by Kevin Haas

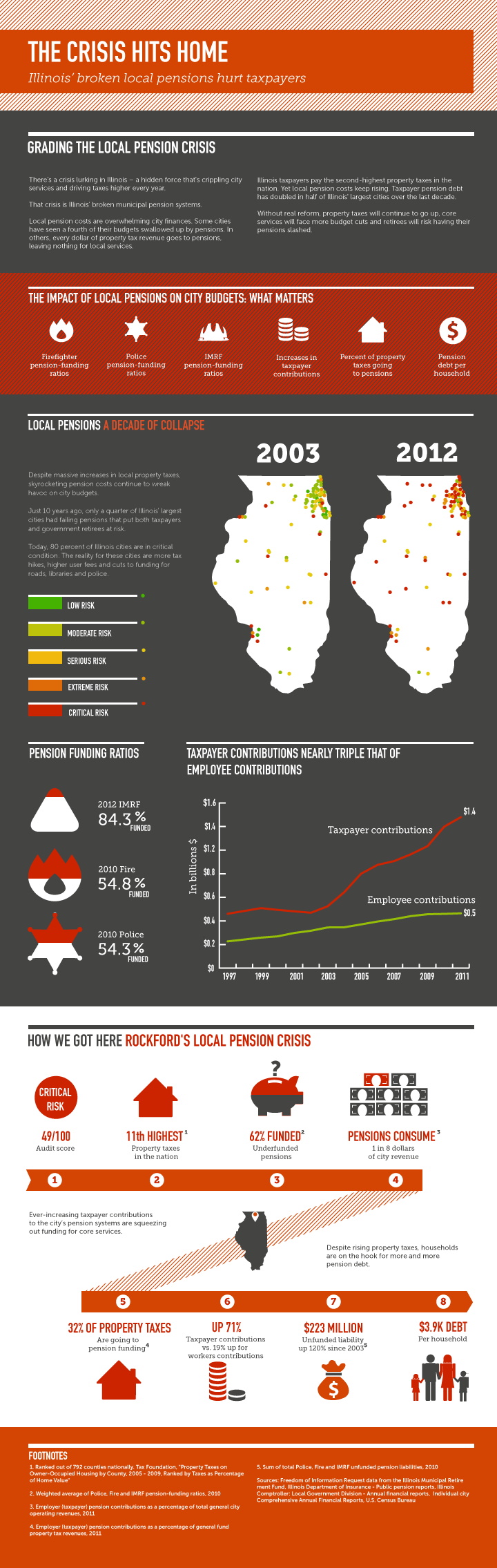

Pension costs have consumed more of Illinois’ cities revenues, forcing higher taxes and cuts in services, a statewide report from the Illinois Policy Institute shows.

The Institute, a research group that previously advocated for 401(k)-style public pension plans, highlighted some of Rockford’s pension woes in the report released last week.

The report states that Rockford taxpayers put three times more money toward city pensions than government employees do, but the city’s police and fire pensions are only funded 60 cents for every $1 promised for city workers’ retirement.

Rockford has nine active government employees paying into pension funds for every 10 that collect benefits, the report says.

“This forces Rockford taxpayers to pick up the tab,” said Ted Dabrowski, lead author of the report.

Each Rockford household is liable for nearly $4,000 of public pension debt, the report says. That’s double the level measure in 2003.

Mayor Larry Morrissey has long stressed that police and fire pensions have handicapped the city’s budget. Morrissey said the data in the report is accurate, however, he took exception to the title on a news release from the Institute that called Rockford one of the “worst-funded municipal pensions systems” in the state. He noted that the Institute’s own data showed Rockford’s fiscal score was better than most of Illinois’ largest communities.

“One of the areas that we’ve demonstrated a lot of discipline is making our payments in to our pension system.” Morrissey said. “It costs us because … every dollar you put there is a dollar you can’t put in current staffing and it’s a dollar you can’t give back to your taxpayers.”

Morrissey said many of Rockford’s pension problems stem from changes to state law in 2000 that increased minimum pension and disability payouts and reduced the time it takes to reach maximum pension benefits, among other changes.

City taxpayer contributions to police and fire pensions grew $4.2 million in 1997 to $9.5 million this year, according to the city.

Dabrowski said communities will continue to struggle to pay for road repairs and other services until there is pension reform. He said the state needs to take action to allow municipalities to switch to a defined contribution system, like a 401(k). Morrissey doesn’t think that’s realistic given that lawmakers rejected such an idea for state workers.

“We should be taking the lead of the private sector, which now 85 percent of the private sector uses a defined contribution plan for retirement,” Dabrowski said. “It seems to be the only way to go if we’re ever going to get any kind of certainty in our budget.”

City workers who aren’t police or firefighters pay into the Illinois Municipal Retirement Fund. The city’s has funded 71 percent of IMRF money needed to cover current pensions and those that will be paid out in the future.

“We have a clear path to get them to 100 percent funding,” said Lou Kosiba, executive director of IMRF. “There are some very positive trends, whether its investment returns or pension reform that are going to bring down costs.”

IMRF had a 20 percent investment return in 2013 and 13 percent in 2012, which added money into retirement accounts, Kosiba said. For every dollar paid to IMRF retirees, 13 cents comes from the retiree; 27 cents comes from the government employer and 60 cents comes from investment returns.

Kosiba called the Institute’s report a “poor excuse for an academic study” that had a forgone conclusion before the research began. He said it blames the pension system for financial woes without recognizing that there were many other increases in municipal operating expenses, falling property values and other factors that contributed to the economic crunch.

“The real focus should be: how do you reenergize the Illinois economy? How do you get people back to work? How do you get them into good paying jobs?” Kosiba said. “This will reduce the stress on local governments.”

Read the article on rrstar.com