Property tax bills hit Kane County mailboxes

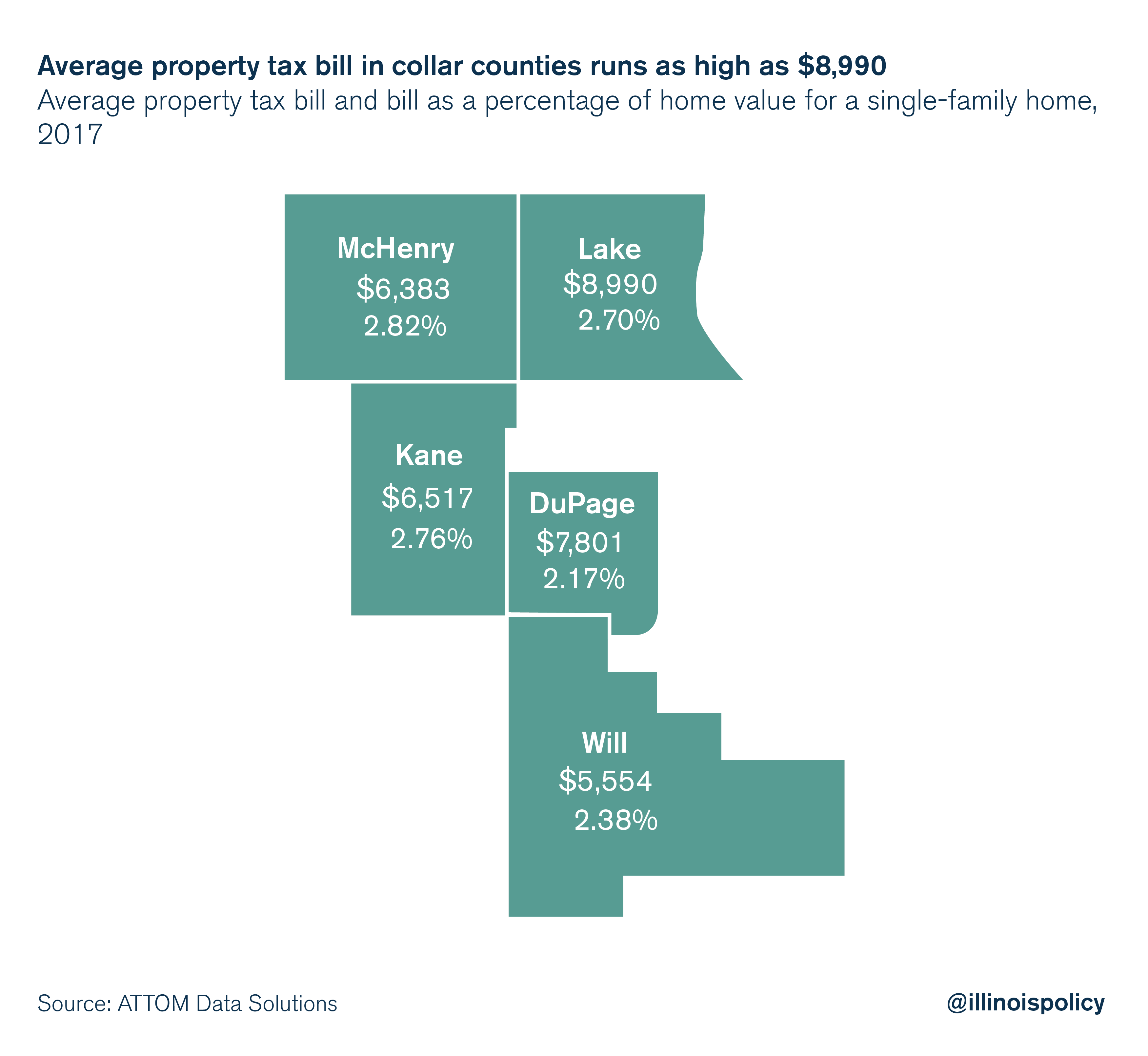

Homeowners’ 2017 property tax bills (payable in 2018) outpace the state and national average, when measured as a share of home value.

Kane County homeowners can expect to see some of the nation’s highest property tax bills arrive this week. The Kane County treasurer guaranteed bills would be mailed no later than May 4.

Typical homeowners in Kane County pay higher property taxes than the state average and more than double the national average, when measured as a share of home value.

The average single-family home in Kane County came with a property tax bill of $6,517 in 2017, according to ATTOM Data solutions, a property data company. With the average estimated home value pegged at nearly $235,800, that bill brings the effective property tax rate up to 2.76 percent.

The national average was 1.17 percent according to ATTOM. Statewide, the average property tax bill on a single-family home was $4,941, an effective rate of 2.22 percent.

Even among the high-tax collar counties, Kane residents’ property tax bills as a share of the average home value stand out – higher than homeowners in Will, DuPage and Lake counties.

