Pritzker budget relies on $800M in legally questionable accounting gimmicks

Illinois law requires the governor to propose a budget balanced with existing revenues. To do so, Gov. J.B. Pritzker proposes cutting aid owed local governments, raiding the road fund, letting health insurance costs pile up and withholding taxpayers’ refunds.

During his annual budget address, Illinois Gov. J.B. Pritzker proposed two paths for next fiscal year: one relies on an unapproved tax hike and the other relies on a mix of legally dubious accounting gimmicks and slower increases in spending.

Neither option can credibly be called a balanced budget under either state law or sound accounting standards. Both options would prolong Illinois’ decades-long fiscal decline, which has resulted in the nation’s worst overall fiscal health.

As both a candidate and governor, Pritzker has been critical of his predecessors for relying on dishonest budget gimmicks. During his first budget address, the governor mocked former Gov. Bruce Rauner for relying on a “fantasy line item” in which he had proposed unspecified savings from a “Grand Bargain” with the General Assembly. Later that spring, after signing the fiscal year 2020 budget, Pritzker rightfully decried that in previous years “the budget included gimmicks and tricks and was balanced in name only.”

However, Pritzker’s budget proposal that year included gimmicks and tricks of his own. An Illinois Policy Institute analysis found Pritzker’s first enacted budget had a deficit of between $574 million and $1.3 billion.

Now, the governor is proposing a budget that relies on significant gimmicks to appear balanced, with a total of $800 million in legally dubious cost shifting that includes growing the state’s $7 billion backlog of unpaid bills. Specifically, the governor’s budget calls for:

- Delaying payment on $400 million worth of state worker medical bills for health care provider services. The bills would be deferred to future years, growing Illinois’ bill backlog and potentially leading to lost coverage for workers similar to what happened during the 2016-2017 state budget impasse. The state is already projected to end fiscal year 2020 with $1.2 billion in unpaid health insurance bills for state employees, which carry a 9% annual interest penalty. This is akin to a family “balancing” its household budget but simply not paying medical bills.

- Failing to pay $300 million in corporate income tax refunds that are legally due to taxpaying Illinois businesses. The state had previously built up a $1.37 billion backlog in the refund fund at the end of 2011, the fund responsible for paying income tax refunds. Pritzker is proposing reviving this bill backlog intentionally – the refund fund ended fiscal year 2019 with a $616 million surplus – despite the fact that refunds more than 90 days late carry a 5% interest penalty.

- Raiding $100 million in transportation revenues from the road fund. From 2002 to 2015, state lawmakers took $6.8 billion from transportation funds and used it for other purposes, according to the Transportation for Illinois Coalition. In response, voters in 2016 overwhelmingly approved a “lockbox amendment” to the state constitution, with nearly 80% voting in favor. The amendment is intended to ensure that revenues related to transportation, such as gas taxes and vehicle registration fees, can only be used for transportation expenditures. Pritzker’s budget proposes “reserving” road fund revenues owed to local governments for unspecified “transit costs.” The budget provides no details regarding compliance with the lockbox requirement.

Of course, the governor’s preferred fiscal path relies on higher income tax revenues from the progressive tax.

But voters have not approved Pritzker’s plan to remove the flat tax protection from the Illinois Constitution and give state leaders greater power to tax at different tax rates based on income. The question will be on the ballot Nov. 3.

The Illinois State Budget Law requires the governor to propose a budget in which expenditures do not exceed revenues expected to be collected under current law. That means budget plans should not include unapproved tax increases, a bad budgeting practice that creates uncertainty for taxpayers and government service providers.

Therefore, Pritzker’s only compliant budget proposal is the one relying on the $800 million in gimmicks and $746 million in slower than expected spending increases. Programs that would see reduced growth in investment include pre-K through 12th grade education, public universities, human services, the state police and more. Local governments would also see state revenue sharing cut by $98 million and grants to purchase open park space cut by nearly $30 million.

In the long run, Pritzker’s administration projects his tax plan will take $3.7 billion more from the economy, about $3.6 billion of which would be used for the state budget after distributions to local governments. However, because it would take effect in the middle of a budget year, the fiscal year 2021 revenues – which covers July 1, 2020, to June 30, 2021 – are projected at $1.44 billion in the budget. Those extra revenues would only be disbursed if voters approved the tax plan at the ballot box.

