The Policy Shop: The connection between Illinois’ pension and population crises

This week’s The Policy Shop is by Bryce Hill, director of fiscal and economic research for the Illinois Policy Institute.

Illinois’ pension crisis is the driving force behind its high property taxes. With $140 billion in unfunded liabilities in the five state-run systems alone, plus another $70 billion in local pension system debt, state lawmakers’ default solution has been to increase taxes, take on more debt or threaten service cuts. Local governments keep raising and throwing property taxes at the problem. The right thing to do is to pursue pension reform, which would not only stabilize the state’s finances but also help local governments get their own ballooning local pension costs under control. That would mean … property tax stabilization. And, ultimately … relief.

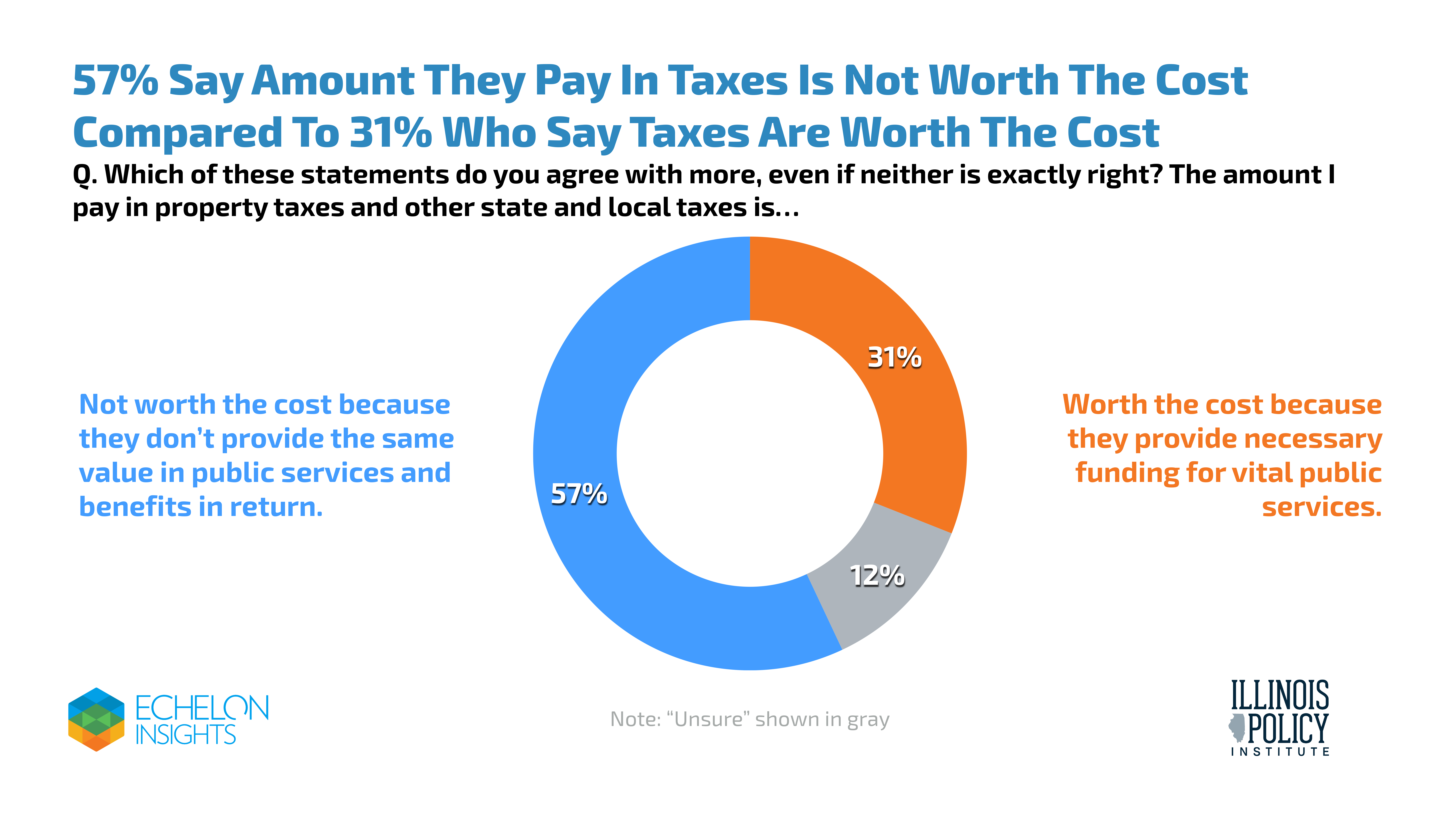

Tax burdens. 57% of Illinois voters polled said their property taxes are too high. Many are leaving the state because of it, according to new polling from Echelon Insights in partnership with our team here at the Illinois Policy Institute.

Kiplinger’s annual state tax analyses at the end of last year found Illinois’ second-highestproperty taxes, eighth-highest combined sales tax and above-average income taxes are costing middle-class families more than anywhere else in the country. Again, more than anywhere else in the country.

The reports also determined Illinois retirees pay the second-highest combined rates in the U.S. for property, sales, income and estate taxes. Only retirees in New Jersey paid more. Of note: Senate Bill 140 in the Illinois General Assembly would repeal Illinois’ estate tax. Lawmakers have stuck it in the assignments committee, where bills go to die.

Illinoisans prefer pension reform. New polling shows Illinoisans prefer to address the pension crisis by amending the Illinois Constitution as opposed to hiking taxes and cutting services – politicians’ go-to, which is making Illinoisans go to other states. The poll found 56% supported amending the state constitution to reform pensions.

The crisis. Since 2000, pension spending is up 584% in our state, while total spending grew by 21% and many vital services to the state’s most vulnerable were cut by 20%. Illinois’ annual pension contributions have historically been lower than actuaries said were needed, which is a major reason why the state’s pension debt has continued to grow. Since the inception of the state’s current funding schedule in fiscal year 1996, the state has shorted the funds by $58.5 billion.

It’s no surprise where funding problems are happening. What is surprising is our government leaders have failed to consider changes voters want and that would fix it.

While Gov. J.B. Pritzker sent out one-time property tax rebate checks averaging $200, Illinoisans’ overall property taxes have still gone up $2,228 since he took office.

Is there really a solution? YES. Illinois lawmakers from both sides of the aisle in 2013 tried to fix the state’s pension system by reducing cost-of-living raises for pensioners who served shorter careers but earned the highest salaries. The law was struck down by the Illinois Supreme Court in 2015 for violating the state’s pension clause, which states benefits can’t “be diminished or impaired.” But a “hold harmless” pension reform plan, such as one developed by the Illinois Policy Institute and based loosely on the bipartisan 2013 reforms, could help eliminate the state’s unfunded pension liability and achieve retirement security for pensioners. The 2013 reforms were rejected by the Illinois Supreme Court, which is why reform requires a change to the Illinois Constitution.

Lawmakers in Springfield must pursue pension reform to achieve retirement security for Illinois’ public servants. Without reform, Illinois’ unfunded liabilities will continue to grow and the state’s pension systems will become even leaner. That puts the retirement of Illinois’ public servants at risk, while also driving more Illinoisans out of the state as taxes rise unnecessarily.