Pritzker releases contradicting numbers on $3.4B tax hike

Illinois Gov. J.B. Pritzker's inconsistent progressive income tax numbers don't add up, which means he will have to pass middle-class tax hikes to raise what he wants to spend.

Illinois Gov. J.B. Pritzker is having a hard time getting the numbers to add up on his $3.4 billion progressive income tax hike. And the administration now is releasing details contradicting data they previously released.

Pritzker first proposed graduated state income tax rates on March 7, after which both the Illinois Policy Institute and Civic Federation noted the governor’s revenue claims could not be replicated and further information on his methodology was needed. The Illinois Policy Institute immediately submitted a Freedom of Information Act request asking for the full details of the assumptions the governor’s team made and what dataset they used.

After a week of questioning, the governor released a one-pager March 15 that was sparse on details about his assumptions, after which the Illinois Policy Institute issued another FOIA request. Then on March 21, Pritzker’s team released a few more details to political blog CapitolFax.

But the governor’s team hasn’t supplied information that matches their previous claims, and the few details they did offer don’t stand up to the mildest scrutiny.

These inaccurate estimates have serious consequences for the state budget and the governor’s proposed progressive income tax. The governor’s estimates mask the true size of the state budget deficit by nearly $1 billion. If the progressive income tax hike passes, and revenue from it is below the administration’s estimate, middle-class tax rates will likely be hiked.

