Progressive-tax proposal would favor corporations over small businesses, give Illinois 2nd-highest small business tax in U.S.

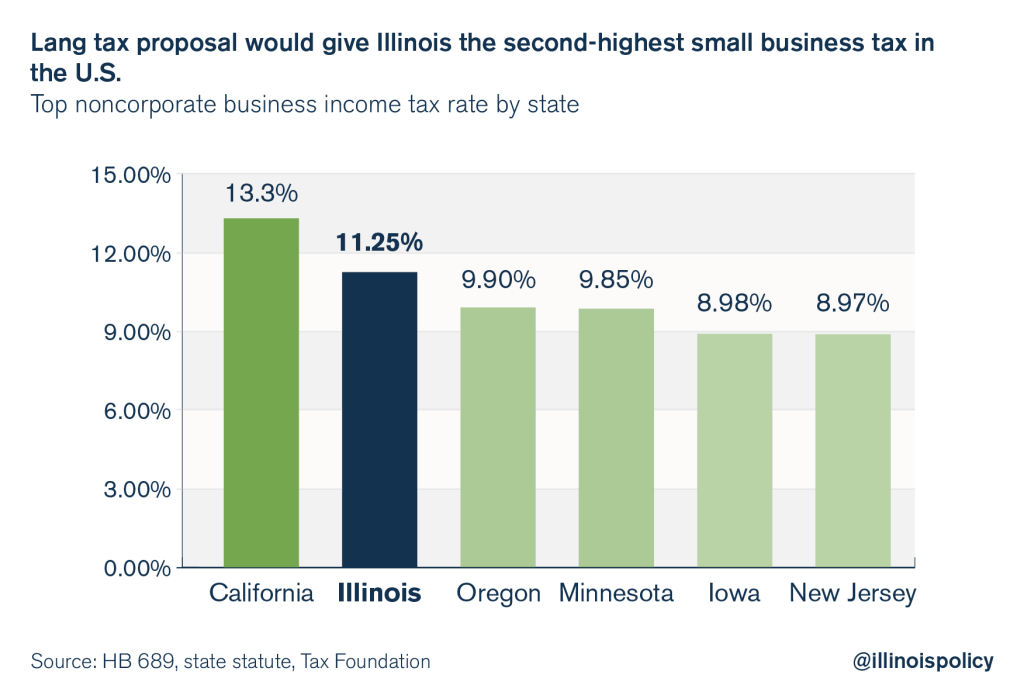

Under Lang’s plan, Illinois’ top tax rate for noncorporate businesses would become 11.25 percent — the second-highest rate in the U.S.

State Rep. Lou Lang’s progressive-tax scheme would put successful small businesses in Illinois on the defensive, not just against small businesses in other states but also against corporate competitors in Illinois.

Lang’s tax bill, House Bill 689, would amend the Illinois income-tax code to nearly triple the top personal income-tax rate, bumping it up to 9.75 percent from 3.75 percent. This would result in Illinois having the second-highest small business tax rate in the U.S., and would put noncorporate businesses in Illinois at a significant tax disadvantage against corporations.

Here’s how it works: When a noncorporate business, such as a neighborhood restaurant, real estate company or a small manufacturer earns income in Illinois, that income is treated as personal income on the business owner’s tax return. So when Illinois raises the personal income tax, that’s a hike in the small business income tax as well.

