Rauner vetoes Lake County assessor bill

Gov. Bruce Rauner vetoed a measure that would let Lake County voters elect an assessor, suggesting that it apply to all counties instead.

Gov. Bruce Rauner issued an amendatory veto of Senate Bill 2544 Aug. 27, which would have allowed for a referendum on Lake County ballots in November asking voters if the county’s chief assessor position should be elected rather than appointed.

Rauner’s amendatory veto removed the provision specifying that this bill applies only to Lake County, and inserted language that would expand it to all counties, stating, “what is beneficial to Lake County taxpayers and voters may also be beneficial to citizens across the state, who should get the same opportunity to determine whether an elected county assessor would better serve their communities.”

Regardless of whether having an elected assessor would improve or worsen the accuracy of assessments, it would do little to address the more pressing issue Lake County homeowners are facing: high property taxes, and the pension costs that are fueling them.

Property tax pain in Lake County

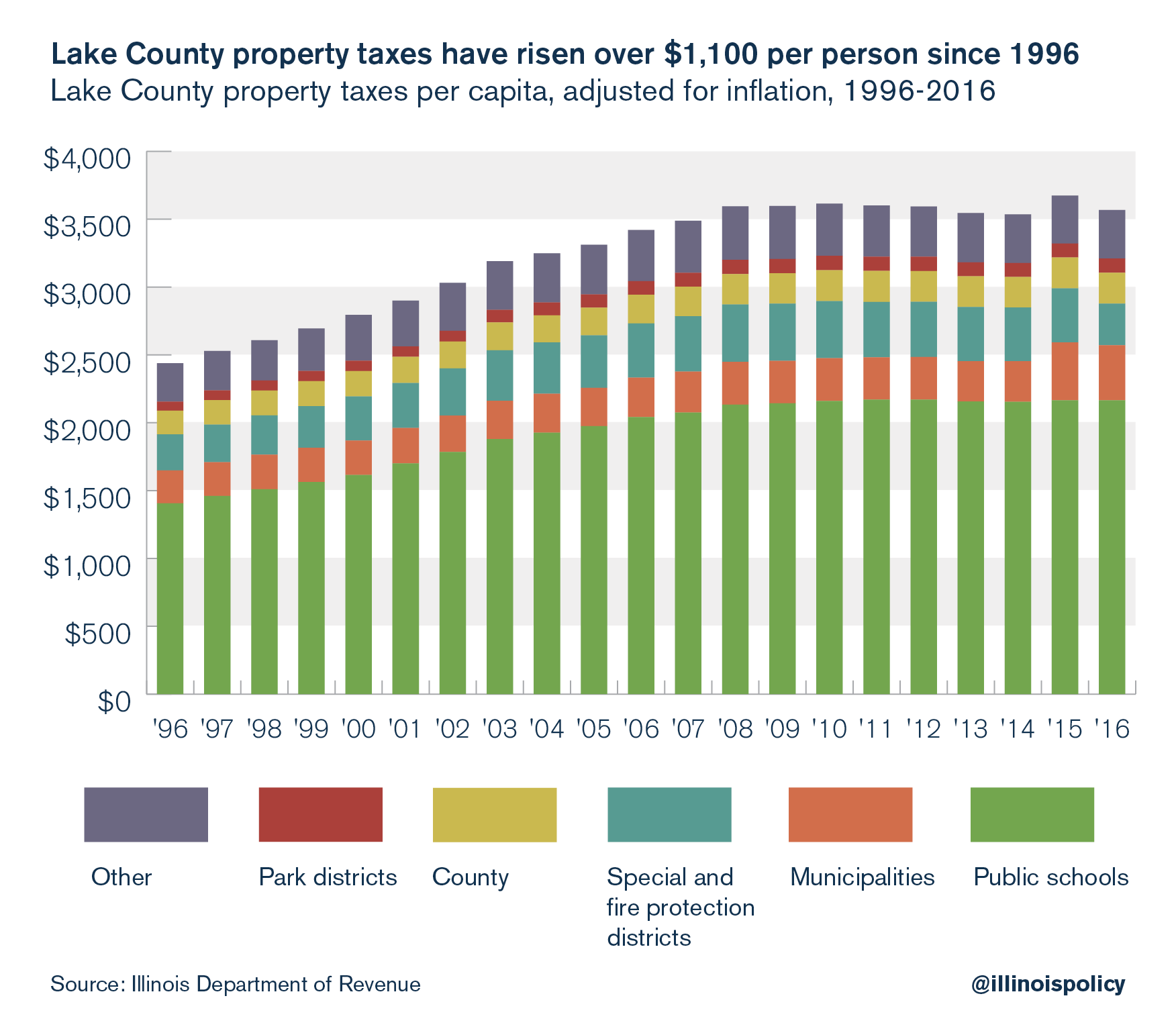

Illinois has some of the most expensive property taxes in the nation, and Lake County has some of the highest property taxes in the state. Lake County homeowners have seen their property taxes rise by more than $1,100 per person since 1996 after adjusting for inflation.