False claims

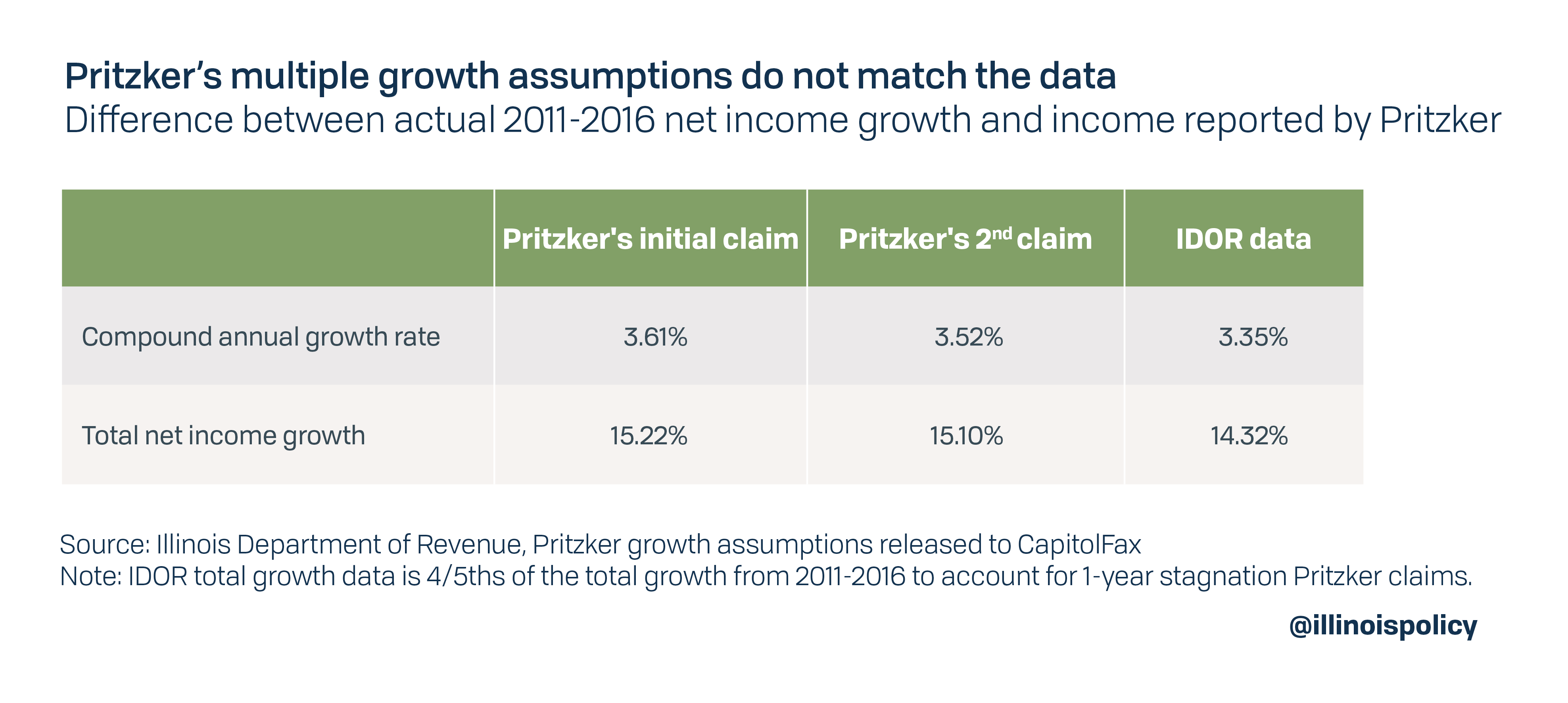

Despite the governor’s releases being light on details, the Illinois Policy Institute showed the governor assumes a four-year annual growth rate of 3.61 percent. This matches the Civic Federation’s calculations.

However, neither analysis is able to conclude that Department of Revenue data substantiate their claims, with annual growth for the past five years being much lower than the governor claims it was.

The governor’s team has changed its figures several times and each of the figures it reported has failed to match any of the actual data. This has not only been confirmed by the Illinois Policy Institute’s analysis of both IDOR and IRS data, but by the Civic Federation’s analysis of IDOR data as well.

The governor’s plan relies heavily on ambitious growth assumptions that do not reflect the historical data as he suggests. While the differences may seem small, using these faulty figures can throw off the governor’s estimates by billions of dollars and will likely mean taxpayers will be asked to cover the difference when revenues come up short. But why don’t the governor’s claims match the data?

