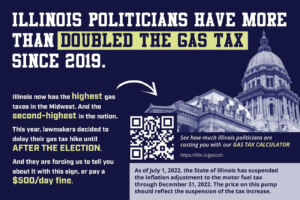

New signs direct drivers to an Illinois Policy Institute calculator to find out just how much Illinois gas taxes, which are second-highest in the nation, added to their fill-up.

PRESS RELEASE from the

ILLINOIS POLICY INSTITUTE

CONTACT: Micky Horstman (312) 607-4977

New signs remind drivers why gas taxes make fill-ups pricier in Illinois

The Illinois Policy Institute combats gas tax propaganda

CHICAGO (June 30, 2022) – Starting July 1, Illinois gas station owners face a $500-per-day fine if they fail to post signs on every gas pump announcing a six-month delay in the state’s next gas tax increase.

The Illinois Policy Institute partnered with the Illinois Fuel and Retail Association, which represents about 95% of Illinois’ gas stations owners, to produce signs that comply with the mandate to announce the pause. The signs also direct drivers to an Illinois Policy Institute calculator to find out just how much Illinois gas taxes, which are second-highest in the nation, added to their fill-up.

For example, in Chicago, $1.12 in taxes is added to every gallon of gas. On a record $6 gallon, 93 cents is directly from state and local gas taxes. Illinois is one of only seven states to levy a sales tax on top of a motor fuel tax, meaning it charges tax on its taxes.

“While pain at the pump is felt nationwide, gas prices are always worse for Illinoisans because of our high gas taxes and sales tax on gasoline,” said Adam Schuster, vice president of policy for the Illinois Policy Institute. “We need to hold lawmakers accountable for their role in these inflated gas prices.”

In 2019, Gov. J.B. Pritzker doubled the gas tax to 38 cents per gallon from 19 cents. He also changed the law so Illinois gas taxes increase at the rate of inflation every July 1. But tomorrow’s increase is paused until Jan. 1, 2023, meaning drivers will face two increases in 2023, worth an estimated 6 cents per gallon total. That could bring the state gas tax to 45.2 cents by July 1, 2023.

“Pritzker’s attempt to provide temporary relief for Illinois residents helps them until just after the election is safely over, meaning it’s more gimmick than aid. A repeal to the annual automatic tax hike would make a bigger difference in helping Illinois drivers,” Schuster said.

The institute also launched an ad campaign at 13 gas stations around Chicago. The ads share the link to the calculator and remind Illinois drivers who’s responsible for inflated gas prices. Drivers will see the ads through July 10 in Chicago, Mount Prospect, Robbins, Countryside, Oak Park and Harvey.

To use the gas tax calculator, visit illin.is/calculator.

For bookings or interviews, contact media@illinoispolicy.