Pension costs ravaging Rockford’s budget as leaders consider police and fire cuts

Rising pension costs in Illinois’ fifth-largest city are pushing Rockford near the edge of a fiscal cliff – a fate that officials are looking to reverse with a series of steep public service cuts.

The city of Rockford is weighing a number of painful measures to make room for employee salaries and the city’s growing pension liability.

Included among the proposals, according to the Rockford Register Star, are the sale of the city’s water system and significantly downsizing its police and fire departments through attrition, eliminating 40 and 27 positions, respectively.

Rockford is one of a number of severely distressed local governments in Illinois dealing with three closely related problems:

- A shrinking population

- An enormous, growing pension burden that is crowding out core government services

- An already-heavy property tax burden that limits the city’s ability to raise revenue without driving out more residents and businesses

If state lawmakers don’t act to allow reasonable reforms to Illinois’ pension systems, odds of solving any of these problems are slim.

Crowding out

Since 2013, Rockford’s pension costs have doubled to $18 million from $9 million per year, which has plunged the city’s finances into crisis. Absent drastic changes, Rockford will completely deplete its budget reserves within five years, according to a consultant’s report for the city.

Led by growth in the city’s pension obligations, Rockford’s expenses are projected to grow three times faster than revenues over the next seven years, which could result in an overall $81 million deficit. “At that point,” according to the Star, “Rockford could eliminate every aspect of city government except for police and fire protection and still not realize enough savings to dig the general fund out of its hole.”

On Oct. 8, Rockford Mayor Tom McNamara unveiled a budget proposal for fiscal year 2019. And while that proposed budget is balanced, the mayor has acknowledged that the Rockford’s long-term fiscal outlook is cause for alarm. “By 2040, we’re going to be spending more money on pensions than we are bringing in and all of our property tax revenue,” McNamara said, according to WREX-TV. But as early as 2025, the mayor says, pensions will consume nearly 60 cents of every dollar of city revenue.