Reported income and income growth don’t match

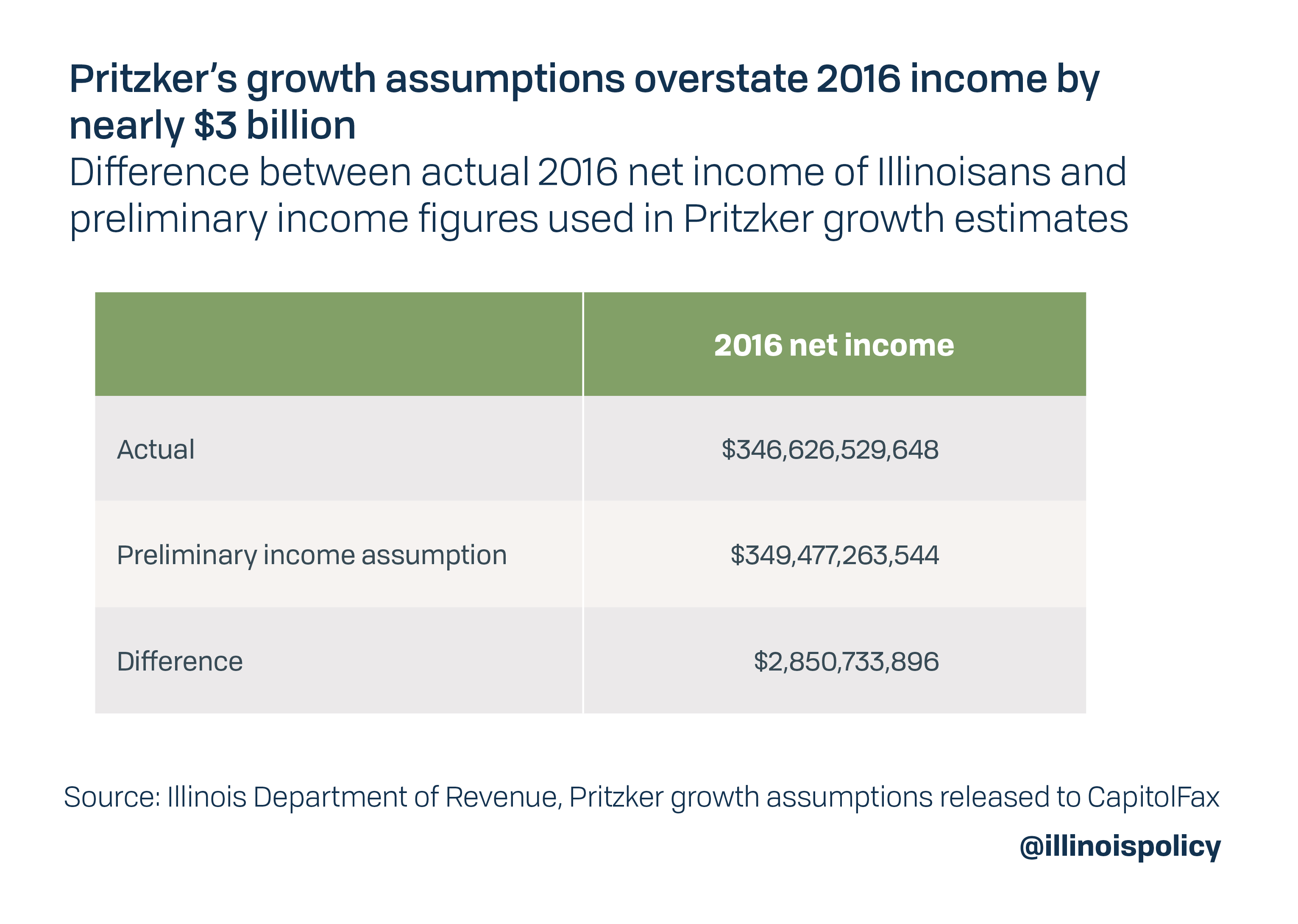

The governor’s team based their growth estimates on a preliminary 2016 income number from the Illinois Department of Revenue even though a final number is available from IDOR. The final number is lower by nearly $3 billion, which means their growth rates are artificially inflated, making the figures in the one-pager released by Pritzker’s office artificially inflated as well.

Furthermore, the growth rates assumed by the Pritzker team are also off and not even the overstatement of 2016 income can account for the difference. The governor claims that the 5-year compound annual growth rate, or CAGR, for Illinoisans to be 3.61 percent from 2011-2016, however this is not true. Net income growth has actually been much lower with Illinois’ total net income growth being 3.35 percent.

The inaccurate reporting that net income growth has been higher leads to excessively generous estimates for projections of total net income in 2021.