In theory, homeowners could benefit from higher property taxes through higher home values, if those property tax dollars were going toward improving the delivery of valued services. That doesn’t seem to be the case in Lake County, where residential property tax bills grew more than 160 percent faster than home values from 1996 to 2016. Sadly, this phenomenon is not surprising nor unique to Lake County. Less than 50 cents of every additional property tax dollar levied in Illinois since 1996 has gone to services. Rather, the single largest driver of the increase in property taxes over that 20-year period was pension costs.

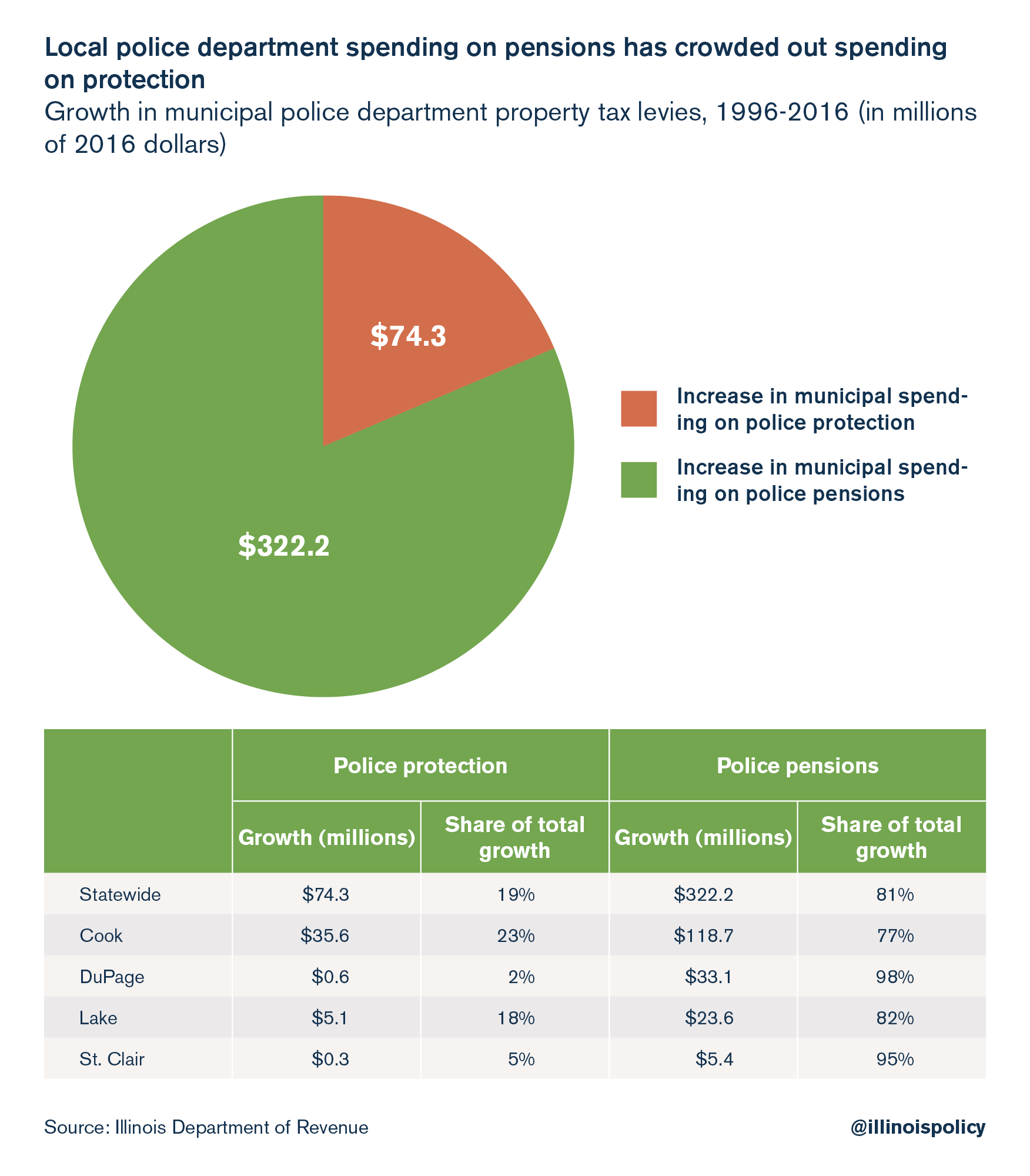

Of every additional property tax dollar that went to municipal police departments in Lake County over that time, 82 cents went to pensions, not law enforcement. Homeowners are now seeing the vast majority of their property tax dollars for police flow to pension payments.

