Pritzker’s ‘fair tax’ relief amounts to $6 for low-income Illinoisans

An Illinoisan making $12,400 a year would still pay nearly $1,800 in state and local taxes under the governor’s plan – a higher share of their income than residents of all but two states.

One of the primary arguments Gov. J.B. Pritzker has made in favor of his progressive income tax proposal is that the state needs to provide tax relief to lower- and middle-income Illinoisans. For poor Illinoisans, that amounts to $6.

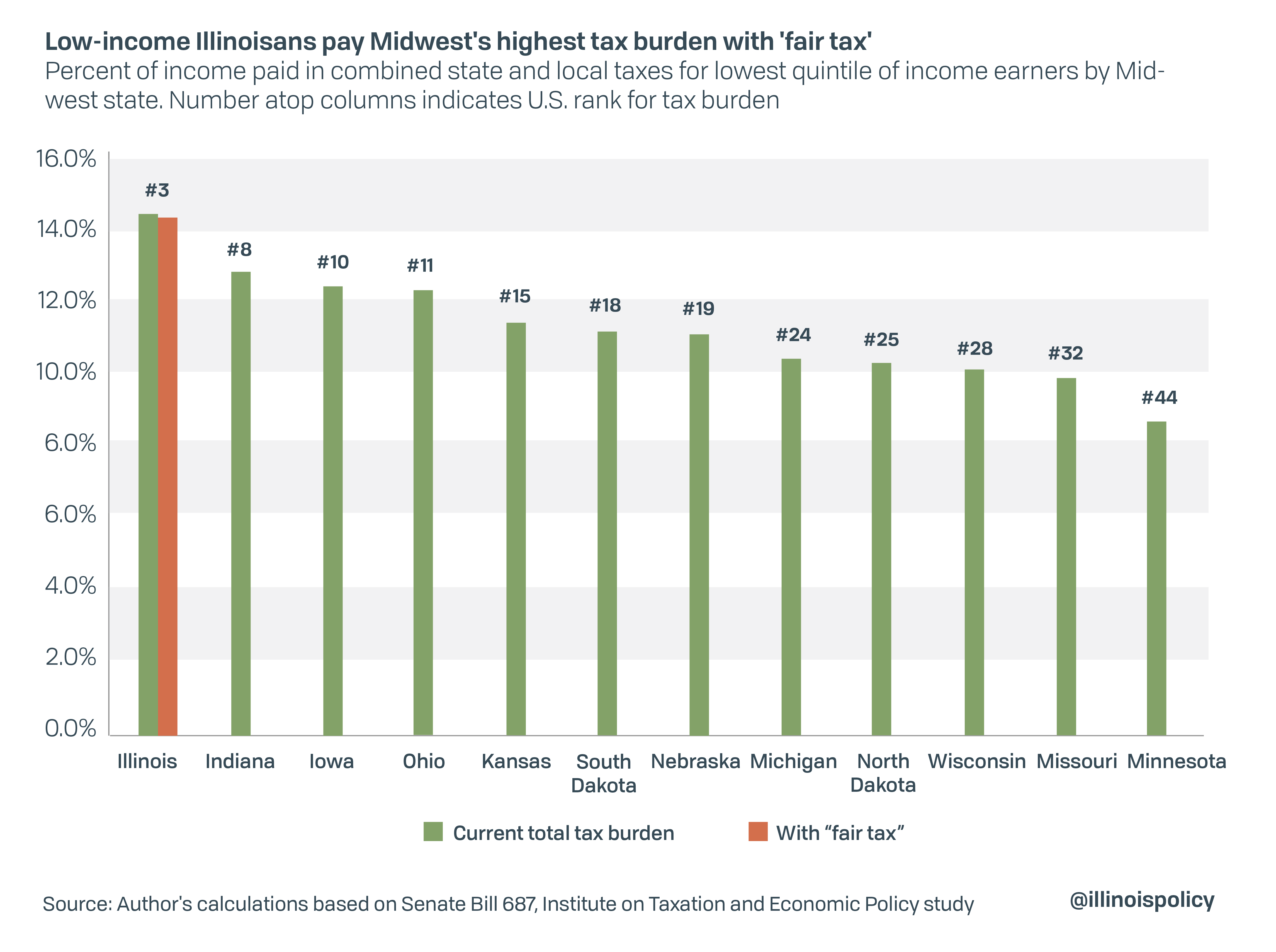

Low-income Illinoisans would still send more than 14% of their income to state and local government under his plan – nearly $1,800 for a resident making $12,400 a year. That would stand as the highest tax burden on low-income residents in the Midwest and third highest in the nation, according to the left-leaning Institute on Taxation and Economic Policy, assuming other states have not made drastic tax changes.