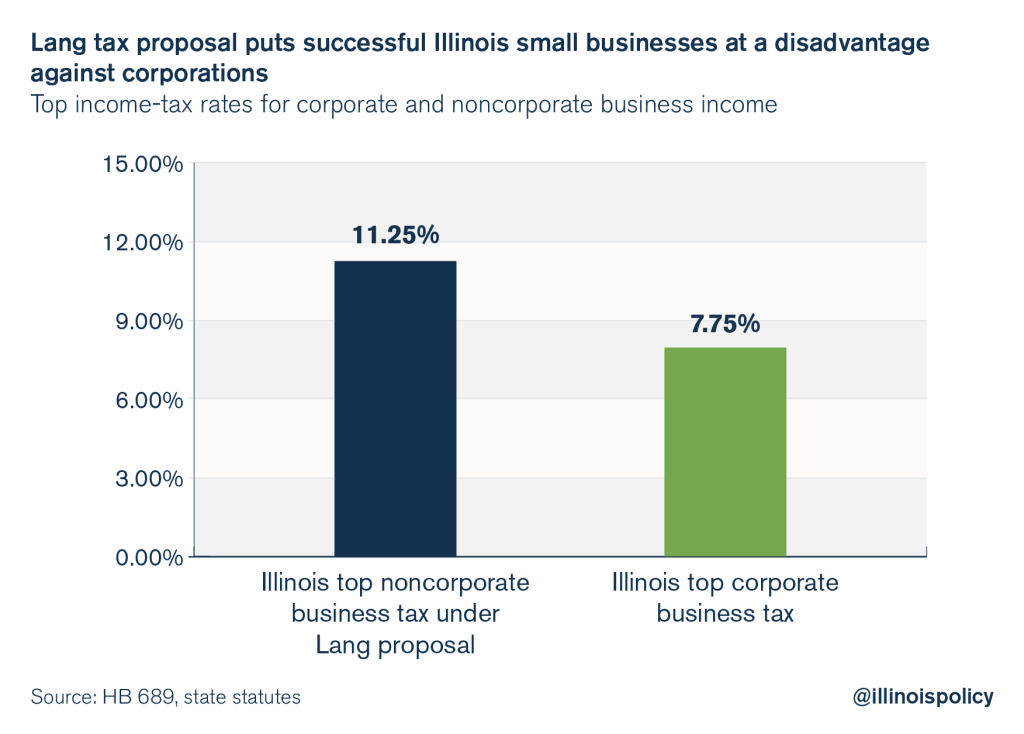

Lang’s proposal would impose a top rate of 9.75 percent on personal income. Small businesses also pay an additional 1.5 percent income tax on all income in the form of the Personal Property Replacement Tax, or PPRT, as specified in Illinois’ income tax code and explained in the Tax Handbook for Legislators. So the all-in, top state tax rate for a noncorporate business in Illinois is 11.25 percent under Lang’s plan, compared to 7.75 percent for corporations in Illinois. This puts Illinois noncorporate business owners at an unfair tax disadvantage against corporations within Illinois.

Under Lang’s plan, Illinois’ top tax rate for noncorporate businesses would become the second-highest rate in the U.S. Only California’s top small business rate of 13.3 percent would be higher than Lang’s proposed 11.25 percent. And unlike Illinoisans, Californians are at least protected by a constitutional cap on property taxes, while Illinois property taxes continue to spiral out of control.

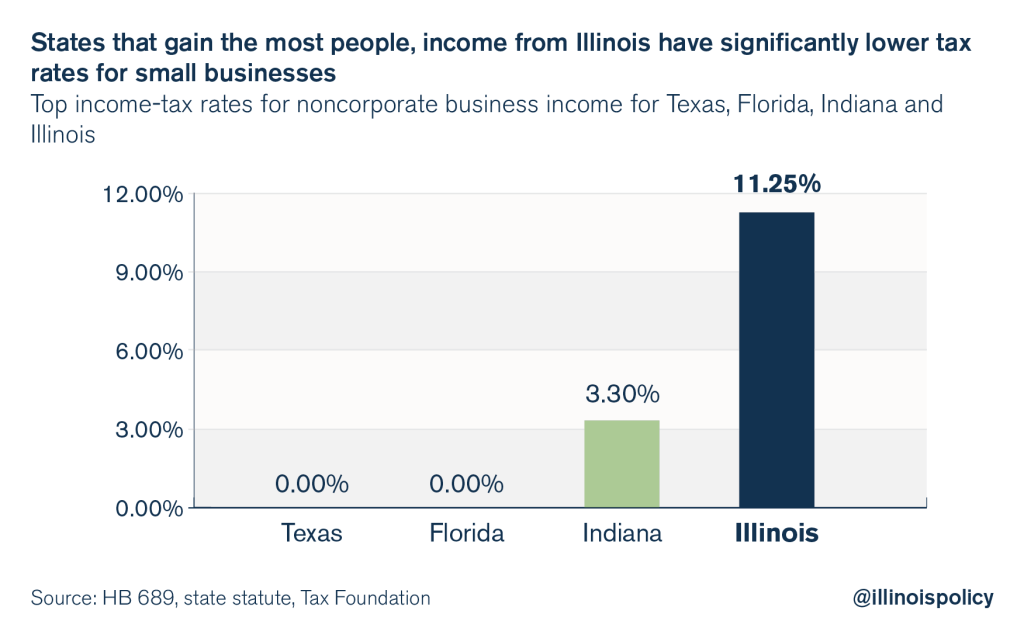

Lang’s proposal would become the single best recruiting tool for competitor states that want to attract successful noncorporate businesses from Illinois. Below is a comparison between Lang’s proposal would put the top income tax rate for Illinois small businesses at 11.25 percent compared to 3.3 percent in Indiana and 0 percent in Florida and Texas. These three states take the top three spots for attracting the most Illinois residents through migration.

