Proposed federal stimulus checks will not cover a single year of the ongoing, hidden public pension cost to each Illinoisan’s bottom line

PRESS RELEASE from the

ILLINOIS POLICY INSTITUTE

MEDIA CONTACT: Melanie Krakauer (312) 607-4977

Illinois’ pension crisis takes an invisible $1,417 per year out of every Illinoisan’s pocket

Proposed federal stimulus checks will not cover a single year of the ongoing, hidden public pension cost to each Illinoisan’s bottom line

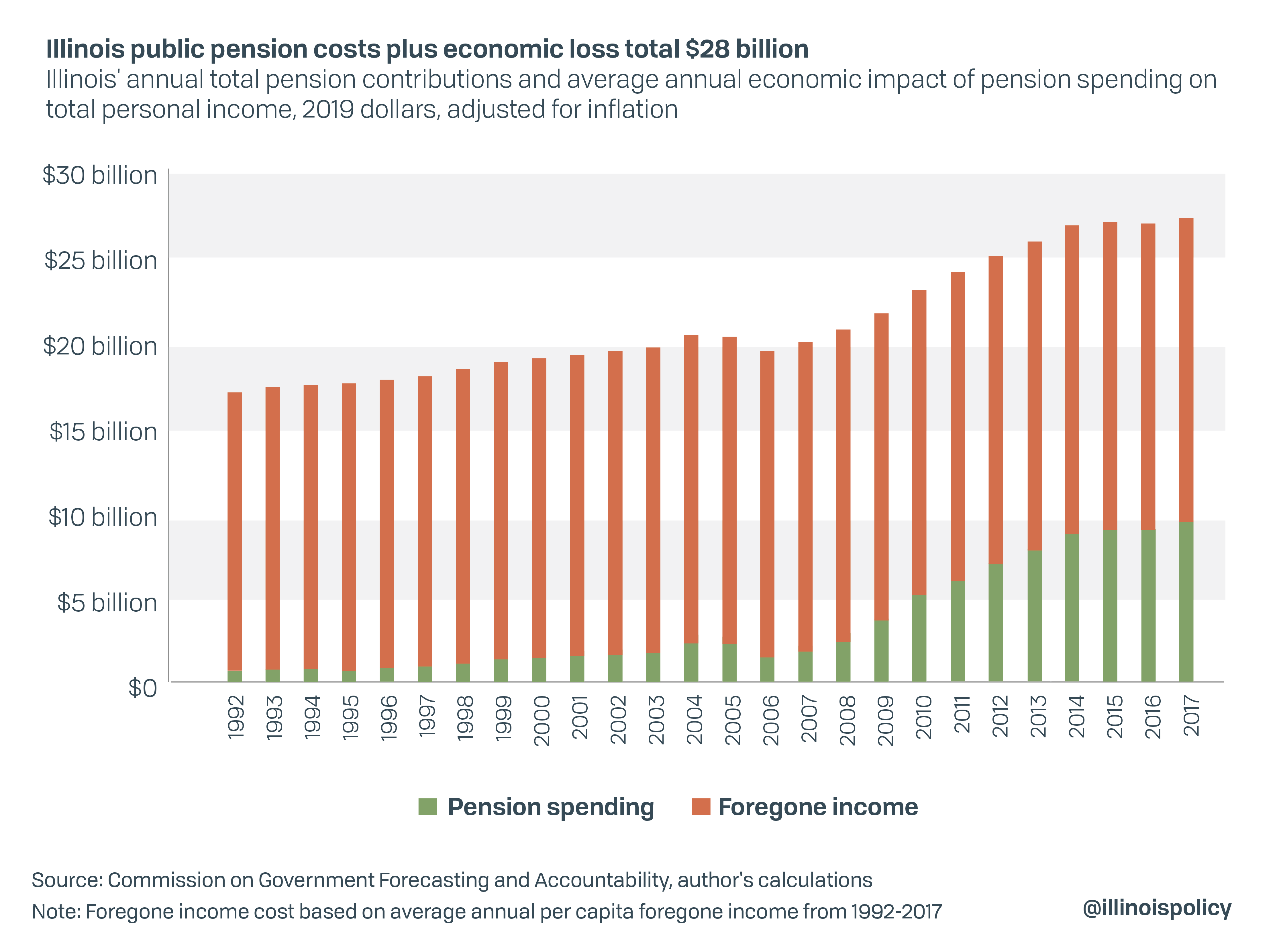

CHICAGO (March 3, 2021) – Illinois’ state pension crisis has a hidden price in addition to taxes: It takes $1,417 per year in potential income from each Illinoisan. That is more than Illinoisans are expected to receive from President Joe Biden’s next federal stimulus check, and unlike the relief check, this hidden cost is likely to grow every year.

Research from the nonpartisan Illinois Policy Institute found increased state spending on pensions has slowed the state’s economy and forced workers to miss out on tens of thousands of dollars in take-home pay during the course of their careers.

Illinois has seen the nation’s second-largest decline in income growth because the state diverts spending to pensions that should go to public investments and social services – such as scholarships to low-income students, child protective services and education spending.

Meanwhile, the U.S. House of Representatives passed a stimulus bill last week to give residents $1,400 – less than each Illinoisan loses from the burden of pensions. The U.S. Senate is now considering the proposal.

What a hidden pension ‘tax’ costs Illinoisans:

- If Illinois had been able to invest more in social services instead of a growing pension burden, Illinoisans would have seen higher incomes over their careers. Comparatively, personal income grows faster in states that spend less of their budget on pensions.

- Illinoisans are already on the hook for $39,458 per household in state and local pension debt, according to the U.S. Pension Tracker, a project of Stanford University.

- Pension spending has grown by more than 500% during the past 20 years, adjusting for inflation, to consume more than a quarter of the state budget.

- Illinois’ economic recovery is significantly lagging behind the national average and other states in the Midwest.

Bryce Hill, senior research analyst at the nonpartisan Illinois Policy Institute, provided the following statement:

“Every dollar spent on pensions is a dollar diverted away from services that benefit most Illinoisans such as education, infrastructure and even direct government transfers to low-income families. These services can help drive economic gain. In the end, taxpayers have lost income they might have had if the state government had better invested its budget.

“Removing the hidden pension tax would do even more for Illinoisans over the long run than the additional $1,400 federal stimulus check that’s part of the Biden administration’s current plan. A constitutional amendment that allows for modest pension reform, such as replacing guaranteed 3% compounding annual benefit increases with a true cost-of-living adjustment tied to inflation, would free up the necessary resources for Illinois to maintain core public services while reducing the economic burden on struggling Illinois families.”

To read more about the hidden costs of the pension crisis, visit: Illin.is/pensiontax.

For bookings or interviews, contact media@illinoispolicy.org or (312) 607-4977.