Apples and oranges

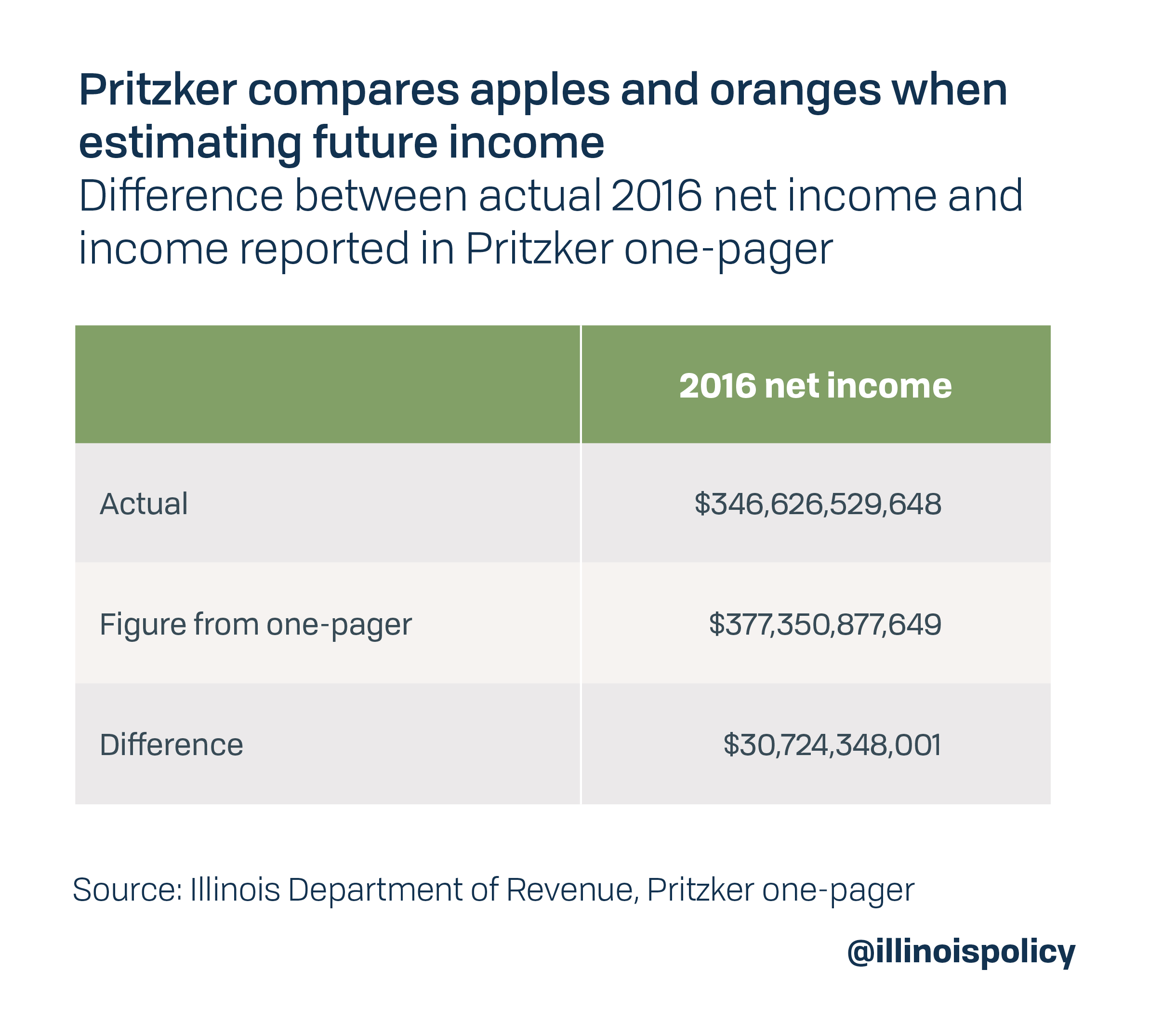

Not only do the figures released not match the actual data, the figures don’t match the total 2016 income number Pritzker initially released in the one-pager.

The reason is that the one-pager added non-Illinois-resident filer income – a highly volatile revenue source – to the total. In other words, they took growth rates from one data set and applied them to a different dataset which includes an additional $31 billion of income.

