in the nation, and more than double the national average.

Wireless customers in Alaska pay the second-highest average statewide rate at 26.1 percent. Oregon paid the lowest at 8.74 percent.

Nationwide, the average household pays a 19.1 percent tax rate on its wireless bill, or $229 per year for four lines – a 3 percent increase from 2017. Illinois’ cellphone tax increase represents a nearly 11 percent spike over the year, surpassing the national average by 30 percent.

Cellphone tax and fee hikes are depriving customers the benefit of falling wireless prices. According to the report, “intense price competition” has driven “significant reductions” in consumer prices for wireless services in recent years. Since 2016 alone, the average monthly bill has fallen to $38.66 from $44.65. That may come as a surprise to many Illinois consumers, who’ve seen rising cellphone taxes snatch the savings from lower prices they’d have otherwise enjoyed.

The Tax Foundation primarily attributes Illinois’ spike in cellphone tax rates to recent 911 fee hikes in Chicago and at the state level. In July 2017, state lawmakers overrode Gov. Bruce Rauner’s veto of a bill that increased the state’s 911 fee to $1.50 from 87 cents per line per month. The bill, which took effect this year, allowed Chicago to increase its 911 fee to $5 from $3.90 per line per month.

Low-income residents are disproportionately hit by high wireless taxes, which the study notes is the case with most excise taxes. While 53 percent of adults in the U.S. live in wireless-only households, nearly 70 percent of poorer adults are strictly reliant on wireless service. Access to wireless communication is essential for economic success, so raising wireless taxes risks pricing society’s most vulnerable out of employment opportunities.

High telecommunication taxes also harm state and local economies by discouraging investment in wireless networks, impairing productivity and efficiency. Economic growth is compromised and job opportunities are limited without ample investment in wireless infrastructure, the study states.

In a state that lost billions of dollars in economic activity and thousands of jobs after a series of record income tax hikes, state lawmakers should aim to create a tax climate that makes businesses want to connect to Illinois – rather than cancel their service.