Missed opportunities to fix Illinois finances

Unfortunately, Pritzker wrote off the biggest reform Illinois could adopt to address its fiscal crisis: constitutional pension reform. Pritzker relied on a bad legal argument to dismiss pension reform, claiming it was a “fantasy” that would be blocked by the U.S. contracts clause. Mark Rosen, a distinguished law professor at Chicago-Kent College of Law, explains why this is wrong in his recent response in Crain’s Chicago Business. Even if a federal court were to rule that unearned future pension benefits are part of a contract with state employees – and it is not certain they would – case law demonstrates contracts can be reasonably changed when necessary to prevent a breakdown in essential purposes of government, such as leaving government unable to fund education, public safety or other core services.

Without pension reform, Illinois is destined to continue its two decades of fiscal decline including reduced investment in spending on the poor and disadvantaged despite the state’s high tax burdens. The Illinois Policy Institute has built a record of predicting unbalanced budgets and calling out unsound accounting gimmicks.

Pritzker’s budget shows how hard it is to build a responsible fiscal plan for Illinois without structural spending reforms to the largest cost drivers, in particular pensions and state worker health care.

In 2019, the Institute’s 2020 fiscal plan detailed how pension and government health insurance reform could have reduced state spending without program cuts.

But rather than reforming public employee health insurance, Pritzker entered into a contract in 2019 with the state’s largest public sector union that provided automatic raises and back pay while continuing platinum health insurance benefits at little cost to the employees.

While the governor has touted slightly increased premiums, his budget shows this provision will save just $6 million for fiscal year 2021 compared to the prior year, close to the $9.7 million the Illinois Policy Institute predicted it would save. The Institute’s plan would have saved roughly $500 million per year over five years, but those reforms are now impossible to pursue until fiscal year 2024 when the current state worker contract expires.

Rather than following the status-quo path outlined by Pritzker, lawmakers should break out of the failed cycle of chasing ever-higher revenues and adopt structural spending reforms, starting with pensions. Illinois Forward, a fiscal plan recently released by the Illinois Policy Institute, shows how the adoption of three commonsense spending reforms can balance the budget, eliminate debt, solve the pension crisis and ultimately provide tax relief.

With structural spending reform as outlined in Illinois Forward, Illinois can make needed investments in programs to help its most vulnerable – including for the troubled Department of Children and Family Services – without tax hikes, increased debt or budget gimmicks that grow long-term costs.

Constitutional pension reform is the only serious solution to Illinois’ fiscal crisis

Ratings agencies have offered lukewarm responses – at best – to Pritzker’s budget proposal.

Ted Hampton, the lead state analyst of credit ratings agency Moody’s Investors Service, told The Bond Buyerin an interview that “the overarching problems still are there even if this budget is put in place.”

The biggest overarching problem? Structural pension deficits that Pritzker’s progressive income tax proposal won’t fix.

Illinois’ pension crisis is the worst in the nation and the most severe problem facing the state. Reducing the cost of pensions to a sustainable and affordable level, while still fully funding the system to avoid debt, is the most important task for any Illinois fiscal plan.

Simply put, tax hikes are not a viable solution to paying down Illinois’ pension debt.