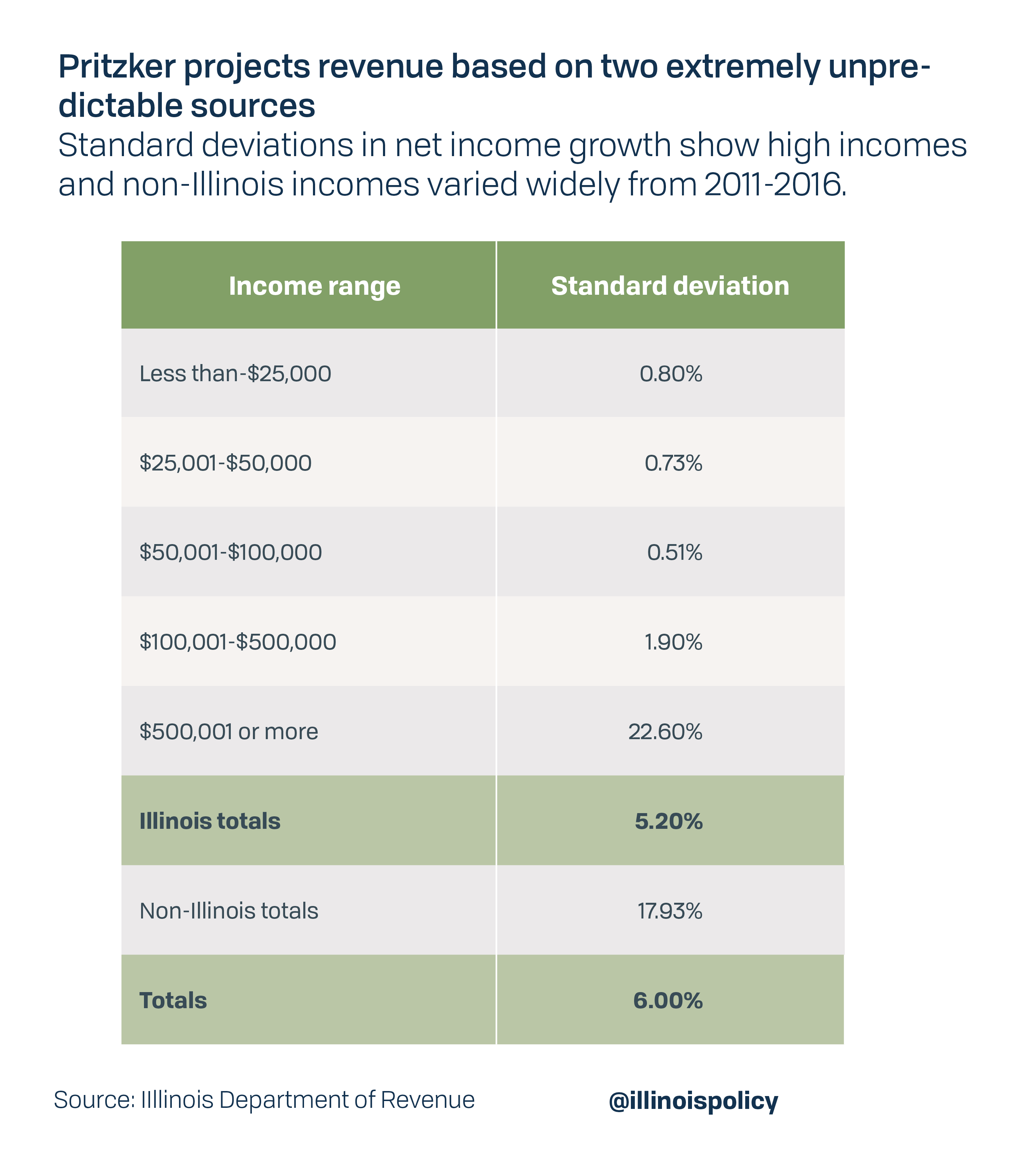

Obviously, the state will be able to generate tax revenue from those who work in Illinois but are not residents of the state. However, including non-resident income – a less certain source of revenue – makes their taxable income estimate rosier in 2021. It is also important to recall that the “97 percent of Illinoisans will see a tax cut” claim – which the governor has already begun to walk back – is based on the one-pager that includes 560,000 non-Illinoisans, so this claim is likely to be inaccurate. It is also irresponsible to rely on this income to grow at any normal rate because non-resident income is extremely volatile.

Income is also highly volatile for those at the top of the earning distribution, which Pritzker is relying on heavily to generate all of the new revenue. This is because these earners generate more of their income from investments which are subject to the ebb and flow of the economy. These massive fluctuations in income will make it even harder to project future tax collections and make income tax revenues less stable, contrary to the governor’s claims. The Civic Federation also warned about relying heavily on volatile income from top earners as a reliable source of future revenue.