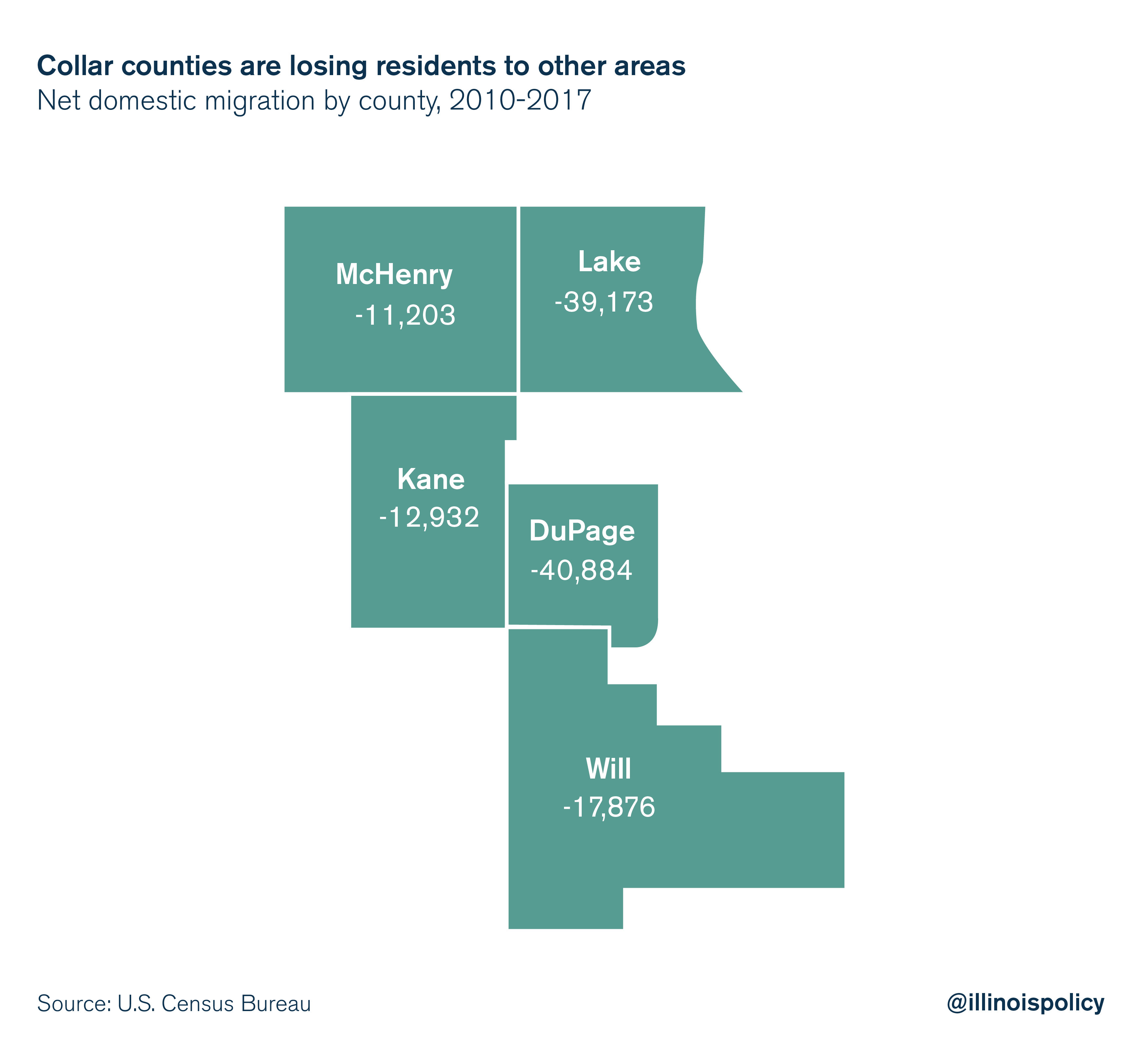

All of the collar counties have seen net outmigration to other counties since 2010, with Kane losing nearly 13,000 residents to domestic migration, according to the U.S. Census Bureau. That amounts to roughly 2.5 percent of the county’s population.

That said, Kane has seen stronger overall population growth in recent years than any of the collar counties. Kane County grew to nearly 535,000 residents in 2017, a 3.6 percent jump from 2010, according to the Census Bureau. That growth was buoyed by a natural increase (births outpacing deaths) of 27,000 people, and a net gain of 5,100 residents from international migration.

At the county level, officials have frozen the property tax levy for the last six years, according to The Courier-News. But without reform from Springfield, Kane County residents have little reason to believe their property tax bills will drop anytime soon.

One example: Government union power over taxpayers in bargaining has lead to consistent salary hikes for Kane County workers in the past several years, despite local officials’ efforts to hold the line on raises, according to the Daily Herald. And more than 100 Kane County probation workers are on strike, with the union seeking pay raises of 3.7 percent each year over the next three years.

All of Illinois’ neighboring states have made reforms to put taxpayers on more equal footing with government worker unions in contract negotiations. Along with other reforms that can reduce property tax burdens without compromising core services, Kane County residents should be demanding the same.