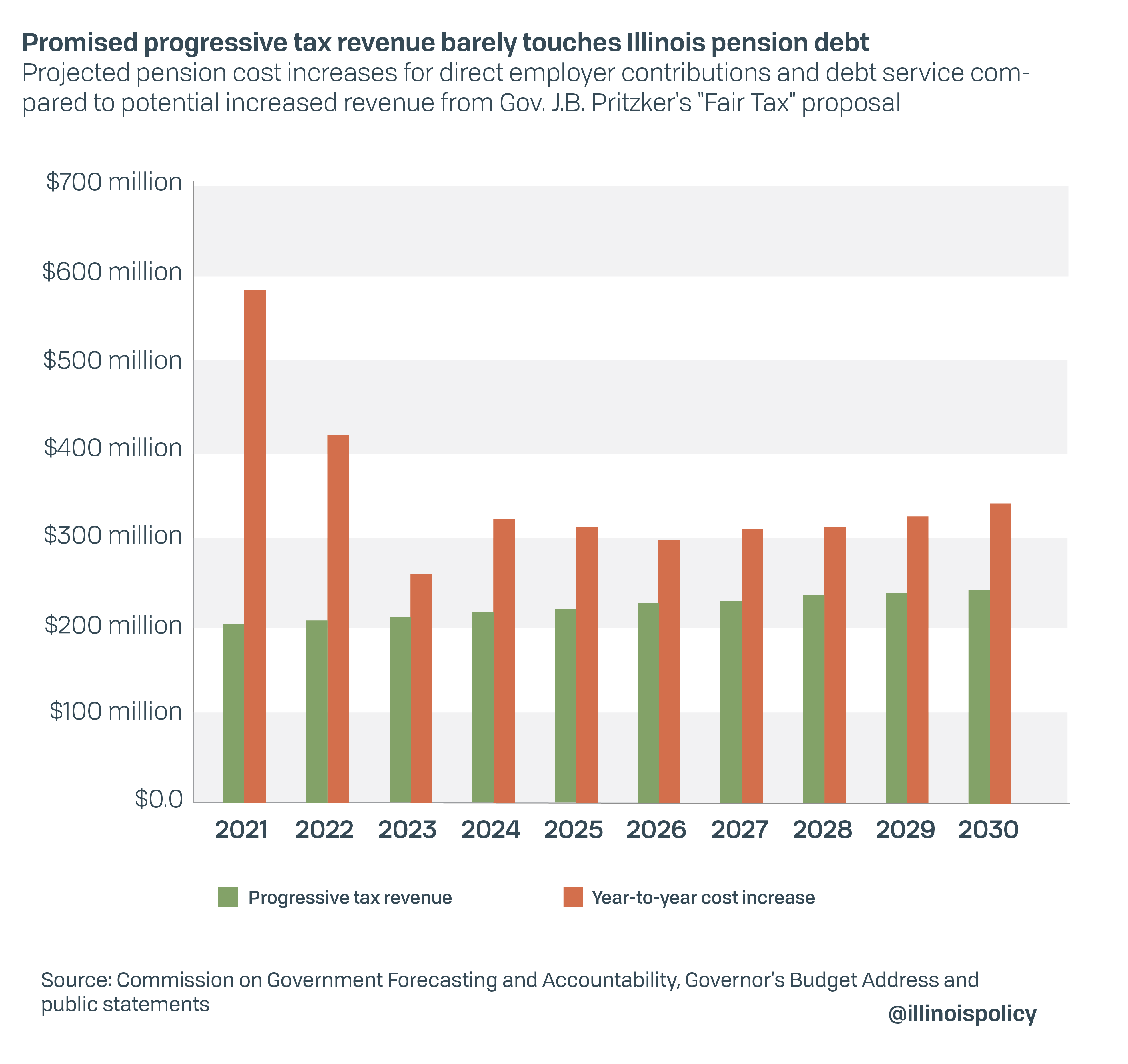

Even if voters approved the progressive tax and then lawmakers dedicated to pensions all of Pritzker’s original projection of $3.4 billion as the state’s share, it would cover less than four months of annual pension spending. In reality, only $200 million of the new revenue has been tagged for higher pension contributions in the long run. That amount would be reduced to $100 million for fiscal year 2021 because the new tax would only be collected for half of the year, roughly one-sixth of this year’s increase in pension costs.

This additional revenue is not enough to even keep Illinois level with annual pension cost increases, let alone meaningfully reduce unfunded liabilities. Illinois’ pension debt would continue to grow year after year under the current plan.

