Progressive income taxes in Illinois’ neighboring states target middle-class workers

Progressive tax proposals by Illinois Democrats would punish those in Illinois’ middle class who earn $50,000 or more and make the state even less competitive with its neighbors.

Listen to the Democratic candidates for governor in Illinois, and they’ll say they’re committed to introducing a progressive income tax scheme – meaning they want to create a system with progressively higher state income tax rates that take a larger share of a person’s income as he or she earns more money.

They claim progressive income taxes will shift the tax burden to the rich. J.B. Pritzker recently said this approach would lessen the burden on middle-class workers while making the rich pay more. According to the (Champaign) News-Gazette, Pritzker said:

“[T]he first question we ought to ask is: Who should pay the bulk of whatever it is that we want to pay for? And the answer is that yes, millionaires and billionaires and people who can afford to pay are the ones who should pay more, not people who make 20 and 30 and 40 and $50,000 a year.”

But a look at taxes in Illinois’ neighboring states tells a different story from the one the candidates are selling.

Instead of soaking the rich, progressive taxes in neighboring states actually hurt middle-class workers, compared with what Illinoisans pay currently.

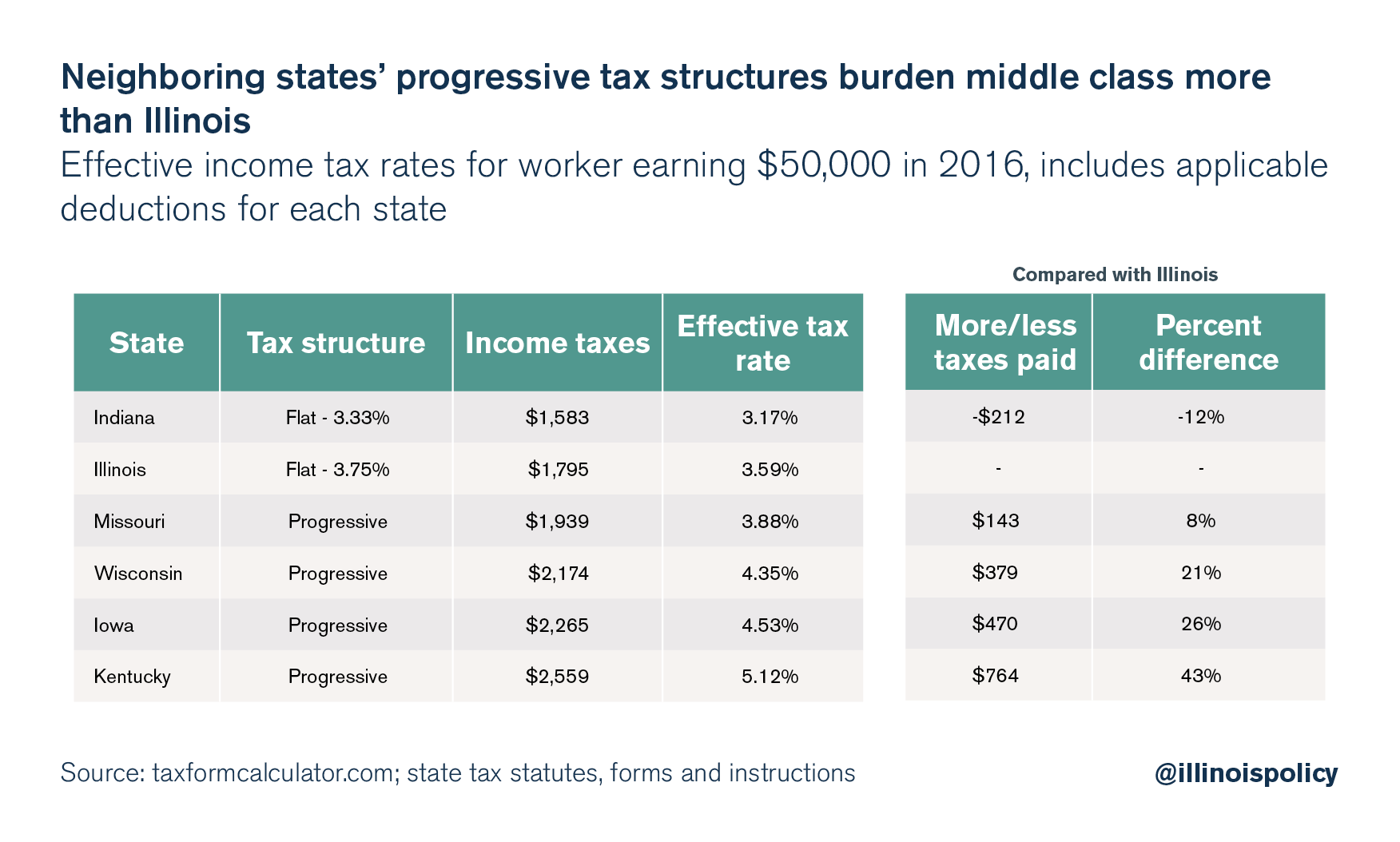

Four of the five states that surround Illinois tax incomes at progressively higher rates. And every one of those states punishes workers earning $50,000 – the starting salary for a Chicago public school teacher – when compared with Illinois.

