A proposed amendment to the Illinois Constitution would effectively transfer power over tax dollars to special interests

PRESS RELEASE from the

ILLINOIS POLICY INSTITUTE

CONTACT: Melanie Krakauer (312) 607-4977

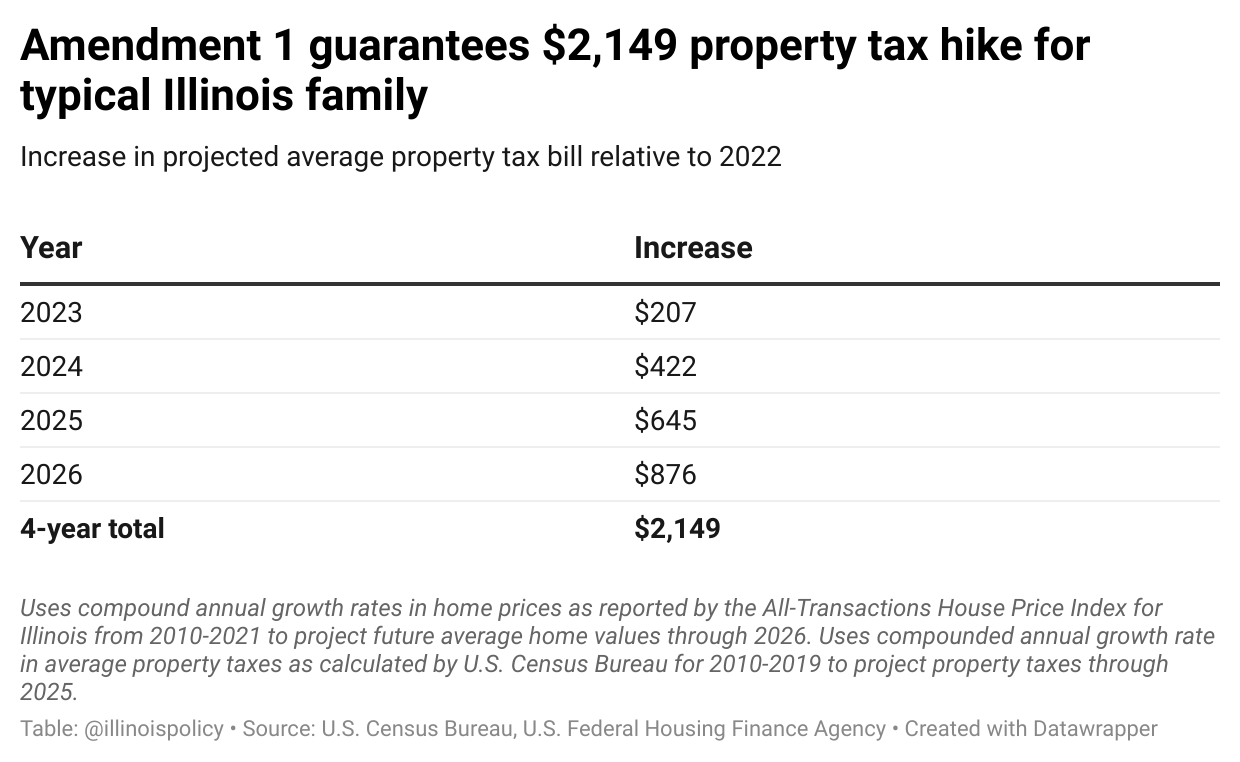

Amendment 1 would guarantee $2,149 property tax hike for typical Illinois family

A proposed amendment to the Illinois Constitution would effectively transfer power over tax dollars to special interests

CHICAGO (June 16, 2022) — At the general election on Nov. 8, Illinois voters will decide the fate of Amendment 1, a proposal being sold as a “workers’ rights amendment” that in reality would hike taxes on Illinois families.

If it passes, the Illinois Policy Institute estimates Amendment 1 would guarantee families pay $2,149 more in property taxes by 2026.

“The amendment would prevent almost any promise of property tax reform, ever,” said Adam Schuster, vice president of policy for the Illinois Policy Institute. “It would give government union leaders an effective veto over commonsense reforms while giving those same special interests virtually limitless new ways to increase costs for taxpayers. That means Illinoisans will continue to see their property taxes rise without an increase in their home values or in the quality of public services.”

The amendment language includes three provisions which would weaken taxpayers’ voice in state government and make it easier for government union leaders to make unaffordable demands in collective bargaining agreements.

Research indicates property taxes could rise higher and faster than even estimated, but by how much remains uncertain because Amendment 1 would lead to unprecedented government union bargaining powers that don’t exist in any other state.

To read more about rising property taxes, visit illin.is/amendment1tax.

For bookings or interviews, contact media@illinoispolicy.org or (312) 607-4977.