Not only are Texas, Florida and Indiana the three biggest gainers from taxpayer migration from Illinois, but they also account for nearly half of Illinois’ net loss of income in tax year 2013, the most recent year of data. Illinois sustained a record net loss of $4.1 billion of adjusted gross income, or AGI, in tax year 2013; Texas, Florida and Indiana accounted for a combined $1.9 billion gain of AGI from Illinois.

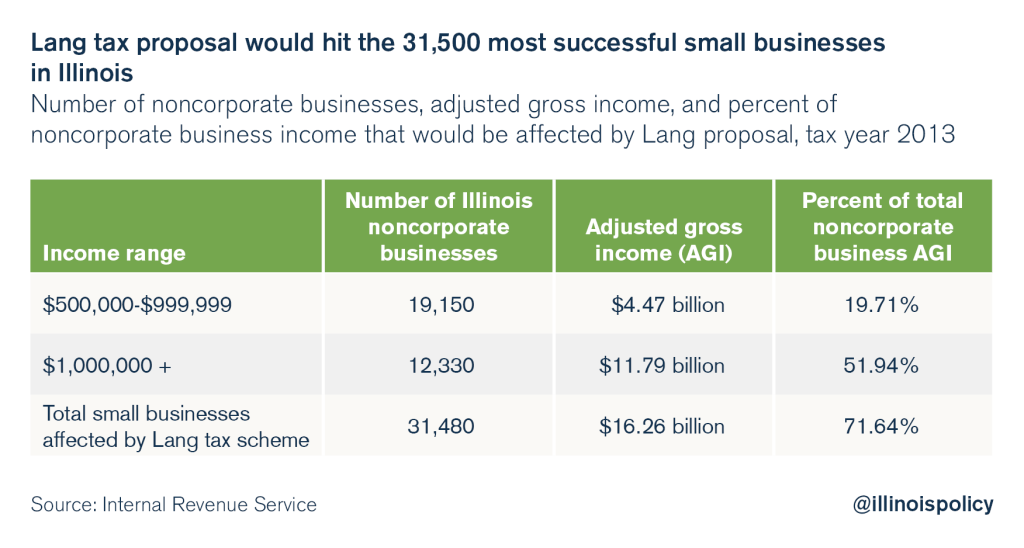

Though Lang’s rates kick in at higher income levels, starting at 8.75 percent for income beyond $500,000, the tax proposal would have an outsized impact on small-business earnings in Illinois. The 31,500 noncorporate businesses responsible for 72 percent of all small business income in Illinois would be hit by higher taxes under Lang’s proposal, according to Internal Revenue Service data.

Some believe Lang’s rates are illusory to pretend that a progressive-tax proposal would lower taxes for many Illinoisans and only raise rates for top earners. State Sen. Don Harmon, D-Oak Park, similarly noted the importance of allowing the General Assembly to be “nimble” with tax rates, which translates to granting legislators the ability to move tax rates wherever they want, whenever they want, onto whomever they want. Lang’s proposed rates aren’t set in stone – if politicians pass a progressive tax, they’ll be able to enact whatever rates they please. And Harmon seems to think that tax nimbleness is a virtue for politicians, but does not consider that small businesses can be just as nimble when they feel like their home state views them as targets for a tax squeeze rather than assets for job-creation.

Some believe Lang’s rates are illusory to pretend that a progressive-tax proposal would lower taxes for many Illinoisans and only raise rates for top earners. State Sen. Don Harmon, D-Oak Park, similarly noted the importance of allowing the General Assembly to be “nimble” with tax rates, which translates to granting legislators the ability to move tax rates wherever they want, whenever they want, onto whomever they want. Lang’s proposed rates aren’t set in stone – if politicians pass a progressive tax, they’ll be able to enact whatever rates they please. And Harmon seems to think that tax nimbleness is a virtue for politicians, but does not consider that small businesses can be just as nimble when they feel like their home state views them as targets for a tax squeeze rather than assets for job-creation.

But even if lawmakers impose the proposed progressive-tax rate, the plan would still be a disaster. Illinois’ 31,500 most successful small businesses would see a significantly higher income tax burden, with the income tax multiplying all at once, while in the background their local property taxes continue to spiral out of control. Some of these noncorporate businesses would see their income-tax burden double – or worse – between 2016 and 2017. To imagine that there wouldn’t be a significant portion of them looking for a new home is fantasy. And many of the successful small businesses that would stay in Illinois would consider raising prices, cutting wages and hiring fewer workers to pass on the cost of this aggressive new tax to someone else.

Even for a dishonest proposal, this is an especially bad one, and has strange timing coming right after Chicago was declared the No. 3 city in the world for millionaire flight. Given that IRS data show Illinois is already losing small businesses and other high-income earners at an aggressive pace, Lang’s proposal would certainly make the problem worse.