New analysis shows Illinois income tax collections could fall by as much as $6.6 billion this year

CHICAGO (April 15, 2020) – Next year’s Tax Day is the first time Illinoisans could feel the effects of Gov. J.B. Pritzker’s progressive income tax, which is slated to appear on the Nov. 3 ballot and has been promoted as a “fair tax” on the rich. But a new Illinois Policy Institute analysis shows the typical Illinois family would have to pay anywhere between $286 to $1,056 more under a progressive income tax if lawmakers rely solely on increased revenue to offset income tax revenue losses from the COVID-19 outbreak.

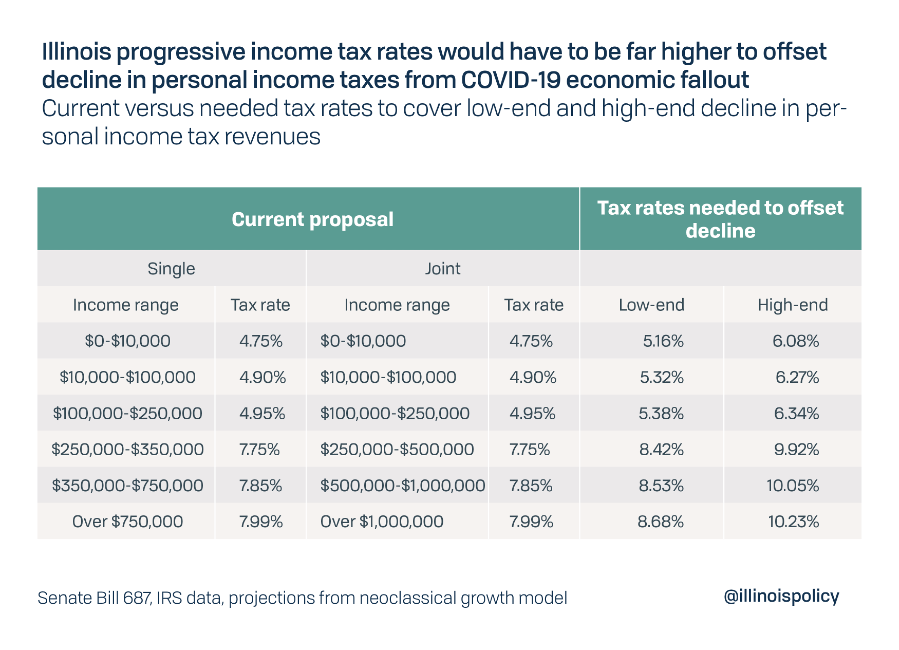

Illinois is expecting to take a huge state revenue hit as a result of COVID-19. That could mean personal income tax revenues fall by as much as $6.6 billion in 2020 alone, according to Institute research. If a progressive income tax structure were to be adopted, rates would have to jump to a range of 6.08% to as high as 10.23% just to recover lost income tax revenue.

A tax hike of this magnitude upon working families would severely dampen the recovery, especially after a crisis that has triggered record unemployment. As the state works to prevent the spread of the disease, businesses are failing and Illinoisans are losing work. Hiking taxes would only exacerbate this economic pain.

Fast facts from the analysis:

- The median family in Illinois earns $81,313 annually. In order to offset the personal income tax revenue losses projected from COVID-19, this family could see their income taxes increase by between $286 and $1,056, if the governor’s progressive income tax structure is adopted.

- With current proposed rates for the progressive income tax ranging from 4.75% to 7.99%, revenue would fall nearly $3 billion short of offsetting personal income tax revenue lost this year due to COVID-19.

- In fiscal year 2020, Illinois collected $19.7 billion in individual income taxes, the largest source of tax revenue for the state. By comparison, if current projections hold, Illinois could see a reduction in income tax revenues ranging from $2.9 billion to $6.6 billion.

- Illinois was already facing a $1.7 billion budget shortfall for the upcoming fiscal year, prior to the COVID-19 crisis.

- Experts predict an economic contraction of between $54 billion and $113 billion in Illinois for the second quarter of 2020.

- Illinois has virtually no rainy-day fund. The state’s budget stabilization fund currently has $1.19 million, enough to cover just over 15 minutes of state spending.

Orphe Divounguy, chief economist for the nonpartisan Illinois Policy Institute, offered the following statement:

“While the final economic effects of the novel COVID-19 crisis are still unknown, one thing is certain: the decline in economic activity is unprecedented. This means a large decline in tax revenues that would have been even larger if Illinois had a progressive income tax structure. States that rely too heavily on revenue from an income tax – especially a progressive tax that leans on small groups of taxpayers – will see larger declines in revenue during this economic downturn.

“Relying on the adoption of a progressive income tax to offset revenue losses is also misguided. The anticipated income tax revenue from the current progressive income tax rates won’t cover half of the projected budget deficit – let alone the billions more lost in personal income tax revenue – prompting the state to raise income tax rates on everyone to cover the shortfall. A tax hike in November would only act to halt any potential economic recovery from the virus subsiding.

“The best way lawmakers can provide certainty and stability for Illinois residents and businesses is to remove the progressive income tax question from the November ballot and enlist strategies other than tax hikes to promote a robust recovery.”

To read the full analysis, visit illin.is/covidrates.

For bookings or interviews, contact media@illinoispolicy.org or (312) 607-4977.