The graduated income tax is expected to be a less stable source of revenue than the state’s current flat tax. This is because the Pritzker’s tax relies heavily on top earners. If Pritzker wants to make his tax plan a more “stable” source of revenue, he will end up raising middle class taxes

Bad assumptions

Even if the governor was correct about net income growth, using the growth rate from the past five years would be a bad estimate of future income growth. First, changes in net income reflect not only growth, but changes in the state tax code such as exemptions and deductions. These changes to the tax code could introduce higher volatility in net income. This is why a more accurate revenue forecast should use Adjusted Gross Income.

Second, Illinois is the only state in the nation to suffer five consecutive years of worsening population decline. Although the governor knows this, his estimates assume that there will be the same number of taxpayers in 2021 as there were in 2016, according to a FOIA response March 25 from the Governor’s Office of Management and Budget. That assumption is already wrong: Since 2016 Illinois has lost more than 80,000 residents and the problem is getting worse every year.

Furthermore, the growth assumptions made in the governor’s estimates are flawed. Illinois’ economic growth – and thus its income growth – is expected to be lower in the next few years. This is why:

- The U.S. economy as a whole is expected to slow down

- The growth rate of Illinois’ economy follows fluctuations in U.S. economic performance. However, Illinois consistently lags the growth rate of the U.S. economy

- Nominal GDP and adjusted gross income are highly correlated, which suggests that when the economy grows or slows, incomes follow at a similar rate (see appendix)

