Pritzker hands federal relief to 2,600 small businesses while pushing for tax increase on 100,000

Despite the hardships small businesses face from COVID-19 restrictions, Pritzker continues to push for a tax increase on them.

Illinois Gov. J.B. Pritzker just handed 2,655 small businesses grants of $10,000 to $20,000 from federal funds for COVID-19 relief. On Nov. 3 he wants voters to hike taxes on more than 100,000 of those small businesses by up to 47%.

Pritzker wants his “fair tax” hike so badly that he took $56.5 million from his own pocket to fund the pro-tax campaign. For context, Pritzker’s money was enough for each of those 2,655 small businesses to receive more than the maximum federal grant: $21,281 each.

The Business Interruption Grant, or BIG, uses funds given to Illinois in the federal CARES Act to help small businesses that were forced to shut their doors during Pritzker’s stay-at-home order in the spring. The grant was given to businesses in about 400 communities that were significantly impacted by COVID-19 and then riots in June.

Jackie Jackson is on the list to receive $20,000 after her Kilwins chocolate shop was financially devastated by the COVID-19 closures and then looted. Rioters smashed the front window of her store at 310 S. Michigan Ave. in downtown Chicago.

“I just said, ‘Please you can take whatever you want. Just don’t smash anything.’ They took the iPad, the laptop; they even took stuff that doesn’t make sense,” she said.

The money will help, but the two financial disasters have left her needing much more.

“We tried to work out something with the landlord, so for July and August we paid the taxes, but we recently got a letter from the landlord saying he’s going to send us a default notice because the rent is at about $70,000. I was like, ‘Where are we going to get the money from?’”

While Pritzker touts himself as a champion of small businesses, he first put $5 million and then in June another $51.5 million of his money into his “fair tax” campaign to raise taxes by as much as 47% on more than 100,000 small businesses. Small businesses are responsible for 60% of the net job creation in Illinois and are the businesses most at risk from the economic fallout of COVID-19.

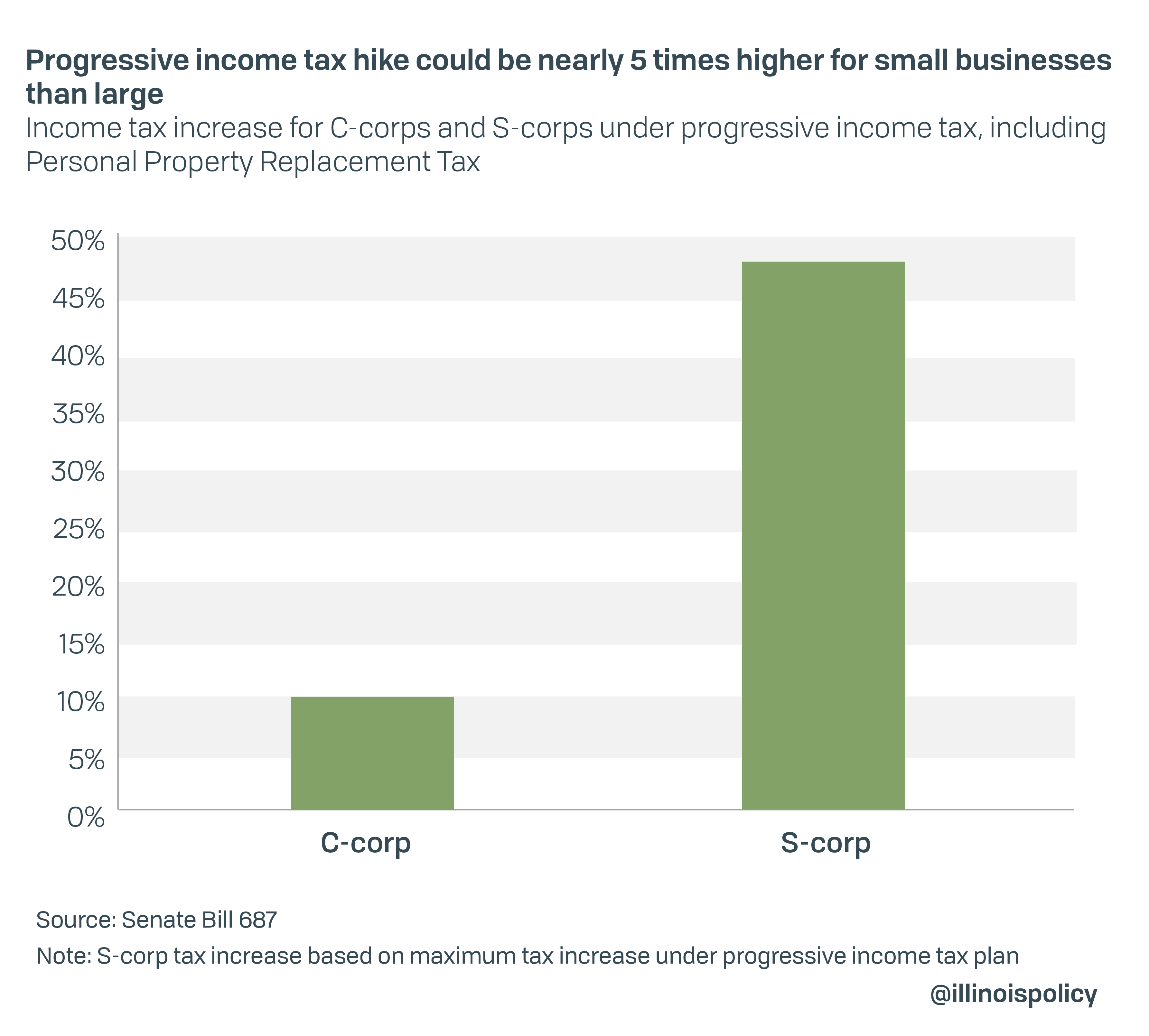

The progressive income tax hike would hit small businesses much harder than their large peers if voters approve it Nov. 3. Small businesses could face an income tax hike nearly five times larger than that for large businesses.

While the total corporate income tax rate – including the Personal Property Replacement Tax – will be hiked by 10% (from 9.5% to 10.49% when including the replacement tax), the tax hike for pass-throughs could be up to 47% (6.45% to 9.49% when including the replacement tax).

Even though all economic indicators show now is clearly a bad time for a tax increase, Pritzker believes now is the perfect time to hike taxes as millions struggle to find jobs.

When he was pressed in April about removing the progressive income tax amendment from the ballot because of the dire economic situation Illinois and the nation had entered, Pritzker said Illinois needed the progressive income tax amendment “more than ever.”

Help 2,600 small businesses with federal grants. Tax more than 100,000 small businesses as they struggle to put people back to work.

Pritzker’s priorities and his $56.5 million are woefully misplaced.