Illinoisans pay 2.5 times for their politicians

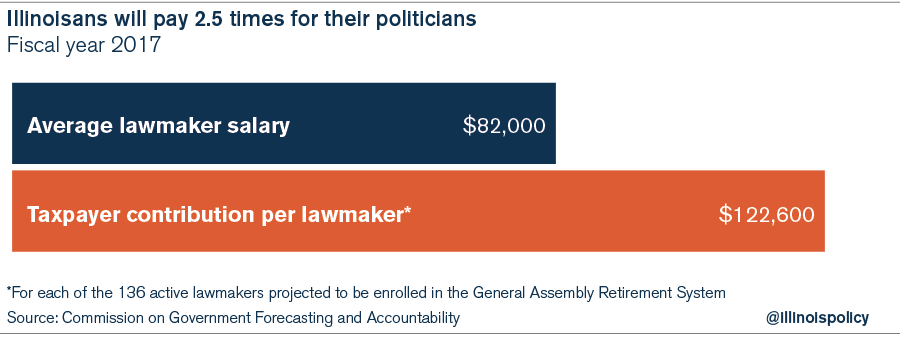

Taxpayers pay once for state politicians’ salaries and another 1.5 times for their bankrupt pension system. In 2017, taxpayers will contribute the equivalent of nearly $123,000 for each lawmaker just to keep the General Assembly Retirement System afloat.

If Illinoisans are already frustrated with their state politicians, taxpayers will be furious to learn they’ll soon be paying the equivalent of 2.5 salaries for each politician: once for the lawmaker’s salary and 1.5 times more to keep the lawmakers’ pension plan from going bankrupt.

According to the Commission on Government Forecasting and Accountability, the average legislative salary currently equals almost $82,000 – already too high for what is legally a part-time job.

But on top of paying for state politicians’ salaries, Illinois taxpayers must also contribute toward their lawmakers’ pension fund. In 2017, taxpayers will contribute the equivalent of nearly $123,000 for each Illinois lawmaker just to keep the General Assembly Retirement System, or GARS, from going bankrupt. That’s one and a half times more than the average legislative salary.

To be clear, the average GARS member won’t receive $123,000 in annual pension benefits. The current average pension for a General Assembly retiree is about $58,400.

Rather, the $123,000 taxpayer contribution per active lawmaker is the amount taxpayers are being forced to pay to keep the legislative pension plan from going bankrupt. GARS is the worst-funded state-run pension plan with just 16 percent of the funding it needs today to meet its future obligations.

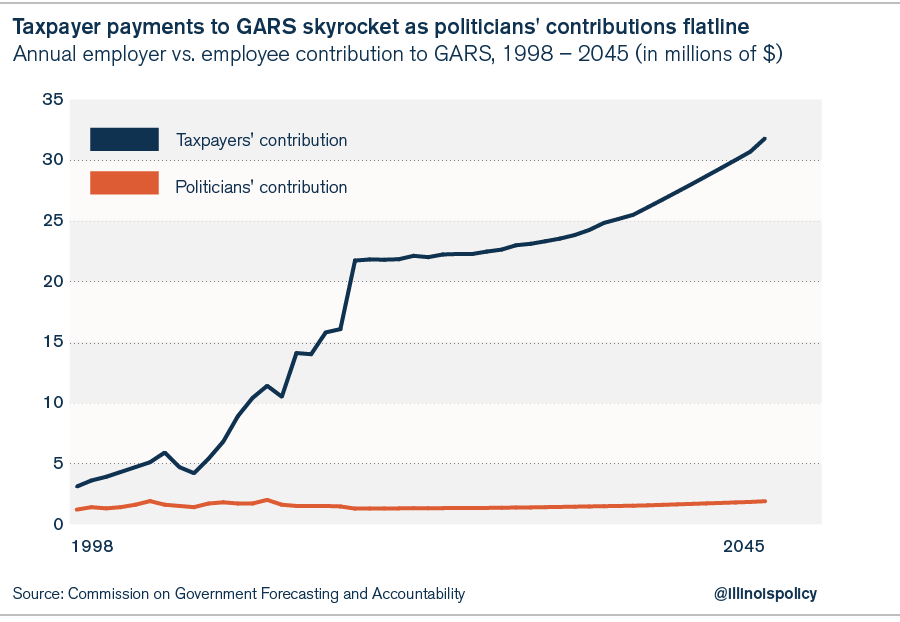

To help prop up the system, the state (taxpayers) next year will contribute 17 times more than lawmakers will toward politicians’ pensions. In fiscal year 2017, the state will contribute nearly $21.7 million, while lawmakers, on the other hand, will put in just $1.28 million toward their own pensions.

By 2045, taxpayers will pay more than $31.8 million a year into GARS, while lawmakers will contribute just $1.9 million.

Reforming GARS

Given the disastrous performance of GARS and its burden on taxpayers, why haven’t Illinois politicians reformed their own retirement plan?

Politicians face no obstacles to reforming their own retirement system. They have no unions to oppose reforms in court.

But there’s a likely reason why many Illinois lawmakers are hanging on to their pension plans. Many have become career politicians earning full-time benefits – even though serving in the General Assembly was never meant to be a long-term career like teaching, law enforcement or firefighting.

According to GARS rules, retired lawmakers earn a pension equal to 85 percent of their final salary after just 20 years of service.

As a result, the average retired lawmaker receives $58,400 in annual pension benefits. And that annual pension grows every year – current retirees are also entitled to an annual, automatic and compounded 3 percent cost-of-living adjustment.

These overly generous benefits for part-time work put lawmakers’ financial interests in direct conflict with the need to reform GARS.

But by reforming their own retirement plan, lawmakers can demonstrate to their constituents – as well as to other government workers – that they are willing to lead by example.

State lawmakers should create a new self-managed plan for themselves that’s fair and ends their insolvent pension fund. Illinois’ existing self-managed plan for nearly 19,000 state-university employees participating in the State Universities Retirement System offers a great model for lawmakers.

Reforms to GARS could serve as the basis for the reform of Illinois’ other state and local retirement systems, finally bringing retirement security to government workers and tax relief to all Illinoisans.