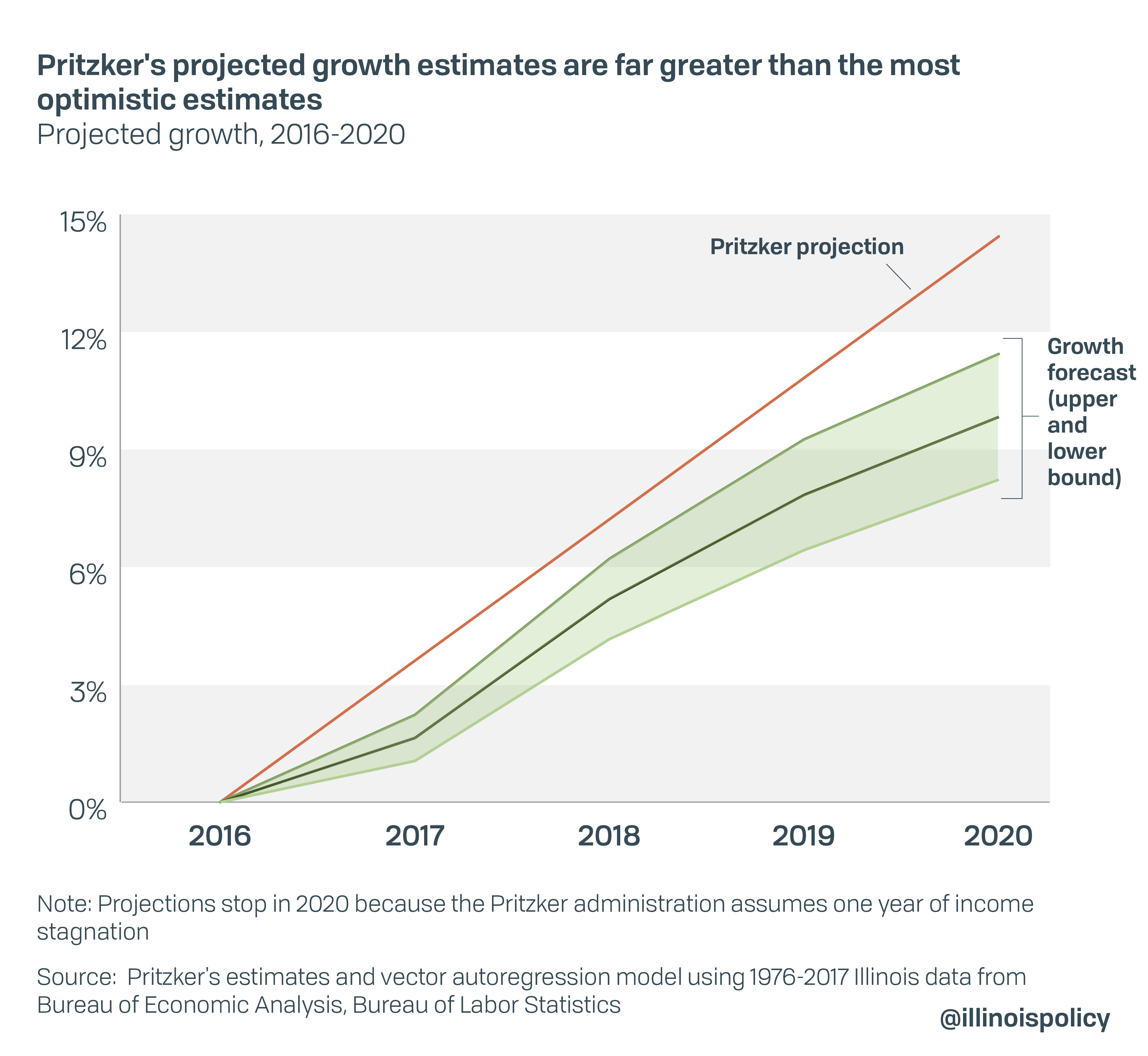

When employing one of the most widely used models for forecasting GDP growth, the data show Pritzker’s administration could be overestimating Illinois’ total adjusted gross income in 2021 by $14 billion to $32 billion (see appendix for methodology). This forecasting model matches the past performance of Illinois’ economy, thus providing reliable estimates of what economic growth will be in the future. These projections do not account for a recession or economic slowdown, which two-thirds of economists project by 2021.

Even under very optimistic assumptions about future growth, Pritzker’s growth estimates are still far beyond any reasonable projection.