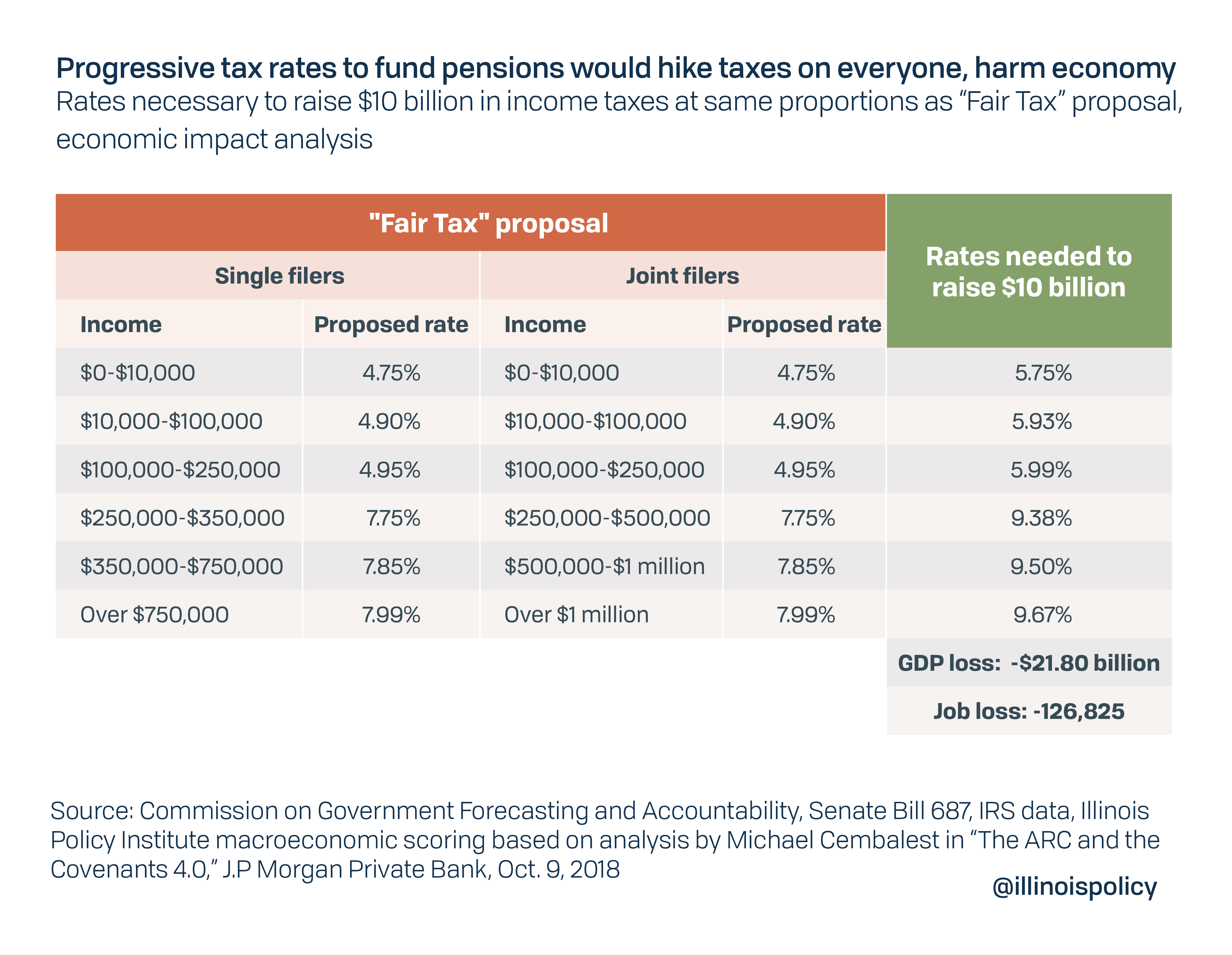

A progressive tax that would actually raise enough revenue to pay off the state’s unfunded pension liability would need to significantly raise taxes on everyone, rather than just the top 3% of earners as has been promised. A tax hike of the size necessary to solve the problem could cost Illinois’ economy nearly 127,000 jobs and $21.8 billion in lost economic output.