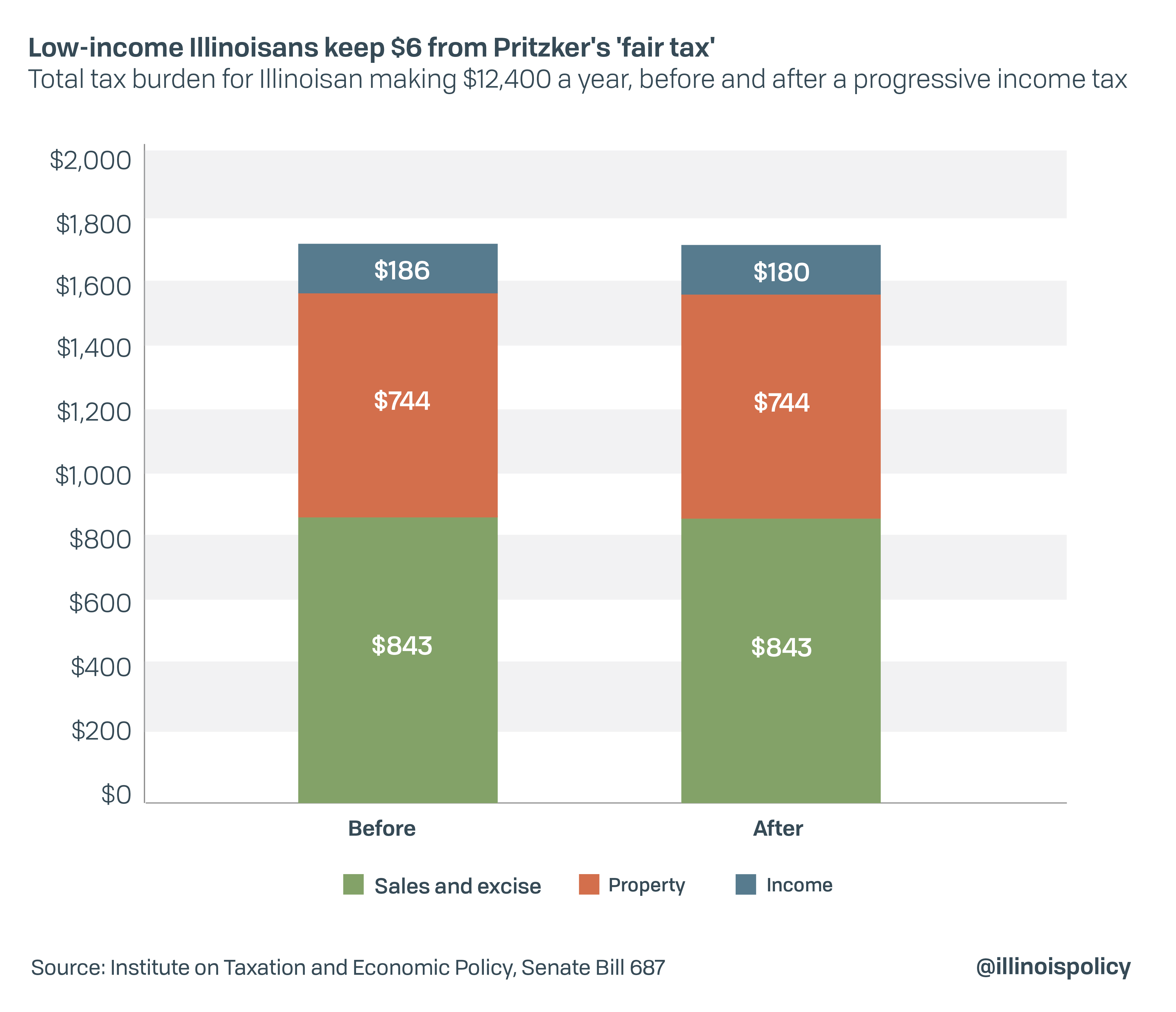

The average Illinoisan in the bottom 20% of income earners makes $12,400 a year, meaning they paid $1,786 in state and local taxes, according to a 2018 ITEP study.

However, their income tax burden is a small share of the overall bill, at $186. If the progressive tax passes, they will pay $180 in income taxes and $1,780 in total state and local taxes – a $6 savings. This calculation does not include expanded exemptions or deductions, such as an additional $100 income tax deduction per child if the taxpayer were eligible. Nor does it include the $100 gas tax hike and $50 vehicle sticker hike signed by Pritzker last year, which fell disproportionately on the poor. It also does not include increases in residential property tax bills, which have risen at a compound annual growth rate of 4.6% for the past 20 years.

The governor often argues the state’s current income tax structure is regressive and leads to lower-income Illinoisans paying the same tax rate as billionaires like him. He further argues his “fair tax” proposal would address this inequality.

However, analysis by ITEP shows this isn’t true. The effective income tax rate (the total income tax rate after accounting for exemptions and deductions) for the lowest 20% of income earners in Illinois is 1.5% while the effective income tax rate for the highest income earners is 4.1%. Under the governor’s proposal, the effective income tax rates for Illinoisans in the bottom 20% would remain virtually unchanged, dropping at most to 1.44%.

That is because Illinois’ flat income tax isn’t the source of disproportionate state and local tax bills. Property, sales and excise taxes are the largest tax burdens on low- and middle-income Illinoisans. In the Chicago area, property tax bills can take nearly 27% of the median household’s income.

With virtually no change in income taxes for the poorest Illinoisans, the state’s recently enacted tax and fee hikes will completely erase any promised tax reductions. The tax burden on these Illinoisans will instead continue to rise because of these tax hikes and the constant increase in Illinois property taxes, which are the second-highest in the nation. Furthermore, the progressive income tax would likely strip Illinoisans of employment opportunities, hitting the state’s largest job creators – small businesses – with large tax hikes as the economy is attempting to regain its footing after the COVID-19 crisis.

Instead of turning to taxpayers for more money, the governor should push for structural reforms to the state’s largest cost drivers. Without those reforms, a progressive income tax will not provide substantial tax relief, and will likely lead to even higher middle-class taxes.