That’s the problem with progressive tax schemes across the nation. Sold as a tax on the rich, the reality is that higher tax rates creep down into lower income levels.

Illinois is already a high tax state. Residents face the highest property taxes in the country and some of the nation’s highest sales taxes. Illinois’ flat income tax structure is one of the only competitive features of the state’s tax system.

Adopting a progressive tax structure would eliminate that only advantage.

In comparison with a worker in Illinois, a Kentuckian pays 43 percent more in taxes on a $50,000 income. That means a worker in Kentucky gets to keep $764 less income compared with an identical Illinois worker.

An Iowan making $50,000 a year pays 26 percent more, resulting in $470 less disposable income when compared with an Illinoisan.

Even a resident making $50,000 a year in Missouri, which has 10 different tax brackets, pays 8 percent more in income taxes than his or her peer in Illinois.

The only neighboring state with a lower income tax bill compared with Illinois is Indiana, which taxed its residents at a flat 3.3 percent rate in 2016. (The state lowered its flat tax to 3.23 percent for 2017.)

A worker in Indiana pays $129 less in income taxes than the same worker in Illinois with $50,000 in income.

Higher effective tax rates

As a result of their tax structures, progressive tax states have higher effective tax rates than Illinois for residents making $50,000 or more.

An effective tax rate is the average weighted tax rate an individual pays on his or her total income after standard deductions are applied.

Kentucky has the highest effective tax rate of Illinois’ neighbors at 5.12 percent (including the state’s basic personal deduction).

Iowa is next. An Iowa worker making $50,000 pays an effective tax rate of 4.53 percent.

Wisconsin’s effective tax rate for this income level is 4.35 percent.

Even Missouri’s effective tax rate, with its 10 brackets, is higher than Illinois’ at 3.88 percent.

Only Indiana, with a flat tax of its own, has a lower effective tax rate than Illinois.

Progressive tax rate schedules hit middle class

Illinois is surrounded by states that have adopted progressive tax structures. That offers an opportunity to analyze how a progressive tax structure might affect Illinois’ middle-class earners.