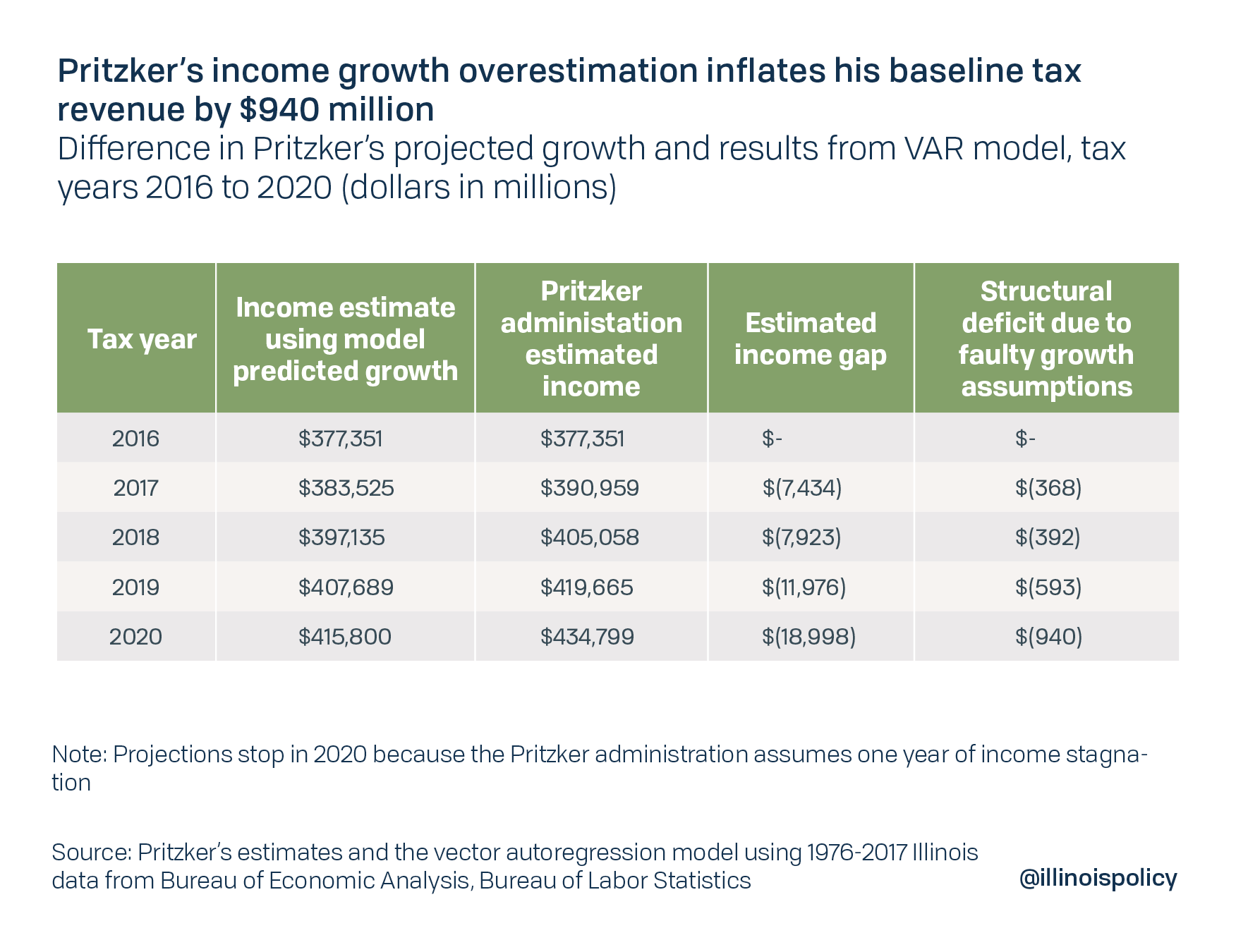

Because of the governor’s rosy projections for future growth in the Illinois economy, his expected tax collections are overstated. Pritzker would need to increase the size of his tax hike in 2021 by nearly $1 billion simply to cover the difference between his assumptions and a more reasonable growth estimate.

The current projection for the 2021 budget deficit is $3.3 billion. However, Pritzker’s faulty revenue assumptions are likely underestimating the size of the deficit. If the governor used more realistic assumptions about the growth in Illinois’ income and future tax collections, the structural deficit for 2021 would grow by $940 million, bringing the deficit to $4.2 billion by the time a graduated income tax hike could take place.

By using outlandish projections for income growth, the administration alleges that a graduated income tax plan is capable of bringing in an additional $3.4 billion while avoiding tax hikes for 97 percent of Illinoisans. Unfortunately, because the governor’s baseline is far off, his plan will not deliver on his promise of closing the structural deficit. When his plan ultimately fails to bring in enough revenue, he will have to raise taxes on middle-class Illinoisans.

Higher than the state’s own projections

Pritzker’s proposed fiscal year 2020 budget was already criticized by S&P Global Ratings for relying on overly optimistic revenue projections. His graduated income tax plan is no different.

In fact, Pritzker’s baseline tax collection estimates are $1.9 billion to $2.5 billion higher than the GOMB projected in November 2018. One reason is that GOMB included a three-quarter recession in its estimates, based on economic projections from analyst group IHS Markit.

A different path forward

Pritzker’s goals – healthy state finances, a strong economy and a tax cut for the middle class – cannot be achieved by the means he’s proposed.

Instead, Pritzker should look to structurally reform Illinois’ spending to address the largest cost drivers of the state’s fiscal problems: government worker health care costs and pension benefits. The Illinois Policy Institute shows how commonsense, bipartisan reforms can be achieved in its recently released “Budget Solutions 2020: A 5-year plan to balance Illinois’ budget, pay off debt and cut taxes.”

Lawmakers have two options ahead of them: They can continue to rack up debt and pursue tax hikes that will further damage the state’s economy, or they can break with past practices and pursue responsible budgeting that protects both taxpayers and core government services.