Rauner strips fee hikes from 911 funding bill

Gov. Bruce Rauner issued an amendatory veto nixing fee hikes from a 911 service reauthorization bill lawmakers sent to his desk. Illinoisans already pay some of the nation’s highest taxes on their cellphones.

Gov. Bruce Rauner issued an amendatory veto June 30 of a bill authorizing state payments to 911 centers, which state lawmakers also used as a vehicle for fee hikes on wireless customers across the state.

Senate Bill 1839 would have increased 911 fees for the state to $1.50 from $0.87, and would allow Chicago to increase its 911 fees to $5 per month per line from $3.90.

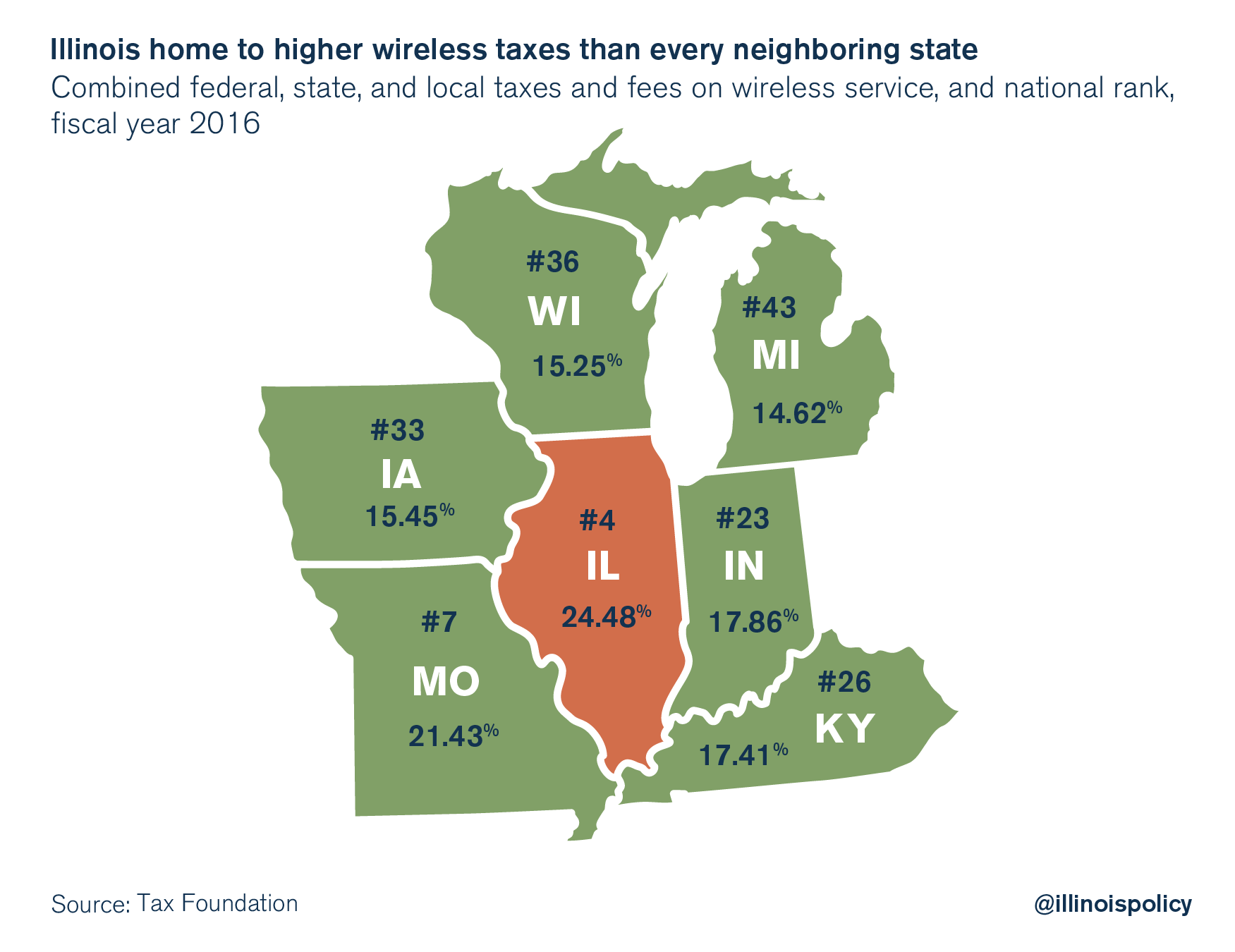

Illinoisans already pay the fourth-highest wireless taxes in the country, according to research from the nonpartisan Tax Foundation. A typical Illinois household with four wireless phones paying $100 per month for wireless service pays more than $290 each year in taxes and fees levied at the local, state and federal levels.

Rauner’s amendatory veto removes the fee hikes from SB 1839, among other changes.

“The majority in the General Assembly waited until the last moment to send this 911 service reauthorization bill to my desk,” Rauner said in a press release. “Unfortunately, those lawmakers also inserted a major tax hike into this bill, a tax that’s both excessive and unwarranted, and that I strongly oppose.”

The bill now returns to the Senate, where lawmakers will have three options. First, state lawmakers could override the veto with supermajorities in the House and Senate. The original bill would then become law despite Rauner’s veto. Second, lawmakers could vote to concur with the governor’s changes, sending the bill back to Rauner’s desk for final approval. Finally, they could do nothing, in which case the bill dies.