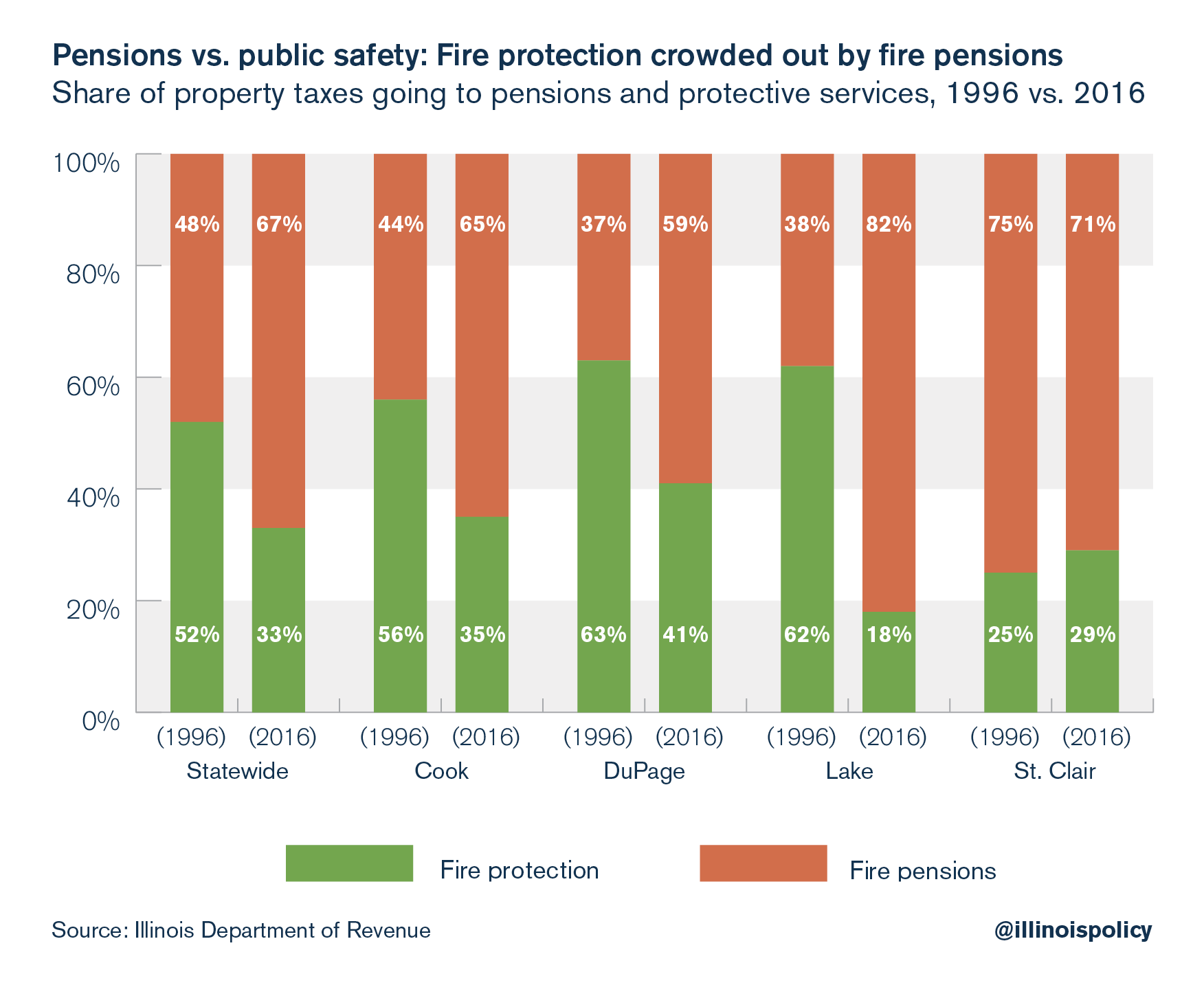

The pension problem is even worse for fire departments in Lake County. Residents saw a $3.6 million cut in property tax dollars flowing toward fire protection and a $12.6 million increase in property tax dollars flowing to pension costs for municipal fire departments in Lake County from 1996 to 2016.

In 1996, 62 cents of every property tax dollar for municipal fire departments went to fire protection in Lake County. But by 2016, only 18 cents of each dollar went to fire protection, with the rest going to pensions.

Until state lawmakers address this overwhelming rise in pension costs, Lake County residents will not see meaningful property tax relief, and government workers will continue to see their retirements put in jeopardy.

A short-term solution to this problem is enrolling every new government worker in a 401(k)-style retirement plan, similar to what more than 20,000 state university workers have opted into. A long-term solution must include a constitutional amendment to allow changes in future, unearned pension benefits for government workers. This would allow for reasonable changes such as ending automatic 3 percent annual benefit increases for retirees and bringing government worker retirement ages in line with the private sector.

Time is of the essence. Due to heavy outmigration, most of Lake County’s largest communities are shrinking, and it is the only collar county to have lost population since 2010.

In order to attract and retain residents, state lawmakers must avoid raising taxes and diminishing services to pay for unsustainable pension promises.