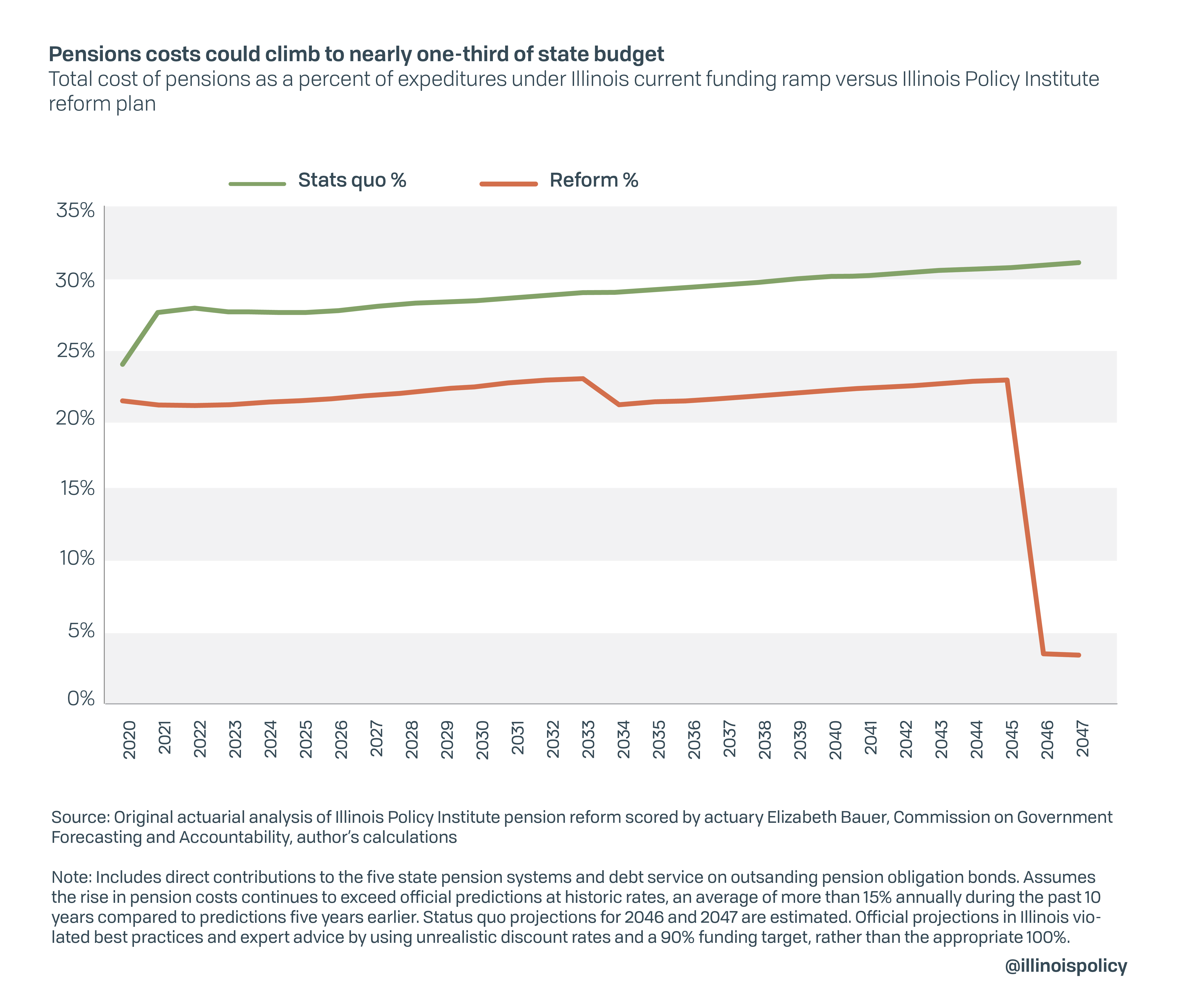

Pension costs have historically grown about 15% faster than predicted five years earlier. If this continues, pensions could climb to 30% of the budget in future years from more than 25% today.

If instead Illinois enacts a constitutional amendment allowing reforms to slow the growth in future pension benefits – without taking away what retirees and current workers have already earned – it could result in an average of $2 billion in annual budgetary savings during the next 10 years. Savings from now until 2045 would be more than $50 billion. The following year pension costs would fall back to historic single-digit levels as a percent of the budget, because the debt would be fully eliminated.

These are results of an original actuarial analysis of the Illinois Policy Institute’s pension reform proposal, scored by pension expert and Forbes contributor Elizabeth Bauer, an actuary. The plan would raise retirement ages for workers under 45, replace 3% compounding post-retirement benefit increases with a measure pegged to inflation and cap the maximum pensionable salary for workers hired before 2011. “Tier 2” workers hired after Jan. 1, 2011, already have a pensionable salary cap. The Institute’s reform plan would benefit younger workers by increasing the cost-of-living adjustment to full inflation from the current one-half of the consumer price index for urban areas. And it would eliminate the pension debt by 2045 rather than settle for the state’s current plan of funding 90 cents on the dollar by then.

These savings are also achievable while preserving the core benefit for every worker and retiree. No retired person would see the size of their current check decrease and no current worker would see their currently promised monthly annuity shrink.

There is no fairer solution for both taxpayers and those relying on Illinois’ pension systems for their retirement security.

Pritzker should match his actions to his words and abandon failed strategies of the past, including tax hikes, budget gimmicks and deferring costs to future years. Constitutional pension reform offers a path to a better future with truly balanced budgets, debt relief and shrinking tax burdens.