Ep. 66: The Chicago Teachers Union’s war on school choice

The Chicago Teachers Union and other teachers’ unions oppose Invest in Kids, a tax-credit scholarship program that allows underprivileged children to attend private schools of their choice. Why would teachers advocate against a program that helps low-income students? Mailee Smith, staff attorney and director of labor policy at Illinois Policy Institute, refutes opponents’ false claims about the program and explains why the Illinois General Assembly should reinstitute Invest in Kids during its next session.

This week’s Policy Shop is by Mailee Smith, staff attorney and director of labor policy at the Illinois Policy Institute.

Happy New Year, friends!

We hope your holidays were festive and fun, and that your kids are happily back in class to start the new year.

To kick us off, this edition of The Policy Shop will tackle the big debate on school choice, which is heating up as lawmakers head back to Springfield.

That’s because Illinois’ life-changing Invest in Kids program is set to expire … unless lawmakers take action to keep it and the scholarships it funds for low-income kids alive. Unsurprisingly, teachers’ union bosses are trying to kill the program. But competition is a good thing, and even if a child opts to use an Invest in Kids scholarship at a private school, their local public school doesn’t take a funding hit. Win-win, right?

Let’s dive in.

Illinois is Investing in Kids … for now: Set to sunset at the end of 2023, Invest in Kids relies on donors for scholarships for low-income children so they can attend the school of their choice. The state limits the program to $75 million per year. To qualify, students must come from a household with an income below 300% of the federal poverty level. The program expands options for families who would send their child to a private school but can’t afford the tuition. While public schools are funded by property taxes and payments from the state and federal government, Invest in Kids is funded through donations, with only a tiny fraction of potential revenue lost to the income tax credits.

The $75 million in income tax credits from Invest in Kids represents roughly 0.29% of the state’s $26 billion in total income tax revenue. The program is minuscule compared to the budget but is a lifeline for kids in need.

The bill: We expect a bill to be heard during the lame-duck legislative session sometime this month that could determine if the program will sunset at the end of 2023 or if it becomes permanent. Lawmakers could make the program permanent through the bill.

Naysayers: Teachers’ unions have long opposed giving parents options, seeing school choice as a challenge to their power. They are telling lawmakers to let the scholarships expire, claiming the program takes away funds from public schools by reducing tax revenue.

“Unfortunately, Illinois legislators have voted to ‘reform’ the worst school funding system in the country with a ticking time bomb of a voucher scheme, and the Illinois Democratic Party has crossed a line which no spin or talk of ‘compromise’ can ever erase,” the Chicago Teachers Union said in 2017 when Invest in Kids passed. “Instead of raising revenue, the mayor and the governor have attached a parasitic voucher program to the bill to create a tax shelter that will benefit big corporations.”

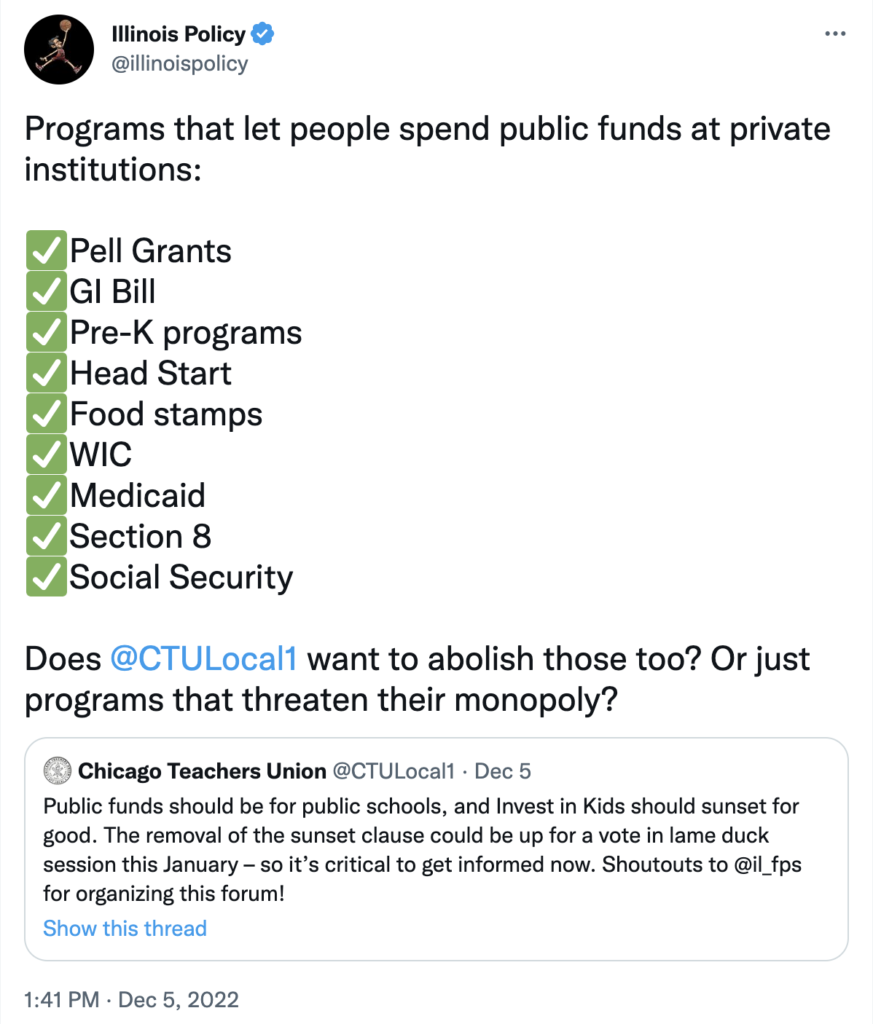

That’s just not right. As we mentioned, Invest in Kids is funded through donations, not tax revenue. And, even if it were … don’t teachers’ unions like many programs that let people spend public funds at private institutions? Hmm …

Fighting for it: Families who have benefited from the scholarships are asking lawmakers to make the program permanent to keep their kids in the schools that offer the best fit for them.

Manuel Rodriguez’ advertising business lost income during the pandemic, so his family had to cut back. They refused to give up their children’s private education, and it cost them a car.

“In 2020, unfortunately, we didn’t receive Invest in Kids scholarships for either of our children. It affected us a lot because there wasn’t a lot of work, either. We had to reduce our expenses, and even still we fought hard to keep both our kids in private school. We had to sell a car in order to stay afloat financially,” Rodriguez said.

Along with the Rodriguez children, 7,600 low-income students in Illinois rely on Invest in Kids tax credit scholarships to maintain that stability in their education. Whether for personal values, educations that better fit their learning needs, safety or financial reasons, over four times that number want help to attend a qualified, non-public school. Over 32,000 are on the Empower Illinois waitlist alone.

“The scholarships help us a lot because I am self-employed, and I don’t always have a fixed income. On my own, it would be very difficult to afford the tuition and fees at our local private school. The scholarship has helped me to keep my kids in a good school,” Rodriguez said.

Call to action: If you are passionate about school choice, contact your lawmaker and tell them to support making Invest in Kids permanent.

Correction: Earlier versions of this article contained the wrong percentage Invest in Kids represents of the Illinois state budget.