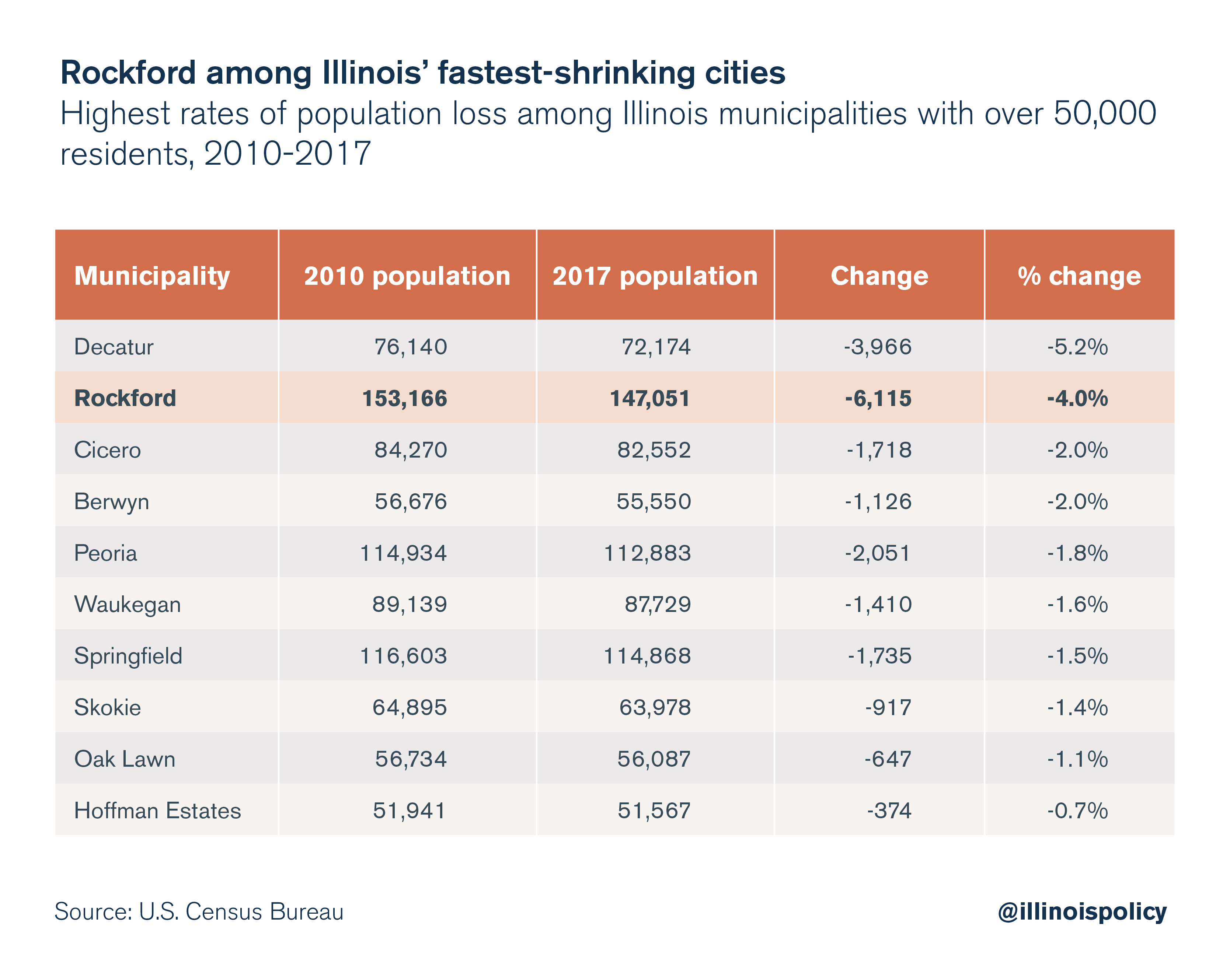

The rise of pension costs is especially concerning given Rockford’s people problem. The city lost more than 6,100 residents, or 4 percent of its population, from 2010 to 2017. Among Illinois cities with over 50,000 residents, only Decatur saw a more rapid decline over that time in percentage terms.

With pension costs crowding out more and more of the budget each year, offering residents tax relief or more bang for their property tax buck is difficult if not impossible. On the contrary, Rockford taxpayers are facing public service cuts at a time when their property tax burden far exceeds the national average. According to property analytics company ATTOM Data Solutions, homeowners in the Rockford metro area shoulder an average property tax bill of just under $3,500, or an effective rate of 3 percent. That’s more than double the U.S. average of 1.17 percent.

Desperate measures

The water sale and public-safety downsizing are just a few of the proposals that the National Resource Network – a coalition of nonprofit and for-profit financial organizations – recommended in an Oct. 9 presentation to city aldermen. Rockford was one of five “economically challenged” cities the network selected to receive special assistance this year.

State law requires local governments in Illinois to have their municipal pension funds at least 90 percent funded by 2040. The purpose of the National Resource Network’s presentation was to outline a financial plan by which the city could meet that requirement.

Aldermen, it’s worth noting, are not required to adopt any particular proposal, and are certainly unlikely to integrate every one of the items presented. The city will gauge public opinion, according to the Star, before City Council pursues any of the recommended proposals.

Reaching the state’s funding requirement will demand some major sacrifices. Other recommendations in the group’s presentation include freezing all city employees’ wages at their current level or temporarily capping annual wage growth at 1 percent, hiking ambulance fees, closing a fire station and increasing required employee health insurance contributions. McNamara incorporated the employee contribution increases into his Oct. 8 budget proposal, according to the Star.

The National Resource Network also recommended raising bus fares and charging residents for downtown parking. In March, City Council approved a utility tax in an effort to close a $3.9 million deficit. That tax, along with the park district’s leasing of its Magic Waters water park to Six Flags Entertainment Corp., allowed McNamara to propose a balanced budget without a property tax hike.

But given the city’s recent population trends, new or increased user fees may not deliver the long-term revenue increases officials might expect. Statewide, Illinoisans cite high taxes as the No. 1 reason they consider leaving the state. While McNamara’s intent to avoid a property tax increase deserves acknowledgement, other new tax or fee hikes come with the risk of further shrinking the city’s tax base, given Illinoisans’ already-high tax burden.

The way forward

McNamara criticized the state’s strict pension requirements in a September press conference, pleading for state lawmakers to lower its funding mandate. However, while lowering the required level of funding would offer municipalities relief in the short term, it would do nothing in the way of controlling the growth of costs ultimately owed to the pension funds. In the long term, lowering the required funding level may actually worsen the problem: Shrinking the funds’ asset pools would shrink size of their investment returns.

The rising cost of pension benefits for government workers is weighing on municipal budgets across the state. In the city of Chicago, as well as the suburbs of North Chicago and Harvey, inability to meet mandated pension funding levels has even prompted state intervention. In each instance, the state comptroller garnished city funds and forcibly redirected them toward the deficient pension funds. Without meaningful reform, Rockford may risk suffering a similar fate.

To provide relief to state and local budgets – and the taxpayers who fund them – Illinois must amend the state constitution’s pension clause to allow for changes to unearned, future benefits – while protecting benefits already owed. To reduce pension liabilities, reforms should aim to achieve the following:

- Increasing the retirement age for younger workers, to bring them in line with private-sector retirement ages

- Capping maximum pensionable salaries to limit excessive pensions

- Replacing permanent compounding benefit increases with true cost-of-living adjustments, or COLAs

- Implementing COLA holidays to allow inflation to catch up to past benefit increases

- Automatically enrolling all new government employees into 401(k)-style retirement plans, similar to what’s overwhelmingly used in the private sector

Defined-benefit pensions jeopardize government workers’ retirement security and tether taxpayers to massive, unpredictable costs. Unless state lawmakers muster the political will to amend the Illinois Constitution, government workers and local taxpayers alike will continue to be subject to looming uncertainty – and painful public service cuts.