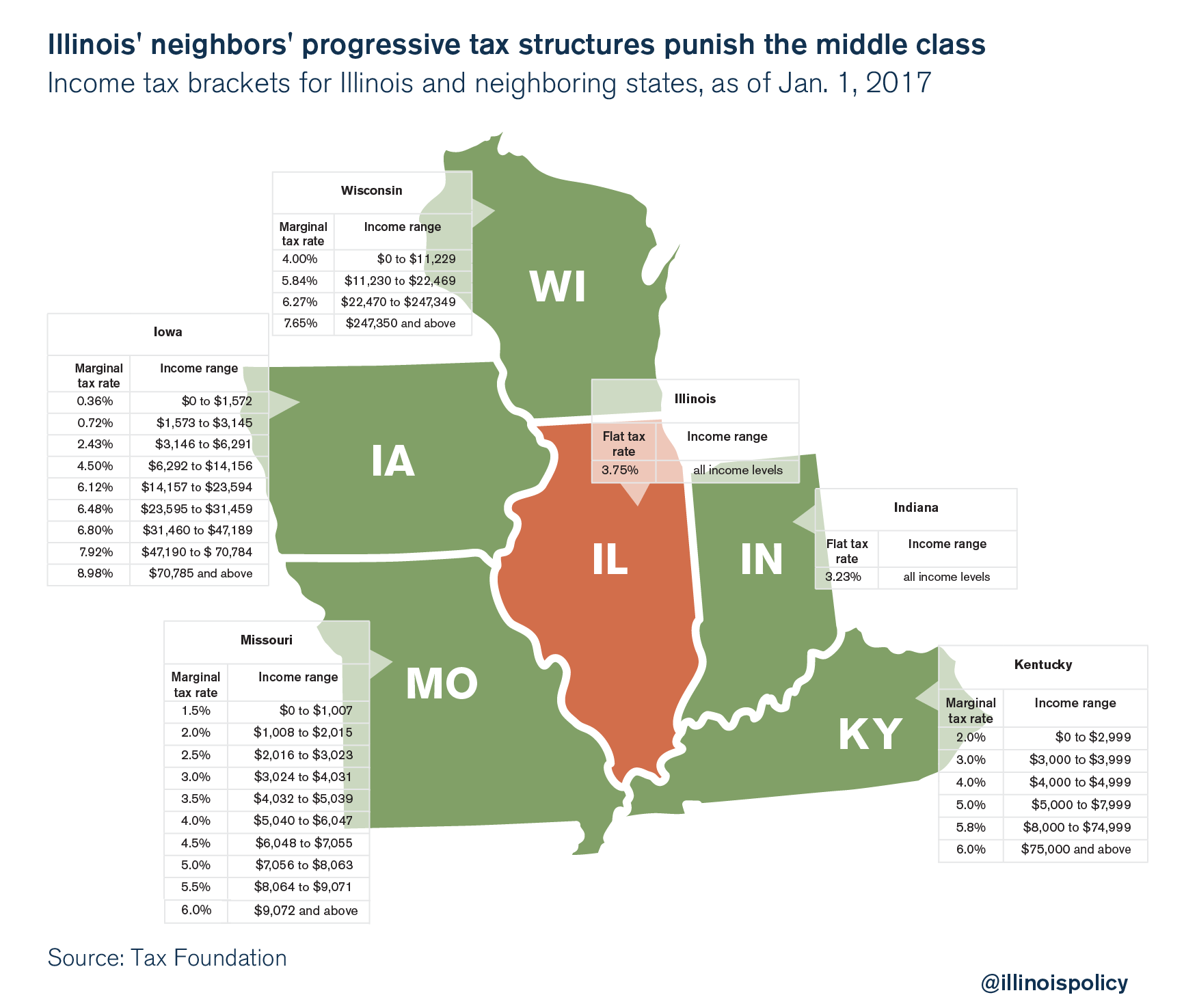

The progressive tax structures of Illinois’ neighbors have an average of over seven brackets with varying breadths of income taxed at each level.

However, each of these systems leads to a higher effective tax rate for individuals earning $50,000 or more compared with the flat tax structures of Illinois and Indiana.

Some states set punishing tax rates at low income levels. Missouri’s tax structure, for example, taxes any income (after deductions) over $9,072 at a rate of 6 percent.

That means a worker is essentially paying a flat rate of 6 percent for all income over $9,072. That’s 2.25 percentage points higher than the current 3.75 flat tax rate in Illinois.

Kentucky taxes any income over $8,000 at a rate of 5.8 percent.

Even Iowa, which starts with a low tax rate, taxes income above $14,157 at a rate of 6.12 percent – far higher than the flat 3.75 rate in Illinois.

And yet other states define “rich” as those earning just $70,000.

Progressive tax structures are often put in place with the claim that they will reduce the tax burden on the poor by increasing the tax burden on the rich. However, the term “rich” has been redefined in many states to dip far into the middle class.

The highest tax rate of 8.98 percent in Iowa applies to those earning more than just $70,785.

The highest tax rate of 6 percent in Kentucky applies to those earning more than $75,000.

Only Wisconsin reserves its highest bracket – 7.65 percent – for incomes of $247,350 and above.

But Wisconsin’s second-highest bracket hits the middle class. Workers’ incomes from $22,470 to $247,349 are taxed at 6.27 percent, much higher than the 3.75 percent flat rate in Illinois.

Illinois cannot afford a progressive income tax

Illinoisans already face one of the highest tax burdens in the nation. Adding a progressive tax structure would only increase that burden.

While advocates of progressive tax structures argue that they reduce the tax burden on the poor by imposing higher tax rates on the rich, in reality, these systems raise taxes for the middle class and even sometimes on low-income earners. This is true despite taking into account the standard deductions allowed by each state.

Many of Illinois’ neighboring states have adopted progressive tax structures that either tax low-income and middle-class workers at punishing rates or redefine “rich” to include anyone with an adjusted gross income of over $70,000 a year.

High taxes have already contributed to the out-migration problem Illinois faces today. People are leaving Illinois for states with lower taxes and more opportunities. A poll the Paul Simon Public Policy Institute released in October 2016 found that nearly half of Illinoisans surveyed want to leave the state, and taxes are the top reason.

A 2017 poll conducted by Fabrizio, Lee & Associates and commissioned by the Illinois Policy Institute found that Illinoisans are fed up with politicians’ “tax hike, no reform” budget proposals. Nearly 80 percent of Illinoisans surveyed agreed that “Illinois state lawmakers should pass major structural reforms before passing any tax increase.”

Illinois’ candidates for governor should abandon the bad idea of enacting a progressive income tax. The state cannot afford to give residents yet another reason to leave.

Instead, they should be promoting the structural reforms Illinoisans want: comprehensive property tax reform, 401(k)-style plans for new state workers, and changes to curb bloated administrative expenses in higher education and state government.