With the combination of federal, state and local wireless taxes and fees, Illinoisans shoulder a nearly 25 percent tax burden on their wireless bills. In addition to 911 fees, Illinois levies a state telecommunications tax of 7 percent, which municipalities other than Chicago can also levy at rates of up to 6 percent. Chicago tacks on an additional 7 percent telecommunications tax at the city level.

Illinois is one of only three states and Washington, D.C. to levy taxes on wireless service at higher state tax rates in lieu of the broad sales taxes that apply to most other purchases. Only Illinois and Florida levy state-level telecommunications taxes with local add-ons.

Americans – especially those in low-income households – increasingly rely on wireless service as their sole means of communication and connectivity. More than 60 percent of Illinois households are wireless-only.

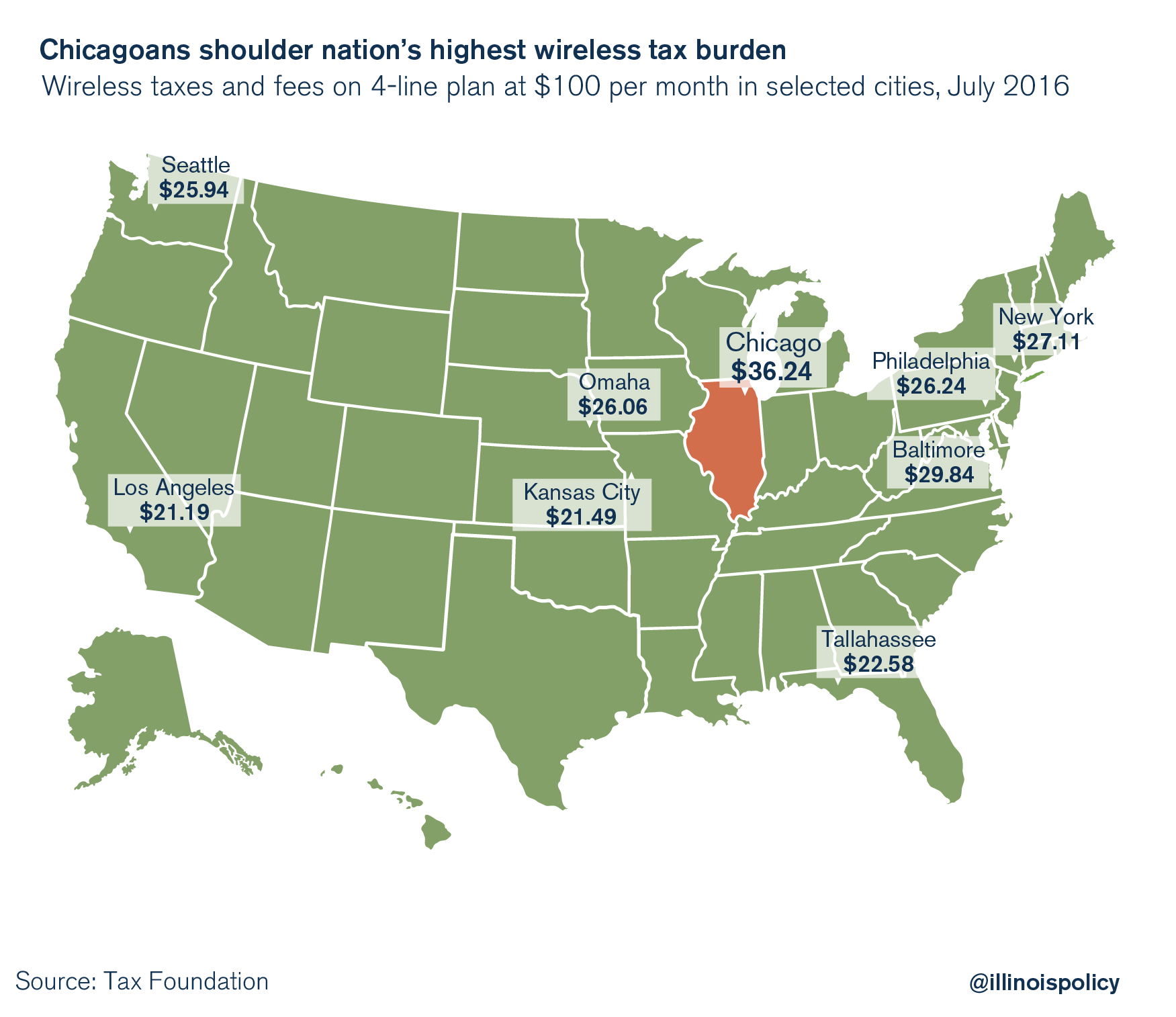

And while Illinois’ wireless taxes are high in general, Chicago’s are even higher. Chicago’s wireless taxes and fees were the highest of any city the Tax Foundation studied, by far. A typical Chicago household with four wireless phones paying $100 per month for wireless voice service pays nearly $435 each year in taxes and fees.

This amounts to a 36 percent tax burden on Chicagoans’ wireless bills. Under some payment plans, a Chicagoan can pay more in taxes on an additional line than on the line itself.

It’s likely Mayor Rahm Emanuel will push Chicago’s 911 fees even higher if the original version of SB 1839 becomes law.

Illinois’ wireless taxes are already some of the highest in the nation. Instead of jacking up wireless bills even higher, lawmakers should find ways to cut costs while preserving public safety.